We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Withdrawal Calculator Excel Spreadsheet

segovia

Posts: 382 Forumite

Hi - I am looking for a basic pension calculator that will provide indicative projections withdrawals. To include starting pot size, inflation, % withdrawal rate fixed, growth expectations. For example, 350k, 2% inflation, 4% avg growth, the pot will last xx years etc. Tried a few online but didn't like them and I don't trust my excel skills

0

Comments

-

For Excel - Lars Kroijier building a financial spreadsheet youtube videos will show you how to build a basic projection (or not so basic one) step by step.

Many people are necessarily hesitant about sharing "free" excel sheets upon which others make critical financial decisions as this could later (whatever you say now) be reinterpreted as a form of advice carrying some liability for errors and omissions.

Consider

Pensions Advice Service (PAS) don't do calculations for you

Pensionwise don't do calculations for you

The MAS and platform calculators do one "tested" thing in the form of a somewhat parameter driven illustration not tailored to circumstances

IFAs are regulated and have PI insurance and use their tools and present you an output cashflow forecast with assumptions linked back to what they documented that you told them to stay inside regulation and insurance.

The rest of us who don't do "advice" at all - just Q&A to understand terminology and tax rules - don't have PI and are not likely to stray into this minefield when many of the above who are lawyered up seem so very keen to avoid it.

For a consumer online tool with some support you could try the subscription based RetireEasy or something similar. I haven't used it so this is just a suggestion based on forum history and reputation

FlexibleRetirementPlanner is also a download to PC (or web based) and free and will do more than you are asking for but the UI takes a bit of getting used to and the tax functionality is US so needs to be zeroed out (which is easy to do)

0 -

If you follow the Lars Kroijer tutorials on YouTube on how to build a financial planning spreadsheet you need only very basic excel skills as everything is shown to you. You can pause and play as many times as you like to take your time getting it right. You can keep going through the tutorials all the way until you add stress testing the drawdown period with variables to your hearts content.0

-

I just typed a post explaining how I do mine then hit the wrong button and navigated away instead of posting

😡😡😡

I'll be back...

In short. Start simple, build from there.How's it going, AKA, Nutwatch? - 12 month spends to date = 3.24% of current retirement "pot" (as at end December 2025)0 -

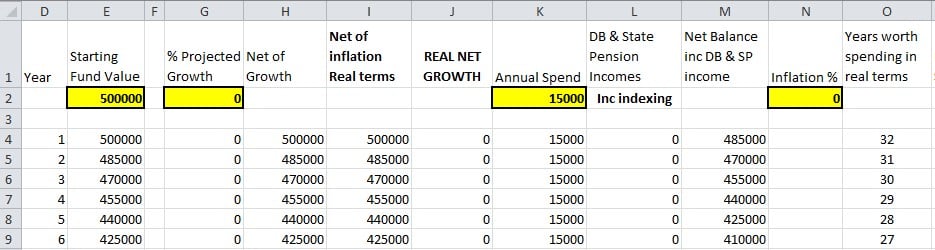

Mine looks like this... (it's my own creation for my personal use, and is not to be relied on for any retirement planning!!)

I'm not sure what level your excel skills are at, but mine aren't that advanced!!

The way I started was to do a basic sheet, without the columns for growth or inflation, then added and tweaked it as i went, making sure I was getting the right answers before moving on to the next bit.

The highlighted boxes are amendable, without effecting the formulas in the other rows, and they they feed into the lower rows by use of the $ in the formula.

For example E4 = $E$2. H4 =E4+(E4*$G$2%) K5 =$K4+($K$4*$N$2%)

So if I were to change growth to 5% and inflation to 3% it would recalculate all the other figures.

It is however, not sophisticated enough to provide "variable" scenarios of growth of X in year one, then Y in year 2 etc. same with inflation. But it does allow me to put in -5% growth and 5% inflation, which gives some scary numbers!!

Hope you find this of help.How's it going, AKA, Nutwatch? - 12 month spends to date = 3.24% of current retirement "pot" (as at end December 2025)2 -

Lots of spreadsheets out there but the first question should be: “what is your withdrawal strategy”? Sheets do what we tell them to. Crap in, crap out.Here is an example based on Variable Percentage Withdrawal strategy. The spreadsheet is linked within this wiki. https://www.bogleheads.org/wiki/Variable_percentage_withdrawal0

-

I have a couple of homegrown spreadsheets, the first shows: A couple of small DB pensions and my state pension increasing by 0.5% per year when they are due, No growth on my SIPP investments (I'm no longer adding to my SIPP which I plan to start drawing down from next year), inflation set at 3% per year.

My Second (slightly more complicated) shows my small DB and state pensions increasing by 0.5%, using the Excel Randbetween() function, inflation is variable ,at present I have it set +3% to +5% per year. SIPP performance is again variable but set between -16% (this was the crash value in my portfolio due to Covid, there can be worse crashes) and +8% per year.

Every time I open or run the second spreadsheet the figures are slightly different due to the Randbetween() function. These show when my SIPP would probably run dry, interestingly they suggest that my SIPP will run dry between (between 88-92yrs), despite some clustered years of negative growth, but then nobody knows the future.

As the years pass I add the absolute figures for the past year, in terms of pension increases, inflation and SIPP value.

I review other online spreadsheets and websites such as Cfiresim, FI Calc and Guiide as examples, but past historic performance can only provide indications it is not absolute.

2 Separate arrays, 7 x JASolar 380w panels (2.66kWp) south facing, 4 x JASolar 380w panels (1.52kWp) east facing, 11 x Tigo optimizers & cloud, Growatt SPH5000, Growatt 6.5kWh Hybrid battery (Go-live 01/12/21) - Additional reporting via Solar Assistant.0 -

I'll try the Lars Kroijer videos, thanks

J0 -

Also see this thread - a few suggestions there ;-)

https://forums.moneysavingexpert.com/discussion/6229495/spreadsheet-to-monitor-pensions/p1

Plan for tomorrow, enjoy today!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards