We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Lloyds Shares Keep or Sell?

nownewretiredin2011

Posts: 25 Forumite

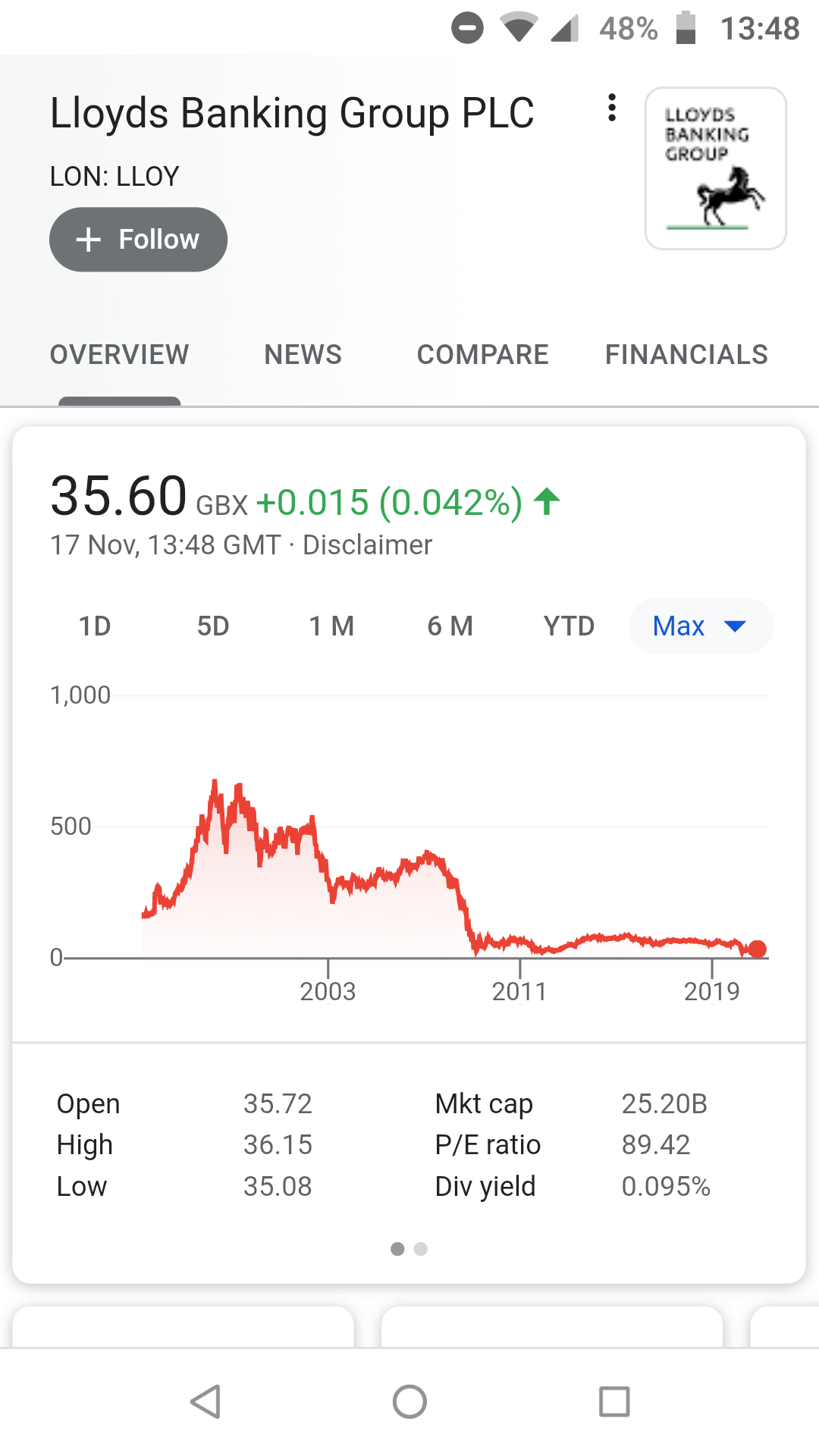

I have 360 Lloyds shares worth what, £125 or whatever I can get for them? that I got from Halifax when I had a mortgage (now paid of thankfully).

Is there any point of hanging on to them now since they are not paying any dividends?

Especially at my age 70's.

Is there any point of hanging on to them now since they are not paying any dividends?

Especially at my age 70's.

0

Comments

-

I feel your pain

I always remind myself of where they were at and, even fairly recently, they were double what they are now.

Different times and all that I guess.

The lack of dividends is irksome too.

is irksome too.

0 -

Probably worth keeping now. Hindsight and past performance are going to annoy you but you have to look past that and focus on prospects for the future. Bank stocks have been beaten down but on the basis there is a return to normalcy after COVID then bank stocks will benefit. Likely bigger upside potential if you can hold on than a more general fund.0

-

I keep my ex-Halifax, now Lloyds shares, 220 of them worth less than £80, as a constant reminder how badly an individual company share can do!Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."1 -

If you had the cash would you buy them now? If not, sell

1 -

It's not worth the hassle keeping £125 of shares.

If you want to invest rather than trade, you should be invested through a diversified fund - not in individual company shares.0 -

My late father ended up with 538 shares. I sold them (as executor) for a net sum of c.£131 a few weeks ago.... so about 28p each gross, 24p net. I would have felt better about it if I had donated them to charity but was glad to tick another financial transaction off 'the list'. Don't ask me about shares in Saga.... the name fits the story.#2 Saving for Christmas 2024 - £1 a day challenge. £325 of £3660

-

I can remember when those were worth over a tenner each!

0

0 -

The last time I ever took any notice of my husband's opinion on matters of finance, well over a decade ago, I paid more than £5 per share for them. Definitely my last ever purchase of single company shares.ranciduk said:I can remember when those were worth over a tenner each!

Now I'm the not-so-independent FA in the family. So far, so good 1

1 -

Probably not worth selling unless you need that cash! There isn’t really anywhere to put cash at the moment, for any decent return, in savings accounts. Lloyds was ticking along pre pandemic at circa 60p. Some members of this board were saying a few years back that that price was deflated by as much as 40p due to PPI claims. Personally I would hang on until at least we see what’s happening with potential vaccines. Just my 2p’s worth!0

-

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards