We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Child critical illness claim

Gjw01

Posts: 10 Forumite

My son has a critical illness, and my partner and I took out a policy each with L&g. Can we make a claim on each if our policies, or do we just claim on one of our policies?

0

Comments

-

If you mean can you both claim - yes you canIf you mean will you get two payouts in full - no you won't0

-

Sorry. To clarify, If we made 2 seperate claims for the same child on two different policies (both with L&G) would we get 2 payouts

0 -

No you won't. With any insurance being the subject of 2 separate policies, the max you will receive will be 50% of claim from each of the insurers.The bigger the bargain, the better I feel.

I should mention that there's only one of me, don't confuse me with others of the same name.0 -

You can claim the full amount on each policy. In the same way that if you had two life policies, or two critical illness policies they would both pay in full. Please ignore the above posts which say otherwise.

Multiple PHI policies would not pay out, because they are designed to cover a portion of your income. However, multiple critical illness policies will most definitely pay out.

To put your mind at rest, call L&G and they will confirm.

I am an Independent Financial Adviser. Any comments I make here are intended for information / discussion only. Nothing I post here should be construed as advice. If you are looking for individual financial advice, please contact a local Independent Financial Adviser.2 -

This is generally true of insurance policies which are intended to cover a specific, well defined loss. For example if you crash your car you will only get your repairs paid for once, even if you have two policies on the car.cattie said:No you won't. With any insurance being the subject of 2 separate policies, the max you will receive will be 50% of claim from each of the insurers.

It is not true of all types of insurance however. In particular with life and critical illness policies the payouts are set arbitrarily when the policy is taken out and are not determined your exact loss of earnings or any other financial loss you suffer. Essentially the policy says that if event X happens it will pay out £Y. If you have a second policy that will pay out £Z if event X happens there is no reason why you cannot claim both £Y and £Z.1 -

We both have the same policy (decreasing life with critical care i think) under our individual names.

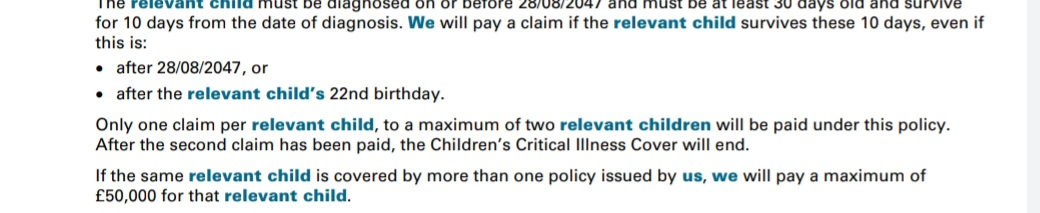

I found the bottom line relevant from the policy booklet. 2

2 -

Sorry to hear about your son. I take it he is still classed as a child ie. under 18 or under 21 and still in full time education?Gjw01 said:We both have the same policy (decreasing life with critical care i think) under our individual names.

I found the bottom line relevant from the policy booklet.

The limit of £50,000 is based on the normal maximum children's payout being £25,000 anyway, irrespective of how much cover you have in place.

I also presume that your partner is your son's father? If not, if you are not married and he has not legally adopted your son then your partner probably won't be able to claim.

I also presume there was no indication of this critical illness before you and your partner took out the policy?

Presuming the answers are yes, yes and no and the condition is of a claimable severity then I can't see any issue arising. Best of luck with any treatment your son needs/has.0 -

Thank you. Its a yes, yes and no so we should be fine on that front. I'll call tomorrow and keep fingers crossed. Thanks for all your help.0

-

Gjw01 said:We both have the same policy (decreasing life with critical care i think) under our individual names.

I found the bottom line relevant from the policy booklet. The potentially ambiguous part is "Only one claim per relevant child". Does that mean the policy holder can only make one claim per relevant child or that only one claim in total, no matter how many people hold policies. I suspect the latter, and it certainly seems to be the case that many insurers will try to find ways to avoid paying out. If they will only permit one payment per child I would certainly be pressing for full refund of all insurance premiums paid on the second policy.In all cases where there are questions about the extent of cover, only the insurer can provide a definitive answer.

The potentially ambiguous part is "Only one claim per relevant child". Does that mean the policy holder can only make one claim per relevant child or that only one claim in total, no matter how many people hold policies. I suspect the latter, and it certainly seems to be the case that many insurers will try to find ways to avoid paying out. If they will only permit one payment per child I would certainly be pressing for full refund of all insurance premiums paid on the second policy.In all cases where there are questions about the extent of cover, only the insurer can provide a definitive answer.

0 -

It's "only one claim per relevant child...under this policy". I would read that as prohibiting further claims (under that policy) if a child suffers more than one diagnosis which would trigger the payment, not that there can only be one claim for the child under every policy which might exist.TELLIT01 said:Gjw01 said:We both have the same policy (decreasing life with critical care i think) under our individual names.

I found the bottom line relevant from the policy booklet. The potentially ambiguous part is "Only one claim per relevant child". Does that mean the policy holder can only make one claim per relevant child or that only one claim in total, no matter how many people hold policies.2

The potentially ambiguous part is "Only one claim per relevant child". Does that mean the policy holder can only make one claim per relevant child or that only one claim in total, no matter how many people hold policies.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards