We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Getting shot of the mortgage sooner than 2049!

Comments

-

Sounds like a sensible decision cancelling the photoshoot and investing in a tripod instead!2

-

Quick spending update

£528.86 Mortgage

£29.26 Life insurance

This has increased; I’ll investigate if I can switch and get it cheaper. We both get decent death in service benefits already, especially me.£29.00 Kid’s activities

Football class for Monkey

£20.24 TV subscriptions

Netflix and TV license

£2.30 Socialising (me)

Soft drink at pub last night

Have left Red with £434 of his salary for his own spending so have marked that off my spreadsheet as spent (I don’t track/itemise his spending).Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)2 -

Feeling a bit tired, I’m walking 3-5 miles a day, each weekday, which probably isn’t a lot to some people but feels quite a lot to me! My legs get sore by Fridays I find.It’s good though, I was worried I wouldn’t get enough exercise having quit the gym but if anything I feel more stiff and sore in the evenings now 😅

It’s been a bit chaotic too, due to lots of roadworks and road closures meaning gridlocked traffic round here this week. Because I’m on foot, it’s not really affected us as much, but it has impacted the school bus. I’m relieved Monkey has made it home and back every day! But today we had to walk to a much further away bus stop to get him. The silver lining was it was next to the botanic gardens so we went there for a bit. I slumped on a bench while the kids ran about 😂

It’s been a bit more of a spendy day today, which is fine. Went to the post office and sent off my Joules wellies, which don’t fit well, so will reallocate that money once it’s back. Also went to tesco to do a food bank shop and our top up shop.Cut Monkey’s hair at his request once we got home from the botanic gardens. He had it a bit on the long side (not shoulder length or anything, just a bit of a mop on the top of his head!) but asked for it “short like daddy’s” this time.

I didn’t actually do it quite as short as Red’s, he gets a number 3 on the sides but Monkey got a number 5. It’s a bit longer on top but nowhere near as long as it had been, I used a number 8 there. He looks so much more grown up and is excited about showing it off at a birthday party tomorrow!

Today’s spends

£3.60 Bus fares

Still spent 3hr outside today and walked nearly 3 miles but a bus was an essential with the shopping and a nice treat home after the botanic gardens 😅

£1 Pocket money

Gave Bambi £1 of her pocket money but still owe the other £1 and Monkey’s

£4.50 Charity shop

Sugar, coffee & tea canisters at £2 for the set, 3x big white dinner plates at £2.50 for the three

£11.01 Tesco - charity

Food bank shop

£41.31 Tesco - our shop

£12 on a digital alarm clock for the kids’ room; £29.31 was food. Included 2x steaks which Red did say he’d pay for from his money but tbh as we didn’t overspend too terribly I won’t bill him unless he offers again 😆

£25.19 DD - InternetPart time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)2 -

Yaay - you found tea and coffee canisters and plates! 😊👏

Thats a lot of walking - I’d be feeling that too! 😂KKAs at 15.12.25:

- When bought house £315,995 mortgage debt and end date at start = October 2039 - now £227,385

- OPs to mortgage = £12,881 Estd. interest saved = £6,203 to date

c. 16 months reduction in term

Fixed rate 3.85% ends October 2030

Read 5 books of target 52 in 2026 as @ 13th January

Produce tracker: £18 of £400 in 2026

Watch your thoughts, they become your words.

Watch your words, they become your actions.Watch your actions, they become your reality.1 -

Often doing a different activity just uses some different muscles and makes you ache. Variety is good

2026 decluttering: 72 🤑🥉 ⭐️

2026 decluttering: 72 🤑🥉 ⭐️

2026 use up challenge: 30🥉 ⭐️

2026 decluttering goals I Use up Challenge: 🥉52 🥈100 🥇250 💎365 I 🥉25 🥈50 🥇100 💎1501 -

Love all the extra walking you’re doing (appreciate it’s out of necessity) and so glad you pleased Reds needs and yours by getting the kitchen accessories from the CS!Did you make a cereal bar/flapjack recipe btw? I’m searching around for one that’s not too sweet for the children and remember you saying you were going to make oneFollow here for the daily life of an ADHD mum with 2 children and a new mortgage to pay

https://forums.moneysavingexpert.com/discussion/6570879/life-in-our-forever-family-home-and-the-mortgage-that-came-with-it#latest2 -

This is the one I make @MissRikkiC but last time I cut the sugar to 85g and they don’t notice 😜 and I add ground mixed seeds. I would add nuts but they are for school snacks and he’s not allowed to take things with nuts in. https://www.bbcgoodfood.com/recipes/yummy-golden-syrup-flapjacks/amp

Yesterday I took Monkey to football then we had a softplay birthday party I took both kids to.Was nice to see my dad and papa today. Haven’t seen my dad since November so he brought the kids money for Christmas (much appreciated and added to our activity fund) and also toys for their birthdays.Mainly did alright except he bought Bambi a kiddie smart watch which plays games 😬😬😬 I wish people would run things like that by the parents, as she isn’t allowed to play screen based games yet (hadn’t planned to introduce til after she’s at school). So now I’m not sure what to do as she’s already seen it and opened it of course 🙄

Anyway! Apart from that dilemma it was a lovely afternoon seeing them. Dad kindly treated us to lunch out which was nice.Spending

£6.90 Taxi to softplay

Attempted the bus but it was very delayed and there was a freezing rain on so we gave up 🙄

£13.50 Softplay entry

Monkey was invited to a party so I paid Bambi in so she could come too. Softplay is definitely so expensive now compared to pre-pandemic!

£1.80 Icecream at softplay

Bought Bambi an ice cream while Monkey was in the party room getting fed

£2.65 Bus farePart time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)3 -

Forgot that I paid for my friend’s child at softplay too and that’s why it was so expensive 😂 she bought the round last night instead, although it had been my turn, so I’ve moved £5 from the kids’ category to my spends to make it right.Received £18.95 refund for the ill-fitting wellies and £10.50 refund for all the things I had to hand back in my Tesco order!!! Annoyed as I don’t have any chicken for Thursday now. Will scrounge in the freezer to see what I have.Watched a zoom call replay last night about the parenting membership I was considering cancelling. To my surprise they are honouring prices for existing members (including honouring where you are in working towards free lifetime membership after 5 years - I’ve been in it 3). This is even though the price is rising significantly for new members and they’re scrapping lifetime membership for them. AND they are dropping a lot of the elements of the course which I felt I’d now mastered (getting your kids to play, decluttering your home), and adding much more content relevant as your kids get older (eg navigating social media & phones). So I think I will stay in that after all.Spending

£111.69 Tesco

Price after refund. Sounds a lot but £47ish was my monthly household item stock up and £4 was sweets for the kids paid for by them. So just over £60 on food.£8.10 Birthday gift

Second hand vehicle encyclopaedia for my friend’s vehicle-obsessed little boy! She won’t mind it being second hand. Would have been £15 new.£22 Insulating front door

We were toying with the idea of replacing our draughty front door this year, but Red bought supplies to seal up the gaps round the frame himself. It’s making a noticeable difference and our front hall isn’t so cold anymore!!£26 Garden project supplies

Missed what this actually is, but Red said something about the garden 😂 think it’s to do with the bike shed he’s upgrading

Goals update

8/52 books read

80hr 11 minutes outdoor time

Midway through my first craft project (knitting baby dungarees!). Have also done some minor mending/repairs which I’m normally bad for neglecting…

£2,930.09 in emergency fund (£5,530.09 total saved when you add in our Help to Save savings)

28.66% average savings rate (of course, that’s just for one month so far!!). This doesn’t count pension contributions.

£400.46 average grocery spend (again, just one month in! Aim is to keep it at around this or reduce!)Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)3 -

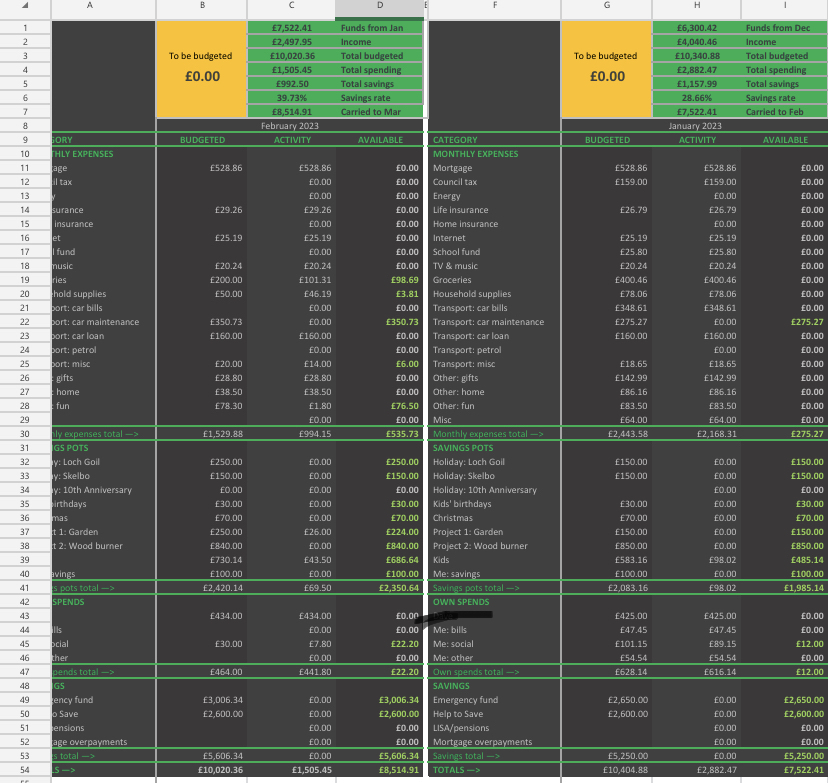

Was feeling grim yesterday (sore throat) so spent most of the evening chilling on the sofa and experimenting by making a spreadsheet to mimic YNAB.

Really pleased by how it’s turned out - it has a transactions tab and a budget tab and all the formulae seem to be working well at pulling between them.This year my aim is to experiment with even more insourcing and to question everything. I have a few weeks til my YNAB subscription renews, so I will use my spreadsheet in that time to evaluate whether it is a viable replacement. I might not actually cancel my YNAB.But even just making it makes me feel quite empowered that I do have the ability to insource this small expense if I want to - I’m by no means an Excel wizard so it was a learning curve to get each formula correct, and it always feels good to master something new. This is one thing I love about frugality and doing things for yourself! Part time working mum of DS (2015) and DD (2018).

Part time working mum of DS (2015) and DD (2018).

NET WORTH Nov 25: £159,943

Assets: £230,000

Investments: £70,169

Savings: £3,288

Debt: -£143,514 (£700 CC / £16k car / £127k mortgage)7 -

This fills my heart with joy! I really hope you use this or similar going forward because the sense of satisfaction is unmatchable!I love my spreadsheet and whilst it’s going to take me a quiet day to tidy and make nice again when I’m back working, it’s functioning at the moment.I started it off as a daily cash flow summary so that I could always see ahead of time what my bank balance should be on that given day so I’d have each day and the bills due for that day and what my overall balance would be after. It grew arms and legs and is now a spreadsheet bullet journal I guess, where it’s got things like; the spends in each catagory link to the catagory spend summary for the year or whatever or the nursery calendar so I know how many days we will be paying for well ahead of time. It’s also got a credit card and a mortgage tab where I can forecast what I can overpay and see the future balances if that happens 😂😂😂 can you tell I’m a spreadsheet lover!Follow here for the daily life of an ADHD mum with 2 children and a new mortgage to pay

https://forums.moneysavingexpert.com/discussion/6570879/life-in-our-forever-family-home-and-the-mortgage-that-came-with-it#latest4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards