We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Complicated House Buying Scenario!

Comments

-

@windofchange That's right, the 'main residence' SDLT exemption only comes into play if you owned a property as a main residence that you sold, either before the new main residence purchase or within 3 years (to be eligible to apply for a refund of the 3% surcharge). So I don't see it being applicable in your case.Windofchange said:

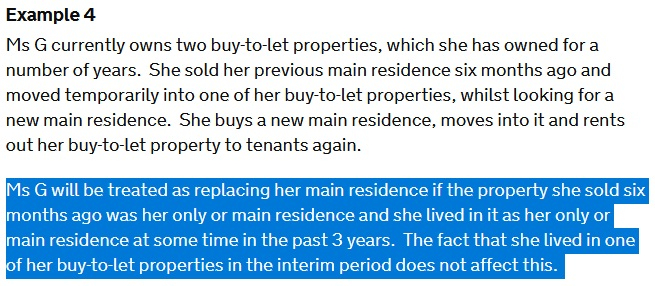

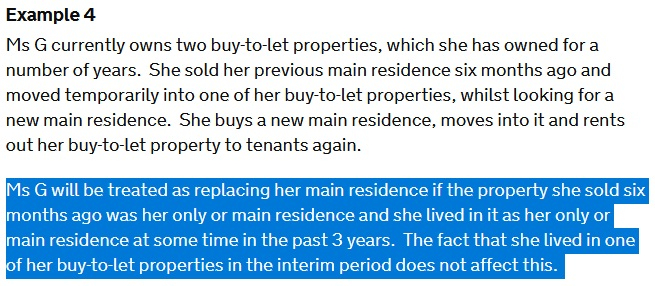

I think the distinction made at the time was we had never owned a property as a main residence, therefore couldn't include it as such. We hadn't sold something, rented something in the meantime and then brought again.K_S said:Windofchange said:Probably something to take professional advice on then? As I say, when we went through this last year the advice from our solicitor was very black and white - if you have a home already that you are occupying then that is your main residence whether you are renting there temporarily or are an owner occupier. Depending on which bit of the country the OP is looking at, it may / may not make much difference, but assuming an average house price of 256k ish then it will be a nasty sting if it does apply, and may then influence quite heavily the decision about what to do with the rental property in my view.@windofchange Tbf conveyancers aren't always SDLT experts. The advice you were given re the part about renting in between is most definitely questionable as I have seen at least 2 cases of clients (who also own rental/second properties) who moved into private rentals between house purchases to be chain free and didn't pay the 3% surchage on their onward purchase.Edit: Same scenario as OP's from the gov.uk SDLT pages https://www.gov.uk/hmrc-internal-manuals/stamp-duty-land-tax-manual/sdltm09810

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Yup - I've just dug up the article that I read that explains it all. If I had owned the home we were in then we would have avoided the 3%. The fact that we rented it means that we were not 'disposing' of a main residence, and therefore I can't claim anything back. Article below for any others who find themselves in a similar position.K_S said:

@windofchange That's right, the 'main residence' SDLT exemption only comes into play if you owned a property as a main residence that you sold, either before the new main residence purchase or within 3 years (to be eligible to apply for a refund of the 3% surcharge). So I don't see it being applicable in your case.Windofchange said:

I think the distinction made at the time was we had never owned a property as a main residence, therefore couldn't include it as such. We hadn't sold something, rented something in the meantime and then brought again.K_S said:Windofchange said:Probably something to take professional advice on then? As I say, when we went through this last year the advice from our solicitor was very black and white - if you have a home already that you are occupying then that is your main residence whether you are renting there temporarily or are an owner occupier. Depending on which bit of the country the OP is looking at, it may / may not make much difference, but assuming an average house price of 256k ish then it will be a nasty sting if it does apply, and may then influence quite heavily the decision about what to do with the rental property in my view.@windofchange Tbf conveyancers aren't always SDLT experts. The advice you were given re the part about renting in between is most definitely questionable as I have seen at least 2 cases of clients (who also own rental/second properties) who moved into private rentals between house purchases to be chain free and didn't pay the 3% surchage on their onward purchase.Edit: Same scenario as OP's from the gov.uk SDLT pages https://www.gov.uk/hmrc-internal-manuals/stamp-duty-land-tax-manual/sdltm09810

https://www.ft.com/content/bb51e06e-2bd1-11e6-bf8d-26294ad519fc

For us it worked out in the end as the stamp duty holiday meant that we ended up paying about the same amount of SDLT as we would have done had we not owned another property, so we were lucky - we just paid the 3% additional rate rather than the basic rate and then the 3%.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards