We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Reclaiming tax on PPI

Locornwall

Posts: 356 Forumite

I have recently found out I can possibly reclaim the tax I paid in a credit card PPI I received last year. How is this calculated? I am a higher rate tax payer (40%) if that makes a difference?

0

Comments

-

If you're a higher rate tax payer, then you likely owe the additional tax on the interest, assuming tax was only applied at 20%.

You can do declare it via an R40 form, I believe, or your end of year tax return.0 -

And remember, you are only taxed on the interest element, not the whole refund0

-

Ok thanks. As I see it I can get the first £500 interest without penalty and then the rest at 40%?0

-

The first £500 is taxed at 0% and then the balance at 40%.

So you can be a higher rate payer and get a refund, it all depends on the exact numbers.

Don't forget that if you are liable to the High Income Child Benefit Charge interest is part of your adjusted net income even if taxed at 0%1 -

Yes I know, I’ve had to pay that back for several years now 😡1

-

In that case there is really nothing for you to "claim back".Locornwall said:Yes I know, I’ve had to pay that back for several years now 😡

You just include the taxable interest (and tax deducted) on your Self Assessment return just like you would any other taxable income and it is taken into account in your Self Assessment calculation.1 -

hi everyone i am looking into claiming my tax on a PPI payout but am totally confused with the figures

and adding them together before tax deducted is very close to the 40% take-up point so i need to be sure I'm doing the right thing i dont want to open a can off worms

with the help off this forum (great work i must say )

i had 4 PPI payouts all together from Canada Square Operations in July 2019 is April 2020 p60 used to claim the tax back ? if that is the case

it was £31054 earnings tax code was 288LX and the total payout of PPI was £5720, tax was deducted totaling £400.95

is this figure correct ? i assumed the basic rate of tax in 2019 was 20% what am i missing here ?

i am now retired and not working from October this year could a claim prove negative for me

thanks in advance for any info or help0 -

PPI refunds are not taxable and do not have any tax deducted from them.

You need to look at the statutory interest paid alongside the PPI refund. That is taxable and does have (20%) tax deducted.

Why do you think you are close to the £50,000 basic rate tax threshold?

What other interest did you receive in the same tax year?1 -

thanks pal appreciate you help

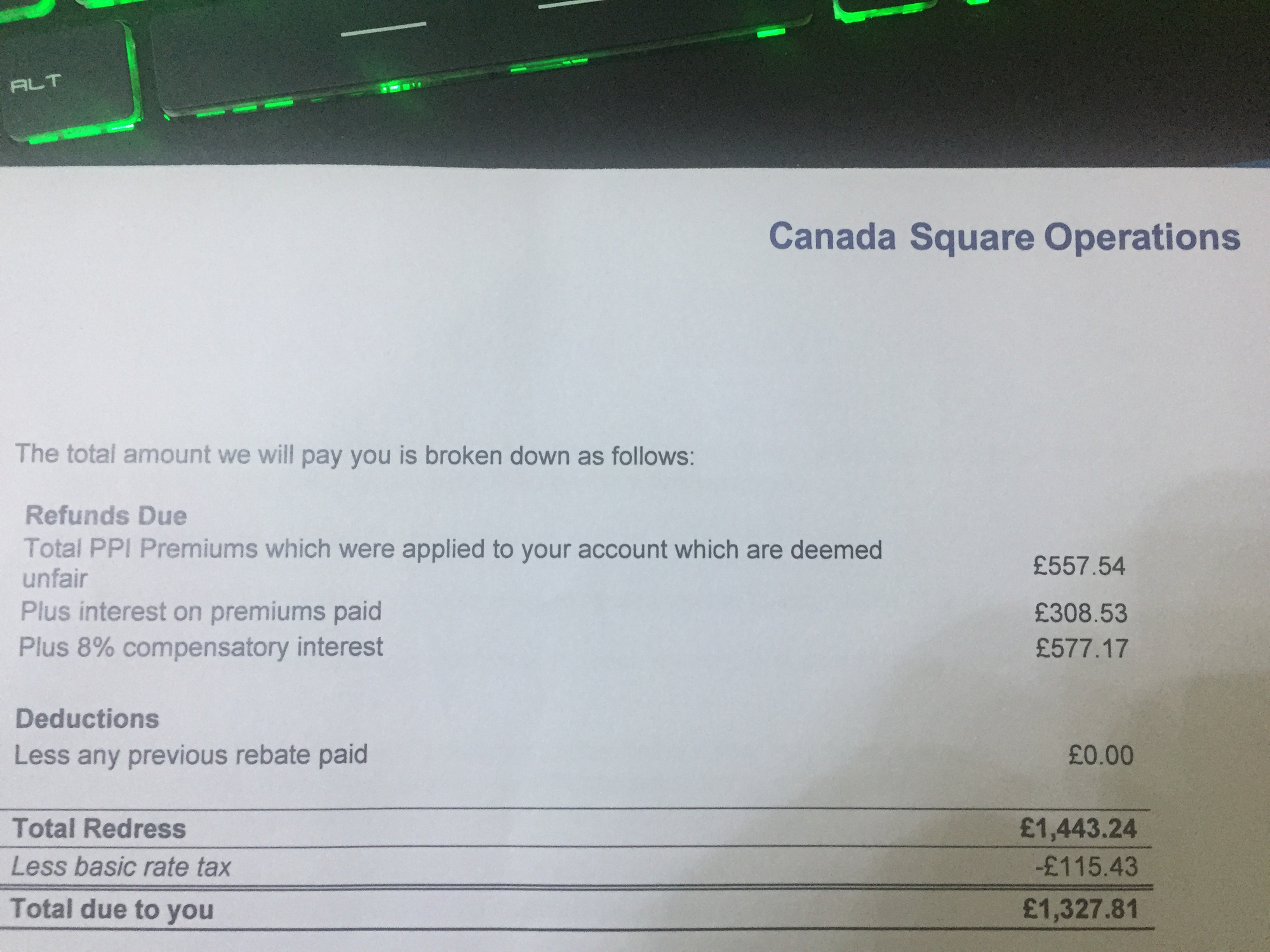

more confused now please see photo of one of the claims paid showing what was paid and deducted i don't know what to calculate or not as you can see from the letter i was deducted tax £115.43

all 4 claims are the same just different amounts

if i am to make a claim on this letter for example, please explain how i do this then i can try and replicate it with the other 3

not sure why i think i,m close to the £50,000 threshold i don't have any other forms off income might have been given wrong info from another forum thats why i am just thinking off claiming

should i assume I'm not near the £50,000 threshold ?0 -

You said your P60 showed £31k so what other income (company benefits?) will take you close to £50k??

That screenshot doesn't show tax was deducted from the PPI refund.

It shows tax of £115.43 which is 20% of the statutory interest of £577.17.

If you tell HMRC about the PPI refund itself (which had no tax deducted) then you will end up with a bill as HMRC will assume you are telling them about it because it is taxable income. Which it isnt.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards