We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Once you've "won the game"

Comments

-

For a true guarantee? None. To illustrate why, consider Russia at the start of the communist takeover or the Pol Pot government in Cambodia. Being killed because you have money or an education doesn't make for a high success rate in achieving objectives that require living or ability to pass on an inheritance.uk1 said:

There are no people in the world that have more than enough?

In less extreme cases there's strictly no guarantee that even very well diversified investment in many countries and multiple citizenships will protect against inflation but the chances rise to very high levels as money increases if objectives remain constant.0 -

The US SWR historically is a hair over 4% using 50:50 equities:government bonds. UK is 0.3% lower. Both before all costs, including costs incurred inside investments; costs reduce SWR by about a third of costs. Using 4% rule for a 30 year plan for this paragraph.OldScientist said:

Thanks for the link to the paper - the comparison between US and UK annuity rates also has to be considered in the context of the historical SWR for the two countries (i.e. approx 3.7% and 3.0%).You should think of an annuity as insurance rather than an investment. If you live long enough to use that insurance then you might sit back in your Bath chair, smiling at your mortality credits and think that you made a good investment...of course that would have to be compared against stock returns etc, but the comparison is rather silly because they are such different financial tools. So just think of it as longevity insurance, expensive right now, but maybe a better deal when you are older.

Here is a recent paper from Vanguard about how fixed income annuities and deferred annuities can be used in providing retirement income. The longer you live the better the annuities do. However, the study uses a payout rate of 5.8% not the current 4.9% that a 65 year old male will get in the UK.

https://institutional.vanguard.com/iam/pdf/ISGGAR_042021.pdf?cbdForceDomain=true

I note that the Vanguard paper uses level annuities at a single purchase age - historically results would have been better (e.g. more income) with phased purchases (i.e. at several ages) and with escalating annuities.0 -

By definition and in realities annuities do not have to be insurance products. Historically they usually weren't insurance products because there was no insurance market from which to buy them. Today one of the better known examples of individuals contractually paying annuities to other individuals is the French viager system.Deleted_User said:

..By definition annuity is an insurance contract.1 -

Forty years of progressively reducing interest rates, longer mortgage terms and more disposable income in peoples pockets. As basic goods became cheaper to purchase. Every cycle eventually comes to an end. A combination of factors may mean that we are on the cusp of a new era.MarkCarnage said:

Pretty accurate I suspect. The implicit target here may be higher general inflation and static nominal house prices.jamesd said:

BoE analysis attributed most of the rise in property process to decreased interest rates. That implies a negative expectation in a time when rates are expected to rise. While nominal house prices tend not to decrease a lot of the time, real prices do fall because people set a nominal get back at least what I (nominally) paid target and inflation reduces the real price for them.Diplodicus said:Cash?

I would be amazed if house prices were lower in 3, 5 or 10 years time because of the political truth that falling house prices equal unpopularity. Therefore rising house prices, unlike shares, are underpinned by Govt in this country.

Being invested in equities has beaten property over the last decade; but property is 95% likely a better alternative than cash.0 -

Quite right. I was wrong not to factor in a possible communist takeover of the UK and being executed for being wealthy.jamesd said:

For a true guarantee? None. To illustrate why, consider Russia at the start of the Communist takeover or the Pol Pot government in Cambodia. Being killed because you have money or an education doesn't make for a high success rate in achieving objectives that require living or ability to pass on an inheritance.uk1 said:

There are no people in the world that have more than enough?

In less extreme cases there's strictly no guarantee that even very well diversified investment in many countries and multiple citizenships will protect against inflation but the chances rise to very high levels as money increases if objectives remain constant.

I’ll update the spreadsheet. 0

0 -

Sorry, I should have been clearer the figures I quoted were 'Safemax', i.e. withdrawals that produced no failures not those where there are 5-10% failure. I've finally got around to implementing non-US data in my own code (the JST data at https://www.macrohistory.net/database/) and found a safemax for the UK (with UK equities and UK bonds, no fees) of about 2.9%, although using 50/50 UK/US equities (using solely UK bonds rather than a mix) increases this to about 3.1%, while a broader mix of equities (UK, US, Australia, Germany, etc. - note I have yet to include some important countries, e.g. Japan since implementing equity series with gaps needs a bit of thought) increases it still further to 3.3% (how significant those differences are is a matter for interpretation).jamesd said:

The US SWR historically is a hair over 4% using 50:50 equities:government bonds. UK is 0.3% lower. Both before all costs, including costs incurred inside investments; costs reduce SWR by about a third of costs. Using 4% rule for a 30 year plan for this paragraph.OldScientist said:

Thanks for the link to the paper - the comparison between US and UK annuity rates also has to be considered in the context of the historical SWR for the two countries (i.e. approx 3.7% and 3.0%).You should think of an annuity as insurance rather than an investment. If you live long enough to use that insurance then you might sit back in your Bath chair, smiling at your mortality credits and think that you made a good investment...of course that would have to be compared against stock returns etc, but the comparison is rather silly because they are such different financial tools. So just think of it as longevity insurance, expensive right now, but maybe a better deal when you are older.

Here is a recent paper from Vanguard about how fixed income annuities and deferred annuities can be used in providing retirement income. The longer you live the better the annuities do. However, the study uses a payout rate of 5.8% not the current 4.9% that a 65 year old male will get in the UK.

https://institutional.vanguard.com/iam/pdf/ISGGAR_042021.pdf?cbdForceDomain=true

I note that the Vanguard paper uses level annuities at a single purchase age - historically results would have been better (e.g. more income) with phased purchases (i.e. at several ages) and with escalating annuities.

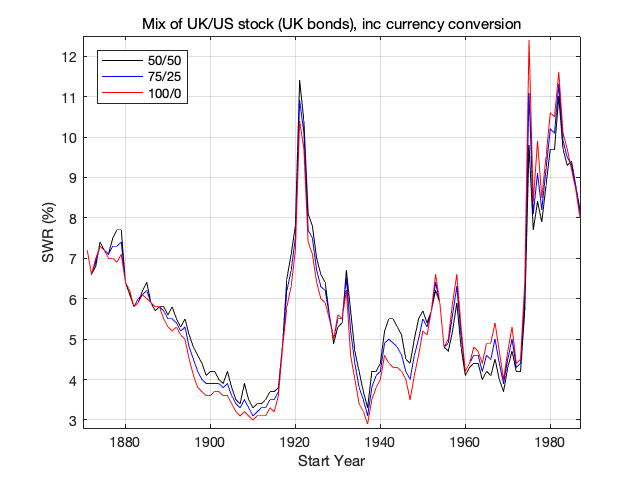

Just for fun, here is the historical SWR for the UK with 60% equities, 40% bonds (the bonds are only UK government) with various UK/US equity mixes (i.e. 100/0 is UK stocks only)

Holding US stocks improves the poor UK retirements starting before and during WWI and just before WWII, but does reduce the SWR in the 1960s where US retirees did rather poorly.

0 -

jamesd said:

The heavy flaw is that there are already two "products" that deliver approximately 100% chance of inflation protected income with no investment risk: buying an inflation-linked annuity (100% FSCS protection) and state pension deferral. If the only job is inflation protecting income then you buy those and stick anything left over in a discretionary spending or inheritance pot.billy2shots said:...

The only job of money invested is to keep pace with inflation (if that's not the only job then you haven't truly won the game).

You can invest all of it in so called 'lower risk holdings' but let's face it, that risk may still be too high to someone who doesn't need to take further risk.

The alternative.

50% cash gaining as much interest as possible whilst the capital remains totally safe. No need to go into detail here but regular savers, PBs etc where the government guarantees it safety, spread across accounts where needed.

The other 50% is invested. If we take 3% as the average rate of inflation then we have to make an average return of 6% on that money (only 50% invested remember so it has to yield twice the return of inflation). ...

For any normal year you would withdraw half your annual income from your cash and the other half from the invested pot.

Stock market down years would see you only take from cash. Better returning years would see you take more from the investment side to rebalance the cash towards a 50/50 weighting once again.

...

It's really simple so probably heavily flawed but sometimes reading on here and other investing forums, people try so hard to overcomplicate things.It's true that an inflation linked annuity will protect the income it pays out from inflation......not in dispute.....but the rub is that the income it pays out is low......Taken to the extreme, if I offered to pay you an index linked income of £100pa for life, in exchange for £100k, it's true that the income would be protected from inflation for the rest of your life, with no investment risk, but the level is too low. That's the crux of it, at least imho.

1 -

Then save more, retire later. When everybody starts adopting the investment strategy then any benefit gets nullified eventually.MK62 said:jamesd said:

The heavy flaw is that there are already two "products" that deliver approximately 100% chance of inflation protected income with no investment risk: buying an inflation-linked annuity (100% FSCS protection) and state pension deferral. If the only job is inflation protecting income then you buy those and stick anything left over in a discretionary spending or inheritance pot.billy2shots said:...

The only job of money invested is to keep pace with inflation (if that's not the only job then you haven't truly won the game).

You can invest all of it in so called 'lower risk holdings' but let's face it, that risk may still be too high to someone who doesn't need to take further risk.

The alternative.

50% cash gaining as much interest as possible whilst the capital remains totally safe. No need to go into detail here but regular savers, PBs etc where the government guarantees it safety, spread across accounts where needed.

The other 50% is invested. If we take 3% as the average rate of inflation then we have to make an average return of 6% on that money (only 50% invested remember so it has to yield twice the return of inflation). ...

For any normal year you would withdraw half your annual income from your cash and the other half from the invested pot.

Stock market down years would see you only take from cash. Better returning years would see you take more from the investment side to rebalance the cash towards a 50/50 weighting once again.

...

It's really simple so probably heavily flawed but sometimes reading on here and other investing forums, people try so hard to overcomplicate things.It's true that an inflation linked annuity will protect the income it pays out from inflation......not in dispute.....but the rub is that the income it pays out is low......0 -

But if the annuity is too low it just mean you haven't 'won the game' yet as without an annuity you are still playing.MK62 said:jamesd said:

The heavy flaw is that there are already two "products" that deliver approximately 100% chance of inflation protected income with no investment risk: buying an inflation-linked annuity (100% FSCS protection) and state pension deferral. If the only job is inflation protecting income then you buy those and stick anything left over in a discretionary spending or inheritance pot.billy2shots said:...

The only job of money invested is to keep pace with inflation (if that's not the only job then you haven't truly won the game).

You can invest all of it in so called 'lower risk holdings' but let's face it, that risk may still be too high to someone who doesn't need to take further risk.

The alternative.

50% cash gaining as much interest as possible whilst the capital remains totally safe. No need to go into detail here but regular savers, PBs etc where the government guarantees it safety, spread across accounts where needed.

The other 50% is invested. If we take 3% as the average rate of inflation then we have to make an average return of 6% on that money (only 50% invested remember so it has to yield twice the return of inflation). ...

For any normal year you would withdraw half your annual income from your cash and the other half from the invested pot.

Stock market down years would see you only take from cash. Better returning years would see you take more from the investment side to rebalance the cash towards a 50/50 weighting once again.

...

It's really simple so probably heavily flawed but sometimes reading on here and other investing forums, people try so hard to overcomplicate things.It's true that an inflation linked annuity will protect the income it pays out from inflation......not in dispute.....but the rub is that the income it pays out is low......Taken to the extreme, if I offered to pay you an index linked income of £100pa for life, in exchange for £100k, it's true that the income would be protected from inflation for the rest of your life, with no investment risk, but the level is too low. That's the crux of it, at least imho.I think....0 -

The Bogleheads rooted out the 1.6% fees that were applied and Pfau posted about it on the Boglehead forum, but here is the whitepaper that he produced for a big insurance companyjamesd said:

The American College of Financial Services was founded for life insurance underwriter training in 1927. Suggesting bias because it was founded to train underwriters ninety years ago and has diversified since then isn't helpful. Personally, in general bogleheads lack authority compared to someone with his reputation, though there are undoubtedly lots of exceptions.bostonerimus said:

His work advocating whole life insurance and annuities has been criticized in the Boglehead community, admittedly they do have a very strong bias against "insurance products". But he does take money from the insurance industry and is a professor at a university set up to educate insurance professionals...so I would be far more comfortable with his work if he was not so strongly tied into the insurance industry. Some of his assumptions (like 1.6% fees on an equity and bond portfolio) and methodologies in his work are argued to be slanted towards whole life and annuities. Also he is using US products and rates and they are very different from what's on offer in the UK.jamesd said:

The traditional and still effective way to do this is to cover the inflation risk with index-linked annuity purchases.waveydavey48 said:... why keep exposing your money to the vagaries of the market when you don't need to.

What happens next?

Is there a way to ensure your money just keeps pace with inflation so that it doesn't decrease in real terms, or maybe increases by 1 or 2% per annum?

A well known US retirement researcher, Wade Pfau, advocates substituting annuities for bonds and continuing with equity investing, on the basis that bonds are for risk reduction and annuity purchase is the ultimate in risk reduction.

For me I simply reject whole life insurance as expensive and complicated. With the disappearance of DB pensions annuities can provide a safe income floor and longevity insurance, but just as bonds look like bad value with today's low interest rates so do annuities. Right now they are an expensive longevity insurance product, but, if you've "won the game" you can afford them.

I don't see a mention of 1.6% fees on a presumably IFA managed equity ad bond portfolio in his paper but maybe you have some other source, and in addition one for the effect of charges deducted on annuity purchase.

At your age and nine annuities don't look particularly attractive but in the podcast I linked to he mentions age 75 as a good sort of buying age and I mention late seventies to early eighties plus state pension deferral from state pension age. They are a useful tool and when there's truly enough the state pension and inflation linked annuity purchases deliver, because annuities here get 100% FSCS protection and state pension failure to deliver inflation is unlikely.

https://static.fmgsuite.com/media/documents/9b364d00-595a-4b3e-92e4-a531e608aa7c.pdf

Now 1.6% in advisor and fund fees is probably quite realistic for many people, but it's sure to annoy Bogleheads who will claim that it's an unnecessary 1.5% headwind for the investments/bond portfolio. They also point out that in many previous papers the fund fees were set at 0.2% or just excluded and no advisor fee was included. It should also be noted that he is American and using American payout rates. The principles will be the same in the UK, but not the numbers.

Many Bogleheads have a great deal of professional experience in this and many also bring analytical skills from science and engineering as well as economics. Pfau has good qualifications from excellent universities, but so do a lot of people and his papers and analysis is not really complicated, just laborious.

There is a general acceptance on Bogleheads of the usefulness of annuities in the right circumstances, but I think there is a great deal of skepticism when it comes to his whole life insurance work. Many Bogleheads will annuitize as time goes on and many also have accounts with the big teachers insurance and financial company TIAA-CREF and they give very good rates to long term members and have always advocated annuities as part of retirement income plans.

I don't think Pfau is an outright insurance salesman as I arrived at some similar conclusions about annuities a while ago, but he does do the circuit of retirement shows and events and now is big on insurance products and I'm cynical enough to believe that his parameters, models and conclusions might be influenced by who is paying for the research. Personally I tend to look at stuff coming out of Bogleheads and Boston College Retirement Center as it's a little more academic, although the get funding from TIAA etc for some work. Here's a paper on annuities that suggests being able to buy additional State Pension (US Social Security) as a retirement option to an annuity from an insurance company.

https://crr.bc.edu/wp-content/uploads/2019/10/wp_2019-13.pdf

“So we beat on, boats against the current, borne back ceaselessly into the past.”0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.5K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.9K Spending & Discounts

- 244.5K Work, Benefits & Business

- 599.8K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards