We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Silver (and Gold) ETFs

Comments

-

I would never own physical gold as an investment or the ETF and I have no idea which ETF would be better.Type_45 said:

My question is more about gold ETFs v buying gold sovereigns.bostonerimus said:If EFTs are too complicated then I suggest that you avoid buying commodities like silver and gold for now as they can be very volatile and tricky. Educate yourself before you do anything, there is no hurry. Stick to savings, your pension (which you should make sure you understand) and paying down debt.

If gold ETFs are a good idea, then which is better out of Wisdom Tree and Invesco?“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

Why not a gold etf?bostonerimus said:

I would never own physical gold as an investment or the ETF and I have no idea which ETF would be better.Type_45 said:

My question is more about gold ETFs v buying gold sovereigns.bostonerimus said:If EFTs are too complicated then I suggest that you avoid buying commodities like silver and gold for now as they can be very volatile and tricky. Educate yourself before you do anything, there is no hurry. Stick to savings, your pension (which you should make sure you understand) and paying down debt.

If gold ETFs are a good idea, then which is better out of Wisdom Tree and Invesco?

I don't really like things knocking about the house. I'm a minimalist. Digital assets suit me better.0 -

I think a lot of the appeal of gold (to some) is that in the event of the (expected, imminent) collapse of civilisation (some) holders believe that gold will keep its value, while digital assets, fiat currency and share certificates would be rendered worthless. If this were your rationale for buying gold, then holding it through an ETF would be pointless. However, if you are considering buying gold as a small % of an overall portfolio, in order to increase diversification, and not because you believe an economic apocalypse is at hand, then the ETF would make sense. For myself, I'm not in either category of gold buyers, so similarly to Bostonerimus, I have no idea which of WisdomTree or Invesco is preferable.

1 -

To compare Etfs, look at the market cap, the volume traded each day which usually influences the buy/sell spread, how the ETF is backed ( you want physical, allocated gold or silver, not derivatives), and who the custodian is and do you trust them.Type_45 said:

My question is more about gold ETFs v buying gold sovereigns.bostonerimus said:If EFTs are too complicated then I suggest that you avoid buying commodities like silver and gold for now as they can be very volatile and tricky. Educate yourself before you do anything, there is no hurry. Stick to savings, your pension (which you should make sure you understand) and paying down debt.

If gold ETFs are a good idea, then which is better out of Wisdom Tree and Invesco?

If you can invest in USD, then the Sprott funds are very well respected; PSLV for silver and CEF for gold/silver mix.1 -

I think Invesco/WisdomTree are much of a muchness, though just be careful whether you want it hedged/unhedged against USD. You'll pay a slight premium for hedged obvs.

Recently went for WisdomTree SGBX myself, first time out in Gold. Not expecting huge returns, but a bit of proper diversification at least, and might benefit from a crypto collapse (just thought I'd light the blue touch paper there)0 -

I've heard from a few people (possibly crazies) that the price of gold is suppressed and that they expect it to rise at some point. That's why I'm interested in it.Frequentlyhere said:I think Invesco/WisdomTree are much of a muchness, though just be careful whether you want it hedged/unhedged against USD. You'll pay a slight premium for hedged obvs.

Recently went for WisdomTree SGBX myself, first time out in Gold. Not expecting huge returns, but a bit of proper diversification at least, and might benefit from a crypto collapse (just thought I'd light the blue touch paper there)

I'm in the process of rebalancing and re-evaluating.

My portfolio is currently just over £70k. I'm toying with the idea of having a few grand in a physical gold ETF.

And then perhaps a few bonds. And the equities split between HSBC FTSE all world and either VWRL or VLS for the rest.

0 -

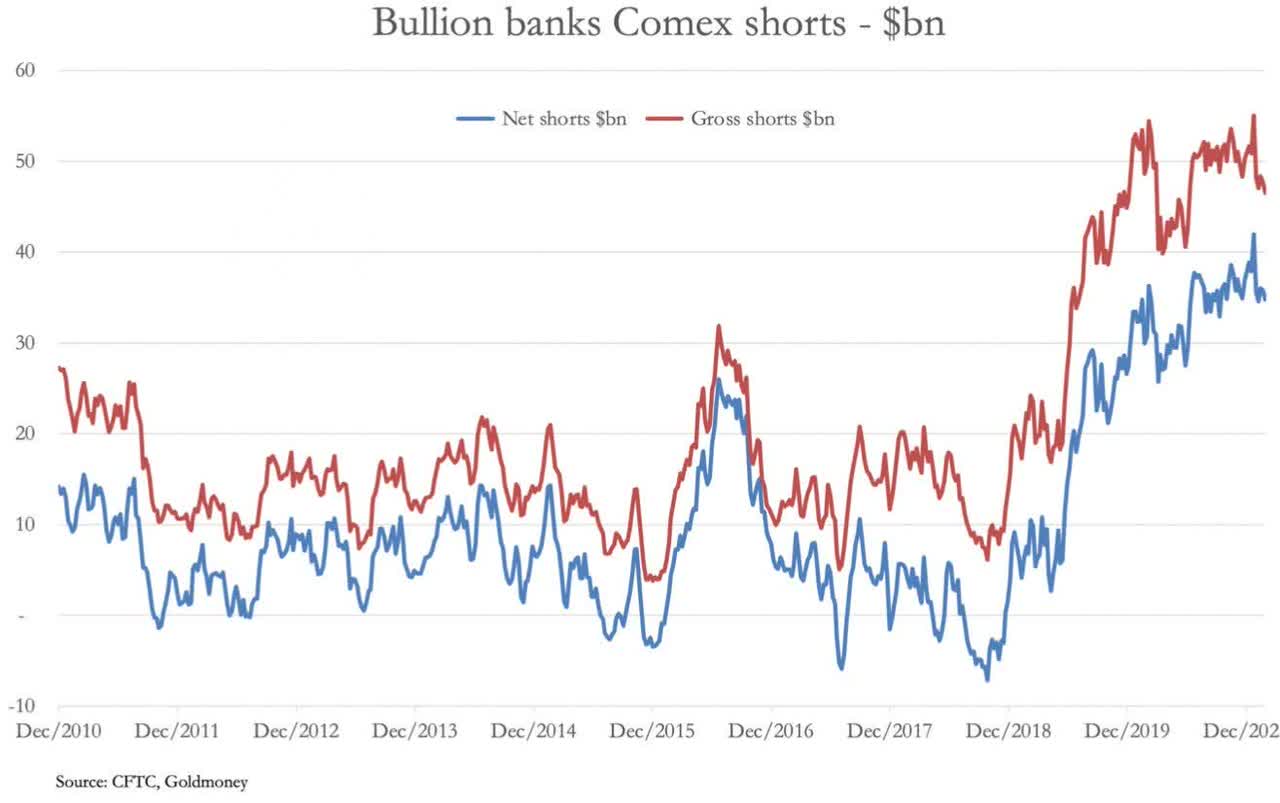

Banks are heavily shorting gold and silver AKA suppressing the price. If that were not so, then the spot price would better reflect what one has to pay to buy physical gold and silver.eskbanker said:

You spelt 'definitely' wrong....Type_45 said:I've heard from a few people (possibly crazies) that the price of gold is suppressed and that they expect it to rise at some point.

1 -

That action is not artificially suppressing the price though. Banks and other market participants, participate in 'price discovery', keeping the market liquid by buying and selling contracts for future gold delivery. If they think the current market price is too high, they sell, expecting to be able to buy back cheaper later. If they think it is suppressed and they expect it to rise soon or at some reasonable point in the future, to a higher 'fair' level, they will buy. The gold price depends on supply and demand, so these 'bets' on the direction of the gold price help to ensure an orderly market and that the prices contributed to the daily auction process reflect market conditions.HansOndabush said:

Banks are heavily shorting gold and silver AKA suppressing the price. If that were not so, then the spot price would better reflect what one has to pay to buy physical gold and silver.eskbanker said:

You spelt 'definitely' wrong....Type_45 said:I've heard from a few people (possibly crazies) that the price of gold is suppressed and that they expect it to rise at some point.

You can't get a coin or physical bar of gold today from a gold dealer for the same mid-price as is quoted on London Metals Exchange today - that's not because of some great conspiracy theory run by the banks, it's because there are separate supply and demand factors for the individual coins that sit on a dealers shelf or safe in different parts of the world. With a gold price of £1345/oz, you might expect to pay north of £1400 to a dealer for a 1 oz bullion coin and maybe £1500+ if you want a specific coin type and year. And if you try to sell a Britannia to a gold dealer, he won't give you £1400 for it, or even £1345 for it, because he needs to pay you less than he can sell it for, to make a profit and stay in business making your local market in physical gold coins.

That's not an indication that the price is suppressed to some artificial low level. You won't have a situation where every investor is long and nobody's short, because opinion and expectation drives supply and demand factors - but if no banks were short, and the price was higher, you would still not be able to buy a physical coin from a physical gold shop for the metals market mid-price, because the gold dealer's selling price would have risen accordingly - he still wants to make a profit margin on top of his purchase price.6 -

Gold is too volatile for me.Type_45 said:

Why not a gold etf?bostonerimus said:

I would never own physical gold as an investment or the ETF and I have no idea which ETF would be better.Type_45 said:

My question is more about gold ETFs v buying gold sovereigns.bostonerimus said:If EFTs are too complicated then I suggest that you avoid buying commodities like silver and gold for now as they can be very volatile and tricky. Educate yourself before you do anything, there is no hurry. Stick to savings, your pension (which you should make sure you understand) and paying down debt.

If gold ETFs are a good idea, then which is better out of Wisdom Tree and Invesco?

I don't really like things knocking about the house. I'm a minimalist. Digital assets suit me better.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards