We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Investing for a house deposit

Comments

-

I posted this question because I got roasted on another forum

I generally do believe you could invest some money to get a little bit of extra cash for a house deposit.

I don't recommend you buy shares I would recommend you buy funds there are many good active funds that go up year on year0 -

Yes of course you can, no one said you can't.Tonys101 said:I posted this question because I got roasted on another forum

I generally do believe you could invest some money to get a little bit of extra cash for a house deposit.

You could also end up investing some money and having to withdraw it at a point where has dropped and have a little bit less cash for a house deposit

Depends if you are willing to take that risk?

(Not sure who you are recommending this to but yes broadly a fund is lower risk than shares in one company).I don't recommend you buy shares I would recommend you buy funds there are many good active funds that go up year on year

But active funds can, and do, drop by double digit %s.

Unless you know an active fund that has never dropped in value?

0 -

A post from half an hour earlier would suggest that OP has already had a chance to learn that particular lesson....grumiofoundation said:

Yes of course you can, no one said you can't.Tonys101 said:I posted this question because I got roasted on another forum

I generally do believe you could invest some money to get a little bit of extra cash for a house deposit.

You could also end up investing some money and having to withdraw it at a point where has dropped and have a little bit less cash for a house deposit

Depends if you are willing to take that risk?Tonys101 said:I am new to investing well new as I learnt my lesson 1 or 2 year a ago I sold my lindsell train global equity fund cuz I was scared and it was COVID

FOR IT TO UP A YEAR LATER 😤3 -

Is this a joke here are two that have consistently gone upgrumiofoundation said:

Yes of course you can, no one said you can't.Tonys101 said:I posted this question because I got roasted on another forum

I generally do believe you could invest some money to get a little bit of extra cash for a house deposit.

You could also end up investing some money and having to withdraw it at a point where has dropped and have a little bit less cash for a house deposit

Depends if you are willing to take that risk?

(Not sure who you are recommending this to but yes broadly a fund is lower risk than shares in one company).I don't recommend you buy shares I would recommend you buy funds there are many good active funds that go up year on year

But active funds can, and do, drop by double digit %s.

Unless you know an active fund that has never dropped in value?

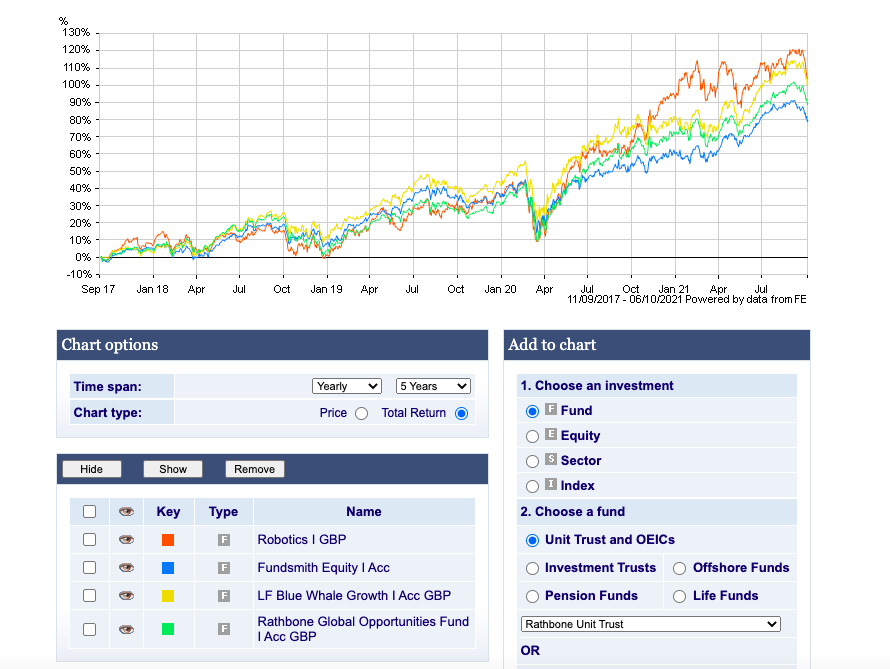

Blue whale fund

Fundsmith equity

Rathbone global opportunities

Picot robotics

Both have gone up 5 years in a row

This is not to say they will continue to go up forever. But when you say is there funds that have gone up consistently yes they are.

That said the chairman of blue whale fund is none other than Peter Hargreaves.

Again you risk what you can afford to loose, what you don't do is leave all ur money to rot with max 2% interest in a bank0 -

No joke I don't think you understood my point.Tonys101 said:

Is this a joke here are two that have consistently gone upgrumiofoundation said:

Yes of course you can, no one said you can't.Tonys101 said:I posted this question because I got roasted on another forum

I generally do believe you could invest some money to get a little bit of extra cash for a house deposit.

You could also end up investing some money and having to withdraw it at a point where has dropped and have a little bit less cash for a house deposit

Depends if you are willing to take that risk?

(Not sure who you are recommending this to but yes broadly a fund is lower risk than shares in one company).I don't recommend you buy shares I would recommend you buy funds there are many good active funds that go up year on year

But active funds can, and do, drop by double digit %s.

Unless you know an active fund that has never dropped in value?

Blue whale fund

Fundsmith equity

Rathbone global opportunities

Picot robotics

Both have gone up 5 years in a row

This is not to say they will continue to go up forever. But when you say is there funds that have gone up consistently yes they are.

That said the chairman of blue whale fund is none other than Peter Hargreaves.

I think you are either just looking at the annual return (which is pretty meaningless as it just provides a snapshot of the last 12 months for a given date - so only really applicable to you if you invested exactly 12, 24, 36... months ago) or you are just looking at average performance year on year. Which as the last 5 years has been 'good times' for investors would actually be hard to find many funds that haven't gone up in that period!

What I actually asked was regarding drops in value.

If you look at the performance charts for your 4 funds you will see in March 2020 they all dropped dramatically (which as posted above you have experienced).

If your house deposit dropped >30% would that impact you?

And would you sell again after it had dropped? Again you risk what you can afford to loose, what you don't do is leave all ur money to rot with max 2% interest in a bank

Again you risk what you can afford to loose, what you don't do is leave all ur money to rot with max 2% interest in a bankAs above so you can afford to lose some of the money? Or is this more of a theoretical point?

This is becoming a circular debate.

You ask can/should I invest my deposit?

You are told - not unless you are willing to risk it dropping in value or time scale is long.

You then state that you believe it is possible to make money towards house deposit by investing.

Again are told - yes you could but you risk losing money.

Ad infinitum.

0 -

Weren't there people on these forums circa 16 months ago that suddenly found their S&S (L)ISA had dropped and they no longer had the right deposit for their house purchase?Make £2023 in 2023 (#36) £3479.30/£2023

Make £2024 in 2024...0 -

I remember this storyannabanana82 said:Weren't there people on these forums circa 16 months ago that suddenly found their S&S (L)ISA had dropped and they no longer had the right deposit for their house purchase?

https://www.dailymail.co.uk/news/article-8096097/Family-miss-325-000-dream-home-coronavirus-crash-wipes-4-500-ISA.html

Edit: sure there were plenty more people who invested money that 'shouldn't' be invested.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards