We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Historic asset spread within 20-60% investment funds - available anywhere?

Sea_Shell

Posts: 10,092 Forumite

Quick question...

If you have an investment fund that is in the 20-60% equities sector, is there any factsheet, or graph that will give you the historic asset split of where the fund has been over the years.

e.g. 7IM AAP Balanced C Acc. Is currently standing at the top end of it's equity portion at 55.77%

Am I able to find out where this % has been at over the years. Has it fluctuated and at some point dropped to nearer 20% equities?

Thanks.

Also am I correct in thinking that fixed % asset funds (eg VLS 40) stay pretty much at their allocated level throughout?

If you have an investment fund that is in the 20-60% equities sector, is there any factsheet, or graph that will give you the historic asset split of where the fund has been over the years.

e.g. 7IM AAP Balanced C Acc. Is currently standing at the top end of it's equity portion at 55.77%

Am I able to find out where this % has been at over the years. Has it fluctuated and at some point dropped to nearer 20% equities?

Thanks.

Also am I correct in thinking that fixed % asset funds (eg VLS 40) stay pretty much at their allocated level throughout?

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)

0

Comments

-

In the absence of any answers yet, I'm guessing it's either a "no" or "no one knows"!

I'd have thought the collective investment brains of MSE would be all over this question like a rash.

Time to start my own monthly spreadsheet??How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

Have you read the annual report for the fund you mentioned? It may have historical data.You are correct that fixed % funds stay at their fixed % allocation.1

-

Yes, you can use the latest annual report to go back a year or so. However I have not found anywhere that holds old reports. The FT have an archive service but you need to pay for it.coyrls said:Have you read the annual report for the fund you mentioned? It may have historical data.You are correct that fixed % funds stay at their fixed % allocation.1 -

Not the answer but I'm guessing you're looking for something on the cautious side just to put away and forget.

The chart which will go back at least 10 years gives you a clue to performance in downturns especially highlighting last year 2020.

Chart Tool | Trustnet

Capital Gearing Trust plc Fund factsheet | Trustnet

Personal Assets Trust plc Ord Fund factsheet | Trustnet

1 -

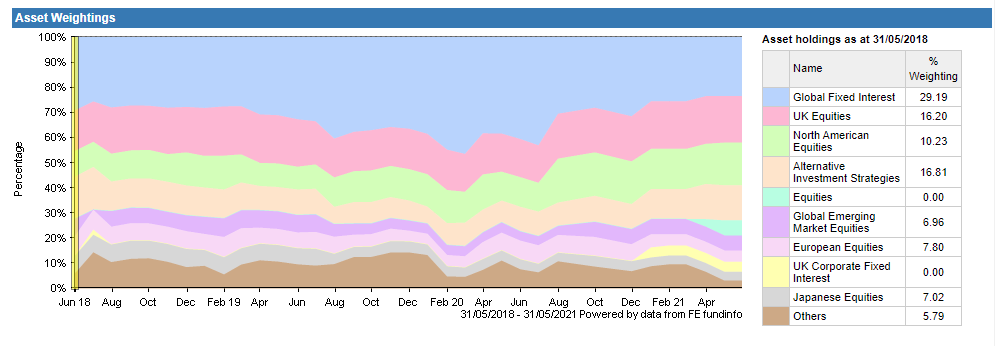

Am I able to find out where this % has been at over the years. Has it fluctuated and at some point dropped to nearer 20% equities?Not in the last 3 years. I can't do the slide on a static image but you can see movements and at no point did it get close to 20% equities.

Also am I correct in thinking that fixed % asset funds (eg VLS 40) stay pretty much at their allocated level throughout?Yes. Although that is not a good thing if you are targeting a certain volatility risk level. The choice is effectively static allocations or fluid allocations.

Also am I correct in thinking that fixed % asset funds (eg VLS 40) stay pretty much at their allocated level throughout?Yes. Although that is not a good thing if you are targeting a certain volatility risk level. The choice is effectively static allocations or fluid allocations.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

Thanks everyone. Especially that chart dunstonh. I'm guessing that's not available to "the public" ?

I have done some digging and found the relevant annual report for year end Nov 20.

Equities were at 52.25% then.

And at 31.78% the year before.

We're trying to keep our overall equity % exposure to 60%, so it's a matter of balancing this with our other ISA funds and pension funds.

One of which is the Rathbones Global Opportunities, 100% equity.How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards