We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Lifestrategy Vs 2 global funds

Comments

-

I didn't, I've only just looked. Previous responses helpful though, thank you.0

-

A few months ago I compared the performance of Vanguard's global bond index (hedged) to the bonds in VLS. Over the last five years the bonds in VLS outperformed the global bond index by a decent amount. I have not compared the constituent bonds to analyse why. (I can post the calculations if anyone want to see them.)

0 -

safe_hands2 said:I didn't, I've only just looked. Previous responses helpful though, thank you.And which will be best over the next two years?Or more importantly, the rest of the economic cycle?I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

-

I've mostly used three index funds to give me global equity and US bond coverage and over the last 30 years I've average around 9% annual return. I did that because it was the least expensive way to get me a fairly broad 70/30ish allocation. I could look back and see a vast range if returns from a 70/30 allocation depending on the composition of the portfolios, but that can be a dangerous thing if you get hung up on the "what ifs". Comparing your portfolio's performance against others is ok as long as you use it to modify your strategy and don't fixate on lost opportunities and beat yourself up about what you did in the past. Also you should not be jumping on every bandwagon in an effort to maximize returns because who knows what will be "best" in the future and you also might be taking on a disproportionate level of risk. Meeting the requirements for risk and return that will allow you to be successful should be your criteria, not some arbitrary level of return you might get from other portfolios.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

-

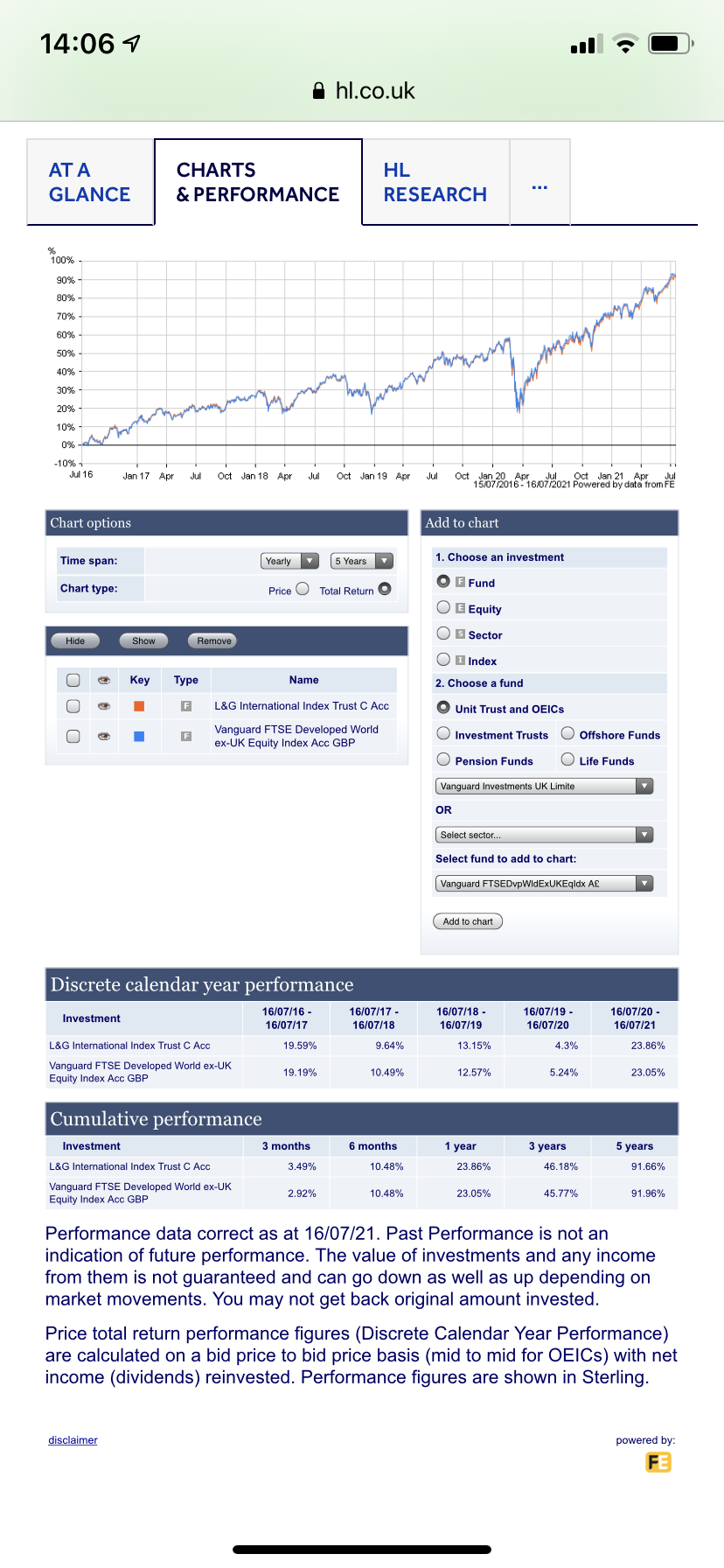

I recently wanted to invest some additional funds into a global index fund, and I looked at the Vanguard FTSE global all cap, but instead I decided to go for the L&G International Index I Acc fund as it has a longer history than the Vanguard FTSE global all cap fund, has better returns and is cheaper.safe_hands2 said:Thanks for replies. It was Vanguard FTSE global all cap and Vanguard global bond index hedged I was looking at. ISA is with Vanguard.

I also hold a VLS60 in a separate portfolio. I do like the VLS funds but in view of the above I would probably be better changing that to 60% of it going in the L&G International Index fund, and 40% going into a global bond fund. The two fund approach also has the advantage of being able to sell just bonds if needed when equities are falling in value.

0 -

The L&G is not totally global as it has no UK cover. It only contains around 2200 companies whereas the Vanguard FTSE all cap contains 3 times as many, so the performances will differ as they are not like for likeAudaxer said:

I recently wanted to invest some additional funds into a global index fund, and I looked at the Vanguard FTSE global all cap, but instead I decided to go for the L&G International Index I Acc fund as it has a longer history than the Vanguard FTSE global all cap fund, has better returns and is cheaper.safe_hands2 said:Thanks for replies. It was Vanguard FTSE global all cap and Vanguard global bond index hedged I was looking at. ISA is with Vanguard.

I also hold a VLS60 in a separate portfolio. I do like the VLS funds but in view of the above I would probably be better changing that to 60% of it going in the L&G International Index fund, and 40% going into a global bond fund. The two fund approach also has the advantage of being able to sell just bonds if needed when equities are falling in value.3 -

The Vanguard equivalent is Developed World Ex Uk there is almost no difference and the Vanguard is a whole 0.01% cheaper.

2

2 -

L&G International is also missing most of the emerging market allocation so is heavier on the remainder including US exposure which is why it will have done well over the past decade. We used to use L&G International alongside other investments but now valuations are suggesting it's likely to be better underweight not overweight on the US market.Stargunner said:The L&G is not totally global as it has no UK cover. It only contains around 2200 companies whereas the Vanguard FTSE all cap contains 3 times as many, so the performances will differ as they are not like for like

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards