We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Beware Sainsburys

Comments

-

I don't necessarily disagree with some of your points although I'm sure credit card companies make more out of those who either simply forget, cannot get another balance transfer card or just simply can't be bothered to do so rather than those like yourself who just get the dates slightly wrong. As you say it's your first time juggling credit cards so I would guess you wouldn't make the same mistake again.HoolyNI said:

That was part of the problem, Its the first time I've juggled credit cards using online statements, and only looked at the "estimated interest" to decide when to clear it.kaMelo said:The expiry date of a 0% offer is wholly independent of payment due dates, payment taken dates or any other dates.

For example, a 0% balance transfer for 18 months will, not surprisingly, expire 18 months from the opening date of your credit card. The payment due date, or date DD's are taken may or may not tie in with this, it's dependent upon the company. Some offer you a choice when your DD will be collected and some don't.

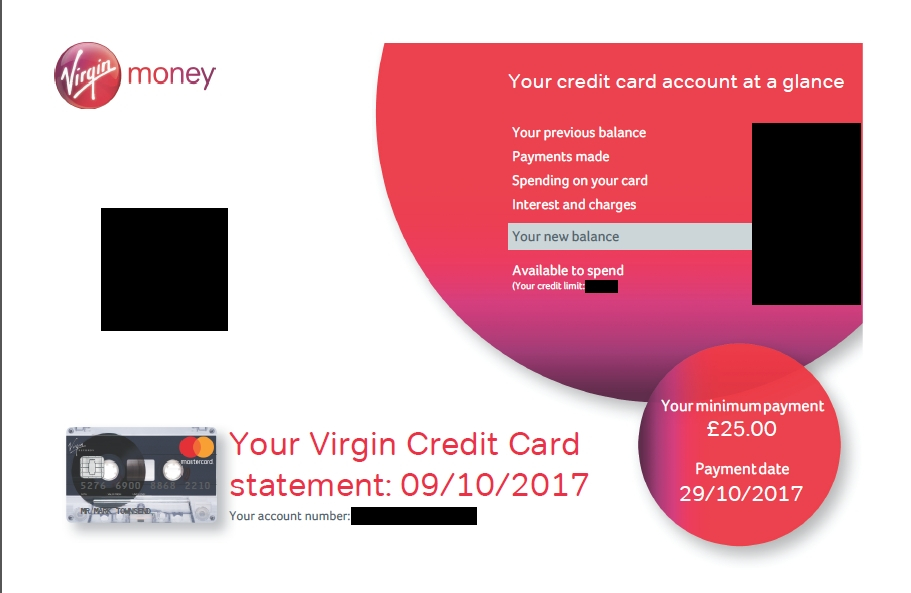

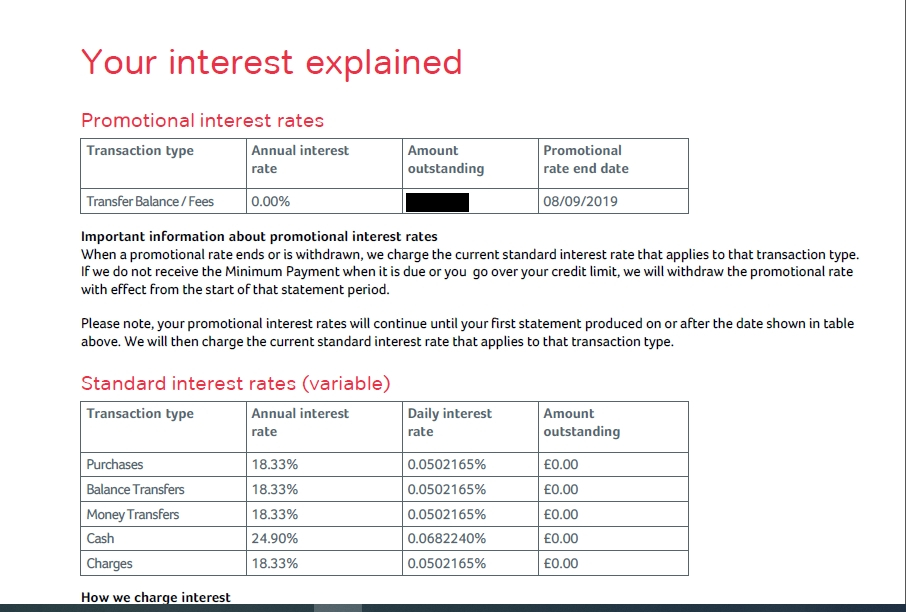

Ultimately the information about when the 0% offer expires is not hidden, it's displayed prominently on page 3 of each and every statement produced as show below.

This is not unique to Sainsbury's, each and every time I've made use of a 0% offer the expiry date is always displayed and is the date from which interest will be charged on the uncleared balance.

As to payment problems, I assume you've had DD's set up to pay the monthly payments so why not just use these to make the payment from your own bank in time to avoid the interest.

For fear of sounding like a know it all, all the problems mentioned in this thread are more self inflicted than a problem with the company and all easily avoidable with a little reading and some foresight.

I was wrong to single out Sainsbury's as shysters, there's none of them any different really. Hoping that the slow-witted mess up their expiry dates is written into their very T&C's...

Although I completely disagree with your point about them burying expiry dates in terms and conditions. The expiry date of an offer is shown clearly on each and every statement produced on the account.

On a more general point, I've made use of various 0% purchase and balance transfer offers on credit cards. Looking back through the statements of them all I've never had the same dates for expiry of the offer and payments, they have always been different. Some earlier mentioned Virgin CC's aligning them which if they did I think was more coincidence than by design. My old Virgin CC aligned the statement date and expiry date but the payment date was completely different.

I would suggest you always assume the offer dates and payment dates don't align as in my experience they never have, no matter who the credit card was with.0 -

Not all card issuers do this. I think I had to contact sainsburys and tsb to find out mine ahead of when they would finally bury it on the penultimate statement.kaMelo said:

The expiry date of an offer is shown clearly on each and every statement produced on the account.

They usually don't even acknowledge the length of the interest free period in any of their welcome correspondence, so was it 12 months, 18 months or 24 months?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards