We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Should i rebalance?

robochaa

Posts: 1 Newbie

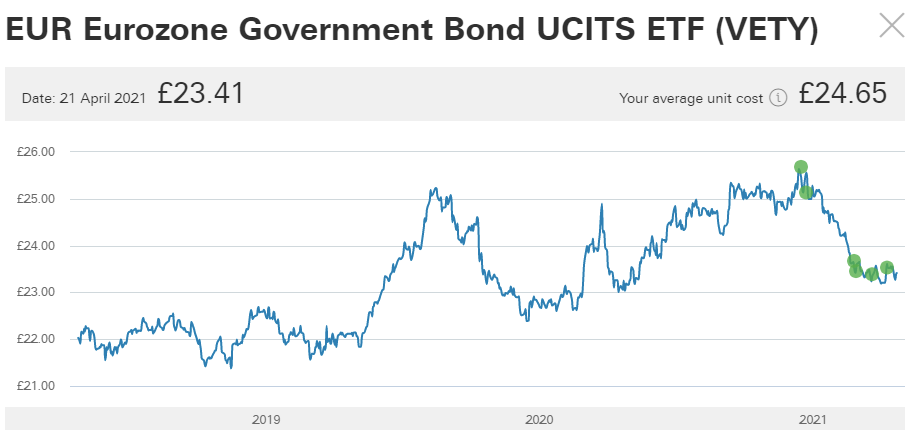

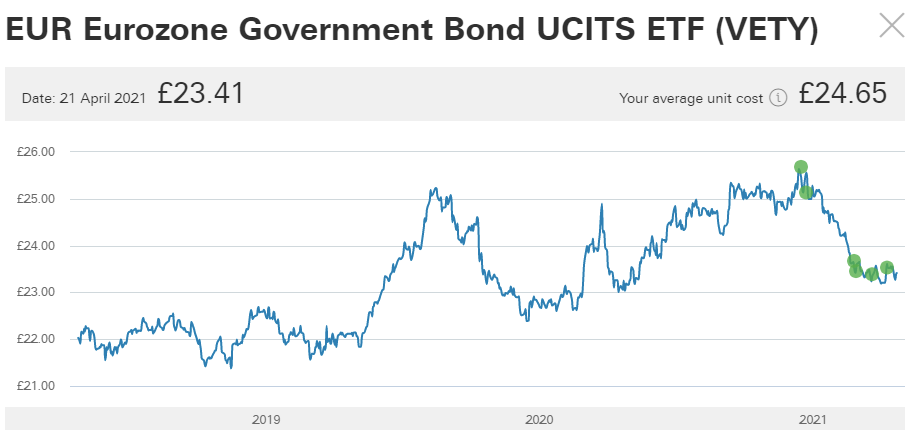

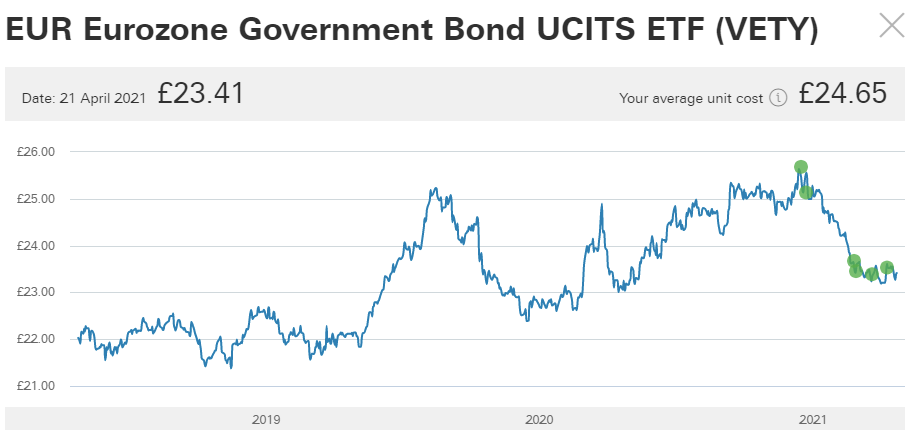

I rebalanced at the start of the year and picked two uncorrelated vanguard bond ETFs, including VETY, but  I failed to check the current price and bought VETY at a record high. I have invested more and more, hoping to buy low, but it keeps going down (or stagnates).

I failed to check the current price and bought VETY at a record high. I have invested more and more, hoping to buy low, but it keeps going down (or stagnates).

I failed to check the current price and bought VETY at a record high. I have invested more and more, hoping to buy low, but it keeps going down (or stagnates).

I failed to check the current price and bought VETY at a record high. I have invested more and more, hoping to buy low, but it keeps going down (or stagnates). After 6 months, I'm tempted to sell low, as it's now 50% of my total portfolio!? Rebalance again when it hits 24.00 and reduce (not remove) exposure to VETY?

0

Comments

-

The term 'rebalance' typically has a specific meaning in investment circles, where it's usually used to signify keeping a portfolio aligned with a specific strategy/allocation, rather than its more generic usage of changing (without necessarily having a particular target in mind), so what is it that you're aiming for?1

-

Rebalancing generally does not work.

It's popular in the financial services industry because it curbs expectations.

As eskbanker says - what you have done is not "rebalancing" , but has the same root misconception "what goes up must come down, and vice versa." The investment you finesse can only move within a narrow band. Think about how much of your portfolio you want in VETY and adjust.0 -

Rightly or wrongly I don't do this rebalancing thing. The bulk of my investments are in Mixed Asset funds so, as long as they don't fundamentally change the fund, I leave the rebalancing down to the experts (the fund managers).I don't care about your first world problems; I have enough of my own!0

-

I think rebalancing works fine for its primary purpose: to adjust the asset allocation back to chosen risk level if it drifts too far away from that by stocks outperforming like crazy or dropping like crazy. Whether one gets any extra returns from it depends on whether you're in a tending market or a swinging market, taxes, trading costs etc.It reads like you're doing other than that, by your regret.I'd be tempted to not realise the loss, and perhaps it will go away eventually. If you're adding new money for years to come you can correct it that way. Be a bit careful choosing funds because they are uncorrelated (in their price movements I suppose you mean). Because they WERE uncorrelated but they might not be so in future so you lose that benefit; if you buy the fund because it has the right characteristics (duration, credit risk etc) then those shouldn't change (without warning). Keep it simple works well enough, according to Rick Ferri on the education of an investor:

- Born in darkness – This is the pursuit of “hot stock tip that will make me rich quick”

- Enlightenment – reached by an epiphany that low cost index investing is the way to go.

- Complexity – rabbit holes such as perfect optimal allocation, products, factor investing, paralysis by analysis etc

- Simplicity – you realize that none of the complexity matters enough, it is

all about asset allocation.

Determine your asset allocation (stock/bonds/cash mix) to match your risk tolerance; choose broadly diversified, low cost, probably index funds; keep faith with your choices through thin and thin; consider every four years whether to rebalance - or something like that, and keep throwing new money at it if you can.

2 -

After 6 months, I'm tempted to sell low, as it's now 50% of my total portfolio!?

I failed to check the current price and bought VETY at a record highThe record high in itself is not an issue but .

'IT's 50% of my portfolio and I did not check the price '

'It's 50% of my portfolio very exposed to exchange rates'

Although many investment predictions can be ignored, there have been a lot of warnings that govt bonds were a poor investment currently

I am afraid rebalancing is not going to solve the problem , which was to buy it in the first place .

0 -

True enough, but this is a prompt to throw some ink at predictions. I’m tempted to say ignore them all, but ‘disregard them’ would show less hubris.Albermarle said:Although many investment predictions can be ignored, there have been a lot of warnings that govt bonds were a poor investment currentlyFirstly, if one has swallowed the index fund passive investing asset allocation story then predictions should have no impact on how you invest. Quite simply, the strategy written in a few dot points contains nothing about basing anything on predictions.Secondly, any predictions more specific than ’stocks will return more than bonds on average over the next century’ has so much uncertainty in it, and unquantifiable uncertainty even worse, that you might as well ignore the prediction. Indeed even that century prediction could be wrong.Thirdly, it might be worth hearing that government bonds are poor investments currently if it was because their returns are so low; but some bond understanding will already have told you that you’re likely to get x%/year for ten years because the yield on ten year bonds is x%/year. Or does that warning about government bonds mean they’re likely to default, or inflation will trash them, or interest rates will rise? A vague prediction needs pulling apart, as a first step, unless you just ignore it.Fourthly, have trashed predictions, here’s some: Vanguard is predicting 10 year return on US stocks ~4.5%/year, and bonds ~1%/year. That’s 3%/year difference. The difference for the last decade was stocks outperforming bonds by 10%/year. More relevantly, for the last 90 years stocks outperformed bonds by 5%/year. So with the prediction now being 3%/year, the ‘return advantage’ moves away from stocks, so perhaps it’s time to move some stocks to bonds! Or you could just ignore the prediction.As well as unpicking predictions, I think we need to see who’s making them. Do they have something to sell, or benefit in some way?If you’re not sure you can evaluate predications soundly, disregard or ignore them for safety?

0 -

robochaa said:I rebalanced at the start of the year and picked two uncorrelated vanguard bond ETFs, including VETY, but

I failed to check the current price and bought VETY at a record high. I have invested more and more, hoping to buy low, but it keeps going down (or stagnates). After 6 months, I'm tempted to sell low, as it's now 50% of my total portfolio!? Rebalance again when it hits 24.00 and reduce (not remove) exposure to VETY?IMNSHO its reckless to have so much (half) in a single investment.I dont understand why you bought more in the first place and what your allocation is of equities vs bonds, but this is horribly out of whack almost irrespective.You say "rebalance when it hits 24" but what makes you think your prediction it will hit 24 is any better than your previous predictions it will go higher than 26?BTW, you say you bought two uncorrelated bonds, what were they and does a graph of the last few years (say) show they actually are uncorrelated? And do you mean you want uncorrelated or would you in fact want correlated, just in opposite directions?0

I failed to check the current price and bought VETY at a record high. I have invested more and more, hoping to buy low, but it keeps going down (or stagnates). After 6 months, I'm tempted to sell low, as it's now 50% of my total portfolio!? Rebalance again when it hits 24.00 and reduce (not remove) exposure to VETY?IMNSHO its reckless to have so much (half) in a single investment.I dont understand why you bought more in the first place and what your allocation is of equities vs bonds, but this is horribly out of whack almost irrespective.You say "rebalance when it hits 24" but what makes you think your prediction it will hit 24 is any better than your previous predictions it will go higher than 26?BTW, you say you bought two uncorrelated bonds, what were they and does a graph of the last few years (say) show they actually are uncorrelated? And do you mean you want uncorrelated or would you in fact want correlated, just in opposite directions?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards