We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Best share dealing platform

mn1

Posts: 40 Forumite

I currently use Fidelity and Vanguard for my share ISAs investing in funds. I am about to buy some shares on Fidelity and I noticed that Fidelity ongoing annual charge is 0.99%.

Could I get better deal with another provider/platform ?

Many thanks in advance

Could I get better deal with another provider/platform ?

Many thanks in advance

0

Comments

-

This might help you choose

https://www.boringmoney.co.uk/calculator/

https://monevator.com/compare-uk-cheapest-online-brokers/

1 -

This question gets asked many times, there is no ‘best’ share dealing platform just like there is no ‘best’ car.

It depends on the person involved, what investments they have already (if any), what type of investments they wish/are holding, how frequently they intend to trade, do they want an ISA/SIPP/GIA or all three, are they an experienced or a beginner.

You should post more details about your circumstances, objectives and other useful info.

In addition, here are a few good articles to help you decide which is the best platform for you:- https://www.amorge.co.uk/blog/which-platform-to-use (Scroll to the end for link to a very useful Google spreadsheet which allows you to plug in your numbers to compare costs).

- https://monevator.com/compare-uk-cheapest-online-brokers

"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)1 -

Thanks for your advicegeorge4064 said:This question gets asked many times, there is no ‘best’ share dealing platform just like there is no ‘best’ car.

It depends on the person involved, what investments they have already (if any), what type of investments they wish/are holding, how frequently they intend to trade, do they want an ISA/SIPP/GIA or all three, are they an experienced or a beginner.

You should post more details about your circumstances, objectives and other useful info.

In addition, here are a few good articles to help you decide which is the best platform for you:- https://www.amorge.co.uk/blog/which-platform-to-use (Scroll to the end for link to a very useful Google spreadsheet which allows you to plug in your numbers to compare costs).

- https://monevator.com/compare-uk-cheapest-online-brokers

I currently invest using my ISA allowance , for last few years I bought only funds on Fidelity , but I am thinking now of buying some shares within my annual ISA allowance

My objective is long term return

I am happy to buy and forget some shares in big companies , I will trade very infrequently , probably 4 or 5 trades a year to buy

I would prefer to have my share ISA with one provider , but I was put off by the ongoing charges on Fidelity

0 -

Not sure where you are getting the 0.99% rate on shares from- the service fee is a max of 0.35%mn1 said:I currently use Fidelity and Vanguard for my share ISAs investing in funds. I am about to buy some shares on Fidelity and I noticed that Fidelity ongoing annual charge is 0.99%.

Could I get better deal with another provider/platform ?

Many thanks in advance

https://www.fidelity.co.uk/stocks-and-shares-isa/fees-and-charges/

0 -

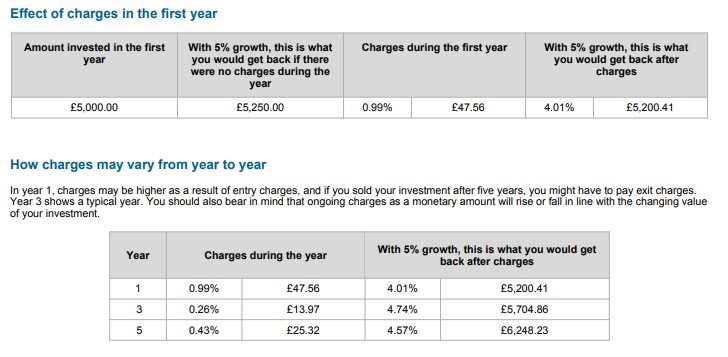

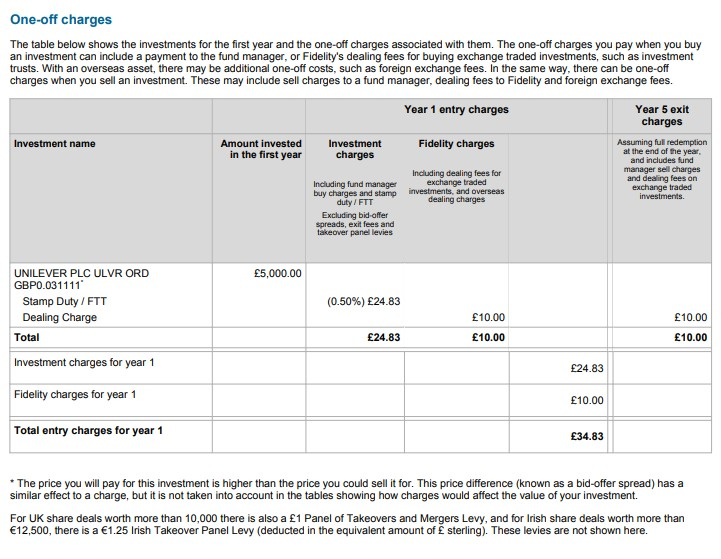

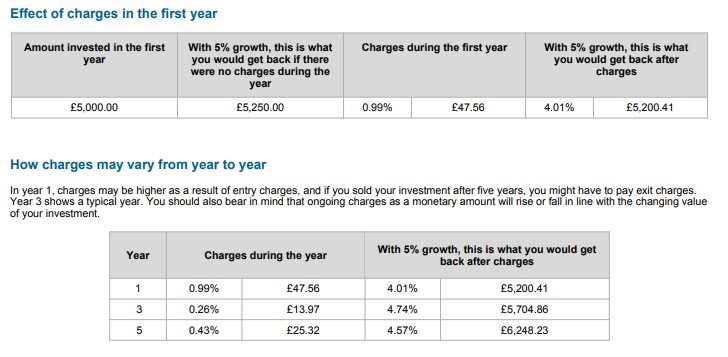

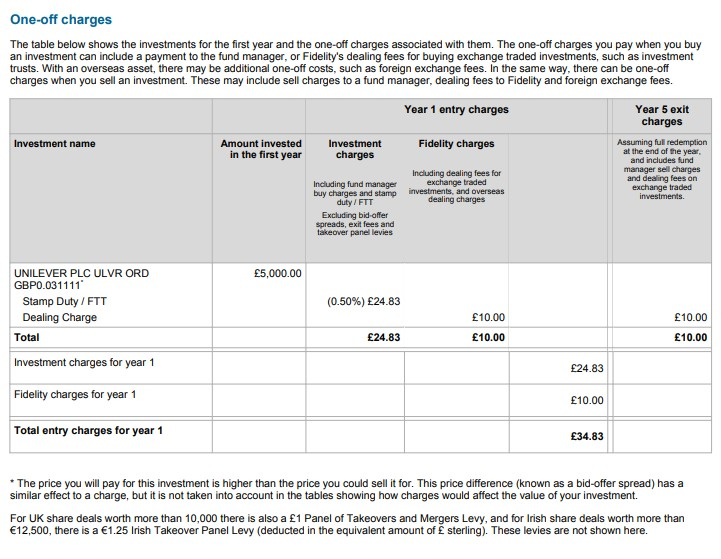

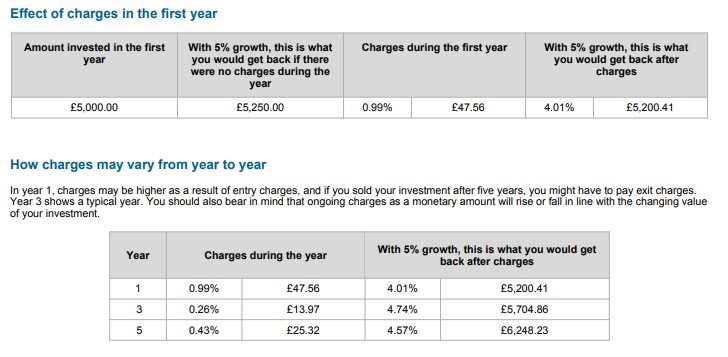

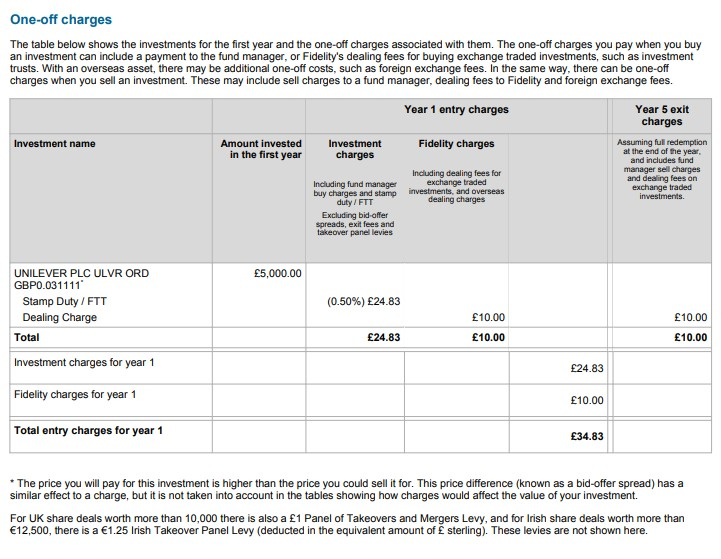

Screenshots when trying to buy Unilever shares as an exampleMDMD said:

Not sure where you are getting the 0.99% rate on shares from- the service fee is a max of 0.35%mn1 said:I currently use Fidelity and Vanguard for my share ISAs investing in funds. I am about to buy some shares on Fidelity and I noticed that Fidelity ongoing annual charge is 0.99%.

Could I get better deal with another provider/platform ?

Many thanks in advance

https://www.fidelity.co.uk/stocks-and-shares-isa/fees-and-charges/

0 -

MDMD said:

Not sure where you are getting the 0.99% rate on shares from- the service fee is a max of 0.35%mn1 said:I currently use Fidelity and Vanguard for my share ISAs investing in funds. I am about to buy some shares on Fidelity and I noticed that Fidelity ongoing annual charge is 0.99%.

Could I get better deal with another provider/platform ?

Many thanks in advance

https://www.fidelity.co.uk/stocks-and-shares-isa/fees-and-charges/

The screenshot doesn't show that they have an 'annual ongoing charge' of 0.99%.mn1 said

Screenshots when trying to buy Unilever shares as an example

There will be some one-off costs associated with them buying the Unilever shares for you on the stock exchange, which they've laid out for you in a table marked 'one-off charges'. For UK shares it includes stamp duty of 0.5% and a dealing fee of £10.

So if you try to invest £5000 and have a one-off £10 fee you will only have £4990 to spend on the shares and the stamp duty on the shares. So you could spend ~£4965 on shares, ~£25 for one-off stamp duty on the £4965 of shares, and £10 as a one-off dealing fee to place the trade on the stock market, within the £5000 order.

Then you will have £4965 of shares and Fidelity will charge you 0.35% a year to hold them, based on the average value of the shares held each month - they split the charge into monthly chunks and charge it based on the previous month's value. If the shares were worth £4965 all year the fee would be about £17, if they go up in value it would be proportionately more depending on how much of the year they spend at the higher value.. But they are saying total costs in year 1 are only £47.65 (including the one-off £35), which implies that their percentage-based fee has only been about £12. Maybe you have enough with them to qualify for a lower tier fee than the standard 0.35%.

Anyway, the point is that it's not 0.99% a year to hold a pile of shares with Fidelity. Year 1 will be more expensive because of a dealing fee and stamp duty, and if you sell in year 5 that year will be more expensive because of a dealing fee to sell. The ongoing years in the middle would just be 0.35% or whatever lower rate you qualify for at Fidelity.

2 -

Thanks for taking the time to explain.underground99 said:MDMD said:

Not sure where you are getting the 0.99% rate on shares from- the service fee is a max of 0.35%mn1 said:I currently use Fidelity and Vanguard for my share ISAs investing in funds. I am about to buy some shares on Fidelity and I noticed that Fidelity ongoing annual charge is 0.99%.

Could I get better deal with another provider/platform ?

Many thanks in advance

https://www.fidelity.co.uk/stocks-and-shares-isa/fees-and-charges/

The screenshot doesn't show that they have an 'annual ongoing charge' of 0.99%.mn1 said

Screenshots when trying to buy Unilever shares as an example

There will be some one-off costs associated with them buying the Unilever shares for you on the stock exchange, which they've laid out for you in a table marked 'one-off charges'. For UK shares it includes stamp duty of 0.5% and a dealing fee of £10.

So if you try to invest £5000 and have a one-off £10 fee you will only have £4990 to spend on the shares and the stamp duty on the shares. So you could spend ~£4965 on shares, ~£25 for one-off stamp duty on the £4965 of shares, and £10 as a one-off dealing fee to place the trade on the stock market, within the £5000 order.

Then you will have £4965 of shares and Fidelity will charge you 0.35% a year to hold them, based on the average value of the shares held each month - they split the charge into monthly chunks and charge it based on the previous month's value. If the shares were worth £4965 all year the fee would be about £17, if they go up in value it would be proportionately more depending on how much of the year they spend at the higher value.. But they are saying total costs in year 1 are only £47.65 (including the one-off £35), which implies that their percentage-based fee has only been about £12. Maybe you have enough with them to qualify for a lower tier fee than the standard 0.35%.

Anyway, the point is that it's not 0.99% a year to hold a pile of shares with Fidelity. Year 1 will be more expensive because of a dealing fee and stamp duty, and if you sell in year 5 that year will be more expensive because of a dealing fee to sell. The ongoing years in the middle would just be 0.35% or whatever lower rate you qualify for at Fidelity.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards