We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Debenhams credit card

Comments

-

Thanks. That makes sense - I was wondering which of their existing brands might be used, and thinking that none of them looked particularly appropriate. I'm slightly surprised that they're offering any cashback at all on the replacement card, so something's better than nothing. When MBNA switched me to one of their own cards, it was without any benefit of this sort.WillPS said:Looks like they'll all be moving to a newly-created in house brand 'Pulse':

Welcome to Pulse (pulsecard.co.uk)

1% cashback for 3 months (good), 0.25% thereafter (the normal).

£150 annual cashback cap - which is unlikely to be a problem unless you hammer the 1%.

0 -

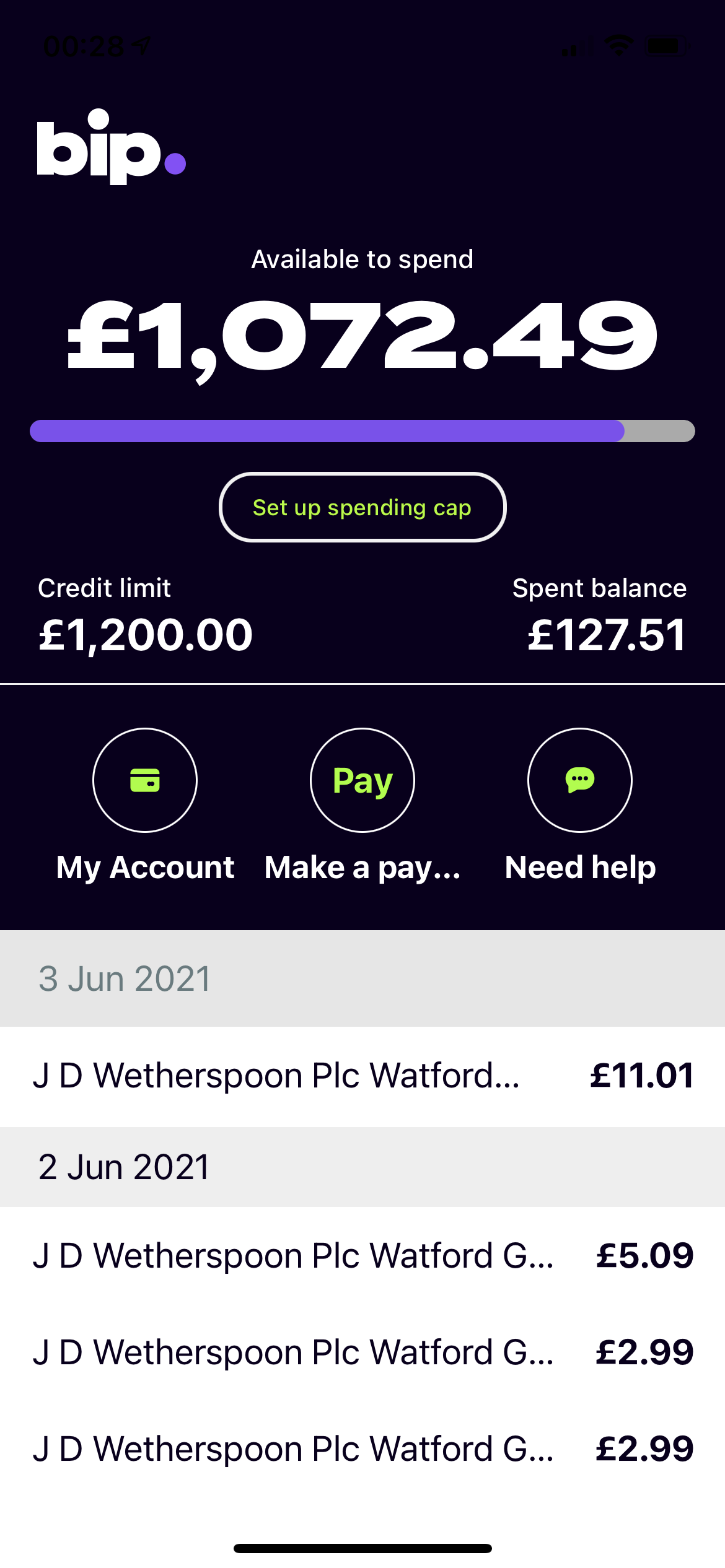

They are also working on a new project called BIP.0

-

I have that - it's online (no card) and I only use it (sadly) in Wetherspoons as I order from the app then pay using Apple Pay with two taps. Very easy to use. I pay in full monthly so no interest or anything. Very small limit but that's fine as I'll only use it in the pub as mentioned!RBYHS said:They are also working on a new project called BIP. 0

0 -

funkycredit said:

I have that - it's online (no card)RBYHS said:They are also working on a new project called BIP.Please forgive my ignorance, but I don't see the benefit. I'd be grateful if you could explain it.If there's no card, presumably you can only use it by linking to Apple Pay or Google Pay? If so, it's completely useless to someone who doesn't use either of those, never mind someone without a mobile phone. And since card-based accounts can already be linked to Google Pay or Apple Pay, it seems to offer no advantage over traditional credit cards.Have I misunderstood something? What?

0 -

Interesting to see a cardless product is already out there - it's a shame they don't actually pass on any of the cost saving benefits to the consumer tho; no cashback or rewards.

Very little reason to choose that account over any card product that supports Google/Apple pay - even if you disposed of the card after setting it up on your phone.1 -

It is an online product; much like PayPal I guess. However it allows full control and spend limits etc so is very user friendly.blue.peter said:funkycredit said:

I have that - it's online (no card)RBYHS said:They are also working on a new project called BIP.Please forgive my ignorance, but I don't see the benefit. I'd be grateful if you could explain it.If there's no card, presumably you can only use it by linking to Apple Pay or Google Pay? If so, it's completely useless to someone who doesn't use either of those, never mind someone without a mobile phone. And since card-based accounts can already be linked to Google Pay or Apple Pay, it seems to offer no advantage over traditional credit cards.Have I misunderstood something? What?It's only accessible by app so without a suitable device you'd not be able to use it let alone apply.The benefits for me are simple - it's ideal for using in Wetherspoons which is my local. Allows easy table ordering and no need to complete card / payment info when ordering drinks. I just tap twice.It's not for everyone. It's for those who will benefit from its functionality - I will as I can walk into the pub and order / pay in less than 30 seconds. Using a card / PayPal means filling in details each time = slower to order my pint!

I don't want to add my main cards to Apple Pay. I've too many and it's just too confusing so this is ideal for literally online stuff like ordering a beer or just eat etc!1 -

Thanks. Nothing that you've said makes me think "I want this". I'm content to continue to use cards. Contactless payment is fast enough for me, even if I do occasionally get told that I have to insert the card and tap in my PIN.funkycredit said:It's not for everyone. It's for those who will benefit from its functionality - I will as I can walk into the pub and order / pay in less than 30 seconds. Using a card / PayPal means filling in details each time = slower to order my pint!

0 -

That's fine; I'm not trying to sell it to you. I'm merely saying it suits my needs for a couple of things I use. I don't use cards for Apple Pay and I don't use it anywhere other than at above places via the Blip app.blue.peter said:

Thanks. Nothing that you've said makes me think "I want this". I'm content to continue to use cards. Contactless payment is fast enough for me, even if I do occasionally get told that I have to insert the card and tap in my PIN.funkycredit said:It's not for everyone. It's for those who will benefit from its functionality - I will as I can walk into the pub and order / pay in less than 30 seconds. Using a card / PayPal means filling in details each time = slower to order my pint! 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards