We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Consolidating Workplace Pension pots

Thanks to auto enrolment I am in the position of having a number of small pensions from previous employers. I would like to consolidate these at some point In the next year.

My main concerns are costs and suitability of the underlying investments. I am 35 with no expectation to retire early. As such for the foreseeable future I expect to be invested in 100% equities or similar.

Pensions :

Close Brothers, Vanguard, Lifestrategy 100 £16,000

Employer Pensions:

Fidelity £17,000

Aegon £5,000

Aviva £6,000

Legal and General £1,000

I would like to leave the SIPP and Legal and General pensions untouched. The SIPP is convenient to have as I can easily add money too. I have a firm grip on its charges and the investment choices. The Legal and General pension is provided by my current employer, again for simplicities sake I’d like to leave this alone.

The remaining pensions (Fidelity, Aegon, Aviva) are a bit of an unknown quantity. They are all invested in the default funds with somewhat reasonable fees. They are all DC pensions with no known additional benefits.

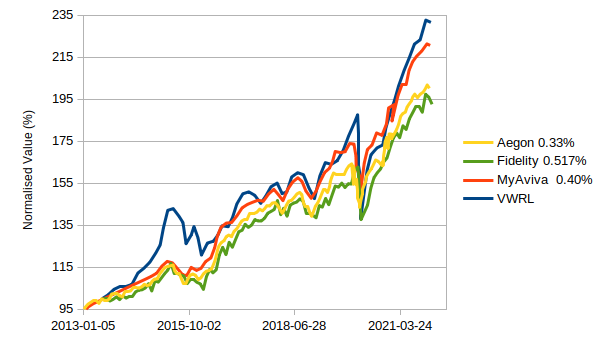

I tracked down the some historic data using fund factsheets and ISIN numbers. Extracting their self reported historic valuations and normalising their value starting from the same day (the earliest data available to me for VWRL, early 2013) produces the following:

Comments

-

Sidetracking a bit, but hopefully still helpful - this is worthwhile reading before you consolidate everything: https://www.thisismoney.co.uk/money/pensions/article-3550085/STEVE-WEBB-merge-small-pension-pots.htmlGoogling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0

-

Fidelity declare that fees are incorporated into the funds unit price.Fidelity's workplace pension is a bundled contract where they quote AMCs rather than OCF. If you use independent software and input the ISIN of the fund, you should get the OCF. Bundled means they include the product/platform charge into the single fund charge. This is very different from Fidelity platform.The Aviva costs are, again, from their factsheets with the caveat that the actual charges may differ.Aviva generic factsheets assume the default charge before discounts. If your scheme has discounts, you will need to knock the discount off the factsheet charge.Assuming my approach to be valid I am tempted to conclude that the Aviva pension being a middle of the road fee and most closely following the trend of VWRL.The Aviva fund name may give it away. You mentioned the fund name for Close Brothers but you didn't mention any fund names with the rest. Aviva's most common default fund is the mixed equity 40-85 fund which is about 85% equities.

The Volatility of VWRL and the rest suggests the rest are lower risk.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Marcon said:Sidetracking a bit, but hopefully still helpful - this is worthwhile reading before you consolidate everything: [redacted]

I am aware of the concerns around transferring DB pensions or pensions with additional benefits. None of mine have posses these traits.

0 -

For those that are interested the pensions are composed of the following funds.Pension Fund CompositionAviva - Aviva Pension My Future Growth FP (ISIN GB00B9GRGZ45)

Aegon - SE Uni LFS Collection ARC (ISIN GB00B3NBD788)

Fidelity - [Redacted]

The underlying fund for the Fidelity PlanView pension would give away some personal information as it is named after my previous employer. The composition of the fund however is:

Schroder Diversified Growth Fund Series 2 49.5%

BlackRock ACS World ex UK Fund 40.9%

BlackRock ACS UK Equity Fund 5.0%

BlackRock Emerging Markets Index Fund 4.6%

As luck would have it, I received the yearly summary today for my Aviva pension. This declares the fees to be 0.2%.Looking at the fundsheets for each fund and the declared investment type composition, they all seem much of a muchness when it comes to proportion of equities. Clearly there as been some "management" of the fund compared to a "raw" index.Given that Aviva has the lowest declared fees and mimics a (very) equity centric benchmark, I feel happy transferring my pensions to the Aviva pension.0 -

That's not the only issue - there are reasons why you might not want to consolidate DC pensions, so worth reading the article.byteseven said:Marcon said:Sidetracking a bit, but hopefully still helpful - this is worthwhile reading before you consolidate everything: [redacted]

I am aware of the concerns around transferring DB pensions or pensions with additional benefits. None of mine have posses these traits.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards