We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is it worth asking Barclaycard for a credit limit increase?

Comments

-

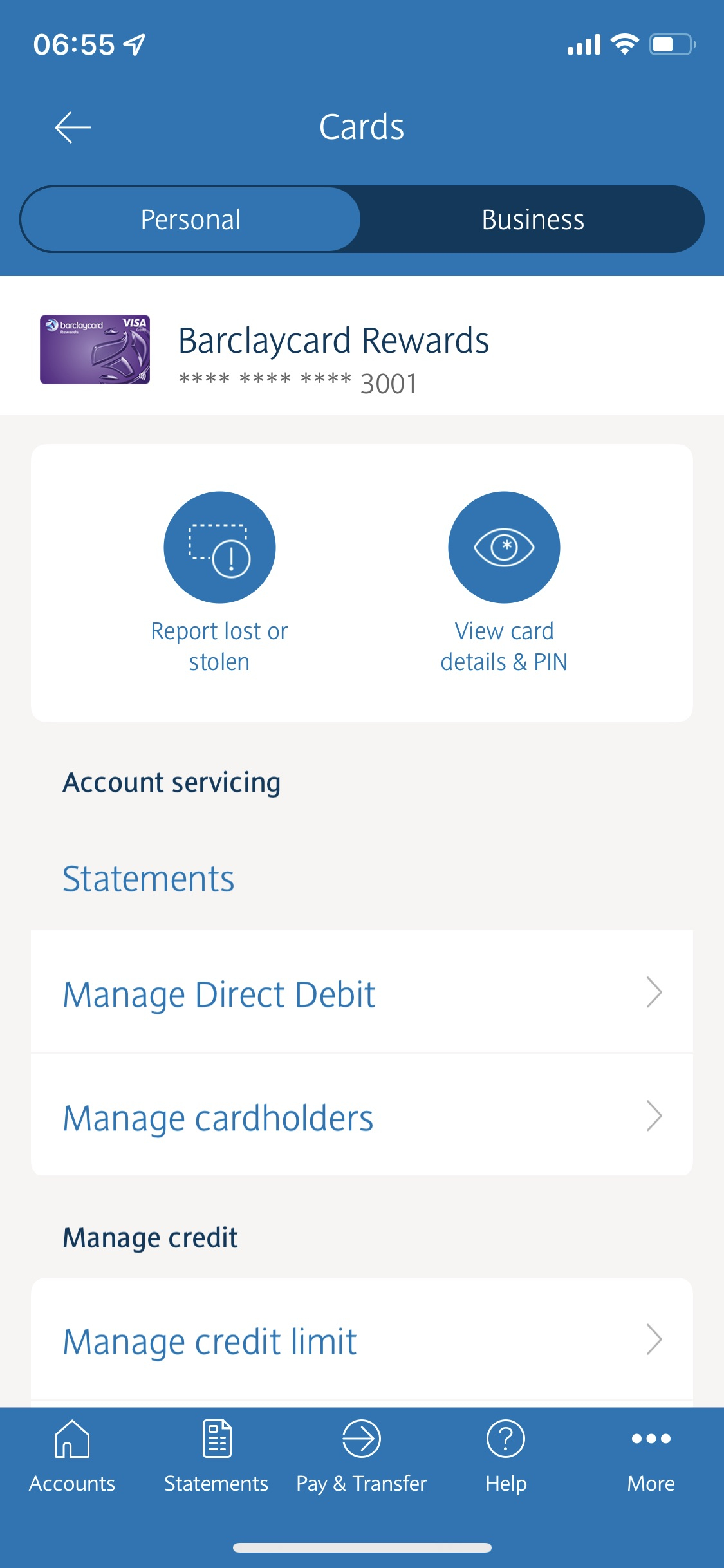

Ha, your post freaked me out a little then. you have the same last 4 numbers as me ;-)Se1Lad said:No need to call - you can do it through the app or website:

Anyway, I asked for an increase from £3,500 to £5,000 last week and was accepted. I'd tried every month for the last few to increase it to £7,000 and was declined but this month tried the lower number and all was good. Trying to get it up to a decent amount before I (hopefully) go on holiday in August.

0 -

Just for anyone new and in case you really meant that, when Barclaycard had bought whatever card provider you originally had, they also bought the credit agreement you had with them, and through the various “notice of changes” they would have given you overtime, they would have eventually brought you back to a standardised Credit agreement for whatever card version you eventually ended up with. An Example is the Barclaycard Cashback card (ex Egg, ex Duo Amex/Visa), which has its standardised Credit Agreement even for people that later moved into it from other Barclaycard products (I did that).Brie said:… (I never applied for their card but had one that had been bought out by various companies eventually ending up with Bs and they didn't have a credit agreement with me, still don't!)1 -

No, CRAs report both values.Deleted_User said:Chino said:

Credit card companies report both the statement balance and the amount repaid by a debtor during the month, so it matters not whether the debtor repays after using the card or on receipt of a statement; either way, lenders see that the debt is being repaid.Jami74 said:(assuming after the statement not after you've used them)

That is incorrect, card companies only report the data at the end of the statement period. If you pay the card once used (i.e. when the charge appears) and thus there is no balance on the card on the date of the statement, it will show as not used i.e. a statement balance of 0, not that there is a debt being repaid. Card companies categorically do not update the CRAs constantly which would be required for your statement to be true.0 -

You don't need to ask anyone these days, just manage it online.I have 7 different credit cards and all limits can be increased online, without asking anyone. I've never had any hard search on my files after increasing card limits.The only one who wanted to hard-search me for limit increase were HSBC so I just closed the card. It was the worst card anyway.EPICA - the best symphonic metal band in the world !0

-

No they don't, there is a monthly update showing end of month balance, not a live update of every spendingDeleted_User said:

No, CRAs report both values.Deleted_User said:Chino said:

Credit card companies report both the statement balance and the amount repaid by a debtor during the month, so it matters not whether the debtor repays after using the card or on receipt of a statement; either way, lenders see that the debt is being repaid.Jami74 said:(assuming after the statement not after you've used them)

That is incorrect, card companies only report the data at the end of the statement period. If you pay the card once used (i.e. when the charge appears) and thus there is no balance on the card on the date of the statement, it will show as not used i.e. a statement balance of 0, not that there is a debt being repaid. Card companies categorically do not update the CRAs constantly which would be required for your statement to be true.0 -

They don’t list every spend which is true, however they do report your statement balance and how much you have paid.Deleted_User said:

No they don't, there is a monthly update showing end of month balance, not a live update of every spendingDeleted_User said:

No, CRAs report both values.Deleted_User said:Chino said:

Credit card companies report both the statement balance and the amount repaid by a debtor during the month, so it matters not whether the debtor repays after using the card or on receipt of a statement; either way, lenders see that the debt is being repaid.Jami74 said:(assuming after the statement not after you've used them)

That is incorrect, card companies only report the data at the end of the statement period. If you pay the card once used (i.e. when the charge appears) and thus there is no balance on the card on the date of the statement, it will show as not used i.e. a statement balance of 0, not that there is a debt being repaid. Card companies categorically do not update the CRAs constantly which would be required for your statement to be true.So say you spent £500 on your credit card but decided to pay £400 of before your statement is produced leaving £100 as your statement balance.It would show as statement balance £100 and a payment of £400 had been made for that month the statement was produced.If they didn’t how else would lenders know that you were paying your statement balances in full!?!Time is a path from the past to the future and back again. The present is the crossroads of both. :cool:0 -

There's no harm in asking. I did last year and they increased it from £3.5k to £6k.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards