We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

750k Drawdown at 58

Comments

-

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.0 -

Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.

Yes it is and we get on really well.Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.Just wondering what the ‘experience’ is like. Do you feel they are ‘still on your side’ if you disagree with them? Seems counter productive, but would their behaviour and advice change if you ignore their advice?0 -

It's entirely fine to use a variable spending cash flow. I did it in my own planning then used cfiresim with the reductions to work out my initial Guyton-Klinger safe withdrawal rate tested against the last 125 or so years of historic performance. That's a fair bit fancier than what your IFA is doing but their assumptions are so cautious that you can expect to die rich if you follow them.GSP said:Increased withdrawals earlier would take us faster towards the end of money predictions, but I would see we would need less money later on, and state pensions would take account of most of the household bills and expenditure.

.

In the SWR thread I linked to a study that looked at changing spending for UK retirees. They weren't forced to cut, the extra that they didn't spend went into savings.

Another thing you can do to improve the plan of your IFA is add five to ten years of deferring claiming the state pension for each of you. It's quite likely that you'll die before breaking even but it delivers two highly desirable benefits:

1. it adds effectively guaranteed income at a 5.8% rate that is above most SWRs, and what your IFA is doing, so it increases the overall safe withdrawal rate

2. it's a form of longevity insurance because it'll just keep on paying however long you live.

What this sort of evidence-based approach can do is demonstrate to the IFA and anyone auditing their work that you know more and are more aware of the possible outcome range than a typically assumed client. That matters in part because there's an "agency problem" involved here: the risk to their business if perceived to have acted wrongly can result in lower risk choices than are best for you.0 -

I believe that a retirement planning exercise done badly is worse than not doing one at all as it can potentially give a false sense of security and given that it's quite a complex exercise (quote below), skipping the basics (a rudimentary expenditure analysis) would make me question whether he has a specialism in this area or is more of a general IFA. You definitely should push back - your IFA should (hopefullyGSP said:Reading comments on here and going back to the cashflow retirement planner from my FA.

While anything could happen, I am tending to disagree with his rationale which does not take into account the less withdrawals as we become older.Increased withdrawals earlier would take us faster towards the end of money predictions, but I would see we would need less money later on, and state pensions would take account of most of the household bills and expenditure.

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

. ) want engaged clients as tends to lead to better client outcomes, IMO.

) want engaged clients as tends to lead to better client outcomes, IMO.“The only way you can look at the retirement problem is through probability. You can’t look at it not with probability. Everywhere you turn there are probabilities: of inflation, of market performance, or mortality. It’s true that you don’t know the range of possible outcomes for next year, let alone 40 years from now. But you try to come up with the most credible set of probabilities that you can.”

1 -

Is the advisor treading on thin advice perhaps? Given the regulatory environment in which transfers are now undertaken. While you pot is sizable , are your income expectations achievable. Would this require them advising what would be regarded as an extremely high risk potentially very volatile portfolio. With absolutely no guarantee of a good outcome.GSP said:Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.

Yes it is and we get on really well.Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.Just wondering what the ‘experience’ is like. Do you feel they are ‘still on your side’ if you disagree with them? Seems counter productive, but would their behaviour and advice change if you ignore their advice?0 -

Thrugelmir said:

Is the advisor treading on thin advice perhaps? Given the regulatory environment in which transfers are now undertaken. While you pot is sizable , are your income expectations achievable. Would this require them advising what would be regarded as an extremely high risk potentially very volatile portfolio. With absolutely no guarantee of a good outcome.GSP said:Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.

Yes it is and we get on really well.Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.Just wondering what the ‘experience’ is like. Do you feel they are ‘still on your side’ if you disagree with them? Seems counter productive, but would their behaviour and advice change if you ignore their advice?

Perhaps the expenditure plans have changed dramatically from the exercise undertaken prior to DB transfer and what seemed achievable then no longer is.Thrugelmir said:

Is the advisor treading on thin advice perhaps? Given the regulatory environment in which transfers are now undertaken. While you pot is sizable , are your income expectations achievable. Would this require them advising what would be regarded as an extremely high risk potentially very volatile portfolio. With absolutely no guarantee of a good outcome.GSP said:Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.

Yes it is and we get on really well.Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.Just wondering what the ‘experience’ is like. Do you feel they are ‘still on your side’ if you disagree with them? Seems counter productive, but would their behaviour and advice change if you ignore their advice?0 -

At the start, there was never any suggestion what amount we should be drawing down.jamesd said:

It's entirely fine to use a variable spending cash flow. I did it in my own planning then used cfiresim with the reductions to work out my initial Guyton-Klinger safe withdrawal rate tested against the last 125 or so years of historic performance. That's a fair bit fancier than what your IFA is doing but their assumptions are so cautious that you can expect to die rich if you follow them.GSP said:Increased withdrawals earlier would take us faster towards the end of money predictions, but I would see we would need less money later on, and state pensions would take account of most of the household bills and expenditure.

.

In the SWR thread I linked to a study that looked at changing spending for UK retirees. They weren't forced to cut, the extra that they didn't spend went into savings.

Another thing you can do to improve the plan of your IFA is add five to ten years of deferring claiming the state pension for each of you. It's quite likely that you'll die before breaking even but it delivers two highly desirable benefits:

1. it adds effectively guaranteed income at a 5.8% rate that is above most SWRs, and what your IFA is doing, so it increases the overall safe withdrawal rate

2. it's a form of longevity insurance because it'll just keep on paying however long you live.

What this sort of evidence-based approach can do is demonstrate to the IFA and anyone auditing their work that you know more and are more aware of the possible outcome range than a typically assumed client. That matters in part because there's an "agency problem" involved here: the risk to their business if perceived to have acted wrongly can result in lower risk choices than are best for you.

If we had not withdrawn anything in the last 3 years since we started, I calculate the fund would have grown c13%. Now, it is £60k less than when we started, but we have abused it in truth which is probably given the FA most concern, and not knowing when we will stop, hence his conversations about this. I will pull numbers together when we took amounts out, and the growth of these and if this is coming down year on year.

TBH I look at the fund amount, and where possible have taken amounts out when the figures have recovered somewhat, trying to take the money while it’s there.

I need to create my own realistic planner which I feel may be closer than the FA’s one assumption over time with nothing else built in.

I don’t want to die rich, but at the same time don’t want to run out of money either.1 -

You never know, that might be the big issue for him. He agreed the transfer so probably feels responsible and perhaps at risk himself if we did run out of money. Not sure if this is becoming a ‘big thing’ people crying foul if they run out of money?Thrugelmir said:

Is the advisor treading on thin advice perhaps? Given the regulatory environment in which transfers are now undertaken. While you pot is sizable , are your income expectations achievable. Would this require them advising what would be regarded as an extremely high risk potentially very volatile portfolio. With absolutely no guarantee of a good outcome.GSP said:Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.

Yes it is and we get on really well.Thrugelmir said:

Is this the same FA that gave you the advice to transfer out of the DB scheme?GSP said:

As an aside, has anyone had any disagreements with their FA? Have you ever overruled them? Did this lead to any friction/a change in FA as the ‘relationship’ was broken?

.Just wondering what the ‘experience’ is like. Do you feel they are ‘still on your side’ if you disagree with them? Seems counter productive, but would their behaviour and advice change if you ignore their advice?0 -

We've had an exceptional period of investment returns. Yet history tells us that average actual returns are in reality much lower. The economic and financial realities of the impact of Covid are going to take time to sink in. This is by far the worst crisis in a hundred years. There can only be a rocky road ahead.GSP said:

At the start, there was never any suggestion what amount we should be drawing down.jamesd said:

It's entirely fine to use a variable spending cash flow. I did it in my own planning then used cfiresim with the reductions to work out my initial Guyton-Klinger safe withdrawal rate tested against the last 125 or so years of historic performance. That's a fair bit fancier than what your IFA is doing but their assumptions are so cautious that you can expect to die rich if you follow them.GSP said:Increased withdrawals earlier would take us faster towards the end of money predictions, but I would see we would need less money later on, and state pensions would take account of most of the household bills and expenditure.

.

In the SWR thread I linked to a study that looked at changing spending for UK retirees. They weren't forced to cut, the extra that they didn't spend went into savings.

Another thing you can do to improve the plan of your IFA is add five to ten years of deferring claiming the state pension for each of you. It's quite likely that you'll die before breaking even but it delivers two highly desirable benefits:

1. it adds effectively guaranteed income at a 5.8% rate that is above most SWRs, and what your IFA is doing, so it increases the overall safe withdrawal rate

2. it's a form of longevity insurance because it'll just keep on paying however long you live.

What this sort of evidence-based approach can do is demonstrate to the IFA and anyone auditing their work that you know more and are more aware of the possible outcome range than a typically assumed client. That matters in part because there's an "agency problem" involved here: the risk to their business if perceived to have acted wrongly can result in lower risk choices than are best for you.

If we had not withdrawn anything in the last 3 years since we started, I calculate the fund would have grown c13%. Now, it is £60k less than when we started, but we have abused it in truth which is probably given the FA most concern, and not knowing when we will stop, hence his conversations about this. I will pull numbers together when we took amounts out, and the growth of these and if this is coming down year on year.

TBH I look at the fund amount, and where possible have taken amounts out when the figures have recovered somewhat, trying to take the money while it’s there.

I need to create my own realistic planner which I feel may be closer than the FA’s one assumption over time with nothing else built in.

I don’t want to die rich, but at the same time don’t want to run out of money either.0 -

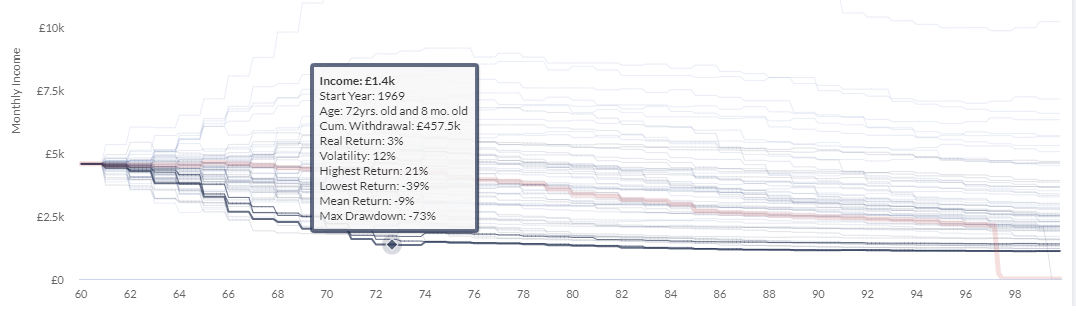

1969 start so that looks like the US worst case sequence that sets the 4% rule safemax there (for others, safemax is the highest income that in all of the sequences doesn't run out of money). Did you really start that one at about 4.8k monthly income with a 500k pot, an initial withdrawal rate of about 57.6k, 11.5%? Or maybe you started with a million?BritishInvestor said:

I take your point on the lower pessimism but I still think the potential drops in real income must be emphasised and could (if we use history as a guide) be worse than your illustration above. For example, historical worse case I see real income decimated if someone had followed that approach in the late 60s and had to live through the 70s inflationary/market slump horror.jamesd said:A fairly severe worked example might be a 40% equity drop in a 65:35 £500k mixture followed by nil investment growth and nil inflation (a simplifying alternative to 2% each). 5.5% initial, upper guard rail 20% higher at 6.6%, lower (prosperity) 20% lower is 4.4%. For comparison 4% rule (UK 30 years before costs) at 3.7% is £18,500 and an age 55 single life RPI annuity with 5 year guarantee quotes 1.624% which on £500,000 is £8,120. This initially looks like:

Year 1 take 5.5%, £27,500 and see equity drop, ending value £370,000.

...

Year 10 planned £14,613 is 6.7% so reduce to £13,151. Final value £206,606. (4% rule final value £212,500).

...

Personally I like the lower initial pessimism of Guyton-Klinger because it tends to favour higher income at younger ages, which is desirable if age-related spending decrease is expected.

As an aside I don't see 5.5% being sustainable which is odd as I'm using Abraham's tool - could be a different dataset he was using back then but just goes to show how sensitive the approach can be.

More than just decimated, that looks like a decimation in all but one of the initial years (using the kill one in ten of a Roman legion punishment meaning). It's the sort of sequence that led Klinger to use 20% in his followup work, if I remember that correctly.

Does that tool include the 20% cut if over the upper guardrail variation? It'd be interesting to observe how their cash flows and minimums differ if you fancy doing that.

I agree that there needs to be understanding of the drop potential. In some of my posts to individuals you'll see me noting the lowest, observing that it goes below target (or DB) and adjusting the constraints to increase it - usually a minimum income constraint in cfiresim for those, which cuts initial income. It's the sort of discussion I'd want to see an IFA having with their client and perhaps covering how that went in their reasons why document.

What success rate are you using with Abraham's tool? To get 5.5% he may have used 95% to skip the UK pre-WW2 worst case yet I don't see that mentioned in his The golden rule: working out a safe withdrawal rate. But it could just be a difference in the data set. But I describe 5.5% as with 90% success rate, which I assume I got from a blog post of his that also ended up at 5.5%. Incidentally, there he wrote "the highest percentage of the initial portfolio, indexed with inflation, which can be withdrawn without running out of money over a 30-year period. More than 100 years of market data for a 60/40 portfolio puts the SWR for the UK at 3.7%" and that's a convenient reference for the UK 3.7% before costs that a normally use.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards