We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Loanpad P2P - Reviews, experiences, info or updates, post them here. I'm having a dabble.

Comments

-

masonic said:

If you are self-certifying as restricted and are ok with continuing as such (not investing more than 10% of your assets in P2P), then the changes won't affect you. It is just those who self-certified as 'sophisticated' only on the basis of having participated in a couple of previous loans that will no longer be able to do so to be free of that limit. I would suggest that 10% is more than enough for "the little guy" to have invested in this sector.Sea_Shell said:Do I need to worry about the new rules around P2P that come into effect on 31st January?*

I'm currently a self declared inexperienced investor, supposed limited to depositing 10% of my investable assets, which I still am.

How might this affect "the little guy" on platforms such as Loanpad?

* Read about briefly on the P2P forum, but I'm not a member and not sure if it'll apply to me .

So the question then moves on the viability of P2P, if those who have self-certified as HNW or "sophisticated" no longer meet the more stringent rules and they [are forced to] pull out of P2P.

I wonder how many of Loanpad's current investors will find themselves betwixt and between the new definitions.

It would be a bit strange if the only people "allowed" to invest in P2P are either the "rich" or "the little guy" and no one in between.How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

The consultation document can be found here, if it is of interest to anyone.

Consultation_response_document_-_updates_to_financial_promotion_exemptions.pdf (publishing.service.gov.uk)

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

Those customers who consider themselves sophisticated, but are not, are the sort that tend to invest above their risk tolerance and then claim they should have been protected if things go wrong. Personally I found it absurd that someone could put their money into a couple of Blackmore or LC&F mini-bonds and then immediately self-certify as sophisticated to dump the rest of their capital into such investments and lose the lot, all the while thinking they were equivalent to savings accounts. This actually happened under the FCA's watch and they had to relent and let the FSCS compensate some of these naive clients - which we are all paying for. I don't think these changes will go far enough to addressing the issue of naive consumers investing in non-mainstream investments without the appropriate understanding of the risks, but it was sort of inevitable this obvious open goal would be removed. One of the platforms I used to use, I can't remember which one but it was one of those still operating today, started nagging me that "because I'd made 2 investments through them in the past year I could now self-certify as sophisticated and could then could invest as much as I wanted on their platform". That was pretty irresponsible in my view. I continued to self-certify restricted throughout.Sea_Shell said:masonic said:

If you are self-certifying as restricted and are ok with continuing as such (not investing more than 10% of your assets in P2P), then the changes won't affect you. It is just those who self-certified as 'sophisticated' only on the basis of having participated in a couple of previous loans that will no longer be able to do so to be free of that limit. I would suggest that 10% is more than enough for "the little guy" to have invested in this sector.Sea_Shell said:Do I need to worry about the new rules around P2P that come into effect on 31st January?*

I'm currently a self declared inexperienced investor, supposed limited to depositing 10% of my investable assets, which I still am.

How might this affect "the little guy" on platforms such as Loanpad?

* Read about briefly on the P2P forum, but I'm not a member and not sure if it'll apply to me .

So the question then moves on the viability of P2P, if those who have self-certified as HNW or "sophisticated" no longer meet the more stringent rules and they [are forced to] pull out of P2P.

I wonder how many of Loanpad's current investors will find themselves betwixt and between the new definitions.

It would be a bit strange if the only people "allowed" to invest in P2P are either the "rich" or "the little guy" and no one in between.The increase in net assets for HNW from £250k to £430k is really just reinstating it around the level it was when it was first introduced. It should really be index linked. CPI inflation since 2001 has been about 80%, the increase here is 72%.It is certainly not the case that the only people "allowed" to invest in P2P are "rich" or "the little guy", anyone can invest up to 10% of their assets per year into non-mainstream investments like P2P, mini-bonds, and unlisted company stocks under the new regime. If this is in a mix of short and longer term investments, the total figure could be considerably higher than 10%. I think you'd have to be off your rocker to want to invest more, but that's just my personal opinion.In my view, what the FCA should be doing is bringing P2P firms under the auspices of full regulation and FSCS cover (equivalent to that available for other investment platforms) and removing them from the other unregulated investments so that they are equivalent to stockbrokers (who after all allow consumers access to riskier markets such as single AIM stocks). A novice investor wouldn't have had to certify as "sophisticated" to pay their life savings into a Freetrade account, invest it all in Pantheon Resources in April 2022 before giving up and selling at a 90% loss a year later, but they would at least have a claim against the platform that they could take to the FOS and FSCS if the platform had encouraged them to make the unsuitable investment.0 -

But my worry is for the wider use of P2P as part of a portfolio, with those who currently "fit" but will no longer do so.

What impact will that have on the likes of Loanpad, if those investors no longer qualify?

Take someone who had relevant assets of £250k, but also had a gold plated DB pension, so they had decided to invest £50k in P2P. They knew the risks and chose to invest over 10% but could, to now, self-certify due to their asset level.

Under the new £430k threshold, they would no longer qualify to be able to hold that £50k, and would have to reduce their holding to £25k. (Not sure how that'll be policed or implemented as yet)

Who knows how many people fall into that sort of scenario.How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

Sea_Shell said:But my worry is for the wider use of P2P as part of a portfolio, with those who currently "fit" but will no longer do so.

What impact will that have on the likes of Loanpad, if those investors no longer qualify?Everyone will continue to qualify to make new investments of up to 10% of their net assets per year into financial instruments that do not have the regulatory safeguards of mainstream investments regardless of how much they currently hold. In effect it means that someone...with £10k net assets could invest £1k per year in P2P (or hold a rolling £3k in 3 year loan contracts built up over 3 years, or a rolling £5k in 5 year loan contracts built up over 5 years)with £100k net assets could invest £10k per year in P2P (or hold a rolling £30k in 3 year loan contracts built up over 3 years, or a rolling £50k in 5 year loan contracts built up over 5 years)with £430k net assets could invest all £430k in P2P on day 1 if that were feasibleOut of all of those, it is the last that I think is most problematic, and before the change, anyone could invest all of their assets in P2P, in some cases after just days or weeks of starting to invest in P2P. So it is good that at least that is being curtailed for many investors. It would be better if the sector itself was brought under the regulatory auspices of mainstream investments to afford consumer investors the additional protection, but that would require a lot of work.I don't know how many LoanPad investors would be impacted by the changes, but I would hope it wouldn't be many, as I think the vast majority do understand the risks and have therefore limited their exposure. The limit has never been policed, and there is no suggestion this will change. It is a declaration made by the investor, and it is their responsibility to take it into account when making investments.Sea_Shell said:Take someone who had relevant assets of £250k, but also had a gold plated DB pension, so they had decided to invest £50k in P2P. They knew the risks and chose to invest over 10% but could, to now, self-certify due to their asset level.

Under the new £430k threshold, they would no longer qualify to be able to hold that £50k, and would have to reduce their holding to £25k. (Not sure how that'll be policed or implemented as yet)

Who knows how many people fall into that sort of scenario.First of all, these rules do not limit your holding, they limit the value of new investments you can make within a 12 month period. Having £250k in net assets would entitle someone to invest £50k in P2P in total providing no more than £25k of new investments were made in the first 12 months of signing the investor declaration. The loans would need to be of sufficient duration.The primary purpose of a pension is to provide an income in retirement, so it should be treated as somewhat equivalent to someone's earning capability, which is not considered a factor unless the investor has had an income of >£170k in the previous financial year. My understanding is that income from a DB pension could be counted towards the £170k.It should also be noted that anyone could invest any amount of their assets in non-mainstream investments under advice, the challenge would be finding a regulated financial adviser who would consider this suitable. Through the advice channel, consumers would get even better protection than they would from buying DIY mainstream investments.0 -

I didn't appreciate it was 10% per year and ones current holdings could be carried over, as it were.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

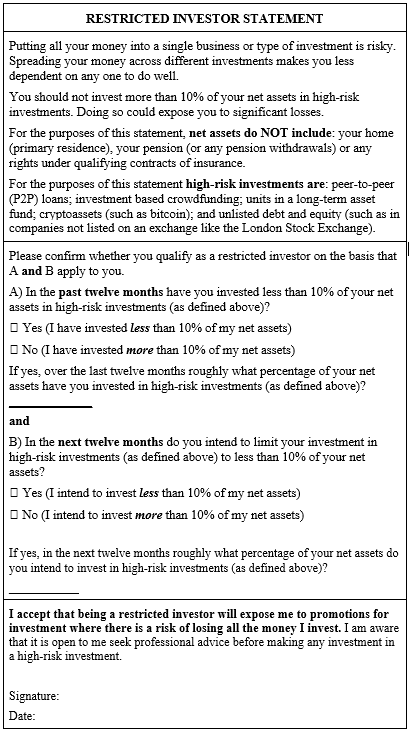

Sea_Shell said:I didn't appreciate it was 10% per year and ones current holdings could be carried over, as it were.I doubt it is the intention, but it is a reasonable interpretation - and it is for the investor to interpret the declaration before making it. Here is the most recent version of COBS 4 Annex 5, which is not subject to the changes ( https://www.handbook.fca.org.uk/handbook/COBS/4/Annex5.html?date=2023-10-08 ):

It certainly states that you should not invest more than 10% of your assets, but you only need to confirm to the specific statements in section A and B apply to you to meet the eligibility for Restricted Investor.The lower questions ask "...over the last 12 months roughly what percentage of your net assets have you invested in high-risk investments (as defined above)?" and "...in the next 12 months roughly what percentage of your net assets do you intend to invest in high-risk investments (as defined above)?"The checkboxes are associated with what you have done in the past 12 months and intend to do in the next 12 months, so if, for sake of argument, your net assets are £250k, and over the last 12 months you invested £25k into some P2P loan agreements, and then over the next 12 months you intend to invest £25k into some other loan agreements, you could in good conscience tick both Yes boxes and answer 10% to the questions asking for a percentage. That could result in you holding 20% of your net assets in P2P loans, though likely the figure is lower if some of the loans paid repaid during the period. When you come to do it again next year, only investments made in the last 12 month within the scope of the question, so again, you can answer 10%.2

It certainly states that you should not invest more than 10% of your assets, but you only need to confirm to the specific statements in section A and B apply to you to meet the eligibility for Restricted Investor.The lower questions ask "...over the last 12 months roughly what percentage of your net assets have you invested in high-risk investments (as defined above)?" and "...in the next 12 months roughly what percentage of your net assets do you intend to invest in high-risk investments (as defined above)?"The checkboxes are associated with what you have done in the past 12 months and intend to do in the next 12 months, so if, for sake of argument, your net assets are £250k, and over the last 12 months you invested £25k into some P2P loan agreements, and then over the next 12 months you intend to invest £25k into some other loan agreements, you could in good conscience tick both Yes boxes and answer 10% to the questions asking for a percentage. That could result in you holding 20% of your net assets in P2P loans, though likely the figure is lower if some of the loans paid repaid during the period. When you come to do it again next year, only investments made in the last 12 month within the scope of the question, so again, you can answer 10%.2 -

Good to see that the new platform software should be available soon(ish), allowing investment and reinvestment for every 1p held.

Detailed in today's email...

New software update

Our new software is currently in testing and we hope to be able to provide a go-live date before too long.

When it is live, investors will be able to invest funds from as little as 1p which will improve compound returns. There will also be a "re-invest interest" option which will mean your interest will be re-invested the same day, as opposed to the following day like it is currently.

There will be additional live data fields and charts and some other new features as well, with many more to be added subsequently.

Importantly, we have been very careful not to add any complications so the platform will remain as simple and easy to navigate as always.

A further update on this will be provided as soon as possible.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)2 -

I'm more intrigued to find out what the new features will be. I'm a big fan of Loanpad, but in reality the specified improvements will make hardly any difference.Sea_Shell said:Good to see that the new platform software should be available soon(ish), allowing investment and reinvestment for every 1p held.

Detailed in today's email...

New software update

Our new software is currently in testing and we hope to be able to provide a go-live date before too long.

When it is live, investors will be able to invest funds from as little as 1p which will improve compound returns. There will also be a "re-invest interest" option which will mean your interest will be re-invested the same day, as opposed to the following day like it is currently.

There will be additional live data fields and charts and some other new features as well, with many more to be added subsequently.

Importantly, we have been very careful not to add any complications so the platform will remain as simple and easy to navigate as always.

A further update on this will be provided as soon as possible.

The reduction in minimum investment from £10 to 1p would gain an extra 32.5p interest per year regardless of investment size for someone in the Premium account with auto reinvestment switched on.

Having interest reinvested on the same day will also make little difference; about 1p per year per thousand pounds invested in the Premium account.4 -

I don't currently have mine set to auto invest, as it kept turning itself off when my rolling withdrawals cashed out (if I didn't cancel them).

So for me, a setting that reinvests interest automatically every day without hitting the cash account, would save me doing it manually every few days.

I think 😉How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards