We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Vanguard Index Funds

Comments

-

Fair enough, "invested in UK-listed companies" would be more accurate, although the case you make presumably cuts both ways too, in terms of UK revenues for companies domiciled elsewhere. I don't have facts to hand but presume that VLS will have a significantly higher proportion of UK-invested content than its peers by any measure, given the undisputed weighting tilt - do you have a more accurate figure in mind than the 20-25% that you berated as 'totally inaccurate'?0

-

Didn't berate. Merely corrected the very basic misunderstanding. That seems to be constantly repeated on the forum.eskbanker said:Fair enough, "invested in UK-listed companies" would be more accurate, although the case you make presumably cuts both ways too, in terms of UK revenues for companies domiciled elsewhere. I don't have facts to hand but presume that VLS will have a significantly higher proportion of UK-invested content than its peers by any measure, given the undisputed weighting tilt - do you have a more accurate figure in mind than the 20-25% that you berated as 'totally inaccurate'?

Revenue isn't as nearly as important as profit. Revenue being no indication of profitability. Companies hedge currencies. UK companies won't leave themselves exposed to floating exchange rates either. They'll have an inhouse Treasury team managing the group's cashflow, contract positions etc.

Vanguard's VLS portfolios are constructed to be within given % ranges of potential volatility. Don't have access to the data myself, but MSCI, Russell, Refinitiv etc will happily sell you this at some considerable cost if you wish to create your portfolio in a specific volatility tolerance,0 -

I'm not sure it's a misunderstanding as such - as above, I agree that VLS's 20-25% "invested in UK-listed companies" would be a more accurate representation than asserting that 20-25% is "invested in the UK" in the broader sense, but the latter is still vague enough to have a variety of legitimate interpretations rather than one 'right' one and multiple 'wrong' ones. I wouldn't disagree that profit is more important than revenue either, but if you're asserting that 5% would be a more realistic VLS100 UK weighting on the basis of relative profitability then you must have some basis for that conclusion?Thrugelmir said:Didn't berate. Merely corrected the very basic misunderstanding. That seems to be constantly repeated on the forum.0 -

That's your opinion. Little point in asking me. I'm merely expressing a personal view. Based on what has been written previously in this regard. Which often turns into gospel as it's relayed on and on. With no degree of comprehension. Hopefully there'll be clarification in due course.eskbanker said:

I'm not sure it's a misunderstanding as such -Thrugelmir said:Didn't berate. Merely corrected the very basic misunderstanding. That seems to be constantly repeated on the forum.0 -

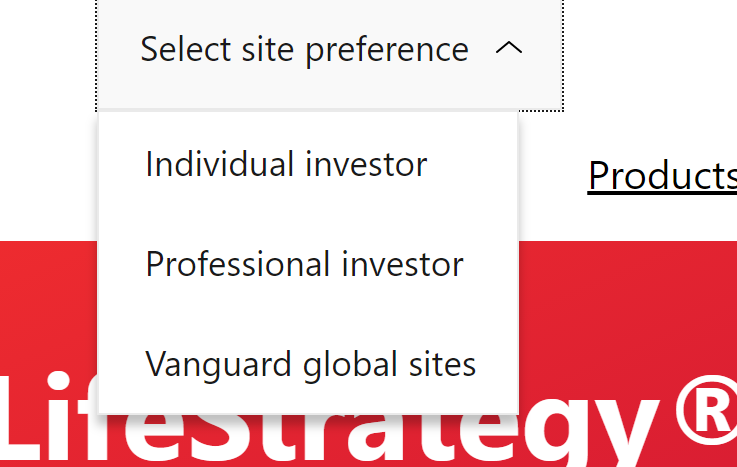

What is the Minimum initial investment with the Vanguard Life Strategy fund? Looking at the funds web page it says £100,000. Is that a mistake as I thought it was £500? Also once set up is it easy to switch from ACC to income as I am not sure when i will need an income?

0 -

It's £500, poss you are looking at the corporate investor site?1

-

Didn't think of that. Here is the link https://www.vanguard.co.uk/professional/product/mf/lifestrategy/9237/lifestrategyr-40-equity-fund-gbp-inc

0 -

It could be less than £500 if bought through a whole of market investment platformI am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

-

Yep you were on the Pro site

0 -

Why is your timeframe only 10 years as a matter of interest? Yes VLS100 is a good choice for a beginner but if you have a definite need for the money within that timeframe then a touch of caution is to be advised.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards