We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Embarrassed 40 year old - no pension.

Comments

-

Your choice is ex Uk, don’t know what choices you have, but I would not choose that over the the including UK version (it’ll just be called something like World Equity Index Fund or similar). While the Uk has not performed particularly well in the last 10 years I don’t see why you would exclude it as it could be best in the next 10 years. Uk is about 3% of world equities.0

-

Ex-UK isn't a bad thing if OP has money tied up in company shares (assume UK based) and also has equity in a home here, and besides the UK isn't a big enough proportion of global index funds to make a huge difference either way.MX5huggy said:Your choice is ex Uk, don’t know what choices you have, but I would not choose that over the the including UK version (it’ll just be called something like World Equity Index Fund or similar). While the Uk has not performed particularly well in the last 10 years I don’t see why you would exclude it as it could be best in the next 10 years. Uk is about 3% of world equities.

I would tend to agree excluding the UK is probably sub-optimal but it's not going to be that much of a drag on performance if UK outperforms.

Op needs to concentrate on freeing up cashflow to push more into pension. He/she has 15-18 years before retirement, objective #1 has to be getting capital in ASAP in order to allow compounding to work it's magic on a bigger pot in the final few years.0 -

Thanks both.

My employee Shares (RSUs) are with a US company. I like the growth prospects of FAANG and tech stocks hence why I was drawn to the pension product mentioned.

I think I've made the right call to move out the lower risk product to help grow my pot better with a slightly higher risk product0 -

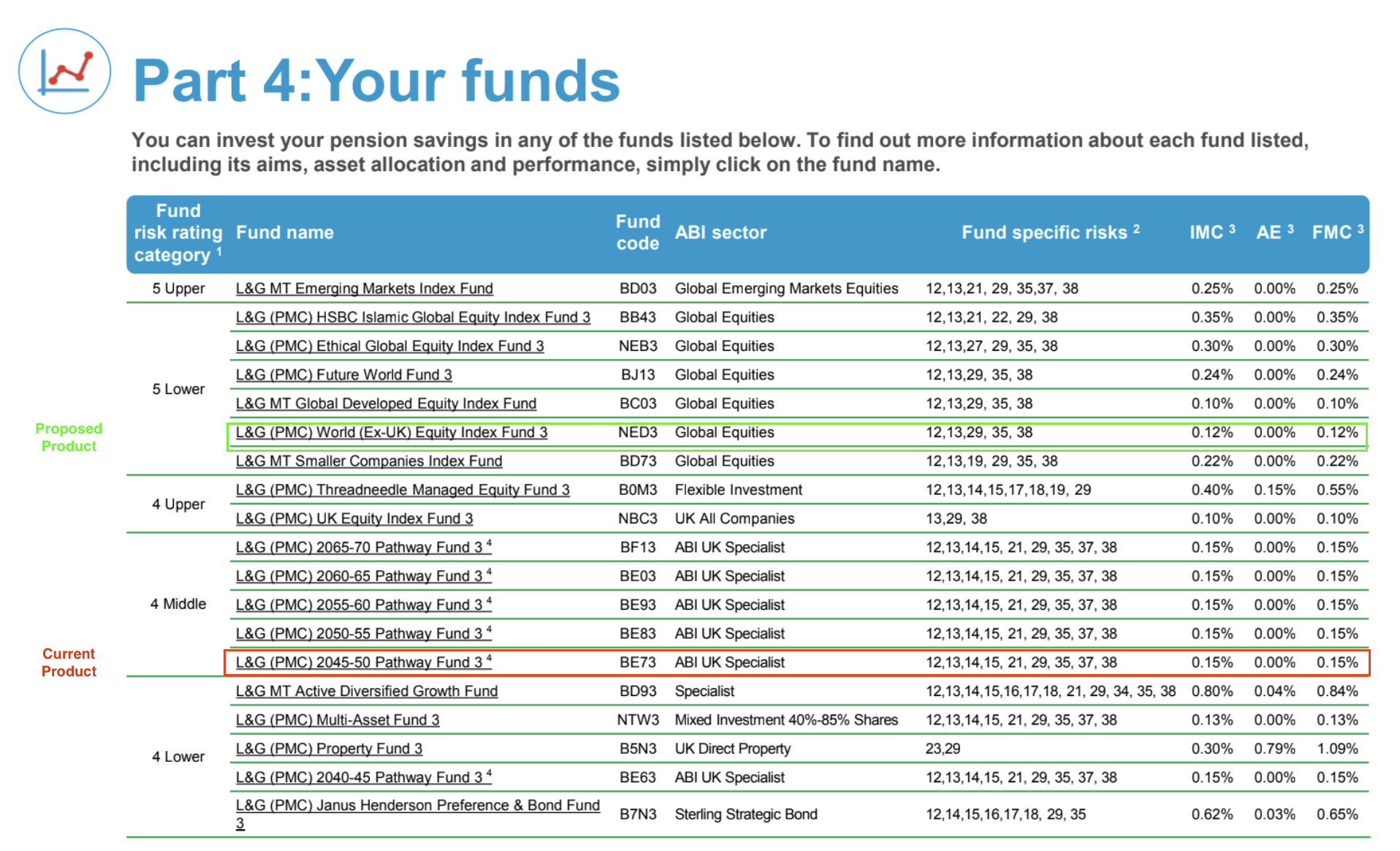

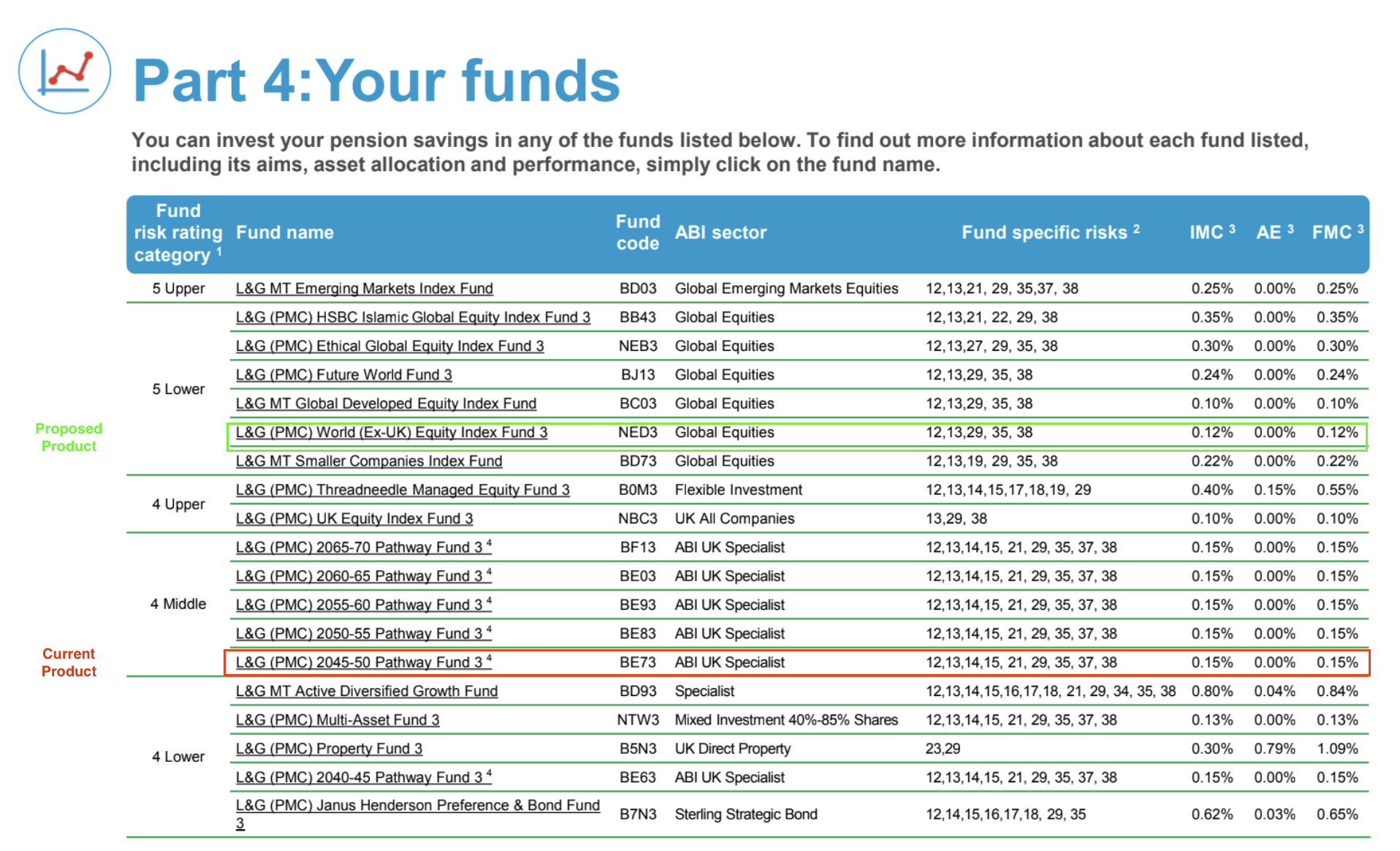

FYI THese were the other products I could select:

0 -

Don't assume that you have to choose just one fund. As you start out it won't make a lot of difference giving you time to do some reading but you might in the future want to do something like 90% in the one you have chosen but also 10% in the UK one (2nd one down in the 4 Upper category). Or some other split - mine are just an example, not advice.

I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.2 -

I would choose the one above almost exactly the same, but has UK exposure and has cheaper fee, although both fees are good.sho_me_da_money said:FYI THese were the other products I could select: 0

0 -

Hi all,

Sorry for yet another question. I am reading online that one has to claim the additional 20% tax through an annual tax return form as I am a higher rate tax payer. Does this apply to my circumstances given that I am using the salary sacrifice to bring my income below the 50K threshold?

Apologies for such a newb question.0 -

sho_me_da_money said:Hi all,

Sorry for yet another question. I am reading online that one has to claim the additional 20% tax through an annual tax return form as I am a higher rate tax payer. Does this apply to my circumstances given that I am using the salary sacrifice to bring my income below the 50K threshold?

Apologies for such a newb question.No. Due to salary sacrifice, you do not make any pension contributions yourself at all, rather, your salary is reduced and your employer makes employer pension contributions. Hence when your reduced salary is paid via PAYE you automatically receive all the relief due.It is individuals contributing through relief at source who have to claim additional relief.

3 -

No.sho_me_da_money said:Hi all,

Sorry for yet another question. I am reading online that one has to claim the additional 20% tax through an annual tax return form as I am a higher rate tax payer. Does this apply to my circumstances given that I am using the salary sacrifice to bring my income below the 50K threshold?

Apologies for such a newb question.

If it is salsac then your tax return will not include this as income.

For example, if you earn £70,000 and salsac £20,000 into your pension, then your gross salary is £50,000 for tax purposes, benefits etc. As such, there's no tax relief to reclaim.1 -

Thank you all.

I just learned that I had a pension in a very old company worth £6K and its just been sat there doing nothing. Would you

1. Transfer it to the current pension provider

2. Transfer it to something called a SIPP - can I take the 6K and throw it all on a stock?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards