We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Monthly contribution or lump sum?

Comments

-

on most modern pensions, charges are not based on the amount you pay in but the amount you have invested.Collyflower1 said:Thanks, i'm hoping me upping my contributions wont result in increased fees!I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

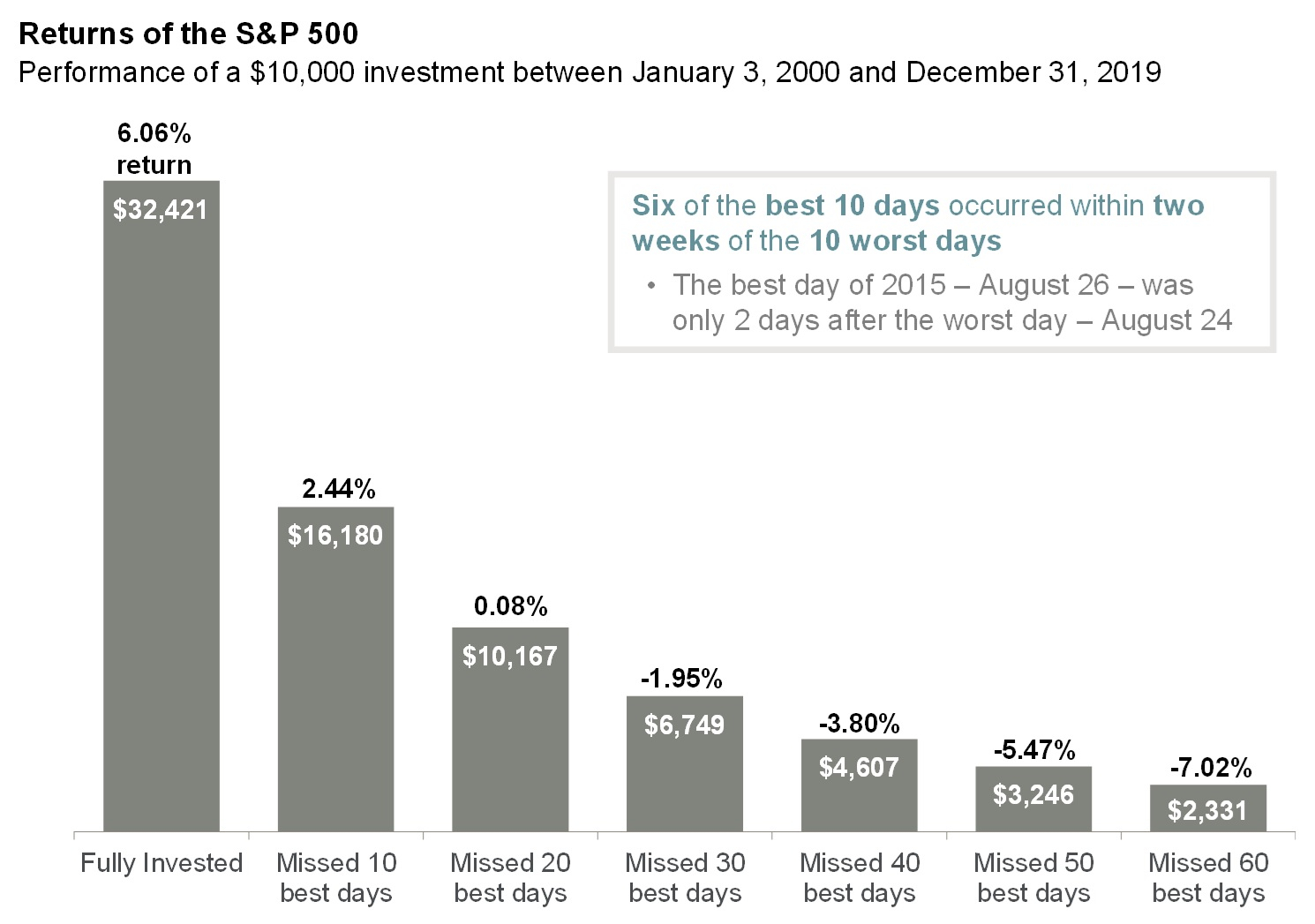

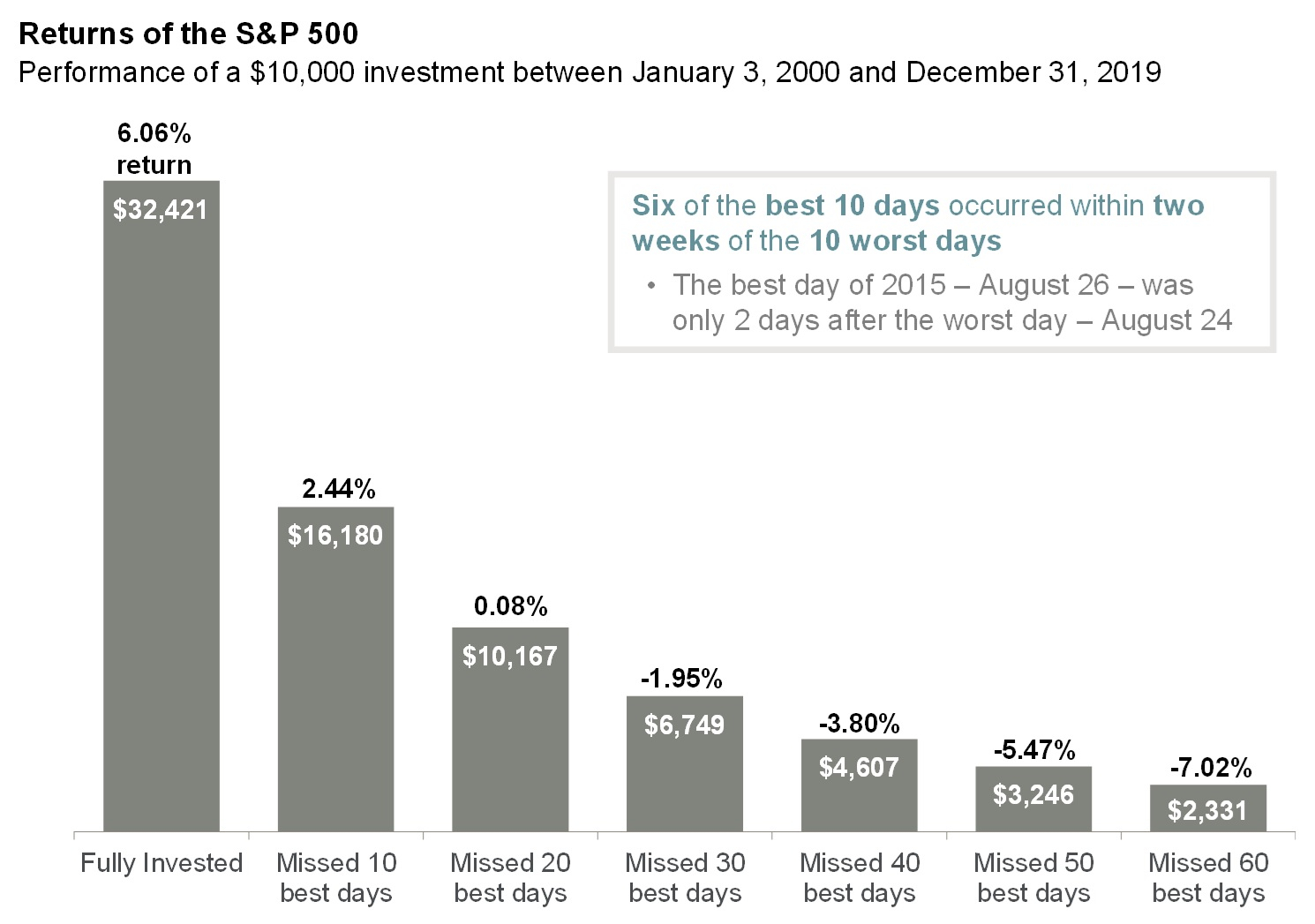

Statistically, whatever amount you plan to invest, you should invest it all straight away. Markets go up over time, so being in the market is the way to benefit from that.Reasons for investing more slowly are emotional. You would be gutted if you put all your money in today, and the market crashed tomorrow. So hold back if it makes you feel better, but realise it is likely to cost you money.For emotional people who would like some help to behave more statistically, here is a graph published annually by JP Morgan. Invest $10,000 in the S&P 500 on 1st Jan 2000. Twenty years later, you have $32,421. Being out of the market for just 10 days could halve that amount. Yes, halve! Pick the wrong 20 days to be out of the market, and you make nothing at all - your 10k turns into just $10,167 in twenty years. So unless you can pick which days are going to be the good and the bad ones (and nobody in history has proven that they can) it's best to get in the market.

1

1 -

Secret2ndAccount said:Statistically, whatever amount you plan to invest, you should invest it all straight away. Markets go up over time, so being in the market is the way to benefit from that.Reasons for investing more slowly are emotional. You would be gutted if you put all your money in today, and the market crashed tomorrow. So hold back if it makes you feel better, but realise it is likely to cost you money.For emotional people who would like some help to behave more statistically, here is a graph published annually by JP Morgan. Invest $10,000 in the S&P 500 on 1st Jan 2000. Twenty years later, you have $32,421. Being out of the market for just 10 days could halve that amount. Yes, halve! Pick the wrong 20 days to be out of the market, and you make nothing at all - your 10k turns into just $10,167 in twenty years. So unless you can pick which days are going to be the good and the bad ones (and nobody in history has proven that they can) it's best to get in the market.

That graph is just as "emotional". What are the the results with "missed worst 10 days, "worst 20 days" then? That would likely show the opposite! You can show anything with selective use of criteria.Investing more slowly smooths out peaks and troughs. Wonder how someone who invested a lump sum in the Japanese stock market in 1989 compares with someone who dripped it in over the next 5 years? Or someone who invested a lump sum at the peak of the dot.com boom in 2000 compared to someone who invested monthly over 5 years 2000-2005.Obviously, in a market that tends to rise, on average you'll be better off if you invest as early as possible. But also statistically, you're more likely to be down after 10 years if you invested everything in one lump sum than if you dripped it in.

That graph is just as "emotional". What are the the results with "missed worst 10 days, "worst 20 days" then? That would likely show the opposite! You can show anything with selective use of criteria.Investing more slowly smooths out peaks and troughs. Wonder how someone who invested a lump sum in the Japanese stock market in 1989 compares with someone who dripped it in over the next 5 years? Or someone who invested a lump sum at the peak of the dot.com boom in 2000 compared to someone who invested monthly over 5 years 2000-2005.Obviously, in a market that tends to rise, on average you'll be better off if you invest as early as possible. But also statistically, you're more likely to be down after 10 years if you invested everything in one lump sum than if you dripped it in.

1 -

Here is some interesting info, https://www.ig.com/uk/trading-strategies/what-are-the-average-returns-of-the-ftse-100--200529

Some of the text taken from the above website.

"The worst two-year return since the FTSE 100 was created was -33%, or -18% on an annualised basis, between 31 December 2000 and 31 December 2002.The worst five-year annualised return was -4% per year, between 31 December 1999 and 31 December 2004.

Since the FTSE 100’s inception in 1983, there has never been a ten-year holding period where the investor lost money. The worst ten-year annualised return was +0.3% between 31 December 1999 and 31 December 2008.

What is also apparent is that the time at which an investor makes their initial investment has a large impact on their long-run average return. An investor that bought the FTSE 100 in 1989 would have been rewarded with an annual average return of 18% over the following 10 years, compared to a 0.3% annual average if they had bought in 1998 and sold at the end of 2008."

I also remember the all time closing high for the FTSE 100 on 31st Dec 1999 was not beaten until 2015 (nominal terms not real).

It's just my opinion and not advice.0 -

Evidence?zagfles said:

... statistically, you're more likely to be down after 10 years if you invested everything in one lump sum than if you dripped it in.1 -

I read some analysis somewhere, sorry can't find it now. But if you look at virtually any stockmarket graph it should be fairly obvious that if you flatten the peaks and troughs by taking the average value over a period, rather than values on a particular day, there is less volatility and so less chance of a fall. Particularly if you sell over a period as well as buy.Secret2ndAccount said:

Evidence?zagfles said:

... statistically, you're more likely to be down after 10 years if you invested everything in one lump sum than if you dripped it in.

0 -

Sorry Can't find the original paper but Vanguard did some research and found that Lump sum beats drip feeding about two thirds of the time, Monevator discusses it here:

Lump sum investing versus drip-feeding - Monevator

1 -

I know statistically it is beneficial to invest the lump sum, but psychologically some people might prefer to pay monthly or maybe split into quarterly lumps, in case of an equity crash just after investing the whole lump sum.NoMore said:Sorry Can't find the original paper but Vanguard did some research and found that Lump sum beats drip feeding about two thirds of the time, Monevator discusses it here:

Lump sum investing versus drip-feeding - Monevator0 -

NoMore said:Sorry Can't find the original paper but Vanguard did some research and found that Lump sum beats drip feeding about two thirds of the time, Monevator discusses it here:

Lump sum investing versus drip-feeding - MonevatorThat's not in dispute. Being 100% in equities will win most of the time. Does than mean people should be 100% in equities?It's not about what wins more, it's about reducing the risk of long term loss, which is more likely to happen if you invest all on one day than if you invest over a period. If you invest all in one go then it could be at or near a peak or in a bubble, for instance the dot.com boom in 2000 or Japan in 1989. If you invest over a period you'd effectively flatten or rather partly flatten most peaks and bubbles.1 -

Yes and the vanguard study looked at more than 100% equities,zagfles said:NoMore said:Sorry Can't find the original paper but Vanguard did some research and found that Lump sum beats drip feeding about two thirds of the time, Monevator discusses it here:

Lump sum investing versus drip-feeding - MonevatorThat's not in dispute. Being 100% in equities will win most of the time. Does than mean people should be 100% in equities?It's not about what wins more, it's about reducing the risk of long term loss, which is more likely to happen if you invest all on one day than if you invest over a period. If you invest all in one go then it could be at or near a peak or in a bubble, for instance the dot.com boom in 2000 or Japan in 1989. If you invest over a period you'd effectively flatten or rather partly flatten most peaks and bubbles.

"This was true across multiple decades and asset allocations – because more often than not equities and bonds trump the returns from cash."

And yes one third of the time you are right and both reduced volatility and your gain are better, and I can agree for some people reducing volatility at the possible expense of gain is right for them.

I think audaxer captured it best: "statistically it is beneficial to invest the lump sum, but psychologically some people might prefer to pay monthly or maybe split into quarterly lumps, in case of an equity crash just after investing the whole lump sum."1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards