We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What is the best investment option for Uni Student?

Comments

-

Thanks every one for reply.She will open a LISA account and will try to put the money in (only which she do not need next 5 to 10 years before she buys her house)I was searching the google andhttps://www.hl.co.uk/ (Master portfolios)https://www.vanguardinvestor.co.uk/ (Life Strategy Funds, they have got so many so many options)Any good fund where the money can be invested in growth stocks to get get good return in the next 5 years.Also if she need to invest further £5K in S & ISA , which undervalued stocks from FTSE 100, FTSE 250 or FTSE all share, she need to pick for investment for 5 years.

0 -

Is she intending to open a cash LISA and a stocks and shares ISA?0

-

If you mean a stocks and shares LISA there are only a limited number of providers ( see link in my first post) HL is one but Vanguard do not.mazibee said:Thanks every one for reply.She will open a LISA account and will try to put the money in (only which she do not need next 5 to 10 years before she buys her house)I was searching the google andhttps://www.hl.co.uk/ (Master portfolios)https://www.vanguardinvestor.co.uk/ (Life Strategy Funds, they have got so many so many options)Any good fund where the money can be invested in growth stocks to get get good return in the next 5 years.Also if she need to invest further £5K in S & ISA , which undervalued stocks from FTSE 100, FTSE 250 or FTSE all share, she need to pick for investment for 5 years.

Whether investing via a LISA or a S&S ISA , avoid HL master portfolios - very expensive.which undervalued stocks from FTSE 100, FTSE 250 or FTSE all share, she need to pick for investment for 5 years.

If there were any undervalued shares do you not think the City professionals with their army of researchers might just have spotted them already ?

In any case normally she should avoid individual shares as it is too risky and avoid being concentrated in FTSE/UK .

Also 5 years is a minimum for stock market based investments , preferably at least 7 and ideally > 10 years .

2 -

Thanks for your reply.Albermarle said:

If you mean a stocks and shares LISA there are only a limited number of providers ( see link in my first post) HL is one but Vanguard do not.mazibee said:Thanks every one for reply.She will open a LISA account and will try to put the money in (only which she do not need next 5 to 10 years before she buys her house)I was searching the google andhttps://www.hl.co.uk/ (Master portfolios)https://www.vanguardinvestor.co.uk/ (Life Strategy Funds, they have got so many so many options)Any good fund where the money can be invested in growth stocks to get get good return in the next 5 years.Also if she need to invest further £5K in S & ISA , which undervalued stocks from FTSE 100, FTSE 250 or FTSE all share, she need to pick for investment for 5 years.

Whether investing via a LISA or a S&S ISA , avoid HL master portfolios - very expensive.which undervalued stocks from FTSE 100, FTSE 250 or FTSE all share, she need to pick for investment for 5 years.

If there were any undervalued shares do you not think the City professionals with their army of researchers might just have spotted them already ?

In any case normally she should avoid individual shares as it is too risky and avoid being concentrated in FTSE/UK .

Also 5 years is a minimum for stock market based investments , preferably at least 7 and ideally > 10 years .

So which is the best fund for investing for 7-10 years with the aim of growth in the capital.

0 -

Normally for newer investors , people on this forum point people towards low cost multi asset funds.

These funds are mix of equity ( many different company shares ) for growth, and bonds for stability . The higher the % equity the higher potential long term growth, but the more volatile the fund . Usually each provider of these funds offer a range from say 20% to 80% equity to suit different customers . Probably the best known are Vanguard Life strategy funds but there are others, such as HSBC global strategy and Fidelity multi allocator. They cost between 0.22% and 0.25 % + the cost of the platform ( typically 0.45% to 0.15% )

If you want to go to 100% equity then a global index tracker will do the job best at similar cost .

If you have a LISA with HL , you can buy any of the above mentioned products on their platform , no need to buy their own expensive products , although you still have their platform fee of 0.45%

For a S& S ISA you have a much wider choice of platform . Vanguard have their own platform that only offers Vanguard products with a platform fee of only 0.15% as one example .

Remember of course that whatever you do , growth is not guaranteed but history shows that kept long term investments should give a good average growth above inflation.0 -

Albermarle

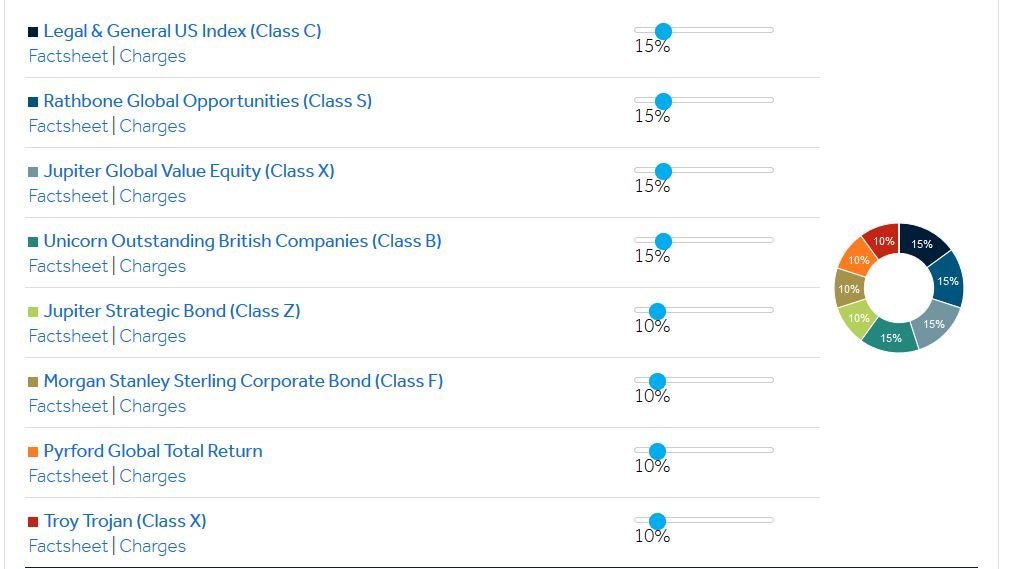

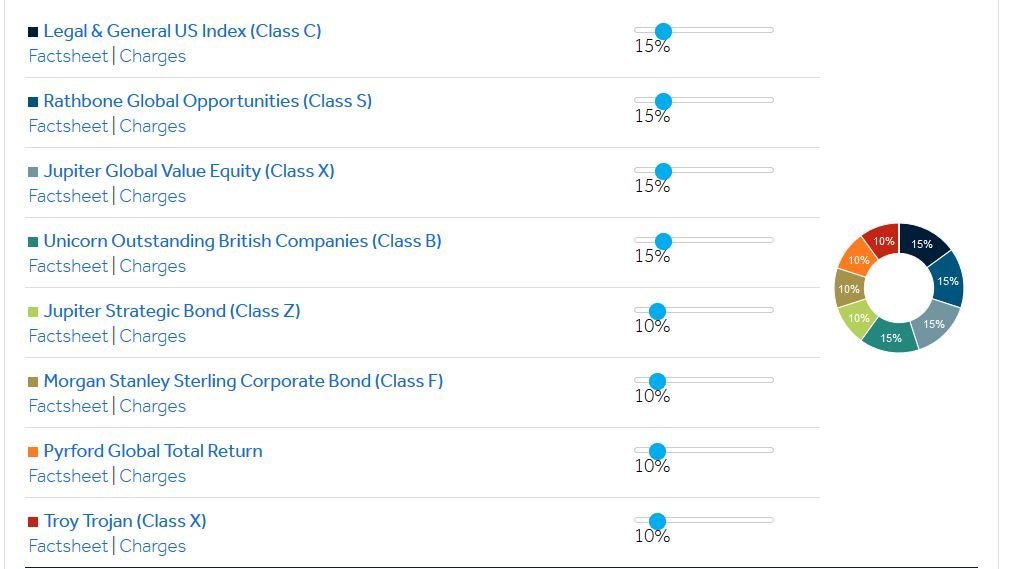

Whether investing via a LISA or a S&S ISA , avoid HL master portfolios - very expensive.You might be thinking here of the HL Multi-Manager funds https://www.hl.co.uk/funds/hl-funds/multi-manager-funds which are indeed very expensive!HL master portfolios are just suggested % splits of other funds, e.g. they suggest things like for a Medium Risk portfoilio:

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0 -

Ok thanks for the clarification. However this master portfolio is probably more suited to larger funds and needs more effort than a multi asset fund .quirkydeptless said:Albermarle

Whether investing via a LISA or a S&S ISA , avoid HL master portfolios - very expensive.You might be thinking here of the HL Multi-Manager funds https://www.hl.co.uk/funds/hl-funds/multi-manager-funds which are indeed very expensive!HL master portfolios are just suggested % splits of other funds, e.g. they suggest things like for a Medium Risk portfoilio: 0

0 -

Albermarle said:Normally for newer investors , people on this forum point people towards low cost multi asset funds.

These funds are mix of equity ( many different company shares ) for growth, and bonds for stability . The higher the % equity the higher potential long term growth, but the more volatile the fund . Usually each provider of these funds offer a range from say 20% to 80% equity to suit different customers . Probably the best known are Vanguard Life strategy funds but there are others, such as HSBC global strategy and Fidelity multi allocator. They cost between 0.22% and 0.25 % + the cost of the platform ( typically 0.45% to 0.15% )

If you want to go to 100% equity then a global index tracker will do the job best at similar cost .

If you have a LISA with HL , you can buy any of the above mentioned products on their platform , no need to buy their own expensive products , although you still have their platform fee of 0.45%

For a S& S ISA you have a much wider choice of platform . Vanguard have their own platform that only offers Vanguard products with a platform fee of only 0.15% as one example .

Remember of course that whatever you do , growth is not guaranteed but history shows that kept long term investments should give a good average growth above inflation.Thanks for your reply.Just for my clarification, as I am new to this world of funds/ISAsDaughter opens LISA accout with £4K , before December 2020, when she will get £1K bonus?I am just assuming that she gets the £1k in Feb 2021, LISA account balance becomes £5K,Can she invest that £5k held in LISA in HL;s Master porfolio? Any extra charges for that?What happens (from tax point of view) if to value of the funds go up or down?Which will happen in the next financial year ie 05 April 2021, she will have to open one more LISA account or she will have to top up £4k more in her previous year LISA account and will get £1k bonus from Government?Are HL Master Porfolios good for putting money in?

0 -

Unless your daughter will be able to the full contribute £4000 per year for the next few years there is not really any rush to deposit in a LISA right now as she can catch up in future years (since withdrawal penalty means (after April) you get back less (6.25%) than paid in if she needs to access).mazibee said:Albermarle said:Normally for newer investors , people on this forum point people towards low cost multi asset funds.

These funds are mix of equity ( many different company shares ) for growth, and bonds for stability . The higher the % equity the higher potential long term growth, but the more volatile the fund . Usually each provider of these funds offer a range from say 20% to 80% equity to suit different customers . Probably the best known are Vanguard Life strategy funds but there are others, such as HSBC global strategy and Fidelity multi allocator. They cost between 0.22% and 0.25 % + the cost of the platform ( typically 0.45% to 0.15% )

If you want to go to 100% equity then a global index tracker will do the job best at similar cost .

If you have a LISA with HL , you can buy any of the above mentioned products on their platform , no need to buy their own expensive products , although you still have their platform fee of 0.45%

For a S& S ISA you have a much wider choice of platform . Vanguard have their own platform that only offers Vanguard products with a platform fee of only 0.15% as one example .

Remember of course that whatever you do , growth is not guaranteed but history shows that kept long term investments should give a good average growth above inflation.Thanks for your reply.Just for my clarification, as I am new to this world of funds/ISAsDaughter opens LISA accout with £4K , before December 2020, when she will get £1K bonus? Depending on exact date between 1-2 monthsI am just assuming that she gets the £1k in Feb 2021, LISA account balance becomes £5K,Can she invest that £5k held in LISA in HL;s Master porfolio? Any extra charges for that? No charges in HL on dealing in funds https://www.hl.co.uk/investment-services/lifetime-isa/chargesWhat happens (from tax point of view) if to value of the funds go up or down? No tax implications as in in an ISAWhich will happen in the next financial year ie 05 April 2021, she will have to open one more LISA account or she will have to top up £4k more in her previous year LISA account and will get £1k bonus from Government? Can use same accountAre HL Master Porfolios good for putting money in? "Good" in what sense?

Edit - agree with previous posters that emergency funds should be the priority. Assuming your daughter is certain she wants to buy a property in the UK the lifetime ISA is the best product, but is there a chance this will not be the case?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards