We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Monthly contribution or lump sum?

Comments

-

NoMore said:

Yes and the vanguard study looked at more than 100% equities,zagfles said:NoMore said:Sorry Can't find the original paper but Vanguard did some research and found that Lump sum beats drip feeding about two thirds of the time, Monevator discusses it here:

Lump sum investing versus drip-feeding - MonevatorThat's not in dispute. Being 100% in equities will win most of the time. Does than mean people should be 100% in equities?It's not about what wins more, it's about reducing the risk of long term loss, which is more likely to happen if you invest all on one day than if you invest over a period. If you invest all in one go then it could be at or near a peak or in a bubble, for instance the dot.com boom in 2000 or Japan in 1989. If you invest over a period you'd effectively flatten or rather partly flatten most peaks and bubbles.

"This was true across multiple decades and asset allocations – because more often than not equities and bonds trump the returns from cash."

And yes one third of the time you are right and both reduced volatility and your gain are better, and I can agree for some people reducing volatility at the possible expense of gain is right for them.

I think audaxer captured it best: "statistically it is beneficial to invest the lump sum, but psychologically some people might prefer to pay monthly or maybe split into quarterly lumps, in case of an equity crash just after investing the whole lump sum."I think you missed my point, I know the Vanguard study looked at more than 100% equities. The point was that "invest a lump sum asap" wins most of the time, and as a separate, unrelated fact, nothing to do with the previous fact, "invest 100% in equities" wins most of the time.So if you want what wins most of the time, go for investing in 100% equities asap.But to reduce volatility, if desired, you could drip-feed and drip-withdraw, and/or you could have a less than 100% equity allocation. On average you'll get lower performance, but less volatility.1 -

I'm wondering what the outlook is for the next 5 years regarding investing/increasing pension contributions especially with the uncertainty of new covid variants?

I notice my with profits pension fund investment mix for last year was company shares 44%, property 13%, govt. & other bonds 36%, cash & other investments 7% with the only real difference from 2019 being 5% less in company shares!

The transfer value in 2020 was quite a bit less than 2019 as expected but still worth it for tax relief i suppose?0 -

Picking the wrong 20 days to be in the market between 2007 and 2011 cost me at least 65% in losses, with at least 44% for the worst ten days. Pick the wrong twenty days to be in the market and you make.. perhaps something close to nothing at all?Secret2ndAccount said:...Being out of the market for just 10 days could halve that amount. Yes, halve! Pick the wrong 20 days to be out of the market, and you make nothing at all

What such things tend to do is conveniently forget what was happening on the other days around those wrong 10 or 20 to be out of the market. Like the large falls on those other days of the month when they want you to be in the market. The firms making that argument tend to charge a percentage of money invested and so they make money by having you invested, whether you are doing well or badly. They make more when you do well but their interest is still best served by having you in the market for as long as possible.

Quoting myself from 2011:"Going back only as far as May 2007 here are some statistics for daily value variations in my S&S ISA, non-cumulative:Over 6% drop: 2

Over 5% drop: 2

Over 4% drop: 4

Over 3% drop: 13 (1.22%)

Over 2% drop: 50 (4.69%)

Over 1% drop: 118

Over 0% drop: 305

Less than 0.01% up or down: 17

Over 0% gain: 355

Over 1% gain: 150

Over 2% gain: 34

Over 3% gain: 10

Over 4% gain: 4

Over 5% gain: 1

Over 6% gain: 1

Over 7% gain: 0

Over 8% gain: 1There were 45 days, 4.2%, where the drop was 2.40% or more, the FTSE 100 report for today. 6.65% of days when there was a loss of 2% or more and 17.71% where there was a loss of 1% or more."

Using normal open ended funds it's impossible to both take the good days and miss the bad ones because they are often consecutive and things happen faster than the fund trading times allow, typically next day at noon price with settlement a couple of business days later, leaving you out of the market for several days.

Long term markets are a positive sum game, so you can expect to make money. But the odds vary and there are good and bad times for particular investment types.1 -

I tend to favour monthly contributions rather than annual for convenience, particularly if you're also taking the money out again, which you can also do as regular monthly payments to cover most of the monthly cost. This way you set up the contributions once and they just carry on for years until say your 75th birthday causes them to be cancelled.Collyflower1 said:Hi, i'm increasing my contributions to my RL with profits to my maximum allowed of £2880 per year and i'm wondering if there is any benefit to putting it in as a lump sum or should i carry on with monthly payments? In my case monthly payments would increase to £240 per month?

Statistically, if current market conditions at the time are ignored, investing a lump sum as early as possible is expected to produce the best result just because the long term trend of markets is upwards and the sooner you jump on the longer time you have to benefit from that average growth. The catch is that in the short to medium term you don't get average growth, you get whatever the market variations happen to deliver. And there are correlations that say that certain times are better or worse.

For your specific situation, where the amounts in relation to your total situation aren't large, just do what's convenient and be aware that there's a real chance that you could see a drop of 30-40% followed by a recovery to eventual gains that takes anything from a few months to a decade or more. Or not, or not for a decade or two, since there is inherent variability.

0 -

Instead of just asking "if the market rises, which approach is likely to give higher returns", you could turn the question on it's head, and ask, "if the market falls which approach is likely to give smaller losses"..........in other words it depends what is more important to you......maximising gains or minimising losses.

Personally I think it depends on the situation......if I had £5k to invest as part of a £500k pot, I'd probably just invest it all straight away.....on the flip side if I had £495k to invest as part of a 500k pot, I'd probably be a little more circumspect, and would probably drip it in over a period.......fear of loss now outweighs desire for gain.

There is no way to know beforehand which approach will turn out best, so in the end it's going to be a judgement call

0 -

You're missing the point. I said two things:jamesd said:Secret2ndAccount said:...Being out of the market for just 10 days could halve that amount. Yes, halve! Pick the wrong 20 days to be out of the market, and you make nothing at all Picking the wrong 20 days to be in the market between 2007 and 2011 cost me at least 65% in losses, with at least 44% for the worst ten days. Pick the wrong twenty days to be in the market and you make.. perhaps something close to nothing at all?

What such things tend to do is conveniently forget what was happening on the other days around those wrong 10 or 20 to be out of the market. Like the large falls on those other days of the month when they want you to be in the market. The firms making that argument tend to charge a percentage of money invested and so they make money by having you invested, whether you are doing well or badly. They make more when you do well but their interest is still best served by having you in the market for as long as possible.

Quoting myself from 2011:

"Going back only as far as May 2007 here are some statistics for daily value variations in my S&S ISA, non-cumulative:

Over 6% drop: 2Over 5% drop: 2

Over 4% drop: 4

Over 3% drop: 13 (1.22%)

Over 2% drop: 50 (4.69%)

Over 1% drop: 118

Over 0% drop: 305

Less than 0.01% up or down: 17

Over 0% gain: 355

Over 1% gain: 150

Over 2% gain: 34

Over 3% gain: 10

Over 4% gain: 4

Over 5% gain: 1

Over 6% gain: 1

Over 7% gain: 0

Over 8% gain: 1There were 45 days, 4.2%, where the drop was 2.40% or more, the FTSE 100 report for today. 6.65% of days when there was a loss of 2% or more and 17.71% where there was a loss of 1% or more."

Using normal open ended funds it's impossible to both take the good days and miss the bad ones because they are often consecutive and things happen faster than the fund trading times allow, typically next day at noon price with settlement a couple of business days later, leaving you out of the market for several days.

Long term markets are a positive sum game, so you can expect to make money. But the odds vary and there are good and bad times for particular investment types.

1. You should invest now for maximum gain. Which I believe.

2. Here is some emotional stuff for emotional investors....

Why would I then go on to show the negative half of the argument, which is obvious if you think about it logically? The logical people have already invested. All that stuff you posted is going to make emotional people not want to invest at all.0 -

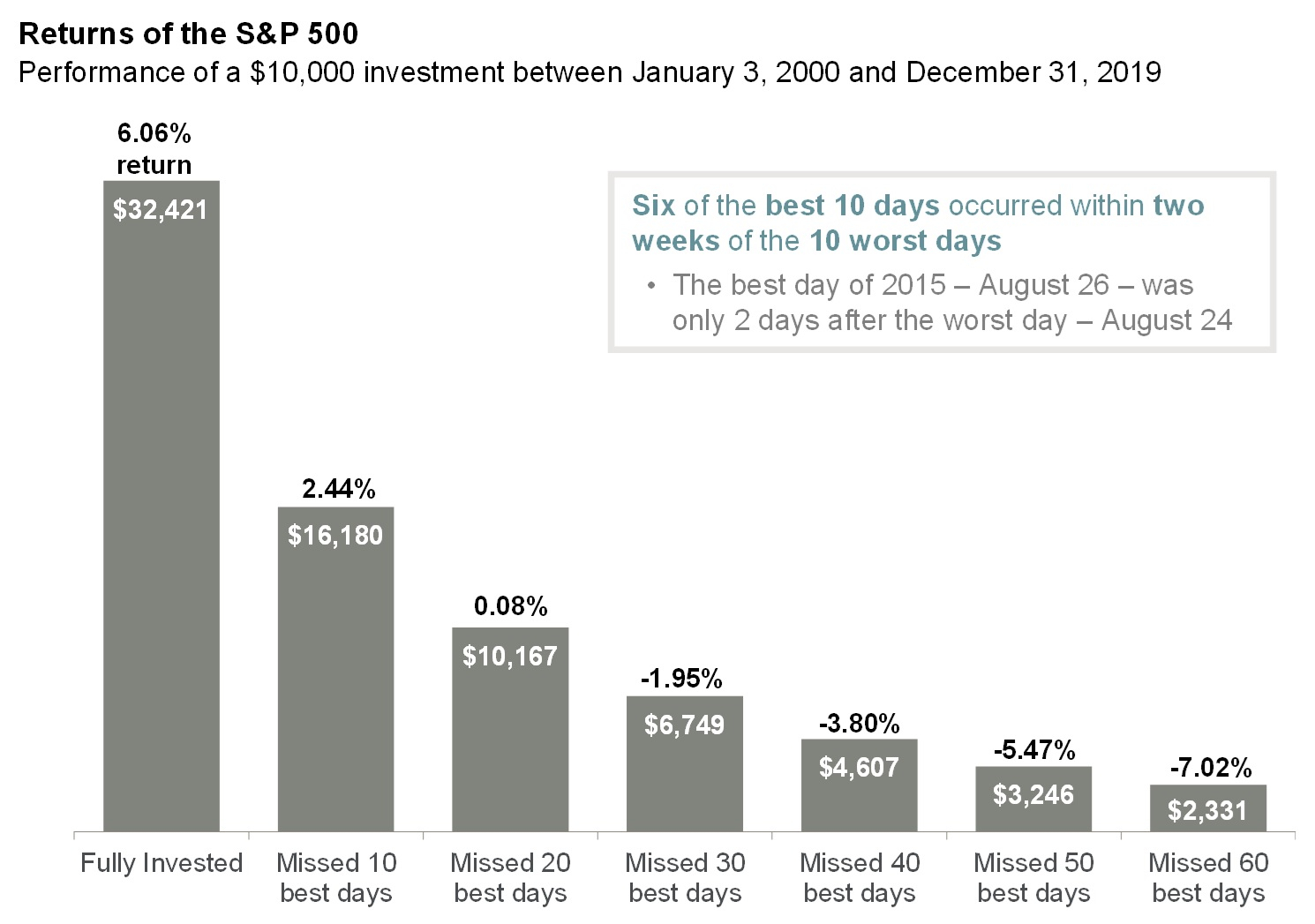

It says in the box in the chart above that Aug 26 was the best day of 2015 and Aug 24 was the worse day of 2015. From the charts I've looked at, while 24 Aug may have been the worse day of 2015, it hadn't recovered to anywhere near previous levels that year by Aug 26.Secret2ndAccount said:Statistically, whatever amount you plan to invest, you should invest it all straight away. Markets go up over time, so being in the market is the way to benefit from that.Reasons for investing more slowly are emotional. You would be gutted if you put all your money in today, and the market crashed tomorrow. So hold back if it makes you feel better, but realise it is likely to cost you money.For emotional people who would like some help to behave more statistically, here is a graph published annually by JP Morgan. Invest $10,000 in the S&P 500 on 1st Jan 2000. Twenty years later, you have $32,421. Being out of the market for just 10 days could halve that amount. Yes, halve! Pick the wrong 20 days to be out of the market, and you make nothing at all - your 10k turns into just $10,167 in twenty years. So unless you can pick which days are going to be the good and the bad ones (and nobody in history has proven that they can) it's best to get in the market. 0

0 -

I didn't miss your point, I contradicted part of it by pointing out that the best n days argument was misleading, because the corresponding argument about the worst n days also applies and they are typically happening at the same month in very volatile markets, as I could illustrate by posting my daily variation percentages from late 2008 again, rather than just the statistical summary of a few years.You're missing the point. I said two things:

1. You should invest now for maximum gain. Which I believe.

2. Here is some emotional stuff for emotional investors....

Why would I then go on to show the negative half of the argument, which is obvious if you think about it logically? The logical people have already invested. All that stuff you posted is going to make emotional people not want to invest at all.

As Audaxer pointed out, the box accompanying the chart even says that six of the best ten days were within two weeks of the worst ten. Since bear markets can last a while some of the other four are also quite likely to be in fairly close proximity, but one or two might be a genuinely raging bull market without rapid gotcha.

We agree that markets are long term going to grow and on average the expected result is best by investing a lump sum as early as possible, so it's two aspects of potential disagreement: the bogus best ten days that ignores the worst ten days typically happening around the same time and whether there's any short or medium run predictability to markets that can be used. But not much need to get into that when I think we both agree that the reason to be in is the long term growth potential, not uncommon daily movements.

And in the case at hand the last paragraph seems largely irrelevant because convenience is likely to be a better deciding factor for the amounts involved.

2 -

Just one more question before i post my application to top up my pension:) Do i need to know my pension's fund value as well as its transfer value? Does it matter?0

-

Transfer value and the total value of all of the funds are typically the same in investment=based pensions. I mainly maters just so you can know the value of the various bits and it's not very important to pay much day to day or even month to month attention when adding money far from retirement..0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards