We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

First time buyers

Comments

-

@almostinnocent Quick thoughts -Almostinnocent said:

I have checked all listed credit reports, all looking great for both of us except one thing. My husband is not on a electoral roll and he cannot be added due to his nationality. He has indefinite leave to remain in UK, but that doesn't affect electoral roll. How important is it? If everything else will be good. Also, yes, he is self-employed, but he can provide every single monthly payslip since 2006. His montly salary is very consistent. I am just trying to understand how bad is it to be self-employed. And should he apply for citizenship before mortgage application?MaryNB said:Check all three credit reports, not just Experian. Ignore the score (lenders don't see it) focus on the data - make sure you and your partner have no CCJs or defaults you weren't aware of.

Use credit karma for free access to TransUnion, Clearscore for free access to Equifax, mse credit club for free access to Experian.

A broker won't laugh. There are many many people on this forum with much poorer financial history than you. While you don't have the funds you need right now for a deposit and stamp duty, you have good saving potential. Your current level of savings is the main issue, focus on getting a deposit together. Don't forget to budget for legal fees, surveys, moving costs etc. You might want to speak to a broker to check the minimum deposit you'll need since your partner is self employed.

Use your credit card every month (keeping the balance within about 30% of the limit) and pay then off in full every month. Lenders like to see responsible usage.

Avoid using overdrafts, avoid taking cash out using credit cards, avoid any new credit applications about 6 months before you apply for your mortgage.

The finance diary is a really good idea. I did that before I bought a house and found by just watching what I spent I was able to save a lot more without impeding on my lifestyle. I was just more careful with money and kept a better eye on it.

Electoral roll - not an issue that will stop you from getting a mortgage. It's a very common scenario in London and I've never had an issue placing a non-EU non-commonwealth visa-national clients due to not being on the electoral roll.

Citizenship - With respect to a mortgage, ILR = citizenship so there's nothing to be gained by getting a UK passport prior to the application.

Self-employment - From your description, he sounds like a contractor. With a 2+ year track record, that *should* be fine, though some lenders may discount his income to x weeks a year (usually 46 or 48), but that will depend on the specifics.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Oh! Thank you much! That sounds so promising. Yes, he is a contractor and always been very honest with hmrc. So all records are traceable and matching bank statements.K_S said:

@almostinnocent Quick thoughts -Almostinnocent said:

I have checked all listed credit reports, all looking great for both of us except one thing. My husband is not on a electoral roll and he cannot be added due to his nationality. He has indefinite leave to remain in UK, but that doesn't affect electoral roll. How important is it? If everything else will be good. Also, yes, he is self-employed, but he can provide every single monthly payslip since 2006. His montly salary is very consistent. I am just trying to understand how bad is it to be self-employed. And should he apply for citizenship before mortgage application?MaryNB said:Check all three credit reports, not just Experian. Ignore the score (lenders don't see it) focus on the data - make sure you and your partner have no CCJs or defaults you weren't aware of.

Use credit karma for free access to TransUnion, Clearscore for free access to Equifax, mse credit club for free access to Experian.

A broker won't laugh. There are many many people on this forum with much poorer financial history than you. While you don't have the funds you need right now for a deposit and stamp duty, you have good saving potential. Your current level of savings is the main issue, focus on getting a deposit together. Don't forget to budget for legal fees, surveys, moving costs etc. You might want to speak to a broker to check the minimum deposit you'll need since your partner is self employed.

Use your credit card every month (keeping the balance within about 30% of the limit) and pay then off in full every month. Lenders like to see responsible usage.

Avoid using overdrafts, avoid taking cash out using credit cards, avoid any new credit applications about 6 months before you apply for your mortgage.

The finance diary is a really good idea. I did that before I bought a house and found by just watching what I spent I was able to save a lot more without impeding on my lifestyle. I was just more careful with money and kept a better eye on it.

Electoral roll - not an issue that will stop you from getting a mortgage. It's a very common scenario in London and I've never had an issue placing a non-EU non-commonwealth visa-national clients due to not being on the electoral roll.

Citizenship - With respect to a mortgage, ILR = citizenship so there's nothing to be gained by getting a UK passport prior to the application.

Self-employment - From your description, he sounds like a contractor. With a 2+ year track record, that *should* be fine, though some lenders may discount his income to x weeks a year (usually 46 or 48), but that will depend on the specifics.

What do you mean by saying discount his income? How does it work?

0 -

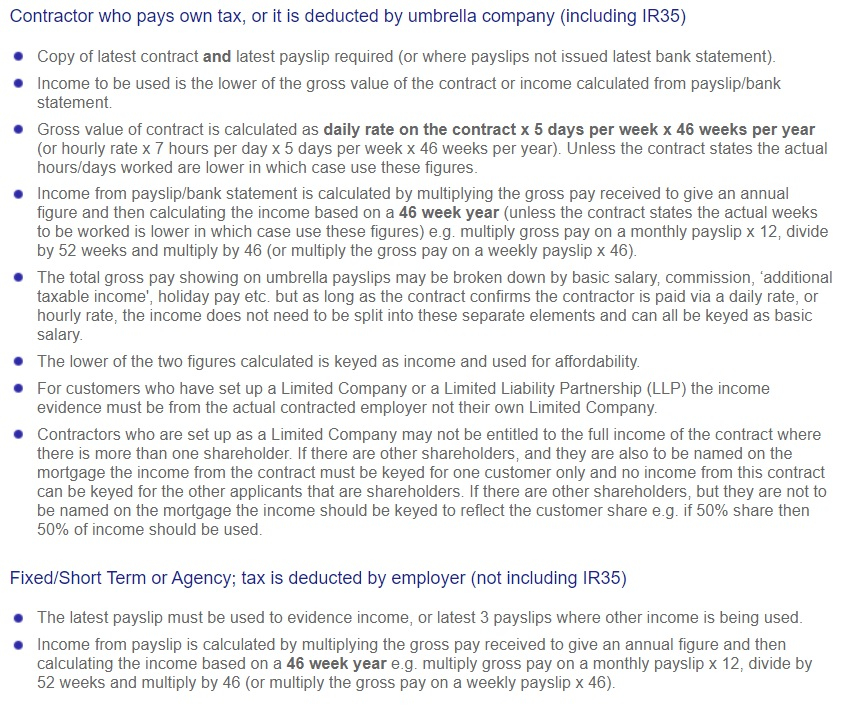

@Almostinnocent Halifax example below. For the avoidance of doubt, this is just a random example for you to get an idea of what lenders may look at for contractor income.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards