We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Actual Spending in Retirement against expectations

Comments

-

Given the mean UK pension pot is about £70k (and that must be a well skewed distribution) most people are going to be a long way off this.

As an 'old scientist ' you will know that statistics can produce any figure you want .

I have seen many figures quoted for average pension pots from £25K to > £100K

Do you include a notional figure for DB pensions ( including all those civil service/teachers/NHS/local government ones )?

Do you include all pensions including auto enrolment ones that have only been going a few months , or a snapshot at 55? or 65 ?

Etc Etc

1 -

OldScientist said:

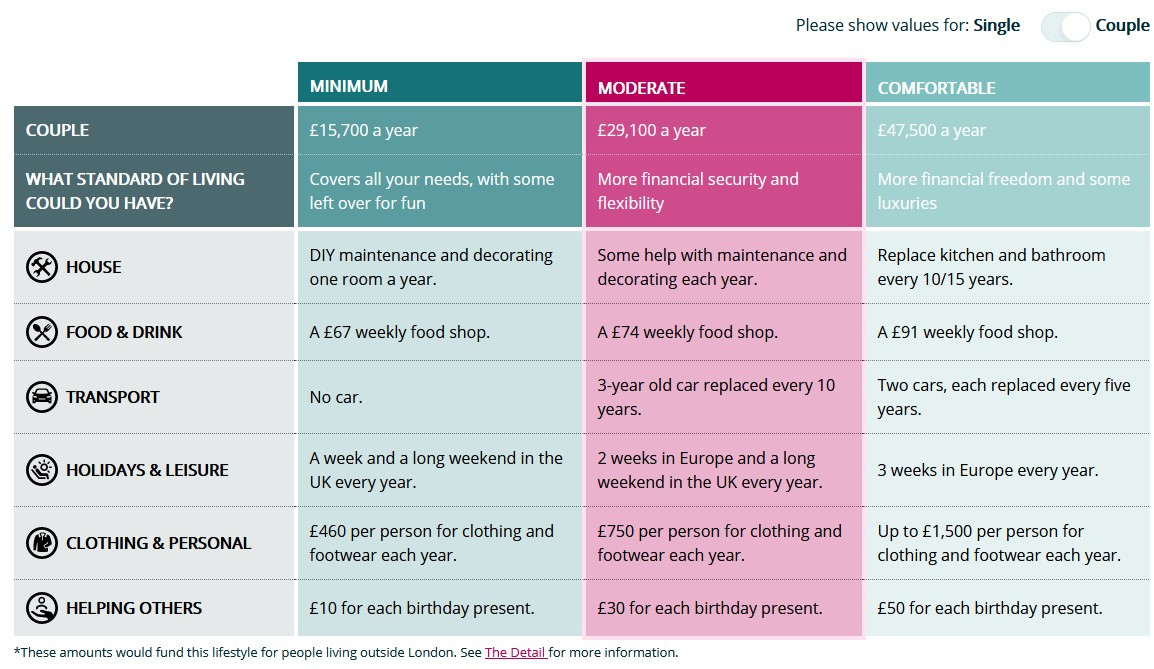

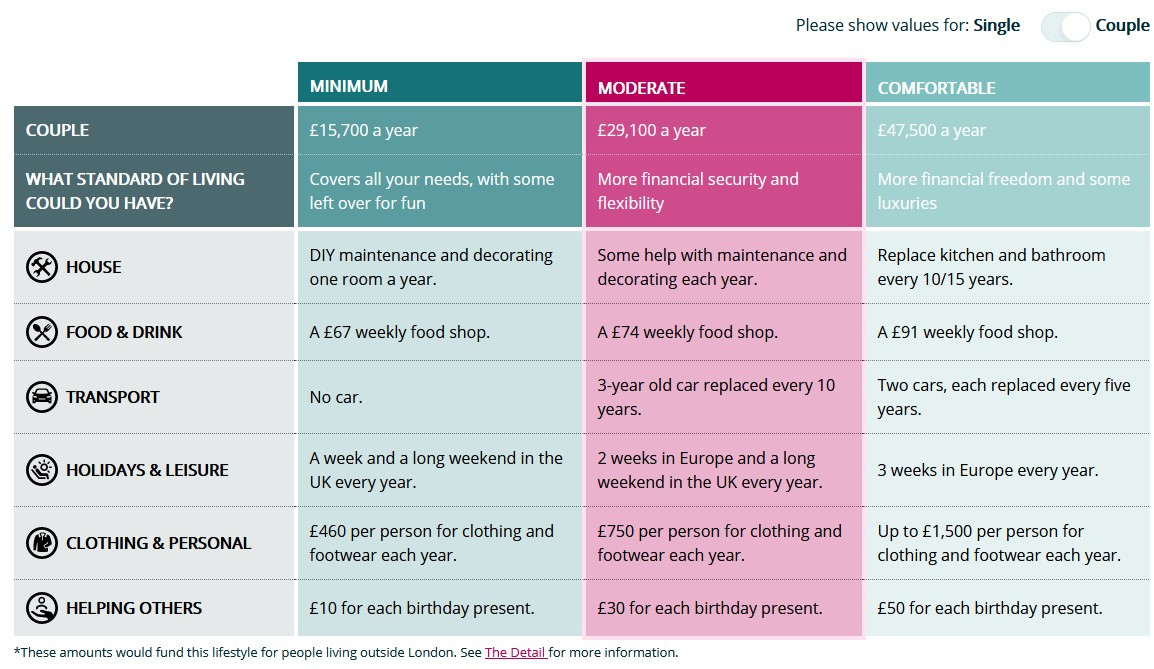

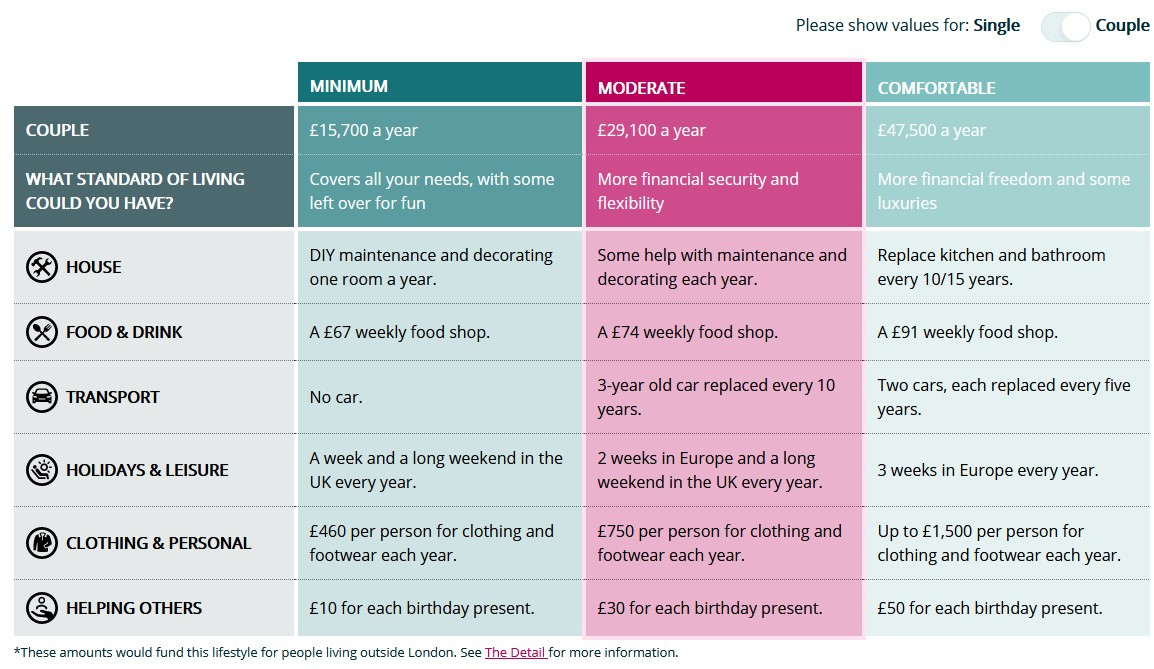

Thanks for the link - I'd read through that before (and should have clicked through to the HL link!) - the methodology is sound (at least it is well described and incredibly detailed, including down to individual items of food from Sainsburys and a 25 year depreciation on a garden fork), but the nomenclature is, I think, somewhat unfortunate. Their detailed calculations indicate that a couple would need about £700k between them to purchase an annuity to obtain the income stated when combined with the SP. I note that they used 4.8% with the annuity (you can currently get level at 65 with this rate, but not RPI until 75). Given the mean UK pension pot is about £70k (and that must be a well skewed distribution) most people are going to be a long way off this.Albermarle said:

This is taken from research by Loughborough University. The amounts are after tax if I remember correctlyhugheskevi said:OldScientist said:You have to ask just who is it 'thought by'?Pension and Lifetime Savings Association - Retirement Living Standards

Which have published some similar figures.

Even the Comfortable figure does not include alcoholic drinks , or cleaners, gardening/tree surgeons , general redecoration etc

Although £1500 each for clothes seems excessive.

I do note that the comfortable couple get through a bottle each of white and red and 8 bottles of beer per week (no tobacco included though). They also have a gardener and cleaner. There's a set of spreadsheets at https://www.retirementlivingstandards.org.uk/RLS-full-data.zip that make interesting reading.As well as the gardner, cleaner and booze apparently you need the following to be "comfortable":£500 each on footwear a year£75 every 6 weeks for the hairdressers (my wife pays £30 and I think that's expensive!)£35 a month for other "beauty treatments" (my wife is naturally beautiful so doesn't need them )£100 for a couple to eat out every week! We typically spend well under £100 for 4 adults!!£30 a month each for mobiles!I think anyone who thinks they need to spend the above amounts to be "comfortable" should read MSE!

)£100 for a couple to eat out every week! We typically spend well under £100 for 4 adults!!£30 a month each for mobiles!I think anyone who thinks they need to spend the above amounts to be "comfortable" should read MSE!

5 -

Perhaps if you rent in retirement the figures might be right. Thankfully August will be my last mortgage payment. With no mortgage, no payments into pensions, one car, no more support for kids at uni, I think 26 k would be adequate.1

-

I had a go at itemising my spending at a high level in tax year 2019/20, the last "normal" year. It was my year of "trialling" retirement - I went part time and bought loads of extra leave so had loads of time off, so we went on a ridiculous number of holidays. My wife was still working but in a school part time & term time only so she had loads of time off as well.Spent about £34k total (ex mortgage, which will be paid off when fully retired). This was for a couple with kids at uni - so they were with us about half the year.£9800 holidays (that was 6 foreign holidays, some inc the kids, one on my own)£6500 supermarket (food, booze, toiletries etc, some clothes)£5200 bills (council tax, utilities, phones etc)£4000 house (new decking, new washing machine, house insurance)£2500 car (petrol, servicing, road tax, insurance, breakdown cover)£6000 on everything else (nights/meals out, presents, clothes, charity, health, hair, public transport, minor household goods & services etc)2

-

Our mandatory expenses will be around £23k (including mortgage & food) leaving around £13k from our budget for "entertainment", luxuries and unplanned expenses.zagfles said:I had a go at itemising my spending at a high level in tax year 2019/20, the last "normal" year. It was my year of "trialling" retirement - I went part time and bought loads of extra leave so had loads of time off, so we went on a ridiculous number of holidays. My wife was still working but in a school part time & term time only so she had loads of time off as well.Spent about £34k total (ex mortgage, which will be paid off when fully retired). This was for a couple with kids at uni - so they were with us about half the year.£9800 holidays (that was 6 foreign holidays, some inc the kids, one on my own)£6500 supermarket (food, booze, toiletries etc, some clothes)£5200 bills (council tax, utilities, phones etc)£4000 house (new decking, new washing machine, house insurance)£2500 car (petrol, servicing, road tax, insurance, breakdown cover)£6000 on everything else (nights/meals out, presents, clothes, charity, health, hair, public transport, minor household goods & services etc)2 -

They are individuals.Sea_Shell said:So then how do you judge "fair"? Split each side of the family 50/50 and then divvy up between them (so 2 get £1500 each and the others get £1000 each), or give £1200 to each of them as individuals?

Each Pound given at age 10 is enough to provide 40p of drawdown pension at 57, so £3,600 leads to £1,426. Retirement is a long way away but it's credible for some to give the gift of early retirement.

You could also facilitate earlier things using pension contributions in your own name with expression of wishes saying divide evenly between them or divide to achieve even value at a set age assuming 5% returns between your death and some specified age, to take ages and different investment times into account. They would then inherit from you a beneficiary pension that can be withdrawn from at any age.

Assumptions: 5% plus inflation growth for 47 years in equities, actual return differences between them ignored, but it favours spreading the money over many years not using a lump.3 -

jamesd said:

They are individuals.Sea_Shell said:So then how do you judge "fair"? Split each side of the family 50/50 and then divvy up between them (so 2 get £1500 each and the others get £1000 each), or give £1200 to each of them as individuals?

Each Pound given at age 10 is enough to provide 40p of drawdown pension at 57, so £3,600 leads to £1,426. Retirement is a long way away but it's credible for some to give the gift of early retirement.

You could also facilitate earlier things using pension contributions in your own name with expression of wishes saying divide evenly between them or divide to achieve even value at a set age assuming 5% returns between your death and some specified age, to take ages and different investment times into account. They would then inherit from you a beneficiary pension that can be withdrawn from at any age.

Assumptions: 5% plus inflation growth for 47 years in equities, actual return differences between them ignored, but it favours spreading the money over many years not using a lump.

We won't be doing anything that elaborate!!How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

It is interesting how those numbers read, eh!zagfles said:OldScientist said:

Thanks for the link - I'd read through that before (and should have clicked through to the HL link!) - the methodology is sound (at least it is well described and incredibly detailed, including down to individual items of food from Sainsburys and a 25 year depreciation on a garden fork), but the nomenclature is, I think, somewhat unfortunate. Their detailed calculations indicate that a couple would need about £700k between them to purchase an annuity to obtain the income stated when combined with the SP. I note that they used 4.8% with the annuity (you can currently get level at 65 with this rate, but not RPI until 75). Given the mean UK pension pot is about £70k (and that must be a well skewed distribution) most people are going to be a long way off this.Albermarle said:

This is taken from research by Loughborough University. The amounts are after tax if I remember correctlyhugheskevi said:OldScientist said:You have to ask just who is it 'thought by'?Pension and Lifetime Savings Association - Retirement Living Standards

Which have published some similar figures.

Even the Comfortable figure does not include alcoholic drinks , or cleaners, gardening/tree surgeons , general redecoration etc

Although £1500 each for clothes seems excessive.

I do note that the comfortable couple get through a bottle each of white and red and 8 bottles of beer per week (no tobacco included though). They also have a gardener and cleaner. There's a set of spreadsheets at https://www.retirementlivingstandards.org.uk/RLS-full-data.zip that make interesting reading.As well as the gardner, cleaner and booze apparently you need the following to be "comfortable":£500 each on footwear a year£75 every 6 weeks for the hairdressers (my wife pays £30 and I think that's expensive!)£35 a month for other "beauty treatments" (my wife is naturally beautiful so doesn't need them )£100 for a couple to eat out every week! We typically spend well under £100 for 4 adults!!£30 a month each for mobiles!I think anyone who thinks they need to spend the above amounts to be "comfortable" should read MSE!We’ve managed life so far without a gardener, cleaner or even a window cleaner…..I’m happy with us using the garden as our ‘gym’ (we may one day join a gym, but who knows!).

)£100 for a couple to eat out every week! We typically spend well under £100 for 4 adults!!£30 a month each for mobiles!I think anyone who thinks they need to spend the above amounts to be "comfortable" should read MSE!We’ve managed life so far without a gardener, cleaner or even a window cleaner…..I’m happy with us using the garden as our ‘gym’ (we may one day join a gym, but who knows!).

That said, I do know people who do spend those sort of sums on clothes (maybe not specifically footwear) & hairdressers.We would rather “overspend” on experiences (Latitude next weekend, IOW festival in September, Cambridge Comedy last weekend). Those can become expensive, esp when eating out most of the weekend. Then again, no foreign holidays for us this year (again), so why not….

My main luxury gift to myself ending the day job was an iPhone 12 Pro…the camera is very good, & whilst Apple is never “money saving” in upfront cost, years of experience tell me they are good bits of kit. The £46 pcm for 2 years (unlimited data) will be worth it….some memorable pictures and videos from my LEJoG already made it worthwhile👍

Oh yes, & quite a few Ryobi One+ tools - makes the gardening & DIY easier to have the right cordless power tools 🤪. Any new additions have to be raised at the weekly fiscal committee meeting now, of course 🤣Plan for tomorrow, enjoy today!3 -

Similar to us - we'd easily be "comfortable" with around £23k, anything more is "luxuries"!pensionpawn said:

Our mandatory expenses will be around £23k (including mortgage & food) leaving around £13k from our budget for "entertainment", luxuries and unplanned expenses.zagfles said:I had a go at itemising my spending at a high level in tax year 2019/20, the last "normal" year. It was my year of "trialling" retirement - I went part time and bought loads of extra leave so had loads of time off, so we went on a ridiculous number of holidays. My wife was still working but in a school part time & term time only so she had loads of time off as well.Spent about £34k total (ex mortgage, which will be paid off when fully retired). This was for a couple with kids at uni - so they were with us about half the year.£9800 holidays (that was 6 foreign holidays, some inc the kids, one on my own)£6500 supermarket (food, booze, toiletries etc, some clothes)£5200 bills (council tax, utilities, phones etc)£4000 house (new decking, new washing machine, house insurance)£2500 car (petrol, servicing, road tax, insurance, breakdown cover)£6000 on everything else (nights/meals out, presents, clothes, charity, health, hair, public transport, minor household goods & services etc)

0 -

cfw1994 said:

It is interesting how those numbers read, eh!zagfles said:OldScientist said:

Thanks for the link - I'd read through that before (and should have clicked through to the HL link!) - the methodology is sound (at least it is well described and incredibly detailed, including down to individual items of food from Sainsburys and a 25 year depreciation on a garden fork), but the nomenclature is, I think, somewhat unfortunate. Their detailed calculations indicate that a couple would need about £700k between them to purchase an annuity to obtain the income stated when combined with the SP. I note that they used 4.8% with the annuity (you can currently get level at 65 with this rate, but not RPI until 75). Given the mean UK pension pot is about £70k (and that must be a well skewed distribution) most people are going to be a long way off this.Albermarle said:

This is taken from research by Loughborough University. The amounts are after tax if I remember correctlyhugheskevi said:OldScientist said:You have to ask just who is it 'thought by'?Pension and Lifetime Savings Association - Retirement Living Standards

Which have published some similar figures.

Even the Comfortable figure does not include alcoholic drinks , or cleaners, gardening/tree surgeons , general redecoration etc

Although £1500 each for clothes seems excessive.

I do note that the comfortable couple get through a bottle each of white and red and 8 bottles of beer per week (no tobacco included though). They also have a gardener and cleaner. There's a set of spreadsheets at https://www.retirementlivingstandards.org.uk/RLS-full-data.zip that make interesting reading.As well as the gardner, cleaner and booze apparently you need the following to be "comfortable":£500 each on footwear a year£75 every 6 weeks for the hairdressers (my wife pays £30 and I think that's expensive!)£35 a month for other "beauty treatments" (my wife is naturally beautiful so doesn't need them )£100 for a couple to eat out every week! We typically spend well under £100 for 4 adults!!£30 a month each for mobiles!I think anyone who thinks they need to spend the above amounts to be "comfortable" should read MSE!We’ve managed life so far without a gardener, cleaner or even a window cleaner…..I’m happy with us using the garden as our ‘gym’ (we may one day join a gym, but who knows!).

)£100 for a couple to eat out every week! We typically spend well under £100 for 4 adults!!£30 a month each for mobiles!I think anyone who thinks they need to spend the above amounts to be "comfortable" should read MSE!We’ve managed life so far without a gardener, cleaner or even a window cleaner…..I’m happy with us using the garden as our ‘gym’ (we may one day join a gym, but who knows!).

That said, I do know people who do spend those sort of sums on clothes (maybe not specifically footwear) & hairdressers.We would rather “overspend” on experiences (Latitude next weekend, IOW festival in September, Cambridge Comedy last weekend). Those can become expensive, esp when eating out most of the weekend. Then again, no foreign holidays for us this year (again), so why not….

My main luxury gift to myself ending the day job was an iPhone 12 Pro…the camera is very good, & whilst Apple is never “money saving” in upfront cost, years of experience tell me they are good bits of kit. The £46 pcm for 2 years (unlimited data) will be worth it….some memorable pictures and videos from my LEJoG already made it worthwhile👍

Oh yes, & quite a few Ryobi One+ tools - makes the gardening & DIY easier to have the right cordless power tools 🤪. Any new additions have to be raised at the weekly fiscal committee meeting now, of course 🤣Indeed - we massively "overspend" on holidays (at least we normally do - saved about £10k in the last year!), for other people it'll be other stuff like shoes, phones etc.But the point is you don't need to spend anywhere near the amounts listed in the quoted article to be "comfortable". Maybe the columns should be headed "basic", "comfortable" and "luxurious".

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards