We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Best allocation across Cash, Bonds & Equities?

Comments

-

Morningstar shows my overall asset split as 61% equity, 15% Fixed Income, 17% cash, 7% other.Canuck01 said:In line with the OP's post, it would be great to hear from some others who are retired or close to it, and what their portfolio split between and stocks and fixed income is, and the reasons for it. As stated mine is 50/50 ish.

The Fixed Income is split 20% gov bonds 27% UK index linked bonds, 41% corporate bonds, and 12% cash deposits.

The Fixed Income is all held by funds with specific objectives - Wealth Preservation and Income. If the fund managers have the knowledge to choose specific bonds to achieve the outcome I want then I am happy to pay them to do so.

In current circumstances I see no purpose in holding general bond funds with a wide range of maturity dates.

1 -

personally, with DB pensions online, and a time period where your DC pot would pay out even if in cash, i feel your mix is too conservative.

I would have more in equities, diversified globally of course.1 -

It's sufficient to warrant the FCA to be currently reviewing the matter with platforms. With £140bn of assets under management , the amount of cash that HL holds at anyone time is sizable. As a consequence there'll be offered better rates. As anything cheaper than BOE base could be potentially beneficial to their bankers.Linton said:

The overnight cash deposit rate is about 0.04%/year. So hardly a massive return compared with the platform charges.Thrugelmir said:

Platforms place client funds on overnight deposit and receive the benefit. HL / AJ Bell didn't get rich from fees alone.Linton said:

How does cash sitting in a SIPP subsidise the brokerage?Deleted_User said:

Cash in a savings account earning interest which you can access in an instant? Absolutely. Cash in a SIPP losing value and subsidizing the brokerage? Why would one ever do that?Albermarle said:

It can mean that , or it can mean cash outside a wrapper, sitting in a normal saving account(s) earning 1% maybe .Deleted_User said:By the way, when the posters here are saying “cash”, do you mean the actual cash sitting within a tax free pension wrapper and earning no interest?

It varies depending on the poster.0 -

1. Long duration bonds carry interest rate risk. Bonds, cash, stocks, any other asset you can think of - they all have risks.allanm02 said:

Nonetheless, the bulk of the fall was over a 6 week period early in the year. Although advice might be 'we didn't mean those kind of bonds!', it is possible to trip oneself up in the act of being cautious.allanm02 said:

Sorry, I misspoke. 12 months it is!Deleted_User said:

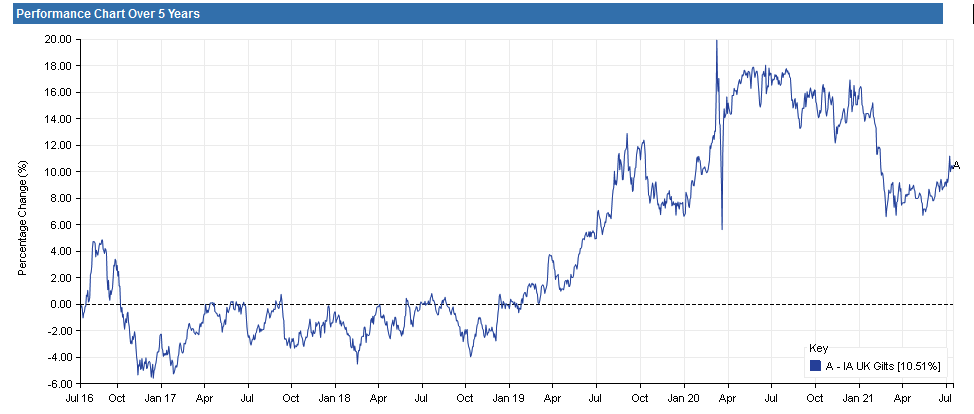

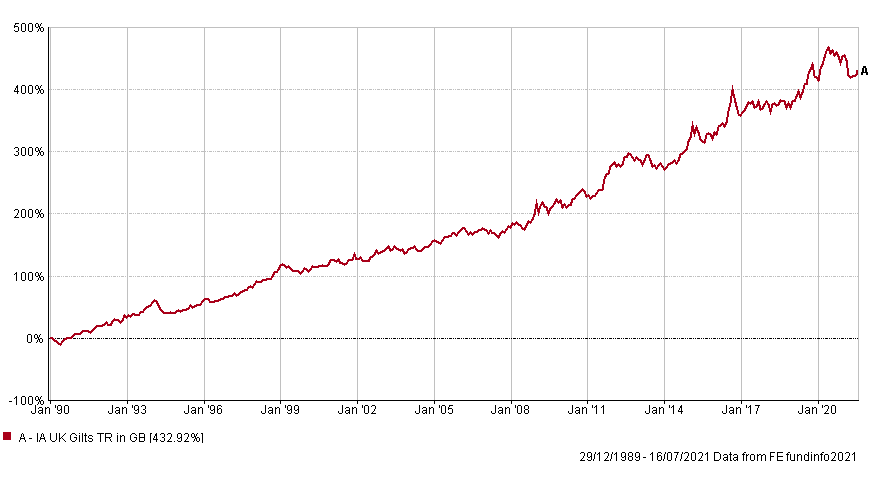

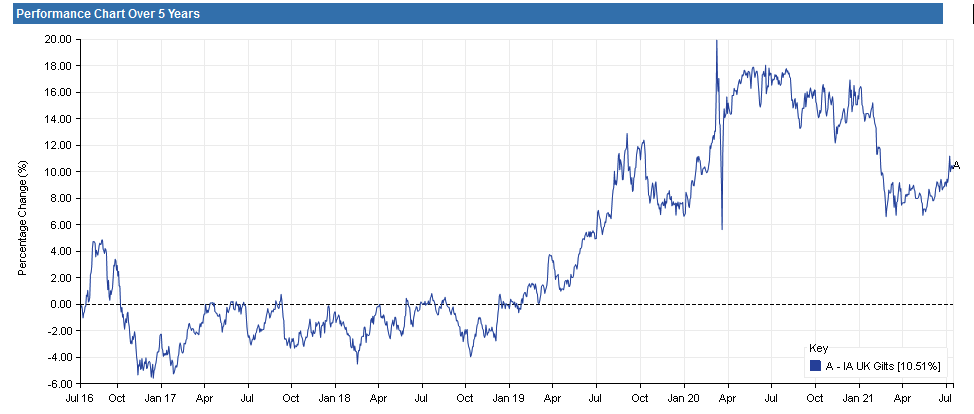

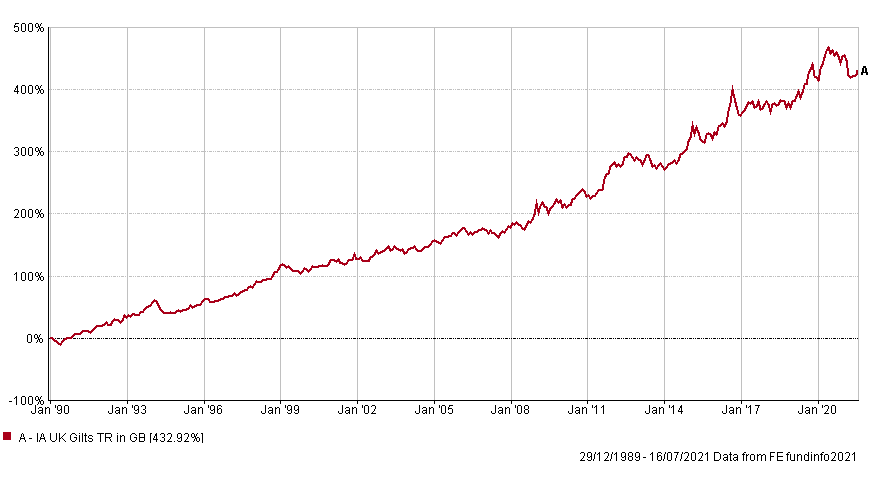

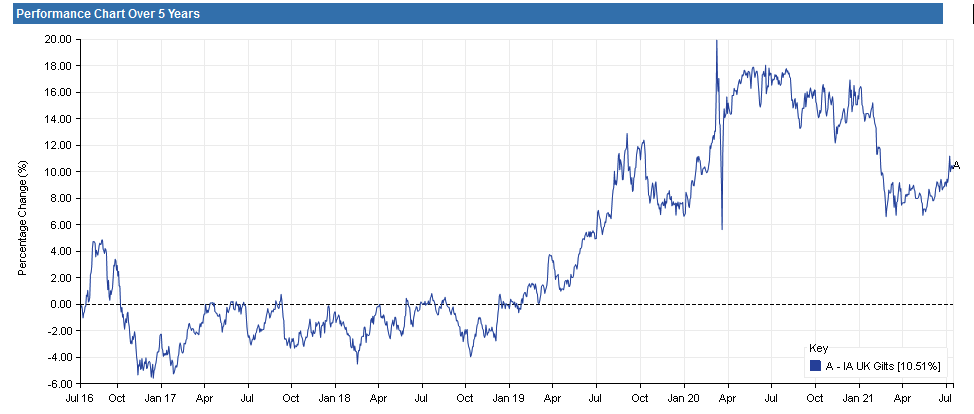

The claim was “2 months”. I’ve seen a rise. Thats quite different from 12 months.dunstonh said:Which gilt fund lost 8% over the last 2 months? I have not followed gilts but treasures did not do anything like this.A number of them are running in that ballpark. Vanguard UK Govt bond is 7% down over 12 months. Although a gilts crash did occur in that period.Some global govt bond funds and long dated gilts have just crept into double digit losses. However, it is worth noting that 2020 saw significant gains way above the typical norm and 2021 saw some of that unwind to bring it back in line with the long term average.

However, it is worth noting that 2020 saw significant gains way above the typical norm and 2021 saw some of that unwind to bring it back in line with the long term average. 2. You don’t get tripped if you select the tools which match your objectives. For example:

2. You don’t get tripped if you select the tools which match your objectives. For example:

- Some people hold bonds to reduce volatility of their overall portfolio. They didn’t get tripped when long duration bonds fell in value. Their overall balanced portfolio increased in value. Volatility was lowered. In fact, they want to hold assets which are not correlated or negatively correlated. Bonds did what was desired and expected of them.- Others may hold bonds specifically for major events. These people tend to focus on government bonds with relatively short durations, often inflation linked. Such bonds did not fall by much, but in any case their function is to provide liquidity when everything else is in free fall.

3. If one is holding bonds or any other asset for the wrong reasons, then sooner or later they do get tripped.1 -

No, my point was in relation to the act of switching. If I had switched a sum from equities to bonds, there are scenarios in which I'd have deflated my value by a significant percentage by that simple act. I'd be looking for a specific scenario, which I'd need to actively manage, to cover that loss and then some.Deleted_User said:1. Long duration bonds carry interest rate risk. Bonds, cash, stocks, any other asset you can think of - they all have risks.2. You don’t get tripped if you select the tools which match your objectives. For example:

...3. If one is holding bonds or any other asset for the wrong reasons, then sooner or later they do get tripped.

The naive investor (that would be me) reads that a sensible portfolio has a proportion of 'bonds' in order to meet a particular objective. Based on their age, perhaps, or a 60/40 rule. If they don't have that proportion, they have to shift to it. But then finds that their picks are the wrong ones! "No, not them! Are you thick or something? Not them either!".

The naive investor might be as well just sticking with equities. Particularly if they have no intention of buying an annuity, so don't need to conserve their gains against an imminent crash.0 -

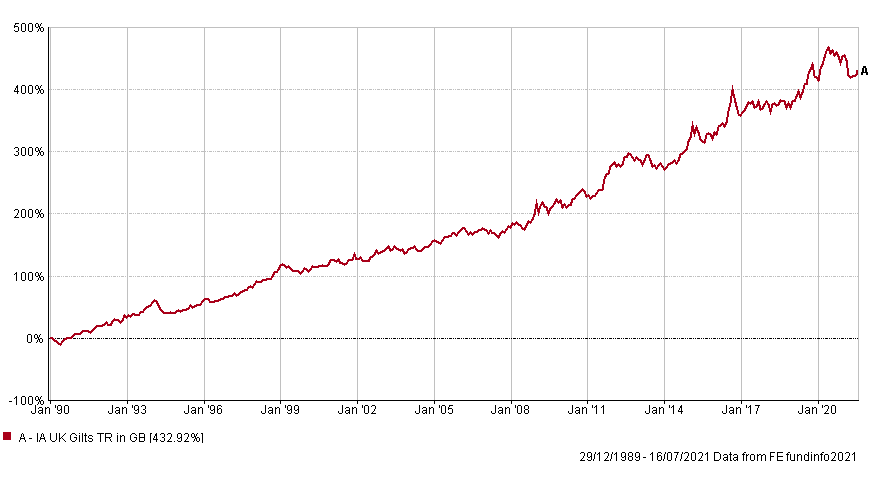

There have been long periods of time when bonds outperformed equities. Someone thinking along your lines would have moved everything into bonds. The investor shouldn’t be naive. He should learn, he should establish objectives and understand risks and develop an appropriate asset allocation. Its his family’s financial security that is at stake. Worth investing a little time into learning0

-

So how would one invest sipp funds in short dated govt index lined bonds? Are there funds that hold 12m and less govt linkers or would one need to purchase the bonds directly and roll them over - which platforms support this?Deleted_User said:

1. Long duration bonds carry interest rate risk. Bonds, cash, stocks, any other asset you can think of - they all have risks.allanm02 said:

Nonetheless, the bulk of the fall was over a 6 week period early in the year. Although advice might be 'we didn't mean those kind of bonds!', it is possible to trip oneself up in the act of being cautious.allanm02 said:

Sorry, I misspoke. 12 months it is!Deleted_User said:

The claim was “2 months”. I’ve seen a rise. Thats quite different from 12 months.dunstonh said:Which gilt fund lost 8% over the last 2 months? I have not followed gilts but treasures did not do anything like this.A number of them are running in that ballpark. Vanguard UK Govt bond is 7% down over 12 months. Although a gilts crash did occur in that period.Some global govt bond funds and long dated gilts have just crept into double digit losses. However, it is worth noting that 2020 saw significant gains way above the typical norm and 2021 saw some of that unwind to bring it back in line with the long term average.

However, it is worth noting that 2020 saw significant gains way above the typical norm and 2021 saw some of that unwind to bring it back in line with the long term average. 2. You don’t get tripped if you select the tools which match your objectives. For example:

2. You don’t get tripped if you select the tools which match your objectives. For example:

- Some people hold bonds to reduce volatility of their overall portfolio. They didn’t get tripped when long duration bonds fell in value. Their overall balanced portfolio increased in value. Volatility was lowered. In fact, they want to hold assets which are not correlated or negatively correlated. Bonds did what was desired and expected of them.- Others may hold bonds specifically for major events. These people tend to focus on government bonds with relatively short durations, often inflation linked. Such bonds did not fall by much, but in any case their function is to provide liquidity when everything else is in free fall.

3. If one is holding bonds or any other asset for the wrong reasons, then sooner or later they do get tripped.

Just looked at a Nov 22 index linked gilt on my platform, the spread seems to be a very unattractive 3%I think....0 -

No, my point doesn't seem to be coming across. The 'naive investor' is already heavily weighted in equities. There is a potential deflating cost to the simple act of changing horses, of going from 100% equities to 0% in your extreme example, or some more realistic proportion as advocated by various strategies. People don't simply parachute in to a particular optimum proportion; they get there from where they are. Of course it differs little from flipping between two equity investments in that regard, but 'you need more bonds' articles rather gloss over this.Deleted_User said:There have been long periods of time when bonds outperformed equities. Someone thinking along your lines would have moved everything into bonds.0 -

Best to buy government bonds direct when they come for an auction. I haven’t done it through SIPP, nor have I ever bought gilts, but the process seems to be identical to US/Canada.michaels said:

So how would one invest sipp funds in short dated govt index lined bonds? Are there funds that hold 12m and less govt linkers or would one need to purchase the bonds directly and roll them over - which platforms support this?Deleted_User said:

1. Long duration bonds carry interest rate risk. Bonds, cash, stocks, any other asset you can think of - they all have risks.allanm02 said:

Nonetheless, the bulk of the fall was over a 6 week period early in the year. Although advice might be 'we didn't mean those kind of bonds!', it is possible to trip oneself up in the act of being cautious.allanm02 said:

Sorry, I misspoke. 12 months it is!Deleted_User said:

The claim was “2 months”. I’ve seen a rise. Thats quite different from 12 months.dunstonh said:Which gilt fund lost 8% over the last 2 months? I have not followed gilts but treasures did not do anything like this.A number of them are running in that ballpark. Vanguard UK Govt bond is 7% down over 12 months. Although a gilts crash did occur in that period.Some global govt bond funds and long dated gilts have just crept into double digit losses. However, it is worth noting that 2020 saw significant gains way above the typical norm and 2021 saw some of that unwind to bring it back in line with the long term average.

However, it is worth noting that 2020 saw significant gains way above the typical norm and 2021 saw some of that unwind to bring it back in line with the long term average. 2. You don’t get tripped if you select the tools which match your objectives. For example:

2. You don’t get tripped if you select the tools which match your objectives. For example:

- Some people hold bonds to reduce volatility of their overall portfolio. They didn’t get tripped when long duration bonds fell in value. Their overall balanced portfolio increased in value. Volatility was lowered. In fact, they want to hold assets which are not correlated or negatively correlated. Bonds did what was desired and expected of them.- Others may hold bonds specifically for major events. These people tend to focus on government bonds with relatively short durations, often inflation linked. Such bonds did not fall by much, but in any case their function is to provide liquidity when everything else is in free fall.

3. If one is holding bonds or any other asset for the wrong reasons, then sooner or later they do get tripped.

Just looked at a Nov 22 index linked gilt on my platform, the spread seems to be a very unattractive 3%I would just contact your broker/SIPP operator and ask how to get authorized and how to buy. With treasuries there are a couple of ways to submit a bid. Typically the issue is that treasuries/government bonds are sold in fairly large chunks, so beginners cant access direct sales. If the portfolio is large enough then this is the way to go. It cuts the cost and reduces the risk. And “diversification” is meaningless if you want government bonds, so funds provide no advantages while costing more and introducing intermediary risk. https://www.moneymagpie.com/manage-your-money/gilts-the-easy-way-to-invest-in-them-20 -

I’m aware of that, but cash receives a 25% contribution from HMRC, so it’s hardly losing value.Deleted_User said:

That has nothing to do with how you use liquidity within a SIPP.sheslookinhot said:

Does cash in a SIPP receive the 25% contribution from HMRC ?Deleted_User said:

Cash in a savings account earning interest which you can access in an instant? Absolutely. Cash in a SIPP losing value and subsidizing the brokerage? Why would one ever do that?Albermarle said:

It can mean that , or it can mean cash outside a wrapper, sitting in a normal saving account(s) earning 1% maybe .Deleted_User said:By the way, when the posters here are saying “cash”, do you mean the actual cash sitting within a tax free pension wrapper and earning no interest?

It varies depending on the poster.Mortgage free

Vocational freedom has arrived0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards