We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Utility default - statute barred?

89tam

Posts: 1 Newbie

I’m a first time poster desperate for some advice please!

I’m a first time poster desperate for some advice please!2013-2014 I was in a huge mess with my finances & other things and moved in with my partner/his parents house. My car is a lease from work & I have had my phone contract for years so have had no need to check my credit file (huge mistake!)

I have recently registered and found out about a CCJ from 4 years ago, I am taking steps to sort this. The only other poor marker on there is a utility default from a previous address. This marker is only showing on Equifax and none of the other reports.

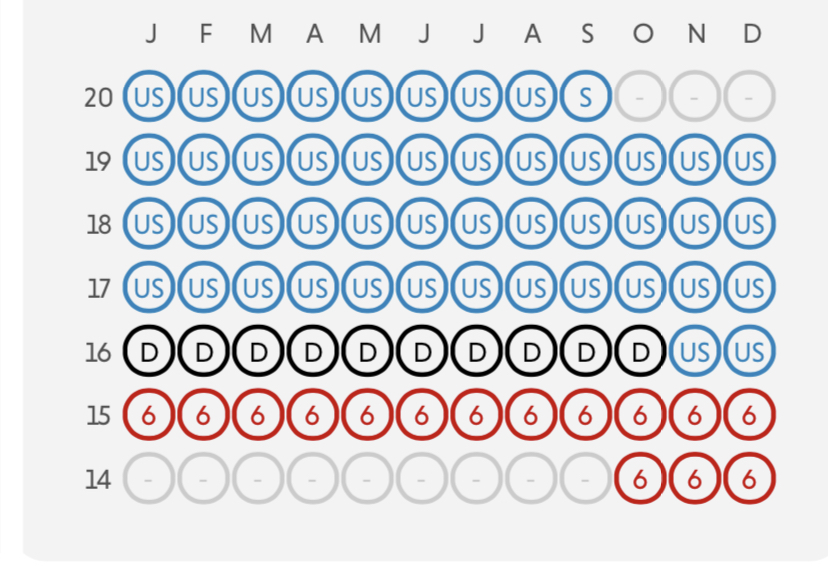

A ‘6 month late’ marker was added to an NPOWER account in October 2014. It continues to say ‘6 months late’ until a default is registered in January 2016. I have seen information about statute barred debts but read mixed messages about whether this is from the date the company COULD have defaulted me (Oct 14) or when they actually did (Jan 16)

Obviously I should have addressed this at the time, as I did my other debts, but am unsure if this is now statue barred or not.

Obviously I should have addressed this at the time, as I did my other debts, but am unsure if this is now statue barred or not.

0

Comments

-

The default date has nothing to do with it.

It is 6 years from the last payment or when you last acknowledged the debt (in writing)1 -

A recent appeal court hearing has clarified the default date can be classed as the cause of action date in many cases, however with utility bills that date is set in stone, only consumer credit act debts can be backdated, as they are governed by FCA guidelines, utility debts are not.

You also mention a CCJ, in which case the limitation act no longer applies, as the claimant has taken legal action against you, so because of this, the account can never be statute barred.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter1 -

You need to reread it. The CCJ is for a different debt.sourcrates said:A recent appeal court hearing has clarified the default date can be classed as the cause of action date in some cases, but you mention a CCJ, in which case the limitation period no longer applies as the claimant has taken legal action against you, so the account can never be statute barred.0 -

My bad, then the default date may still be considered the cause of action date in that case.2021BJ said:

You need to reread it. The CCJ is for a different debt.sourcrates said:A recent appeal court hearing has clarified the default date can be classed as the cause of action date in some cases, but you mention a CCJ, in which case the limitation period no longer applies as the claimant has taken legal action against you, so the account can never be statute barred.

The remainder of my post still applies.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Citation please.sourcrates said:

My bad, then the default date may still be considered the cause of action date in that case.2021BJ said:

You need to reread it. The CCJ is for a different debt.sourcrates said:A recent appeal court hearing has clarified the default date can be classed as the cause of action date in some cases, but you mention a CCJ, in which case the limitation period no longer applies as the claimant has taken legal action against you, so the account can never be statute barred.0 -

I did say “may be considered the default date” it’s not clear if the ruling applies to utility debts, the OP would need to clarify this with someone like National Debtline.2021BJ said:

Citation please.sourcrates said:

My bad, then the default date may still be considered the cause of action date in that case.2021BJ said:

You need to reread it. The CCJ is for a different debt.sourcrates said:A recent appeal court hearing has clarified the default date can be classed as the cause of action date in some cases, but you mention a CCJ, in which case the limitation period no longer applies as the claimant has taken legal action against you, so the account can never be statute barred.New rules for some debts – January 2019

In January 2019 there was a decision in the Court of Appeal (Doyle v PRA) that has changed the point at which the six-year period starts for some debts including credit cards and loans.

I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

It isn't going to apply to any debt that isn't regulated under the consumer credit act as only those debts require default notices to be sent.sourcrates said:

I did say “may be considered the default date” it’s not clear if the ruling applies to utility debts, the OP would need to clarify this with someone like National Debtline.2021BJ said:

Citation please.sourcrates said:

My bad, then the default date may still be considered the cause of action date in that case.2021BJ said:

You need to reread it. The CCJ is for a different debt.sourcrates said:A recent appeal court hearing has clarified the default date can be classed as the cause of action date in some cases, but you mention a CCJ, in which case the limitation period no longer applies as the claimant has taken legal action against you, so the account can never be statute barred.New rules for some debts – January 2019

In January 2019 there was a decision in the Court of Appeal (Doyle v PRA) that has changed the point at which the six-year period starts for some debts including credit cards and loans.

As the default we're talking about here is a CRA default, not a CCA default, it doesn't apply.0 -

There you go then.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

-

I had a similar issue with British Gas where they reported an account which was closed in 2013 as 6 months arrears until December 2019. After complaining to BG and getting nowhere, I went to the ombudsman with my complaint and within a week BG agreed to delete the accounts because they should've dropped off in 2019 as defaulted.

I suggest you contact NPower asking them to backdate the default to the point where you went into 6 months arrears and if they don't, go to the ombudsman with your complaint with an argument. That's probably your best option in terms of updating your credit file. As far as the debt being statute barred I'm not sure where this would leave you as requesting they backdate the default would be deemed as acknowledging the debt.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards