We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Successfully upgraded your Cash Account?

Comments

-

Exactly. 👆👆👆👆dahj said:

The FlexBasic does almost everything that the FlexAccount does except the overdraft.Fighter1986 said:

Yeah their eligibility checker for a new account also only recommends flex basic.stclair said:

I would just apply for a new account with them and see what happens. My brother recently opened a flex plus account with 15 odd defaults.Fighter1986 said:Thank you for all your replies, it's very helpful and although none of this is solid evidence it does suggest that I've made the right choice with Nationwide. I'm comfortable banking with them and will just carry on as I am, enquiring about an upgrade every six to twelve months until the day comes that they trust me.

Grand, Thank you.

It's alright, it's not been long since my BR, I'll just sit tight carrying on exactly as I am.

Really appreciate everyone's input 👍

Good ATM limit (£500), supports contactless payments and works at Pay at Pump too.

OP never responded to this Q of mine:

I hope for their sakes they aren't on a quest to get an expensive overdraft.0 -

Oh I covered this back on Page 1, sorry if you missed it:colsten said:

Exactly. 👆👆👆👆dahj said:

The FlexBasic does almost everything that the FlexAccount does except the overdraft.Fighter1986 said:

Yeah their eligibility checker for a new account also only recommends flex basic.stclair said:

I would just apply for a new account with them and see what happens. My brother recently opened a flex plus account with 15 odd defaults.Fighter1986 said:Thank you for all your replies, it's very helpful and although none of this is solid evidence it does suggest that I've made the right choice with Nationwide. I'm comfortable banking with them and will just carry on as I am, enquiring about an upgrade every six to twelve months until the day comes that they trust me.

Grand, Thank you.

It's alright, it's not been long since my BR, I'll just sit tight carrying on exactly as I am.

Really appreciate everyone's input 👍

Good ATM limit (£500), supports contactless payments and works at Pay at Pump too.

OP never responded to this Q of mine:

I hope for their sakes they aren't on a quest to get an expensive overdraft.

"I understand, I'm really not that bothered at all as cash accounts are fairly full featured these days anyway"

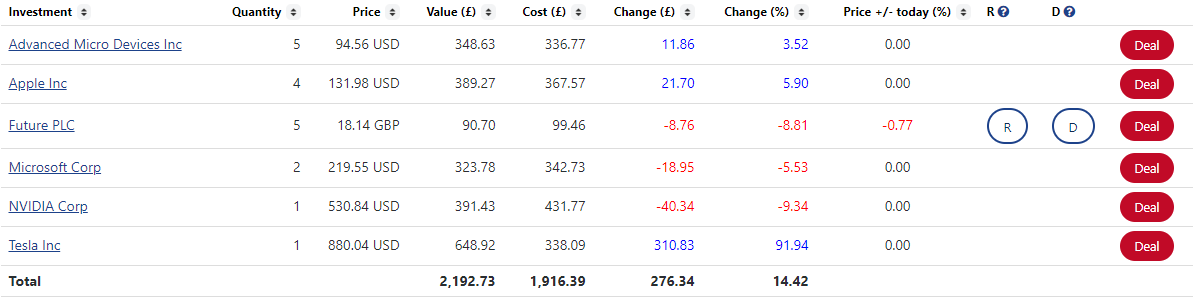

I've certainly got no interest in any kind of borrowing whatsoever until I apply for a mortgage in two years' time. I've got a credit card paid in full every month building credit history between now and then, and I have plenty of liquid savings; plus shares... Including Tesla... Jeez, that boy is like a runaway freight train

It's not a huge portfolio just a little something I keep on the back burner to learn the market without risking the capital we'll use for our house.

0 -

You need an OD if you are looking to build credit profile up and want to get a mortgage. Just dont use it. Works wonders for your credit profile. Also always good to have an OD for emergencies.0

-

I have no interest in an overdraft to be honest. I've got a large enough financial cushion.xlnc99 said:You need an OD if you are looking to build credit profile up and want to get a mortgage. Just dont use it. Works wonders for your credit profile. Also always good to have an OD for emergencies.

I would agree that an unused overdraft does have a positive effect on ones creditworthiness, however

0 -

Unused overdrafts and credit cards are very positive but lenders will be looking for a decent deposit, no late payments and regular income/affordability as a mortgage is secured lending.1

-

Quite. We will have 15% down + a healthy additional float, no debt, and will be looking to borrow about 4.25x out combined annual basic salaries. So all good on that front 👍dahj said:Unused overdrafts and credit cards are very positive but lenders will be looking for a decent deposit, no late payments and regular income/affordability as a mortgage is secured lending.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards