We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Doing anything to protect savings during Brexit?

Comments

-

Companies forward trade their currency exposure. Often up to a year ahead.masonic said:

I'd have thought the effective closing off of the UK's main supply lines just before Christmas would have had an impact on Sterling this morning, but there is nothing discernable.Sailtheworld said:Meanwhile fruit & veg is rotting in Calais. There were already queues (stockpiling) but Boris catastrophising about the new (since September) covid strain as cover for the Christmas U turn has, not surprisingly, led to the closure of borders.

0 -

Bourses are closed this pm. Small print has to be digested.Albermarle said:Despite the various speculation above, the Pound's rise against the Euro following the announcement of a deal , has been surprisingly muted .0 -

Thrugelmir said:

Companies forward trade their currency exposure. Often up to a year ahead.masonic said:

I'd have thought the effective closing off of the UK's main supply lines just before Christmas would have had an impact on Sterling this morning, but there is nothing discernable.Sailtheworld said:Meanwhile fruit & veg is rotting in Calais. There were already queues (stockpiling) but Boris catastrophising about the new (since September) covid strain as cover for the Christmas U turn has, not surprisingly, led to the closure of borders.They would have needed incredible foresight to have predicted the mutant Covid strain, catastophising by Boris as an excuse for further lockdown restrictions, and subsequent closing of borders. But I'm not suggesting that exchange rates move in a predictable manner in response to news, far from it!0 -

Currency positions are constantly hedged once contracts for delivery are signed. Locks in the buying/sellling price and hence the gross margin.masonic said:Thrugelmir said:

Companies forward trade their currency exposure. Often up to a year ahead.masonic said:

I'd have thought the effective closing off of the UK's main supply lines just before Christmas would have had an impact on Sterling this morning, but there is nothing discernable.Sailtheworld said:Meanwhile fruit & veg is rotting in Calais. There were already queues (stockpiling) but Boris catastrophising about the new (since September) covid strain as cover for the Christmas U turn has, not surprisingly, led to the closure of borders.They would have needed incredible foresight to have predicted the mutant Covid strain, catastophising by Boris as an excuse for further lockdown restrictions, and subsequent closing of borders. But I'm not suggesting that exchange rates move in a predictable manner in response to news, far from it!1 -

I'll bleed profusely if make a deep incision into my hand. I can't pretend it wasn't because I cut myself on that occasion just because other cuts and grazes have happened in the past and will happen in the future. The fall of the pound against practically every currency on 24 June 2016 was because of shock of the Brexit result. But attempting to predict what will happen to the pound post 2020 is pointless.

"Real knowledge is to know the extent of one's ignorance" - Confucius0 -

Gets forgotten that the Euro itself was in crisis betweeen 2010-2012.kinger101 said:I'll bleed profusely if make a deep incision into my hand. I can't pretend it wasn't because I cut myself on that occasion just because other cuts and grazes have happened in the past and will happen in the future. The fall of the pound against practically every currency on 24 June 2016 was because of shock of the Brexit result. But attempting to predict what will happen to the pound post 2020 is pointless. 1

1 -

The OP was wondering if there was anything they should do this week to protect their money. The thesis was that if you pick a currency largely unaffected by Brexit (e.g. USD) then the currency movements would be closely correlated with the likelihood of a deal, as ZPZ put it: "hour by hour, day by day, year by year, £ fluctuates on post-Brexit expectations", and as Sailtheworld interjected: "Messy no deal brexit sterling falls. Extension to transition or a deal agreed and sterling rises. It's obvious."

Yet here we are with a deal agreed, and sterling is ever-so-slightly down on the week, and fell from the morning high once the agreement was announced in the afternoon.The reality is that the existence of a deal still leaves many uncertainties (not all of them related to Brexit) and exchange rates could go up or down from here.1

Yet here we are with a deal agreed, and sterling is ever-so-slightly down on the week, and fell from the morning high once the agreement was announced in the afternoon.The reality is that the existence of a deal still leaves many uncertainties (not all of them related to Brexit) and exchange rates could go up or down from here.1 -

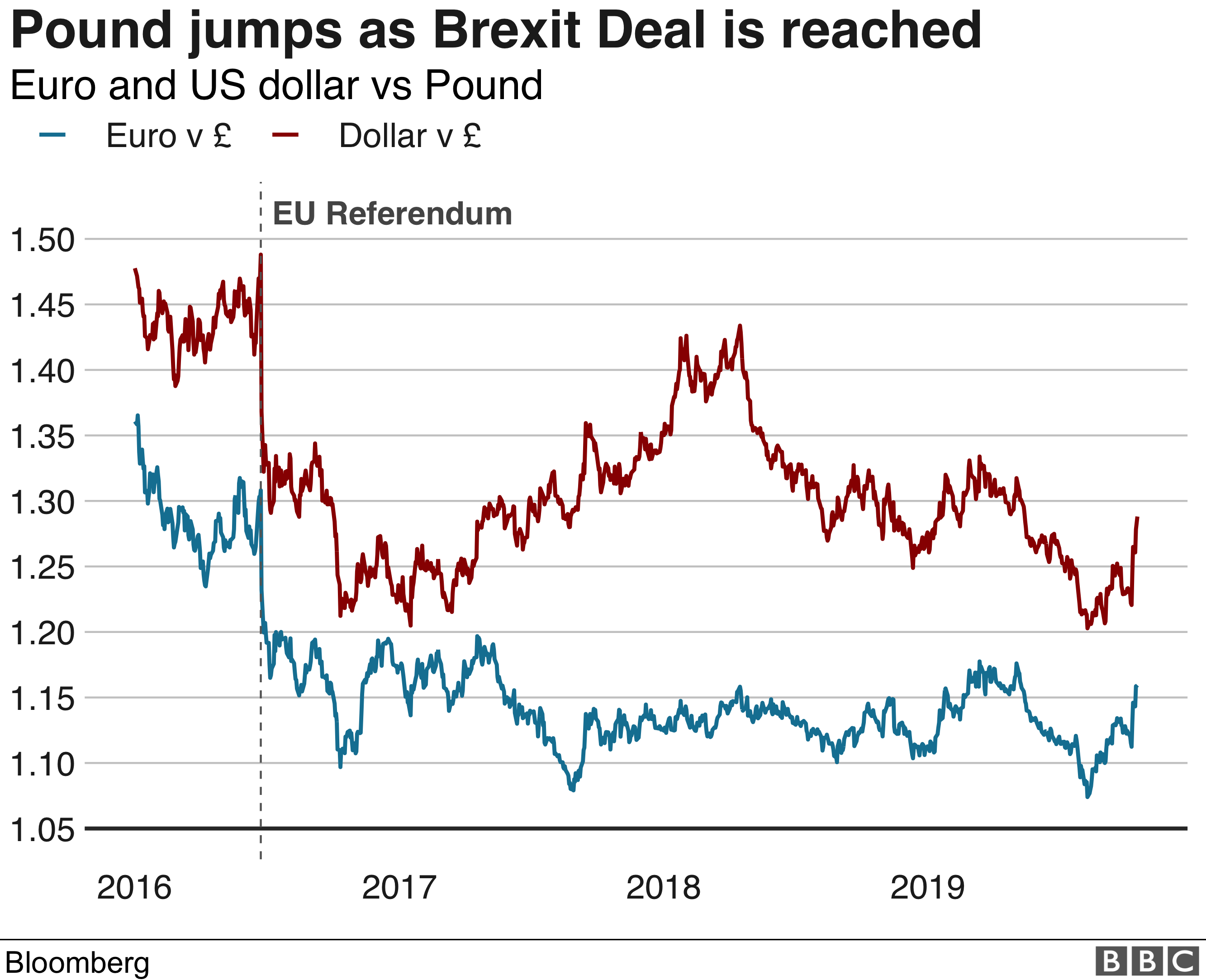

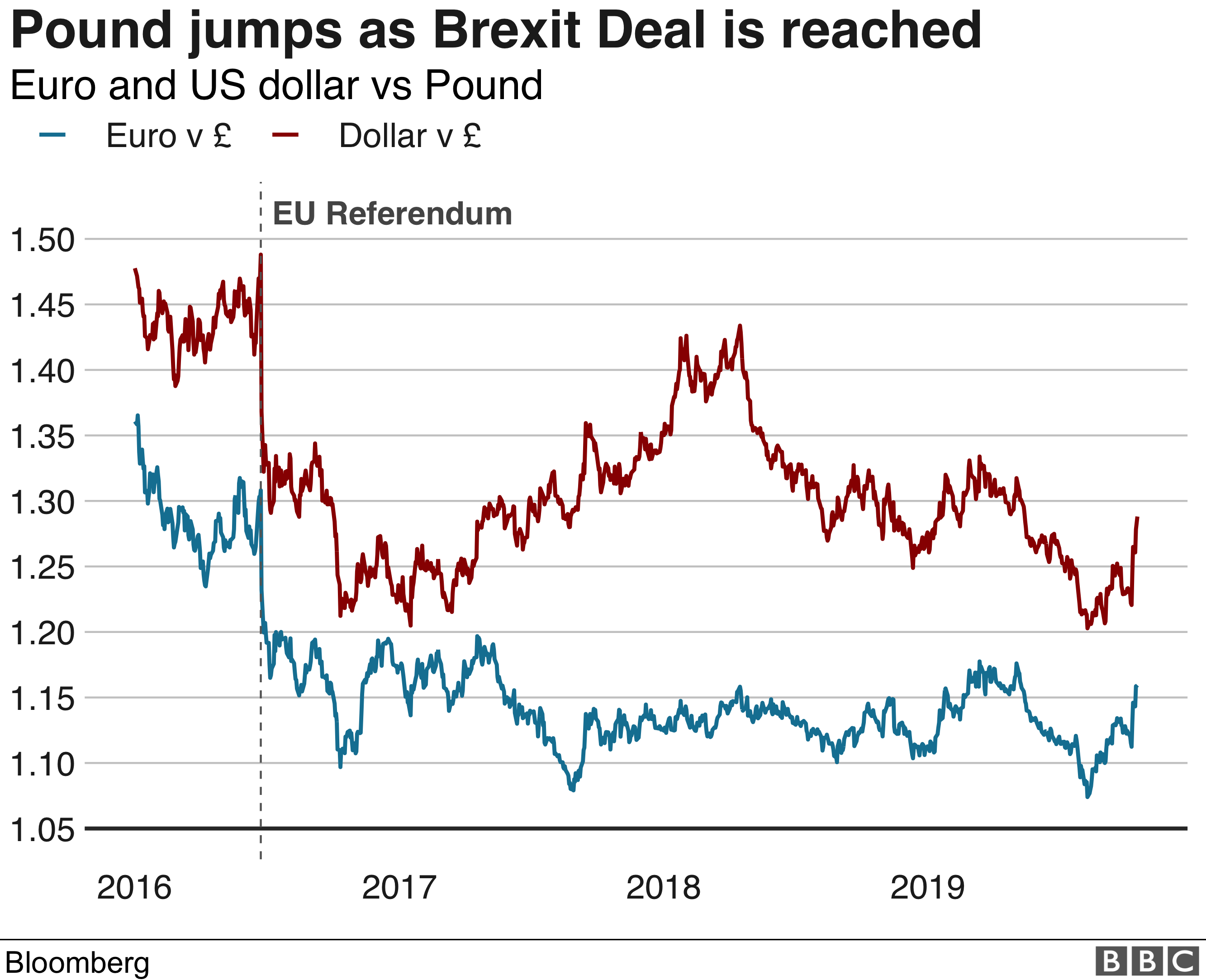

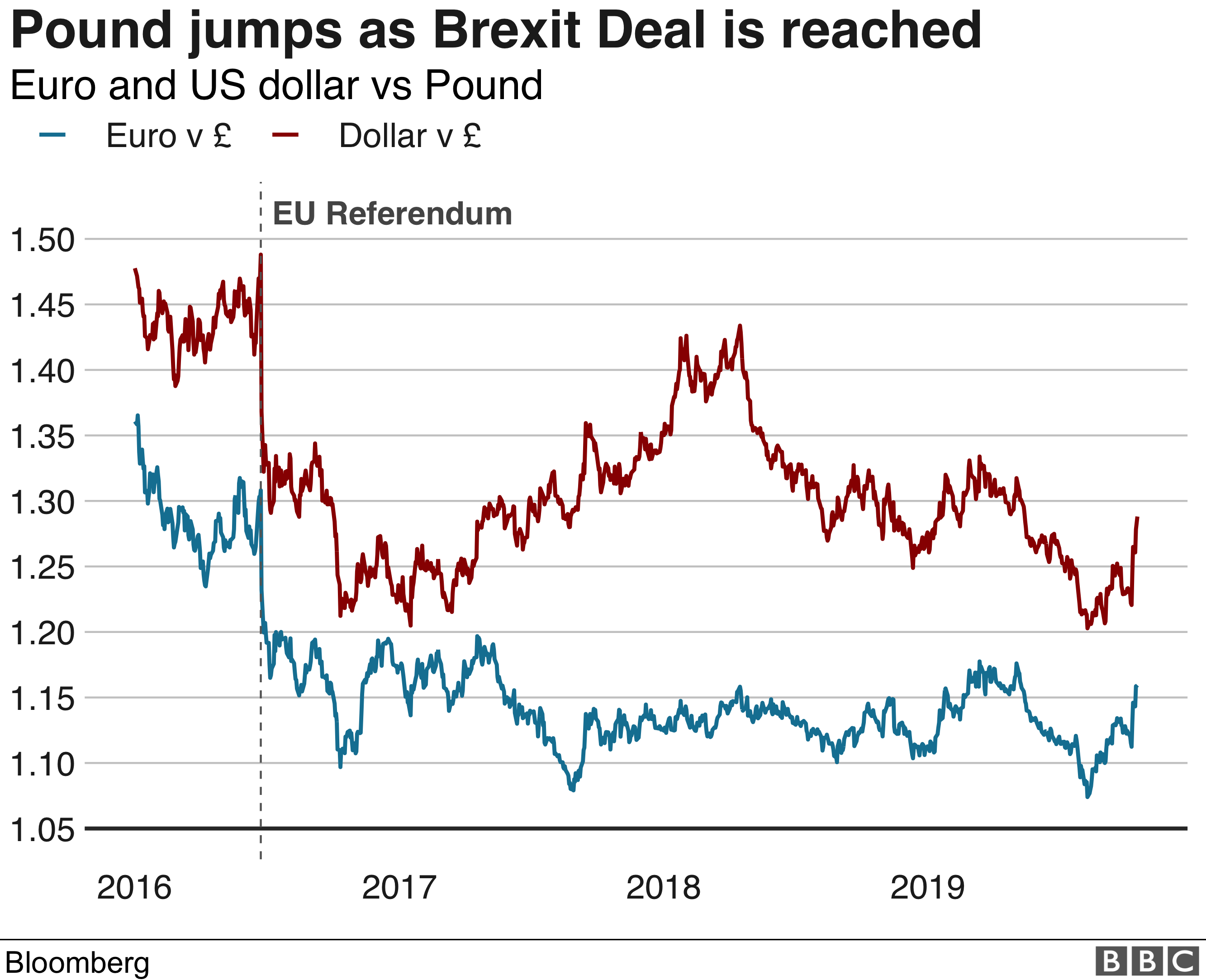

I call fake news if that chart is being used in any attempt to correlate exchange rates with final Brexit deal negotiations, as the title appears to imply! It bears no resemblance to recent rates, as might be expected when it doesn't actually include 2020 - the £/$ rate has been between $1.27 and $1.35 since the summer and the only times it's been below $1.20 all year was during the initial Covid dip in March, and there's no recent spike as apparently suggested by the chart....kinger101 said:I'll bleed profusely if make a deep incision into my hand. I can't pretend it wasn't because I cut myself on that occasion just because other cuts and grazes have happened in the past and will happen in the future. The fall of the pound against practically every currency on 24 June 2016 was because of shock of the Brexit result. But attempting to predict what will happen to the pound post 2020 is pointless. 3

3 -

the best investors are those with hindsight. You cannot predict the market, unless your Warren buffet"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP0 -

When your Berkshire Hathaway you are the market.csgohan4 said:the best investors are those with hindsight. You cannot predict the market, unless your Warren buffet0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards