We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Active vs Passive Funds

Comments

-

Many thanks team0

-

https://imgur.com/a/zfzSo5uAsifM068 said:

Much appreciated sir.billy2shots said:AsifM068 said:The eventual plan, after transfer of funds to Vanguard is to have 40% Global All Cap and 30/30% FTSE 250 and Europe Ex UK ETFs. It's a strategy that I am comfortable with👍

With the magic of Trustnet (and some others), you can set up a portfolio with your current holdings.

You can then create a portfolio of your intended holdings.

In the charting tool you can then select each portfolio and see how they compared over various points in history.

Don't worry too much about the cash part when creating the portfolio it's more about the % split between your holdings. I use £100k total investment because it's then very easy to put £ values in each holding (20% in Royal London UK would be £20k etc etc).

Alternatively tell us your % split and the exact funds they are in and some kind soul will chart it for you.

I would like to know the relative performance of the following 3 active RL funds, equally weighted, compared to the Vanguard FTSE Global All Cap please for the past 18 months if at all possible please.

RL UK Growth Trust A

RL Sustainable Leaders Trust A

RL European Growth Trust A

Many thanks

Asif LP

LP

Not an expert at adding pictures so it probably won't show up.

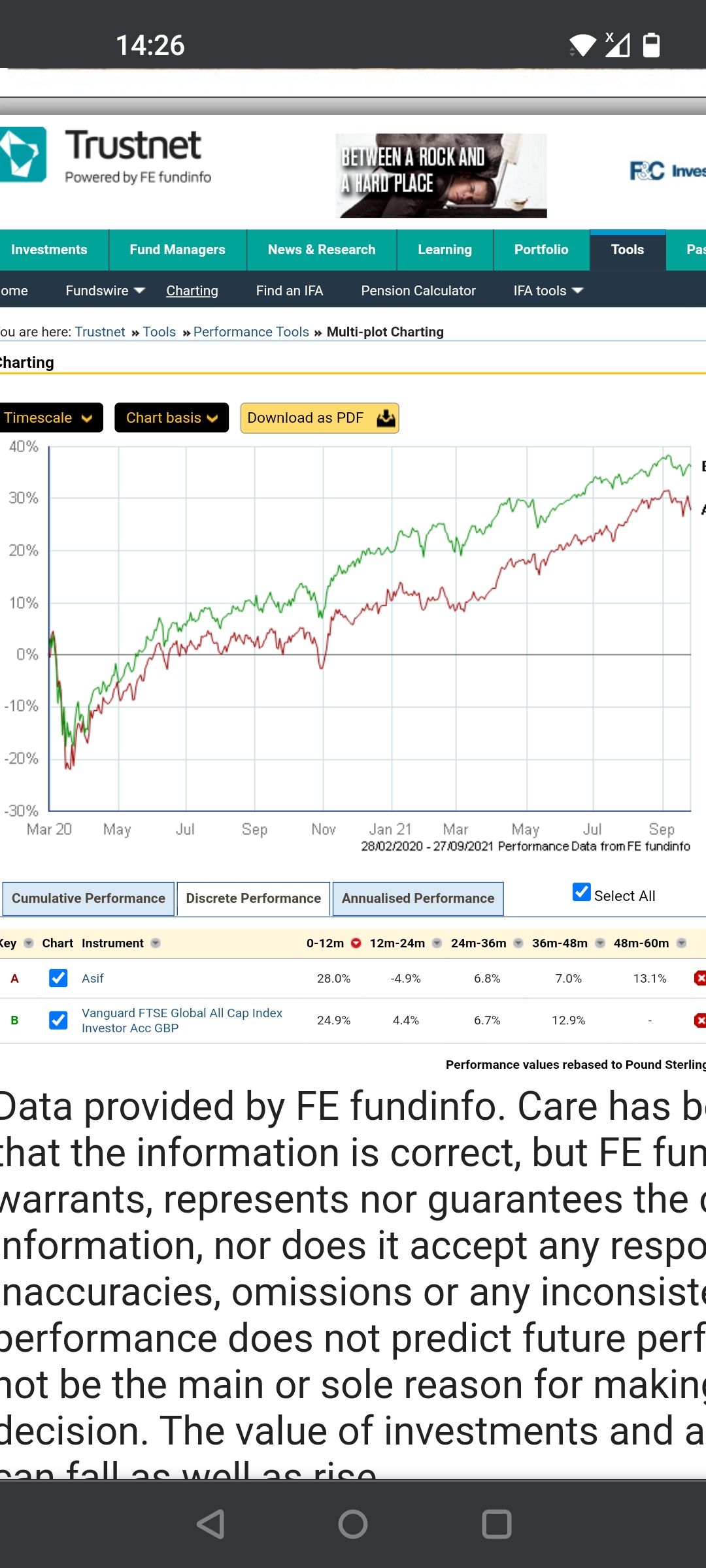

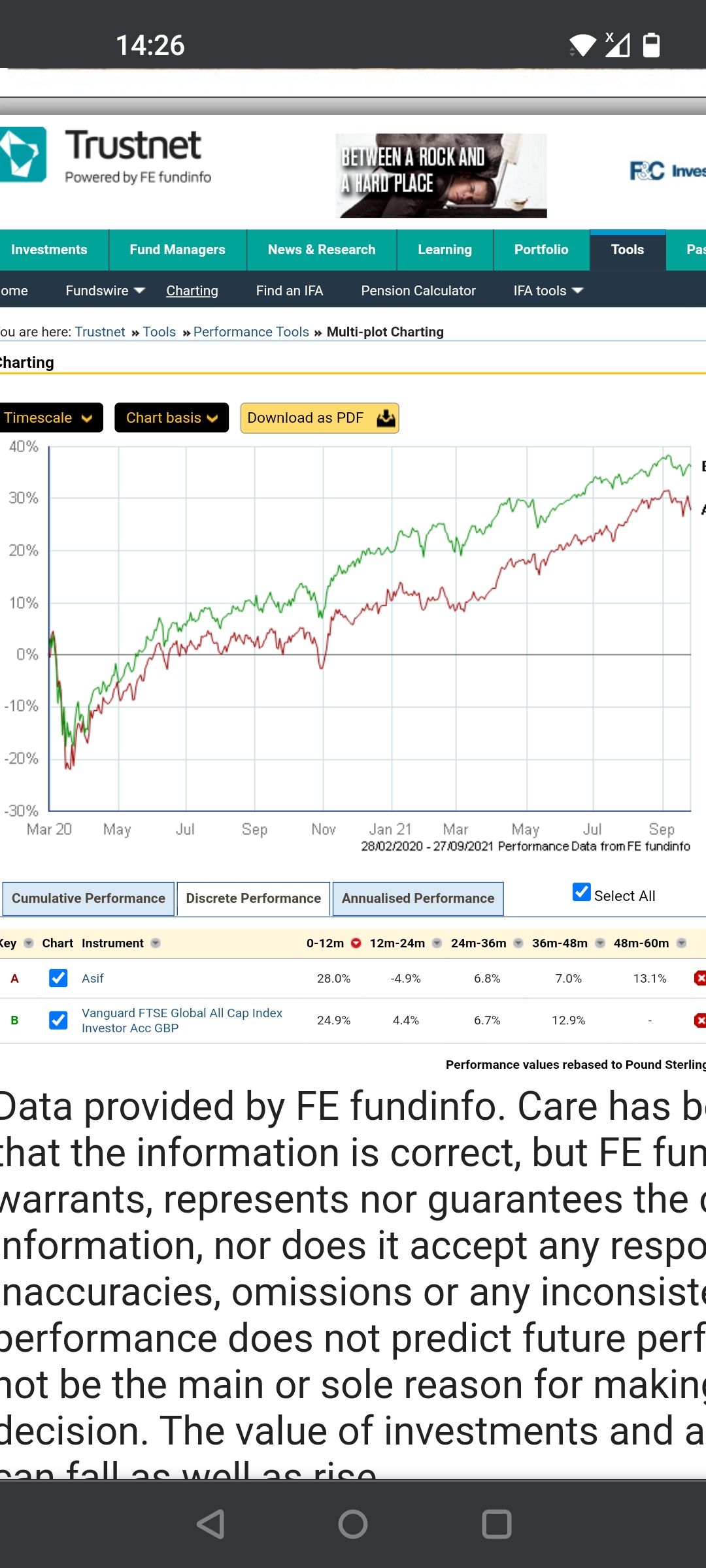

From 1st March 2020 until today, the cheap passive Van Global All Cap has returned 8% more than your portfolio if the holdings are equally held (33% in each). That's before fees so make that 9% better off for the ALL Cap fund.

It's why so many people opt for a cheap passive tracker these days.At its worst when the covid crash happened Feb 19th 2020, your portfolio dropped 29%. Van All Cap slipped 26%0 -

I think at some point I'll have to do a thread correcting this very popular misconception. Take rerating and net equity issuance (i.e. S&P 500 buybacks exceeding dividends) out of it and the so-called lack of growth, as in actual earnings growth, you're seeing disappears.Linton said:

The UK did not. The problem is with the companies that make up the FTSE100. It is unable to hold onto major growth companies. Any like ARM which are or have a potential to be world leaders get taken over by foreign companies well before they form a significant part of the FTSE100.AsifM068 said:Why did the UK fare so poorly relative to the global market at the time?

1 -

The trouble is that you can't take rerating out of the equation. When UK companies are comparatively cheap compared to a US equivalent, that is when private equity, or a big US company comes in and buys them. Thats why we can't hold on to them.tebbins said:

I think at some point I'll have to do a thread correcting this very popular misconception. Take rerating and net equity issuance (i.e. S&P 500 buybacks exceeding dividends) out of it and the so-called lack of growth, as in actual earnings growth, you're seeing disappears.Linton said:

The UK did not. The problem is with the companies that make up the FTSE100. It is unable to hold onto major growth companies. Any like ARM which are or have a potential to be world leaders get taken over by foreign companies well before they form a significant part of the FTSE100.AsifM068 said:Why did the UK fare so poorly relative to the global market at the time?

In addition it scares off promising IPOs where the owners don't want to see a lower valuation just because its listed in the UK. So they IPO in the US instead.1 -

I called them mediocre based on the comparative performance of many Vanguard managed active funds. The BG managed one outperforming helps to illustrate why I used that term. Mediocre for the range doesn't eliminate there being the odd one or two that's good compared to the whole active fund universe.Deleted_User said:Also worth saying that although the fees are higher for this fund than the classic passive Vanguard funds, they're still lower than most active funds. Calling funds like this "mediocre" makes little sense at the best of times. You judge a fund on its performance not how fancy or exciting it looks.

It would be fair to say the choice of active funds at Vanguard is mediocre (i.e. they don't have many compared to other platforms) but that's a different thing entirely.

1 -

I agree over-rating of growth shares is not sustainable. The real growth may be illusory however it has been a feature of the markets since the GFC which is the sort of time period over which many people are comparing the FTSE100 with the US.tebbins said:

I think at some point I'll have to do a thread correcting this very popular misconception. Take rerating and net equity issuance (i.e. S&P 500 buybacks exceeding dividends) out of it and the so-called lack of growth, as in actual earnings growth, you're seeing disappears.Linton said:

The UK did not. The problem is with the companies that make up the FTSE100. It is unable to hold onto major growth companies. Any like ARM which are or have a potential to be world leaders get taken over by foreign companies well before they form a significant part of the FTSE100.AsifM068 said:Why did the UK fare so poorly relative to the global market at the time?1 -

Thanks a million Billy2shots - great work sir! Really goes to show the power of a passive index fund held in the long term.billy2shots said:

https://imgur.com/a/zfzSo5uAsifM068 said:

Much appreciated sir.billy2shots said:AsifM068 said:The eventual plan, after transfer of funds to Vanguard is to have 40% Global All Cap and 30/30% FTSE 250 and Europe Ex UK ETFs. It's a strategy that I am comfortable with👍

With the magic of Trustnet (and some others), you can set up a portfolio with your current holdings.

You can then create a portfolio of your intended holdings.

In the charting tool you can then select each portfolio and see how they compared over various points in history.

Don't worry too much about the cash part when creating the portfolio it's more about the % split between your holdings. I use £100k total investment because it's then very easy to put £ values in each holding (20% in Royal London UK would be £20k etc etc).

Alternatively tell us your % split and the exact funds they are in and some kind soul will chart it for you.

I would like to know the relative performance of the following 3 active RL funds, equally weighted, compared to the Vanguard FTSE Global All Cap please for the past 18 months if at all possible please.

RL UK Growth Trust A

RL Sustainable Leaders Trust A

RL European Growth Trust A

Many thanks

Asif LP

LP

Not an expert at adding pictures so it probably won't show up.

From 1st March 2020 until today, the cheap passive Van Global All Cap has returned 8% more than your portfolio if the holdings are equally held (33% in each). That's before fees so make that 9% better off for the ALL Cap fund.

It's why so many people opt for a cheap passive tracker these days.At its worst when the covid crash happened Feb 19th 2020, your portfolio dropped 29%. Van All Cap slipped 26%

Very much appreciated.

Asif

0 -

Another myth. Listing requirements in the US are generally far laxer than the London markets. London might be small but it's highly regarded. Hence why companies such as Experian list here rather than the US.Prism said:tebbins said:

I think at some point I'll have to do a thread correcting this very popular misconception. Take rerating and net equity issuance (i.e. S&P 500 buybacks exceeding dividends) out of it and the so-called lack of growth, as in actual earnings growth, you're seeing disappears.Linton said:

The UK did not. The problem is with the companies that make up the FTSE100. It is unable to hold onto major growth companies. Any like ARM which are or have a potential to be world leaders get taken over by foreign companies well before they form a significant part of the FTSE100.AsifM068 said:Why did the UK fare so poorly relative to the global market at the time?

In addition it scares off promising IPOs where the owners don't want to see a lower valuation just because its listed in the UK. So they IPO in the US instead.1 -

Team, I'm looking at a £ 160/170K invested over a 40/30/30% split between the following Vanguard funds (following RL active ISA transfer next month) to be held over 10 years or so to seed my retirement fund;

FTSE Global All Cap (40)

FTSE 250 ETF (30)

Europe Ex UK ETF (30)

I will also have just under 50k in premium bonds as my emergency pot when my NS&I Index Linked Certificate matures next spring.

I am 53 with a 20 year Civil Service DB pension to be taken at 60.

Is there anything glaringly wrong with this selection / strategy please?

Many thanks team.0 -

Slightly off topic team but why is the UK renown for high dividend investments / stocks or have I got this wrong?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards