We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

We're aware that some users are experiencing technical issues which the team are working to resolve. See the Community Noticeboard for more info. Thank you for your patience.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Debt Consolidation Advice (£44K debt)

Options

Scoty88

Posts: 7 Forumite

Evening all,

I currently have £44,113.73 in debt.

Split over the following:

Loan 1 - £10,822.27 (APR 12%, monthly payments £382.58, 33 payments left)

Loan 2 - £4,619.08 (APR 20%, monthly payments £198.26, 25 payments left)

Overdraft - £3400 (paying approx. £50 per month, remains constant)

Credit Card 1 - £6,431.70 (paying approx. £170 per month, APR 17.36%)

Credit Card 2 - £4,852.18 (paying approx. £190 per month, APR 22.90%)

Credit Card 3 - £1,924.99 (paying approx. £65 per month, APR 28.31%)

Credit Card 4 - £8,826.01 (paying approx. £160 per month, APR 20.01%)

Credit Card 5 - £1,923.77 (paying approx. £60 per month, APR 21.90%)

Credit Account 1 - £1,313.73 (paying approx. £50 per month, APR 21.90%)

My gross monthly income is £2,848

Out Goings:

Mortgage: £540

Child Maint. £390

Other bills (Phone, Energy, C/Tax, Internet, Insurances): £350

After all is taking out I am left with about £250 a month.

I have a 120 mile round trip to work (3 days a week).

Fuel plus food and that £250 is long gone.

This leaves we with no disposable income for clothes, maintenance, life etc.

Which means I keep having to tap back in to my credit cards. Adding £150/£200 to my total credit card debt per month.

I have tried my best to reduce my spend and tidy up my finances as best I can but its still not enough and the stress is too much.

All my dues come out 3 days after pay day.

I don't do anything that will cost me money (so miserable right now, dreading xmas)

Child Maintenance is the advised amount by the Child Maintenance Services.

All my bills are down to a minimum and the only subscription package I have is Netflix at £9.99.

I was traveling to work 5 days a week but manage to get it down to the 3 days.

I am reluctant to change my job for anything closer to home as I can't find one that pays the same as I earn just now.

At this moment, I want to get debt free but I feel that I really need to free up some more of my monthly income so i can get away from relying on my credit cards.

I am hoping to avoid defaulting or any other negative impacts to my credit rating.

I have never missed a payment yet.

Loan 1 has offered me a top up of £12,000 with a new APR of 19%, total monthly payments at £530 for 6 years.

Is it worth me taking the £12K top up to pay off some of the other debt?

If so, which debts should I pay off?

Further to this I have over £40K in equity in my house.

I have 1 year left on my current mortgage deal but I don't even know where to start with equity release or if it is even a good idea.

Finally, I received a Long Term Incentive from work last year in the form of shares.

I can sell the 1/3 of the shares in Feb 2022 and then 1/3 each Feb after that.

Current value is approx. £20K, so I will be able to cash out £6.5K in Feb 2022, although I will need to pay 40% tax on this.

Overall, any advice on what you would do (Or what I should do) in my situation would be greatly appreciated.

Thanks,

Scot

I currently have £44,113.73 in debt.

Split over the following:

Loan 1 - £10,822.27 (APR 12%, monthly payments £382.58, 33 payments left)

Loan 2 - £4,619.08 (APR 20%, monthly payments £198.26, 25 payments left)

Overdraft - £3400 (paying approx. £50 per month, remains constant)

Credit Card 1 - £6,431.70 (paying approx. £170 per month, APR 17.36%)

Credit Card 2 - £4,852.18 (paying approx. £190 per month, APR 22.90%)

Credit Card 3 - £1,924.99 (paying approx. £65 per month, APR 28.31%)

Credit Card 4 - £8,826.01 (paying approx. £160 per month, APR 20.01%)

Credit Card 5 - £1,923.77 (paying approx. £60 per month, APR 21.90%)

Credit Account 1 - £1,313.73 (paying approx. £50 per month, APR 21.90%)

My gross monthly income is £2,848

Out Goings:

Mortgage: £540

Child Maint. £390

Other bills (Phone, Energy, C/Tax, Internet, Insurances): £350

After all is taking out I am left with about £250 a month.

I have a 120 mile round trip to work (3 days a week).

Fuel plus food and that £250 is long gone.

This leaves we with no disposable income for clothes, maintenance, life etc.

Which means I keep having to tap back in to my credit cards. Adding £150/£200 to my total credit card debt per month.

I have tried my best to reduce my spend and tidy up my finances as best I can but its still not enough and the stress is too much.

All my dues come out 3 days after pay day.

I don't do anything that will cost me money (so miserable right now, dreading xmas)

Child Maintenance is the advised amount by the Child Maintenance Services.

All my bills are down to a minimum and the only subscription package I have is Netflix at £9.99.

I was traveling to work 5 days a week but manage to get it down to the 3 days.

I am reluctant to change my job for anything closer to home as I can't find one that pays the same as I earn just now.

At this moment, I want to get debt free but I feel that I really need to free up some more of my monthly income so i can get away from relying on my credit cards.

I am hoping to avoid defaulting or any other negative impacts to my credit rating.

I have never missed a payment yet.

Loan 1 has offered me a top up of £12,000 with a new APR of 19%, total monthly payments at £530 for 6 years.

Is it worth me taking the £12K top up to pay off some of the other debt?

If so, which debts should I pay off?

Further to this I have over £40K in equity in my house.

I have 1 year left on my current mortgage deal but I don't even know where to start with equity release or if it is even a good idea.

Finally, I received a Long Term Incentive from work last year in the form of shares.

I can sell the 1/3 of the shares in Feb 2022 and then 1/3 each Feb after that.

Current value is approx. £20K, so I will be able to cash out £6.5K in Feb 2022, although I will need to pay 40% tax on this.

Overall, any advice on what you would do (Or what I should do) in my situation would be greatly appreciated.

Thanks,

Scot

Debt-Free Wannabe

Day of 1st action: 06/12/2021

Initial Debt: £44,113.73

Current Debt: £44,113.73

Day of 1st action: 06/12/2021

Initial Debt: £44,113.73

Current Debt: £44,113.73

0

Comments

-

Scot I don't think this is a hole you're going to be able to climb out of while you're paying interest as high as that. It looks to be approx £8k a year in interest, and you're borrowing more every month.

Others are much more knowledgeable in this area than me but I'd say you should consider calling Stepchange for some free debt advice, as a first step.1 -

Hi, I totally agree with what TheAble has said. Please do contact one of the free debt help agencies. I'd also recommend Stepchange because they are the agency that helped me. It's a free phone call and well worth your time, including any time you have to wait to speak to anyone.

Contact details : https://www.stepchange.org/

Help is out there.Please note - taken from the Forum Rules and amended for my own personal use (with thanks) : It is up to you to investigate, check, double-check and check yet again before you make any decisions or take any action based on any information you glean from any of my posts. Although I do carry out careful research before posting and never intend to mislead or supply out-of-date or incorrect information, please do not rely 100% on what you are reading. Verify everything in order to protect yourself as you are responsible for any action you consequently take.0 -

I doubt your going to get a decent mortgage deal when it comes to renew as they will take your 44k of debt into consideration.

Could you move closer to work or work come closer to you?Mortgage free wannabe

Actual mortgage stating amount £75,150

Overpayment paused to pay off cc

Starting balance £66,565.45

Current balance £58,108

Cc around 8k.0 -

Hi... You've come to the right place for advice....

First things first do a proper statement of affairs... http://www.stoozing.com/soa.php

Go through last 3 months of statements and include everything, you'll need this accurate as you/we can see where you can make cut backs and guide you going forward.

Generally repaying debt by borrowing more is a big no, especially replacing non secured debt to secured debt. What's pushing you under is the interest rates, ideally get them to zero and you can start paying them off. So I would be thinking a DMP as mentioned above.

But for now I would read the sticky posts at the top of this forum most by sourcrates, and get the SOA filled out and posted so someone more knowledgeable can advise you better.

Well done for taking the first step, we've all been here at some point, I wish you well on your journey to paying this off, on the plus side once this is paid off you'll never look at money the same again.

1 -

Agree with those saying Stepchange or similar (free) debt advice charity, but completing the SOA and posting that here too is also a good plan as there may be areas that stand out to us where we can identify savings. Three months of statements is a good start but be alive to anything you currently pay annually or 6 monthly too.Don’t even CONSIDER borrowing against the house to deal with currently unsecured debt - it’s the worst thing you could do. Consolidation would be a close second in the “worst thing” stakes. You can’t borrow your way out of debt.On the job thing, when deciding whether it’s “worth” getting something closer to home, do factor in the time aspect, as well as your current huge use of fuel too - you must be burning through close to a tank a week, depending on what car you drive? Other factors in there are increased wear and tear on the car, higher consumable costs and more frequent servicing. It all adds up. If you enjoy the job sufficiently then that’s a factor on the other side, but if that’s not so much the case, I’d think about doing a proper analysis of whether you “really” can’t get something closer that pays better in real terms.🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her0 -

It's not that I am not willing to change job to something closer to home, I have looked and applied.

But the wages I have been offered are all at least 30% less than what I am on just now.

Plus I loose my Long Term Incentives if I leave my current job before 2023.

Loosing my LTI and the wage decrease equates to a loss of £50-60K over the next 3 years

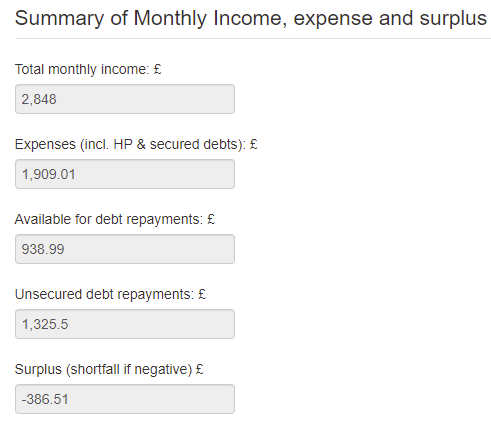

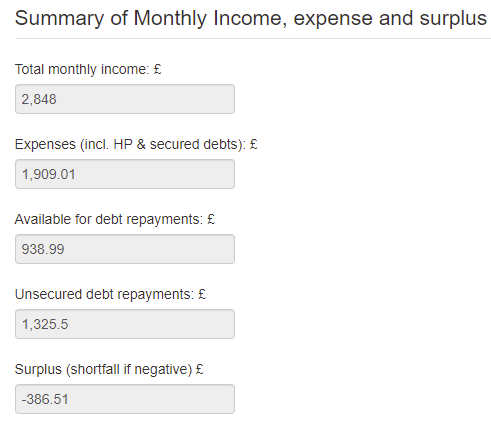

I have completed my SOA.

I can see some small areas for improvement.

My fuel is about £250 a month.

I repair and service my car myself. I spent less than £300 on parts and an MOT over the past year.

This was a lot less than I though it was spending.

My groceries is averaging £250 a month. - I shop at a mix of Aldi and Tesco.

I'll drop Tesco going forward.

This is more than I thought I was spending.

I am spending less that £50 per month activities / social events for my son and I.

Clothes averages out at £25 per month as well.

There is a few yearly payments that I hadn't considered previously.

Mainly YouTube Music, Amazon Prime and PlayStation Online.

I have gone and cancelled them just now.

Thanks for the responses so far, I hadn't really comprehended the amount I am paying in Interest per year.

I think a DMP is going to be the best option. Statement of Affairs and Personal Balance SheetHousehold InformationNumber of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1Monthly Income DetailsMonthly income after tax................ 2848Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0Total monthly income.................... 2848Monthly Expense DetailsMortgage................................ 536.4Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 117Electricity............................. 40Gas..................................... 60Oil..................................... 0Water rates............................. 0Telephone (land line)................... 0Mobile phone............................ 31TV Licence.............................. 12.54Satellite/Cable TV...................... 0Internet Services....................... 22.99Groceries etc. ......................... 250Clothing................................ 25Petrol/diesel........................... 220Road tax................................ 3Car Insurance........................... 23Car maintenance (including MOT)......... 25Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 390Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 8.73Contents insurance...................... 0Life assurance ......................... 23.38Other insurance......................... 0Presents (birthday, christmas etc)...... 30Haircuts................................ 20Entertainment........................... 50Holiday................................. 0Emergency fund.......................... 0AA Membership........................... 3.99Netflix................................. 9.99Total monthly expenses.................. 1909.01AssetsCash.................................... 0House value (Gross)..................... 165000Shares and bonds........................ 20000Car(s).................................. 3000Other assets............................ 0Total Assets............................ 188000Secured & HP DebtsDescription....................Debt......Monthly...APRMortgage...................... 116575...(536.4)....0Total secured & HP debts...... 116575....-.........-Unsecured DebtsDescription....................Debt......Monthly...APRLoan 1.........................10822.....382.5.....12Loan 2.........................4679.08...198.......20CC 1...........................6431.7....170.......17.36OD 1...........................3400......50........12CA 1...........................1313.73...50........20CC 5...........................1923.77...60........21.9CC4............................8826.01...160.......20.01CC 3...........................1924.99...65........28.31CC 2...........................4852.18...190.......22.9Total unsecured debts..........44173.46..1325.5....-Monthly Budget SummaryTotal monthly income.................... 2,848Expenses (including HP & secured debts). 1,909.01Available for debt repayments........... 938.99Monthly UNsecured debt repayments....... 1,325.5Amount short for making debt repayments. -386.51Personal Balance Sheet SummaryTotal assets (things you own)........... 188,000Total HP & Secured debt................. -116,575Total Unsecured debt.................... -44,173.46Net Assets.............................. 27,251.54[Created using the SOA calculator at www.stoozing.com.Reproduced on Moneysavingexpert with permission, using other browser.Debt-Free Wannabe

Statement of Affairs and Personal Balance SheetHousehold InformationNumber of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1Monthly Income DetailsMonthly income after tax................ 2848Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0Total monthly income.................... 2848Monthly Expense DetailsMortgage................................ 536.4Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 117Electricity............................. 40Gas..................................... 60Oil..................................... 0Water rates............................. 0Telephone (land line)................... 0Mobile phone............................ 31TV Licence.............................. 12.54Satellite/Cable TV...................... 0Internet Services....................... 22.99Groceries etc. ......................... 250Clothing................................ 25Petrol/diesel........................... 220Road tax................................ 3Car Insurance........................... 23Car maintenance (including MOT)......... 25Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 390Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 8.73Contents insurance...................... 0Life assurance ......................... 23.38Other insurance......................... 0Presents (birthday, christmas etc)...... 30Haircuts................................ 20Entertainment........................... 50Holiday................................. 0Emergency fund.......................... 0AA Membership........................... 3.99Netflix................................. 9.99Total monthly expenses.................. 1909.01AssetsCash.................................... 0House value (Gross)..................... 165000Shares and bonds........................ 20000Car(s).................................. 3000Other assets............................ 0Total Assets............................ 188000Secured & HP DebtsDescription....................Debt......Monthly...APRMortgage...................... 116575...(536.4)....0Total secured & HP debts...... 116575....-.........-Unsecured DebtsDescription....................Debt......Monthly...APRLoan 1.........................10822.....382.5.....12Loan 2.........................4679.08...198.......20CC 1...........................6431.7....170.......17.36OD 1...........................3400......50........12CA 1...........................1313.73...50........20CC 5...........................1923.77...60........21.9CC4............................8826.01...160.......20.01CC 3...........................1924.99...65........28.31CC 2...........................4852.18...190.......22.9Total unsecured debts..........44173.46..1325.5....-Monthly Budget SummaryTotal monthly income.................... 2,848Expenses (including HP & secured debts). 1,909.01Available for debt repayments........... 938.99Monthly UNsecured debt repayments....... 1,325.5Amount short for making debt repayments. -386.51Personal Balance Sheet SummaryTotal assets (things you own)........... 188,000Total HP & Secured debt................. -116,575Total Unsecured debt.................... -44,173.46Net Assets.............................. 27,251.54[Created using the SOA calculator at www.stoozing.com.Reproduced on Moneysavingexpert with permission, using other browser.Debt-Free Wannabe

Day of 1st action: 06/12/2021

Initial Debt: £44,113.73

Current Debt: £44,113.730 -

There are a few areas where you could make savings but I don't think it will be enough to cover your monthly shortfall of £386.51. Essentially you'd just be rearranging the deckchairs on the Titanic. A Debt Management Plan would take just under 4 years to complete, maybe a bit longer if you want to live and not just survive. It will mean defaults on your credit file but if you keep going the way you are you will start defaulting anyway when you eventually use up the last of your available credit. What is it that worries you so much about defaulting?Scoty88 said:It's not that I am not willing to change job to something closer to home, I have looked and applied.

But the wages I have been offered are all at least 30% less than what I am on just now.

Plus I loose my Long Term Incentives if I leave my current job before 2023.

Loosing my LTI and the wage decrease equates to a loss of £50-60K over the next 3 years

I have completed my SOA.

I can see some small areas for improvement.

My fuel is about £250 a month.

I repair and service my car myself. I spent less than £300 on parts and an MOT over the past year.

This was a lot less than I though it was spending.

My groceries is averaging £250 a month. - I shop at a mix of Aldi and Tesco.

I'll drop Tesco going forward.

This is more than I thought I was spending.

I am spending less that £50 per month activities / social events for my son and I.

Clothes averages out at £25 per month as well.

There is a few yearly payments that I hadn't considered previously.

Mainly YouTube Music, Amazon Prime and PlayStation Online.

I have gone and cancelled them just now.

Thanks for the responses so far, I hadn't really comprehended the amount I am paying in Interest per year.

I think a DMP is going to be the best option. Statement of Affairs and Personal Balance SheetHousehold InformationNumber of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1Monthly Income DetailsMonthly income after tax................ 2848Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0Total monthly income.................... 2848Monthly Expense DetailsMortgage................................ 536.4Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 117Electricity............................. 40Gas..................................... 60Oil..................................... 0Water rates............................. 0Telephone (land line)................... 0Mobile phone............................ 31TV Licence.............................. 12.54Satellite/Cable TV...................... 0Internet Services....................... 22.99Groceries etc. ......................... 250Clothing................................ 25Petrol/diesel........................... 220Road tax................................ 3Car Insurance........................... 23Car maintenance (including MOT)......... 25Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 390Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 8.73Contents insurance...................... 0Life assurance ......................... 23.38Other insurance......................... 0Presents (birthday, christmas etc)...... 30Haircuts................................ 20Entertainment........................... 50Holiday................................. 0Emergency fund.......................... 0AA Membership........................... 3.99Netflix................................. 9.99Total monthly expenses.................. 1909.01AssetsCash.................................... 0House value (Gross)..................... 165000Shares and bonds........................ 20000Car(s).................................. 3000Other assets............................ 0Total Assets............................ 188000Secured & HP DebtsDescription....................Debt......Monthly...APRMortgage...................... 116575...(536.4)....0Total secured & HP debts...... 116575....-.........-Unsecured DebtsDescription....................Debt......Monthly...APRLoan 1.........................10822.....382.5.....12Loan 2.........................4679.08...198.......20CC 1...........................6431.7....170.......17.36OD 1...........................3400......50........12CA 1...........................1313.73...50........20CC 5...........................1923.77...60........21.9CC4............................8826.01...160.......20.01CC 3...........................1924.99...65........28.31CC 2...........................4852.18...190.......22.9Total unsecured debts..........44173.46..1325.5....-Monthly Budget SummaryTotal monthly income.................... 2,848Expenses (including HP & secured debts). 1,909.01Available for debt repayments........... 938.99Monthly UNsecured debt repayments....... 1,325.5Amount short for making debt repayments. -386.51Personal Balance Sheet SummaryTotal assets (things you own)........... 188,000Total HP & Secured debt................. -116,575Total Unsecured debt.................... -44,173.46Net Assets.............................. 27,251.54[Created using the SOA calculator at www.stoozing.com.Reproduced on Moneysavingexpert with permission, using other browser.

Statement of Affairs and Personal Balance SheetHousehold InformationNumber of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1Monthly Income DetailsMonthly income after tax................ 2848Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0Total monthly income.................... 2848Monthly Expense DetailsMortgage................................ 536.4Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 117Electricity............................. 40Gas..................................... 60Oil..................................... 0Water rates............................. 0Telephone (land line)................... 0Mobile phone............................ 31TV Licence.............................. 12.54Satellite/Cable TV...................... 0Internet Services....................... 22.99Groceries etc. ......................... 250Clothing................................ 25Petrol/diesel........................... 220Road tax................................ 3Car Insurance........................... 23Car maintenance (including MOT)......... 25Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 390Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 8.73Contents insurance...................... 0Life assurance ......................... 23.38Other insurance......................... 0Presents (birthday, christmas etc)...... 30Haircuts................................ 20Entertainment........................... 50Holiday................................. 0Emergency fund.......................... 0AA Membership........................... 3.99Netflix................................. 9.99Total monthly expenses.................. 1909.01AssetsCash.................................... 0House value (Gross)..................... 165000Shares and bonds........................ 20000Car(s).................................. 3000Other assets............................ 0Total Assets............................ 188000Secured & HP DebtsDescription....................Debt......Monthly...APRMortgage...................... 116575...(536.4)....0Total secured & HP debts...... 116575....-.........-Unsecured DebtsDescription....................Debt......Monthly...APRLoan 1.........................10822.....382.5.....12Loan 2.........................4679.08...198.......20CC 1...........................6431.7....170.......17.36OD 1...........................3400......50........12CA 1...........................1313.73...50........20CC 5...........................1923.77...60........21.9CC4............................8826.01...160.......20.01CC 3...........................1924.99...65........28.31CC 2...........................4852.18...190.......22.9Total unsecured debts..........44173.46..1325.5....-Monthly Budget SummaryTotal monthly income.................... 2,848Expenses (including HP & secured debts). 1,909.01Available for debt repayments........... 938.99Monthly UNsecured debt repayments....... 1,325.5Amount short for making debt repayments. -386.51Personal Balance Sheet SummaryTotal assets (things you own)........... 188,000Total HP & Secured debt................. -116,575Total Unsecured debt.................... -44,173.46Net Assets.............................. 27,251.54[Created using the SOA calculator at www.stoozing.com.Reproduced on Moneysavingexpert with permission, using other browser.

0 -

Your soa doesn't look too bad. You can afford to live and pay the mortgage and also have nearly £1000 to throw at the debts. However you are paying a lot in interest and so that needs to be killed off, and it's going to be really difficult to do that without a debt management plan.

I think that is the way forward.

Are you getting your single person discount on the council tax?

What's the story with water rates? Are you in Scotland?0 -

A few things on the SOA - I take it you do have contents insurance, but have missed it out? If not then that’s one to get sorted urgently.Savings can be made on mobile and broadband when you’re out of contract so diarise when terms are up and look to switch.TV license - check that, we pay £13.37 a month, £12.xx hasn’t been the case for a while.Allowing that you have equity in your home, do you need the life assurance?Haircuts are pricey.Nothing for water rates - are you in Scotland? If so fine, otherwise this may be overlooked. (Edit to add, your username may be a clue here…😆)Agree that while the savings are good to make, you can’t fix your current situation just by making them. Advice from a debt charity is still the way forwards, I suspect they will advise that you stop paying to the debts, build an EF while things default, then move forwards with a DMP. I do get your concern about your credit history, but right now the last thing you need is access to more credit, so I’ve personally view the next few years as a good chance to reset my thinking on that side of things.As for the job situation, sounds like you’ve already done an exhaustive positives/minuses analysis and know what you are best to do there - that’s the right way to go about it.🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her0 -

Scoty,

With a deficit like that, no amount of budgeting is going to make that much difference.

Your situation is untenable, you are spending more than you earn, and your position worsens as each month goes by, you need to stop, and do something, before this reaches the point of no return.

Fortunately there is a very simple, straightforward solution to all of this, you have already mentioned a DMP, why have you not started the ball rolling as yet ?

As all your debts are non priority, unsecured borrowing, your best bet is to default on the lot of them, that would free up £1300 per month.

Approx £600 per month split between your debts pro rata, on a monthly basis, would, assuming interest was stopped, see you clear this lot in a little over 4 years.

That would also add an extra £700 per month to your disposable income, so you could save for full and final settlements, and therefore reduce further the time you are in debt.

No brainer to me.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards