We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FCA performance scorecard - comparison metrics for personal current accounts 2021

colsten

Posts: 17,597 Forumite

Some stats from the FCA website

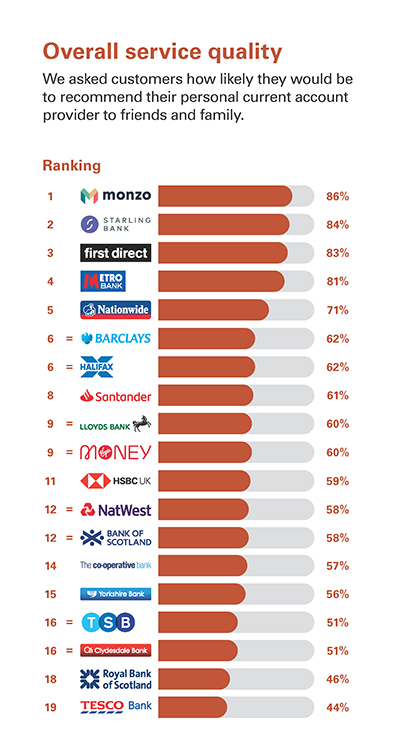

Quality of service is determined by how likely customers would be to recommend their provider to friends and family.

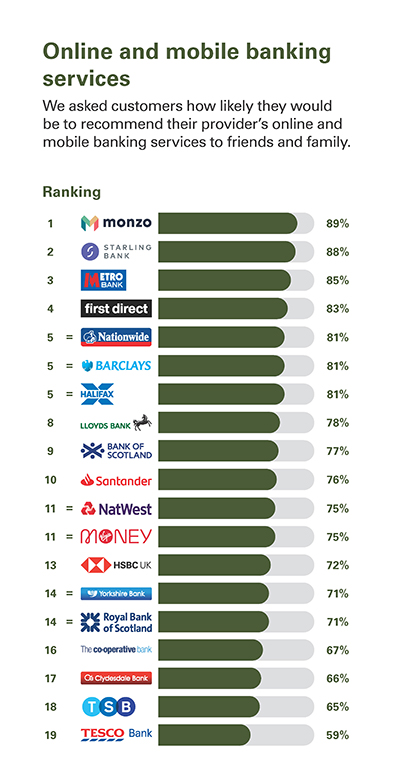

Online and mobile banking services is determined by how likely customers would be to recommend their provider’s online and mobile banking services to friends and family

Quality of service is determined by how likely customers would be to recommend their provider to friends and family.

Online and mobile banking services is determined by how likely customers would be to recommend their provider’s online and mobile banking services to friends and family

5

Comments

-

Maybe it was just a slow news day when they put that page together last week but I can't see any obvious reason why they're basically just re-presenting the biannual quality data that was first published last August (and other service/complaint data from September and October)?

0 -

Looks like another nail in the coffin for Tesco bank although I have an account with them and can't understand why they are so low. Always worked well for me with efficient app.Remember the saying: if it looks too good to be true it almost certainly is.1

-

I'm amazed at FD and Metro Bank scoring higher than Barclays and Nationwide for online and mobile services. I'd even rate them lower than Halifax/Lloyds.1

-

I have current accounts with most of these, missing Metro, Santander, Yorkshire, and Clydesdale from my collection.

I've actually had no issues with Tesco Bank's customer service, we're nice for the 3% current account interest, but like many banks, have stripped away any reasons for me to use them.

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards