We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

First Homes Scheme - Your thoughts?

Sunsaru

Posts: 737 Forumite

"First-time buyers in England offered new homes at up to 50% off | First-time buyers | The Guardian" https://amp.theguardian.com/money/2021/jun/04/first-time-buyers-in-england-offered-new-homes-at-up-to-50-off

Nothing is foolproof to a talented fool.

0

Comments

-

Think it's a good idea. FTBs have never encountered a market as difficult as this before in terms of just getting on the ladder, and new homes are too often snapped up by greedy landlords.0

-

I'm pretty bummed it's only available to first time buyers, and not those who have previously owned a property but don't currently.

We escaped our shared ownership flat a few months ago after it taking a whole year to sell and are currently living with relatives. Can't afford to buy anywhere locally with prices having jumped so high and my partners keyworker job isn't able to be done remotely for us to relocate. Desperately need the space for our family but currently stuck. I don't see why those having previously owned property should be excluded. This would be ideal for us, although in our borough currently they only seem to be building high rise flats rather than houses so maybe it doesn't matter anyway.

0 -

Where's the cut-off point though?crazyoldmaurice said:I'm pretty bummed it's only available to first time buyers, and not those who have previously owned a property but don't currently.

Can I sell my property that's gone up 500% since I bought it and have paid off the mortgage, move into rented for a bit, and then take advantage of the scheme because 'I've previously owned a property but don't currently'?

3 -

Another weak palliative! 10,000 per year in future years! Wow:Failing to meet housing needBut I'm sure the builders will continue to make obscene profits.

Estimates have put the number of new homes needed in England at up to 345,000 per year, accounting for new household formation and a backlog of existing need for suitable housing. In 2019/20, the total housing stock in England increased by around 244,000 homes. This around 1% higher than the year before – and the amount of new homes supplied annually has been growing for several years – but is still lower than estimated need.

Cancel HS2 and spend all the money on building homes, 2/3/4 bedrooms to standard plans, to a defined standard and to a fixed price.

Compulsory purchase of land that has been sat in land banks.

Sell 50% at cost plus admin fees and keep 50% for proper social housing (no RTB, never to be sold)

Start now, do it quickly and free the excessive money going into large building firms and private landlords pension schemes to go into the wider economy.

Accept that for some this is heresy and intolerable but we should be focusing on an enduring solution that will provide housing at a reasonable price for our children and grandchildren.Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!2 -

BikingBud said:Another weak palliative! 10,000 per year in future years! Wow:Failing to meet housing needBut I'm sure the builders will continue to make obscene profits.

Estimates have put the number of new homes needed in England at up to 345,000 per year, accounting for new household formation and a backlog of existing need for suitable housing. In 2019/20, the total housing stock in England increased by around 244,000 homes. This around 1% higher than the year before – and the amount of new homes supplied annually has been growing for several years – but is still lower than estimated need.

Cancel HS2 and spend all the money on building homes, 2/3/4 bedrooms to standard plans, to a defined standard and to a fixed price.

Compulsory purchase of land that has been sat in land banks.

Sell 50% at cost plus admin fees and keep 50% for proper social housing (no RTB, never to be sold)

Start now, do it quickly and free the excessive money going into large building firms and private landlords pension schemes to go into the wider economy.

Accept that for some this is heresy and intolerable but we should be focusing on an enduring solution that will provide housing at a reasonable price for our children and grandchildren.

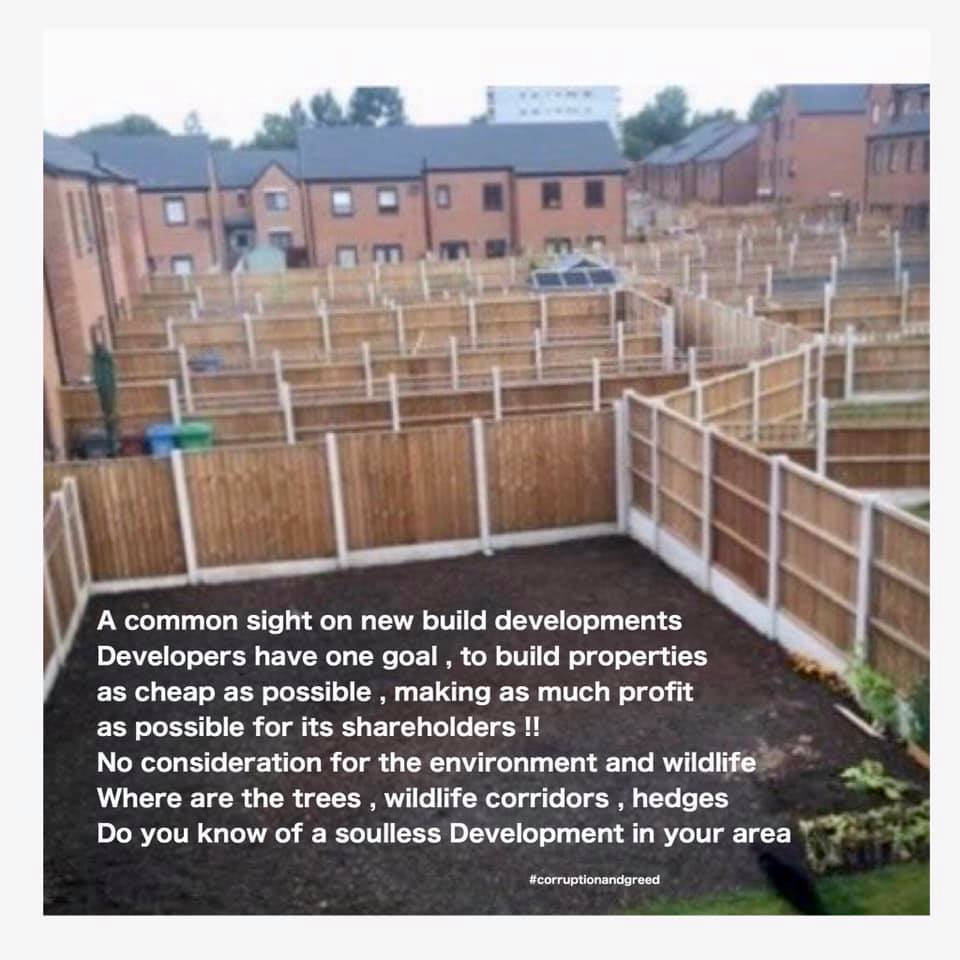

Yes, those are the only sorts of things that will stabilise, even reduce, house prices. But beware of mass building of pokey little homes just for the sake of statistics and political points scoring. We should be not satisfied with minimally 'adequate' homes that are little more than 'breeding boxes' with tiny 'runs' for a garden.

1 -

It says somewhere on the info about the scheme that you must not have the money to buy on the open market in the area you currently live/work in the usual way. So there's the cut off, unaffordable is unaffordable.Slithery said:

Where's the cut-off point though?crazyoldmaurice said:I'm pretty bummed it's only available to first time buyers, and not those who have previously owned a property but don't currently.

Can I sell my property that's gone up 500% since I bought it and have paid off the mortgage, move into rented for a bit, and then take advantage of the scheme because 'I've previously owned a property but don't currently'?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards