We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

'Annuities are poor value' - what do they know that we don't?

Comments

-

Age 55 no health issues annuity for self and 100% for spouse, RPI increase (HL tool): 1.39%

No fail in 40 years SWR based on historic data 75:25 stocks/bonds 0.25% fees drag (cfiresim): 3%

Seems to me there is not much chance of your withdrawals having to go down below 1.39% based on any reasonable drawdown strategy?I think....0 -

And even if you started off at 1.39% drawdown you would still have the capital,michaels said:Age 55 no health issues annuity for self and 100% for spouse, RPI increase (HL tool): 1.39%

No fail in 40 years SWR based on historic data 75:25 stocks/bonds 0.25% fees drag (cfiresim): 3%

Seems to me there is not much chance of your withdrawals having to go down below 1.39% based on any reasonable drawdown strategy?0 -

Sailtheworld said:

If you hold shares / ETFs the custody charge will be £10 / month max. There are no drawdown charges from tomorrow. I'm not at a drawdown age yet and invest once per year. Total platform charges next year will be £129.95 plus 0.22% OCF for one ETF and 0.07% for the other. Plus a few other trades because I can't help myself.BritishInvestor said:

Are you paying fund managers or holding cash?Sailtheworld said:

With Youinvest you can have a £1,000,000 SIPP in drawdown and total charges would be £120/ year plus any trading. It's peanuts.zagfles said:

As opposed to drawdown providers, fund houses, financial advisers etc?Sailtheworld said:

The financially savvy tend to try and avoid expensive things. They're also aware that annuity providers aren't acting altruistically.garmeg said:

No. They are expensive because gilt yields are very low and annuity providers will be investing (almost all of) the purchase monies in gilts of appropriate term to match the profile of their liabilities.Sailtheworld said:

Because they tend to be purchased by people at the less financially savvy end of the bell curve.michaels said:So why are annuities so expensive?Do you think they are "acting altruistically" ?0 -

If you believe what didn't happen in the past can't happen in the future, and that neither of you will live past 95, then it's a no-brainer. Otherwise, you're taking a risk. Maybe a small risk, but a risk nonetheless.michaels said:Age 55 no health issues annuity for self and 100% for spouse, RPI increase (HL tool): 1.39%

No fail in 40 years SWR based on historic data 75:25 stocks/bonds 0.25% fees drag (cfiresim): 3%

Seems to me there is not much chance of your withdrawals having to go down below 1.39% based on any reasonable drawdown strategy?

1 -

Thrugelmir said:

How many people accumulate a £1 million in their SIPP by the time they are 55. Those that do are going to have considerable sums in other assets as well.MK62 said:

On the other hand, who, today, at 55, would swap £1M for a joint life, index linked annuity of c£15-16k pa? That's what's on offer from annuity providers at the moment.zagfles said:Sailtheworld said:

Because they tend to be purchased by people at the less financially savvy end of the bell curve.michaels said:So why are annuities so expensive?No they aren't. Those people will look at the pension value or CETV and say, duh, that's a big number, definitely better than my annual DB pension, I'll transfer it and I'll be mega rich. Generally, financially clueless people will underestimate how much a guaranteed income will cost, and they'd think it a no-brainer to take a £million lump sum over a £30k pa inflation linked pension. So they'd avoid buying an annuity, as they think rates are so low because they're being ripped off by insurance companies in their fancy buildings etc rather than very low gilt yields, negative in the case of index linked.Quite a few people have large pensions, but little else other than emergency money (though I didn't specifically say pension....you can buy annuities with non-pension money too).......though tbh, I'm not sure why other assets are all that relevant, other than somebody with considerable "other assets" would have less to worry about whether the annuity purchase decision is right or wrong (which they would only actually know in 20-30 years time)The question remains though........who, today, at 55, would swap £1M for a £15k pa index linked income for life?If you prefer, who, today, at 55, would swap £500k for a £7.5k pa index linked income for life?For many, the question will be moot anyway.......an annuity, at the moment, simply won't provide sufficient income to retire......waiting until their state pension kicks in may not be all that appealing for many tbh (assuming an annuity plus state pension would then be enough - though granted the annuity on offer would be bigger by then).In the end, it's only when we are into our later years that we'll actually know for sure what we should have done at 55.....there is an element if risk whichever decision is taken today........each must assess the risks for themselves.Personally, I'm satisfied with the drawdown option......others may take the opposite view, and that's fine - sat here today, there is no way to know for sure which option will end up being the best one.......and for those who can't decide, the two options aren't mutually exclusive, they can both be partially used together in whatever amounts are seen fit.0 -

We really need "longevity annuities", as they have in the US https://en.wikipedia.org/wiki/Longevity_insuranceYou can easily pool investment risk by investing in a wide range of assets, and look at worst case scenarios from the past and make the leap of faith that the future won't be worse, but you can't pool longevity risk in drawdown.I'm sure there'd be a market for such annuities in the UK, strange that no-one is offering them. They'd make drawdown planning so much easier, you have a fixed timescale that your pot needs to last eg 60-85 and then at 85 the annuity kicks in if you're still alive. They should be reasonably cheap since they pay out nothing if you die before 85.1

-

Sounds similar to deferred annuities written by insurance companies in tne 1970s on a 'nil return on death' basis. If only these were now available using part of one's crystallised funds!zagfles said:We really need "longevity annuities", as they have in the US https://en.wikipedia.org/wiki/Longevity_insuranceYou can easily pool investment risk by investing in a wide range of assets, and look at worst case scenarios from the past and make the leap of faith that the future won't be worse, but you can't pool longevity risk in drawdown.I'm sure there'd be a market for such annuities in the UK, strange that no-one is offering them. They'd make drawdown planning so much easier, you have a fixed timescale that your pot needs to last eg 60-85 and then at 85 the annuity kicks in if you're still alive. They should be reasonably cheap since they pay out nothing if you die before 85.1 -

I'm thinking this sounds like a sort of reverse life assurance so you would think it would make sense for life companies to sell it to hedge their risks?garmeg said:

Sounds similar to deferred annuities written by insurance companies in tne 1970s on a 'nil return on death' basis. If only these were now available using part of one's crystallised funds!zagfles said:We really need "longevity annuities", as they have in the US https://en.wikipedia.org/wiki/Longevity_insuranceYou can easily pool investment risk by investing in a wide range of assets, and look at worst case scenarios from the past and make the leap of faith that the future won't be worse, but you can't pool longevity risk in drawdown.I'm sure there'd be a market for such annuities in the UK, strange that no-one is offering them. They'd make drawdown planning so much easier, you have a fixed timescale that your pot needs to last eg 60-85 and then at 85 the annuity kicks in if you're still alive. They should be reasonably cheap since they pay out nothing if you die before 85.I think....1 -

The rules of the game are changing in several fairly fundamental ways. The governments across the world are inflating assets and following MMT without saying so. All these money governments are throwing at people are accompanied by decreases in production. Facebook and Netflix are producing as much as before the pandemic but food production has been reduced. Yet the money supply is growing fast in most countries around the world.That money is going somewhere eventually. Will people just leave the extra cash in savings accounts with negative real interest? Will they buy shares? Will they take cruises? Will they buy Bitcoin or houses? Do we have asset bubbles? Will the secular decrease in inflation since 1980s be reversed? Which assets will be favoured as a result of new and increasing taxation?

I don’t know the answers to any of these questions but its not obvious why statistics on past market performance should be used to predict the future. Diversification is going to be key to wealth preservation and annuity is one of the tools within that mix.3 -

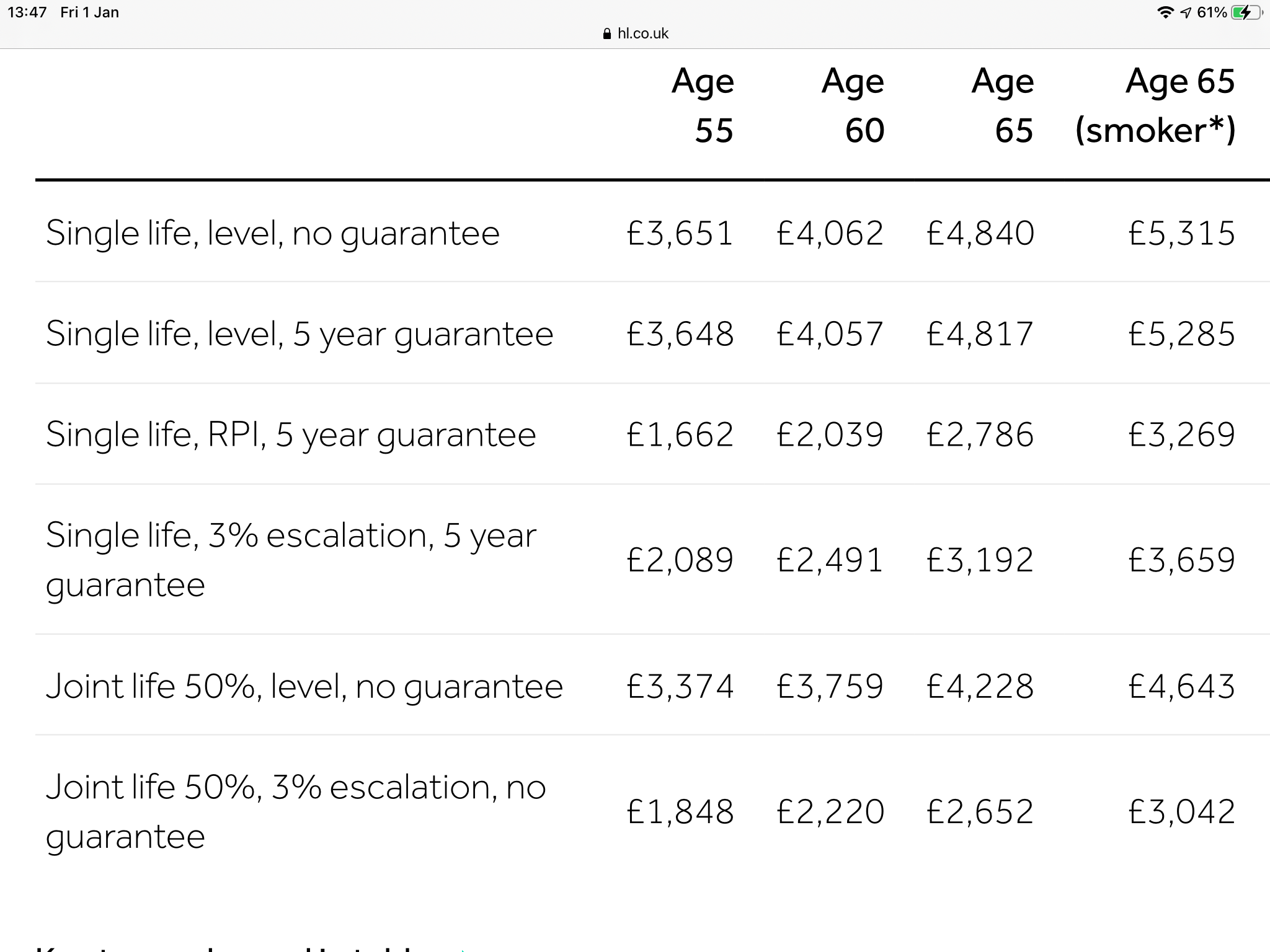

If you look at the amount of level annuity and RPI annuity purchased for the same purchase amount, the annuity market seems to be pricing in a very high level of future inflation compared to that we have been witnessing recently.Not sure if the RPI annuity received will ever catch up with the level one but certainly unlikely to pay out as much if you allow for prior annuity underpayments since purchase!

eg level annuity at 55 is about £3,650 and RPI annuity is about £1,660 ... 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards