We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Would you retire really early and burn down most of your DC pension assets?

Comments

-

Thanks for the concern. Although somewhat playing devil's advocate here,.I think my perspective is sound.Bravepants said:Diplodicus said:

People are different but reckon you are more likely to be disappointed with Life than I, going forward.cfw1994 said:

Whilst I respect your opinion, I have to say I disagree very firmly with this 🤔Diplodicus said:To quote SirAlex Ferguson, Work is the best part of life.

Retirement is retreat, there is no question about that.

Of course, there comes a time when any individual should recognize their waning power, step back and settle for a blander existence.

There is no shame in that

”Waning power”? “Retreat”?

Ludicrously negative words for a period I view as the time to press forward with life. I genuinely feel sorry if you feel that is your perspective as you may head to stepping away from the salaried job.How better to appreciate that sunset than by having taken that day as the only sunny day forecast in the week to go on a long bike ride (as I did yesterday, or perhaps a full days hike), and then to enjoy that sunset without the thought of having to get up early for the next shift

The moments of satori you probably hope for may come; but if they haven't visited when you were busy, being idle won't help.

Sorry to be down on retirement, if you see it as a culmination.

I think our generation are uniquely lucky in that most of us have fought no wars and can look forward to many years of retirement (although I love work, I won't work once eligible for the state pension).

It is easy to forget that, when we were young, pensioners were the poor of society. Now they are the rich. And on that note,

do not rebalance your investments, cfw1994 - long term it pays to let the winners run."The Man" has brainwashed you into thinking that working your life away is the only way to feel worth anything.Every hour one works beyond that required to maintain a particular lifestyle is an hour wastedYou need to try to break your mind free from the grip of "The Man", fYou've fallen for the propaganda, don't fall further.

I don't Live to Work and certainly don't Work to Live. The second approach is even more reductive than the first. Leaving aside the individual's compact with the State, those who work entirely for their salary are denying both themselves and their employment their best work. Shakespeare probably had enough money to retire before he wrote King Lear and Van Gogh died penniless.

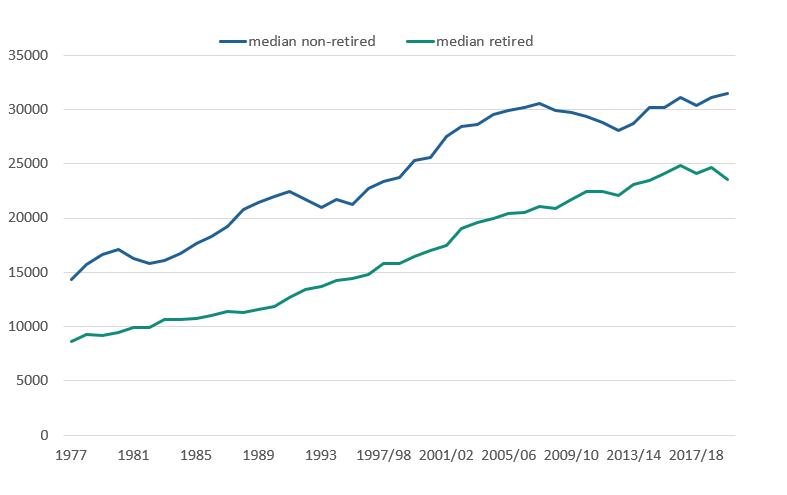

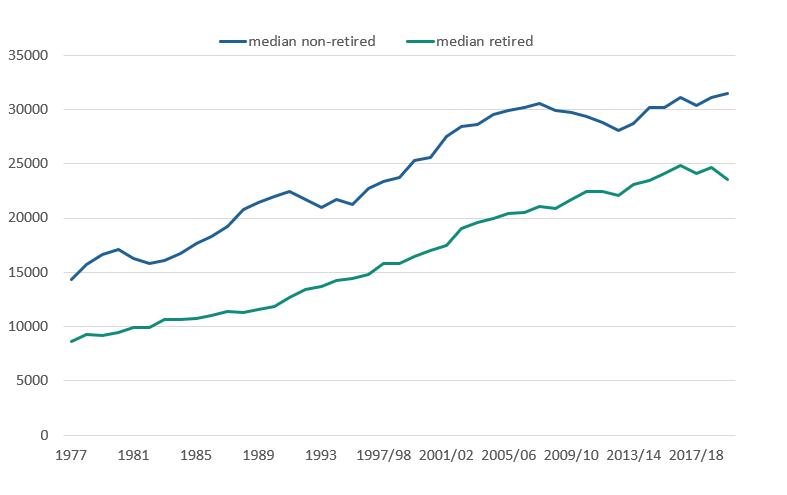

Terron's graph is interesting; note that in 1977 disposable income was only just over half that of non retirees - the legacy of those days lives on today with stuff like free bus passes for pensioners. And of course, disposable income is only the tip of the iceberg when weighing wealth today. For a large number of seniors, pensions have now overtaken property as the main focus of harbouring wealth.1 -

I suppose the other argument against ajfielden's proposition would be the beneficial investment advantages of a pension.

Many people of my age are intent on increasing rather than "burning down" their wealth, and circumstances could hardly be more favourable. So a pension may well be the best vehicle for building a fortune in a tax-friendly environment.0 -

It’s great hearing all the different perspectives. I think perhaps the danger is in thinking of anything as a panacea or the holy grail. Work brings many benefits- so does time- so does money. If you are generally discontented and and think being retired/ mortgage free/ out of debt will make you happy it’s probably an illusion. On the other hand they all relieve some pressures- my experience is that lots of problems and stresses can be improved by throwing money or time at them.I like my job, but the pandemic has changed things. I’m hoping once we are back in the office and I’m interacting with my colleagues more I will get my mojo back- but if not I would like to have options!0

-

What's the old adage...

Teenager - energy, time, but no moneyMiddle age - energy, money but no time

Old age - time, money but no energyHow's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)11 -

I agree completely - I was just answering the question of how the ONS define it!pensionpawn said:

I've always defined disposable income as the money I have left after I have paid for the essentials (rent / mortgage, council tax, food etc). i.e. money that I can chose how to dispose of (or save) rather than money needed to pay essential bills. Same goes in retirement, however the essentials are hopefully much lower!cfw1994 said:Wonder no more: from ONS here:“Disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax, National Insurance and Council Tax) have been accounted for. It includes earnings from employment, private pensions and investments as well as cash benefits provided by the state.”

So no, *not* after housing costs - they will come out of that income….hence perhaps many retired folk will have more “real usable” wealth to hand, I would guess 👍

I also believe it is harder to figure out 'disposable income' for those with primarily DC pots 🤨

I've not yet touched mine (aside from some TFLS to mitigate LTA issues, all reinvested around ISAs & closing mortgage) - working off some of the most fluid savings for now, before perhaps some premium bonds, so the question of what our disposable income is becomes a little.....fluid 🤪

At some point, we will settle on into some drawdown. Still not sure quite how much.....will the pot have increased by then? Perhaps....perhaps not....it's up 14% since the middle of May, so who knows, we live in interesting times 😉

Very, very true 🤣Sea_Shell said:What's the old adage...

Teenager - energy, time, but no moneyMiddle age - energy, money but no time

Old age - time, money but no energy

Perhaps the key reason I focussed on stepping away from work early.....the next 5-10 years should be ones where I can build up my strength & health. Perhaps my own fault in the past, but with the growing family, finding time to focus on health was more limited, I found. Already down to a weight I haven't been for literally *decades* 😎👍

How about adding a category?

Teenager - energy, time, but no moneyMiddle age - energy, money but no time

Golden age - energy, money & time

Old age - time, money but no energyPlan for tomorrow, enjoy today!5 -

This sort of works better but then again housing costs, food etc there is a degree of latitude over essential vs optional extra/upgrade expenditure.pensionpawn said:cfw1994 said:michaels said:

Interesting, I wonder how disposable is defined for this metric for example if it is after housing costs then where you live in the country, whether you have a mortgage, rent or have paid off your mortgage well as as how much of your income you decide to commit to housing could give very different 'disposable' income figures.Terron said:Diplodicus said:

It is easy to forget that, when we were young, pensioners were the poor of society. Now they are the rich. And on that note,

do not rebalance your investments, cfw1994 - long term it pays to let the winners run.Pensioners still have on average lower disposable incomes that non-pensioners, though the ratio is not as high as it used to be, and both are richer. This graph from the ONS shows median disposable incomes adjusted for inflation. Wonder no more: from ONS here:“Disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax, National Insurance and Council Tax) have been accounted for. It includes earnings from employment, private pensions and investments as well as cash benefits provided by the state.”

Wonder no more: from ONS here:“Disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax, National Insurance and Council Tax) have been accounted for. It includes earnings from employment, private pensions and investments as well as cash benefits provided by the state.”

So no, *not* after housing costs - they will come out of that income….hence perhaps many retired folk will have more “real usable” wealth to hand, I would guess 👍

I've always defined disposable income as the money I have left after I have paid for the essentials (rent / mortgage, council tax, food etc). i.e. money that I can chose how to dispose of (or save) rather than money needed to pay essential bills. Same goes in retirement, however the essentials are hopefully much lower!cfw1994 said:michaels said:

Interesting, I wonder how disposable is defined for this metric for example if it is after housing costs then where you live in the country, whether you have a mortgage, rent or have paid off your mortgage well as as how much of your income you decide to commit to housing could give very different 'disposable' income figures.Terron said:Diplodicus said:

It is easy to forget that, when we were young, pensioners were the poor of society. Now they are the rich. And on that note,

do not rebalance your investments, cfw1994 - long term it pays to let the winners run.Pensioners still have on average lower disposable incomes that non-pensioners, though the ratio is not as high as it used to be, and both are richer. This graph from the ONS shows median disposable incomes adjusted for inflation. Wonder no more: from ONS here:“Disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax, National Insurance and Council Tax) have been accounted for. It includes earnings from employment, private pensions and investments as well as cash benefits provided by the state.”

Wonder no more: from ONS here:“Disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax, National Insurance and Council Tax) have been accounted for. It includes earnings from employment, private pensions and investments as well as cash benefits provided by the state.”

So no, *not* after housing costs - they will come out of that income….hence perhaps many retired folk will have more “real usable” wealth to hand, I would guess 👍I think....0 -

Diplodicus said:I suppose the other argument against ajfielden's proposition would be the beneficial investment advantages of a pension.

Many people of my age are intent on increasing rather than "burning down" their wealth, and circumstances could hardly be more favourable. So a pension may well be the best vehicle for building a fortune in a tax-friendly environment.

Yes that is the flip side, continued growth, but not for myself. It would be for the benefit of my kids. The reason I wouldn't want to burn everything is to help them buy their own homes, or at least pay a substantial deposit.

2 -

ajfielden said:Diplodicus said:I suppose the other argument against ajfielden's proposition would be the beneficial investment advantages of a pension.

Many people of my age are intent on increasing rather than "burning down" their wealth, and circumstances could hardly be more favourable. So a pension may well be the best vehicle for building a fortune in a tax-friendly environment.

Yes that is the flip side, continued growth, but not for myself. It would be for the benefit of my kids. The reason I wouldn't want to burn everything is to help them buy their own homes, or at least pay a substantial deposit.There is an argument that you should give your money to your children BEFORE you die. Why make them wait for their "inheritance" for decades if they are struggling now for example?Check out Bill Perkins' book "Die With Zero".Of course the other benefit is that once you HAVE given money to your kids, the rest of it is YOURS to do with as you please.If you want to be rich, live like you're poor; if you want to be poor, live like you're rich.4 -

Bravepants said:ajfielden said:Diplodicus said:I suppose the other argument against ajfielden's proposition would be the beneficial investment advantages of a pension.

Many people of my age are intent on increasing rather than "burning down" their wealth, and circumstances could hardly be more favourable. So a pension may well be the best vehicle for building a fortune in a tax-friendly environment.

Yes that is the flip side, continued growth, but not for myself. It would be for the benefit of my kids. The reason I wouldn't want to burn everything is to help them buy their own homes, or at least pay a substantial deposit.There is an argument that you should give your money to your children BEFORE you die. Why make them wait for their "inheritance" for decades if they are struggling now for example?Check out Bill Perkins' book "Die With Zero".Of course the other benefit is that once you HAVE given money to your kids, the rest of it is YOURS to do with as you please.

I'm not talking about inheritance. You're right that would be too late for them to benefit. I would give them the money shortly after I retire, as that is when I'll know what is in the pot.

Maybe by then, house prices will have come down to a sane level, we can only hope.

2 -

I gave mine money. Problem is now they won't work. No need. There must be an optimum time to give them money.4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards