We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FIREside Chats

Comments

-

Thanks both, that sounds a lot better! So someone could work 13 hours/week at minimum wage of £9.50, rather than the 26 hours I was thinking - which didn't sound very part-time to me!Mortgage start: £65,495 (March 2016)

Cleared 🧚♀️🧚♀️🧚♀️!!! In 5 years, 1 month and 29 days

Total amount repaid: £72,307.03. £1.10 repaid for every £1.00 borrowed

Finally earning interest instead of paying it!!!3 -

I realise this thread has been a little quiet, but wanted to revisit to give a (hopefully) brief update (after my initial postings in April 21). MrLOL has just retired and seems really happy to have waved goodbye to the stress of corporate life. I am really happy that he is happy. Despite a recent drop in the current valuation of our investments, the seemingly ever increasing inflation rate and all the general madness in the world I’m hopeful that we will be ok. I am currently lobbing 50% of my salary into my pension and will carry on for a little while longer (with the emphasis on little). Thanks to all those who post such useful comments - it’s made a real difference to our lives.5

-

@listoflists - it sounds like you're striking a good balance. Even if we are heading to hell in a handbasket I'd rather have tried to provide for my future!

2

2 -

It has been a while since I updated on my plans too.I'm now 4 months from the likely date I head off on a big trip away with my wife, likely flight date is 8th September. Since February a few things have changed:

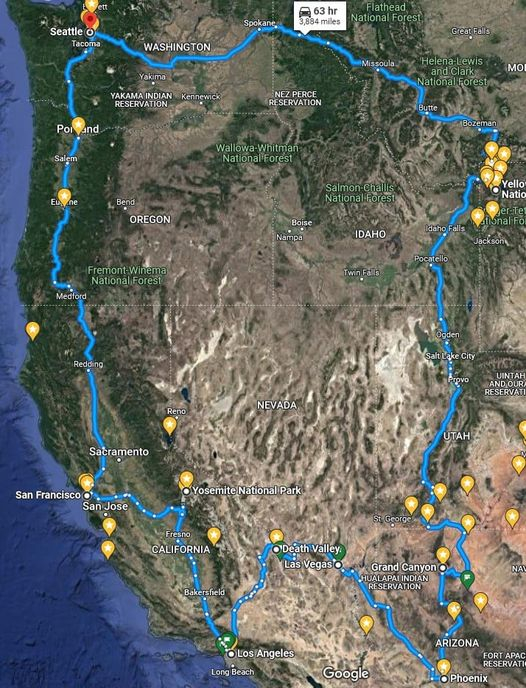

- I decided to just focus on visiting the best attractions in western USA, along with things we will be driving extremely close to. The cost of travel there (and in Canada) is so much higher than in Central and South America, and the cost doesn't justify the quality of the sites compared to what is on the rest of the continent. Plus there was the added complication of ESTA only allowing 3 months from date of arrival, this new plan removes any concerns about that.

- I still plan to start with a week in Alaska starting 8th September, cruise down to Vancouver, but then go straight to Seattle, skipping Calgary, Jasper and Banff National Parks. Then hire a car and go in a huge clockwise circle, taking in Yellowstone, Grand Teton National Park, Bryce Canyon, Zion National Park, Wupatki National Monument and Sunset Crater Volcano, Grand Canyon, Cathedral Rock, Phoenix, Hoover Dam, Las Vegas, Death Valley, Los Angeles, Yosemite, San Francisco, Redwood National Park, Portland and back to Seattle. That will probably end up being something like a 5,000 mile road trip over 5-6 weeks.

- Then fly back to Phoenix, and take a bus down to El Paso and cross into Mexico in early November. That should mean spending Christmas and New Year at the stunning Lake Atitlan in Guatemala - really looking forward to spending a relaxing 12 days at somewhere like this.

I've been updating my house a bit over the last few months ready to rent it out for the two years we are away traveling. I engaged an estate agent this week, and will market house at the end of June. Still some things to sort out, but most of the work is done now. Quite glad that there is very little painting left - sick of the sight of tins of paint and masking tape now.All our bank accounts and credit cards have been changed to ones best suited for traveling. So we now have Chase, Starling and Virgin current accounts, along with Barclaycard Rewards and Halifax Clarity credit cards.We will both be taking a 2 year unpaid leave break from work. I expect we will come back and return to work, but only for a maximum of 1 year whilst we sell house and move to our retirement location of choice, which is likely to either be Shropshire or north-east Wales. I'm thinking that if we come back in summer 2024 we can spend a few months settling back in and preparing to sell house, then market house in Spring 2025 and move to new place in summer 2025. There is a nice added benefit to that of avoiding higher rate tax by working part years in 2022/23, 2024/25 and 2025/26.Financially, by the time we leave I should have all the money we need for 2 years in cash/saving accounts. Then ISAs are in place for the period between when we come back (age 47) and when we get access to DC pensions (age 57). DB pensions will be taken at age 55 and should be plenty, even without DC to top-up (DC will effectively be replacing State Pension for the period between age 57-68). Our house in London will be used to fund new house purchase, costs and furnishing.We shouldn't need to return to work, but we probably will as it is good value due to tax efficiency, and also we can then take out an offset mortgage like this on the new property, which will be fully offset and just there as contingency. It will also be a good opportunity to move into a new place and rebalance everything if investments haven't performed, or expenses been higher than forecast before finally fully retiring. Also, our available income will be quite a lot higher from age 57, so it will also smooth things out a bit - that is a minor thing though, as even at the earlier ages we should plenty so the extra from age 57 will just be a bonus (but also why I'm keen to have available funds from offset mortgage in case of need, which can then be paid back with DC funds).In June we will be booking flights, cars, and buying all the things we will take traveling, so that will be quite a bit of expense - particularly for a new phone, new laptop and probably a GoPro to record stuff for a YouTube channel, which should be great to watch back in the future.So next few months are going to be super-busy all the way through to late August. I'm targeting August Bank Holiday to stop work, then use up remaining leave (these sort of trips are a fantastic way to tax-efficiently convert leave into hard cash!)4 - I decided to just focus on visiting the best attractions in western USA, along with things we will be driving extremely close to. The cost of travel there (and in Canada) is so much higher than in Central and South America, and the cost doesn't justify the quality of the sites compared to what is on the rest of the continent. Plus there was the added complication of ESTA only allowing 3 months from date of arrival, this new plan removes any concerns about that.

-

Wow, that sounds amazing. How exciting, I’m only 99% jealous!Reduction in daily mortgage interest since October 23 (new mortgage) - £2.84 December 25

% of house owned/% of mortgage paid off. December 25 - 40.34%/33.36%

MFiT-T7 #21

MFW 2025 #2

MF Date: Oct 37 Feb 374 -

Hugheskevi's travel plans always elicit envy from me, but it's envy in the most positive inspirational sense of the word - makes me want to invest more so that I can do similar when I get to that stage of my lifetwinklie said:Wow, that sounds amazing. How exciting, I’m only 99% jealous!

4 -

Your plans sounds amazing. Well done and have fun when you finally goAchieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/262 -

That sounds absolutely incredible hugheskevi and I hope that you have an absolute ball.Start mortgage date: August 2022; Start mortgage amount: £240,999; Original mortgage free date: August 2056

Current mortgage amount: £224,460.73

Start student loan 2012: £29,750; current student loan: CLEARED July 2025

Unread owned books Jan 2026: 256

Undone crafts 2026: +13 -

Some really inspiring posts on here I always enjoy reading.My plans are err not going at all to plan.

Our lodger moved out without paying his notice period - now we know to get this upfront. So £400 down per month, plus I e turned down work connected to having a spare room. Plus a big electric bill now £350.My vanguard target retirement 2035 isn't doing incredibly well (vanguard state that my personal return is -3.4 percent)

I was about to set up regular payments into this having worked out our new budget, but I stopped as I find it hard to invest in something loosing me money. I guess advice would be to look at it as a long term investment ? Ignore the rate of return now?

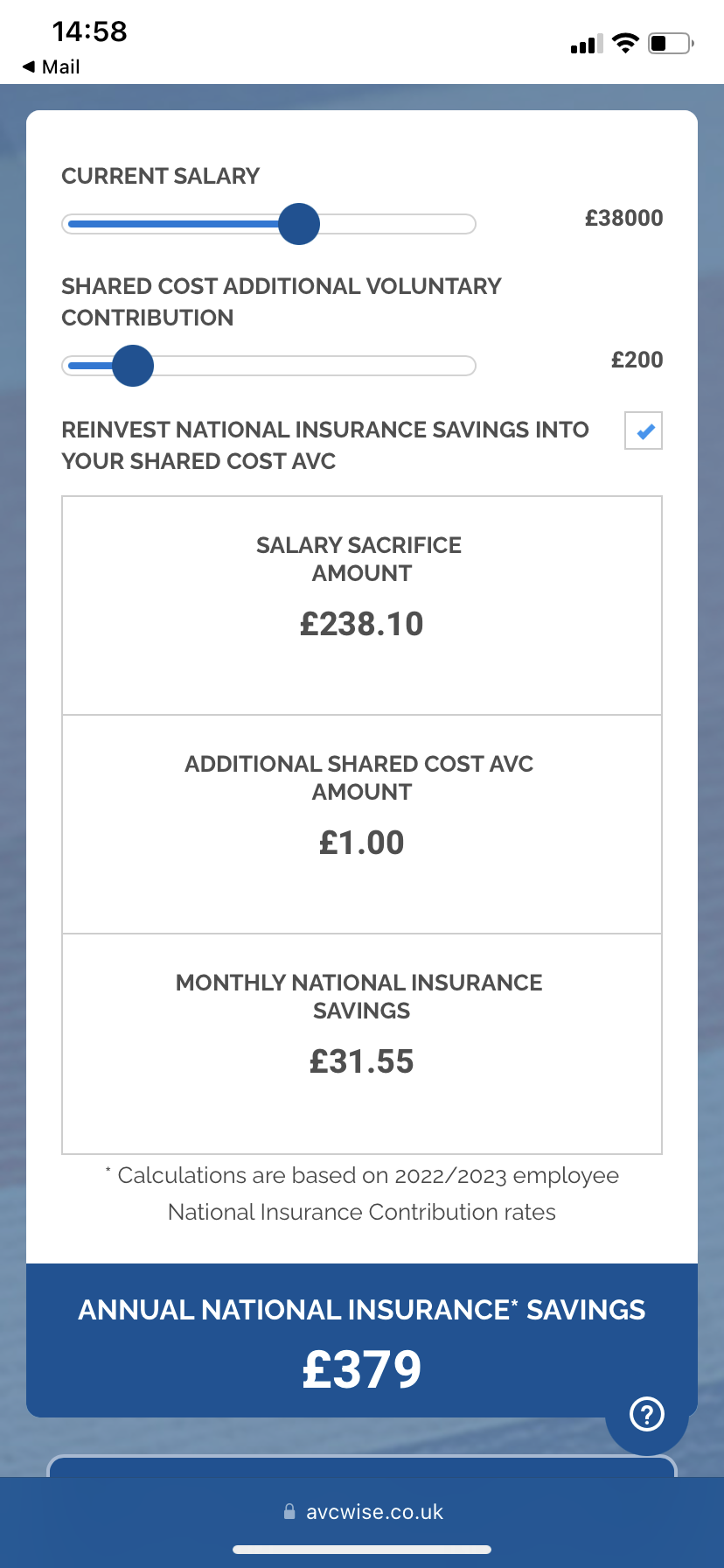

my work are also advertising a new avc partner. I'm a teacher. I don't think it will be advantageous to put money here as I want to retire around age 50. My money would be locked away till well after this. The deal they have offered is below.I feel like I'm going backwards at the moment! Save £20,000 in 2025. April 2k, May 3.5k1

Save £20,000 in 2025. April 2k, May 3.5k1 -

@earthgirl2 - definitely a long term thing - you've just started at a bad time with Vanguard. Mrs E invested £500 for DD2 and it's already in the red.

You need to think about this as a long term investment that will help to improve your quality of life in retirement, week to week changes should be ignored. My SIPP is down c. 10% over the last 6 months, I just keep buying.

Also, remember the tax benefits. If you're currently a higher rate tax payer, chances are you won't be in retirement, so tax relief towards SIPP payments will be something of a free lunch, a chance to turbocharge your returns.

That said, AVC offer looks fine because you save NI as well as getting tax relief. You can transfer AVCs to SIPP whenever you like, you're not obligated to take at same time as your teachers pension. I'd be using AVCs in your shoes.4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards