We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Thank you for that! Probably just need to relax. Just had the fear they’d have an issue with the debt being paid off and the cards being closed.K_S said:

@christopherwg You are overthinking it. Based on the limited info in your post, whether they ask for your bank statements or not is pretty immaterial.christopherwg said:Hi, hoping you can offer some advice. Recently managed to become debt free - apart from my mortgage - and this is now reflecting on my credit score on MSE, Clear Score and Credit Karma. Cancelled the credits cards and just have two now.

my husband and I are keen to move and buy a house and sell the flat which is only under my name. We got a mortgage offer in principal from Nationwide - my current mortgage is with Halifax.

The only thing worrying me is that despite the good credit rating and never having missed a payment or having any negatives on my report and having a strong monthly wage - will they ask for three months bank statements when we properly apply? Will they see all the debt being paid off and baulk? Should we wait until i have three “normal” months of bank statements or am I overthinking it?

thanks

Chris

All the best!

appreciate the reply!0 -

Thanks lovely, I appreciate your help. I thought I'll give an update for other people who haven't had to do two solicitors before.K_S said:

@jemma01 I don't know the answer to your question, as I very rarely come across cases where there are different sols acting for the borrower and lender, and where I have, there's never been an issue for me to get involved in. If I had to pick one, I would guess it's the borrower's solicitor (as they would have done all the ground work to ensure that a clean mortgageable title exists) but that's just a guess.Jemma01 said:I tried to google this answer and I'm confused, some sources say the lender others say the borrower.

We're about to exchange. I called my lender, and they said they're missing the COT (cert of title), and that my solicitor needs to produce one, but I've got one solicitor working for me (borrower) and another working for the lender. From the emails flying around, it sounds like the lender's solicitor is responsible for providing this. Does anyone know for sure how these things work?

I want to exchange, but not prepared to do that until I have a confirmation everything is in good order for funds to be released. Our lender's solicitor said everything is fine and she'll ask for funds to be released, but it was a surprise that the COT hasn't been produced yet (it's only been 5 working days since her confirmation, including today)

In any case, the solicitor acting for you should/will not proceed to exchange until they are sure that the lender will release funds, whatever that might involve.

This is some of the standard CML blurb around the CoT re solicitor's responsibilities towards the lender.

You should not submit your certificate of title unless it is unqualified or we have authorised you in writing to proceed notwithstanding any issues you have raised with us.

We shall treat the submission by you of the certificate of title as confirmation that the borrower has chosen to proceed with our mortgage offer and as a request for us to release the mortgage advance to you.

All the best, hope it gets sorted soon!

For HSBC, if you choose a solicitor who is not on their approved list, they'll appoint their own solicitor to represent them, and you can have another to represent you. You'll need to pay £300 for their appointed solicitor on top of your own. So if you want to save money, you can ask them who they want to use, but having your own solicitor protects your interests rather than theirs alone.

Either way, the Cert of Title was the duty of the lender's solicitor to produce to the lender, so once they've done that and uploaded the cert, after that they usually do some registry check for the final approval. They wouldn't tell me how long it would take, they said it is unlikely to cause problems at this stage, and my solicitor said the same thing, so I exchanged yesterday 🥰, really pleased.

Could the bank find an issue and refuse to release funds? What I learnt is (and I'm not even remotely an expert) that yes there is a small possibility, but I couldn't hold back. One of the folks in the chain was vacating and wanted assurance we wouldn't mess him around after he moved out, so I needed to get on with it.I'm FTB, not an expert, all my comments are from personal experience and not a professional advice.Mortgage debt start date = 11/2024 = 175k (5.19% interest rate, 20 year term)- Q4/2024 = 139.3k (5.19% -> 4.94%)

- Q1/2025 = 125.3k (4.94% -> 4.69%)

- Q2/2025 = 108.9K(4.69% -> 4.44%)

- Q3/2025 = 92.2k (4.44% -> 4.19%)

- Q4/2025 = 44k (4.19% -> 3.94%)

- Q1/2026 = 41k (3.94%)

0 -

After some advice. Me and my partner are looking to buy a house towards the end of next year he is on a wage of about 40k a year, I am self employed partner in a family farm business so have bo set wage atm. We will have a sizeable deposit by the end of next year which will be around 20% of the value of the cost. My partner has an apartment he plans on renting I will be a first time buyer. What is the best way to look at mortgages either together or are we better applying in just my partners name also looking for how much we would likely get a mortgage for. Will be around 25k deposit available.

Thanks in advance0 -

@SelfemployedbuyerSelfemployedbuyer said:After some advice. Me and my partner are looking to buy a house towards the end of next year he is on a wage of about 40k a year, I am self employed partner in a family farm business so have bo set wage atm. We will have a sizeable deposit by the end of next year which will be around 20% of the value of the cost. My partner has an apartment he plans on renting I will be a first time buyer. What is the best way to look at mortgages either together or are we better applying in just my partners name also looking for how much we would likely get a mortgage for. Will be around 25k deposit available.

Thanks in advanceYou've mentioned that you'll have a 20% deposit, also that the deposit will be 25k. Given those numbers I'm assuming that your house price budget is 125k and you're looking to borrow 100k at 80% LTV.Assuming the above is correct, given the limited info in your post, the simplest mortgage would be one based solely on your partner's PAYE salary income. Unless there is a lot of debt in the background or other complications, a 40k PAYE income should be sufficient for a loan size of 100k.Do note that this does NOT necessarily mean a sole application in your partner's name. The application can still be in both your names, just that your income will be disregarded on it. This is quite common where one partner is a homemaker or has a form of income which doesn't easily meet mortgage requirements.If you want to get a very rough idea of what the maximum is that you might potentially be able to borrow on your partner's income, just play around with a few lender affordability calculators.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi everyone

I really need some clarity from a mortgage adviser regarding this…..

I have a house I’m finishing renovating and planning on holiday letting it. After the kitchen is completed in a few weeks it will be worth £300,000. There is no mortgage on it now.

Another house has come up for sale for £500,000. I believe I can re-mortgage the first house to get a deposit to put down to buy the second house? How does this work though exactly?

if I remortgage 75% of the first house, that would give me £225,000. If I put this down as a deposit to buy the second house I would need a mortgage of £275,000 to get to the £500,000.So basically, I would have two mortgages? One of £225,000 on the first house and £275,000 on the second house? Is that how it basically works? The lender may give me a portfolio mortgage and it would be just one mortgage of £500,000, but in essence that’s how it would work?Thanks

Dill0 -

I’m getting different answers from mortgage brokers re: whether or not child maintenance can be included as part of income / affordability calculations for a mortgage. Do you guys have any experience / insight on this?

Kids are under 5. Maintenance agreement is informal, kids dad transfers me £500 per month, but no court order or CSA. Evidenced by bank statements.

Nationwide, for example, states in their Mortgage Proofs under maintenance, "Please provide your most recent 3 months of bank statements showing a maintenance payment for each month" - which seems to indicate they would include it.

Estate Agent Mortgage Broker seems to think no issues, his system says yes. But at the risk of being ageist(!) he looks fairly young / inexperienced.

Experienced, recommended independent mortgage broker, who I’d normally trust, says absolutely no chance this maintenance would be accounted for in my mortgage application, with any lender, because it’s an informal arrangement.

0 -

@stressedette I can't speak for your specific case but generally speaking - with income from child maintenance payments, it depends on the lender.

Each lender will have slightly different criteria about what they need to consider this as income for a mortgage application, what % they will include and how long it needs to run for to be considered 'sustainable'.

A few will indeed consider informal agreements supported by a track record evidenced by bank statements, most will look for a CSA agreement, court order, a solicitors letter, consent order, etc. and some will only consider court ordered maintenance.

All the best!stressedette said:I’m getting different answers from mortgage brokers re: whether or not child maintenance can be included as part of income / affordability calculations for a mortgage. Do you guys have any experience / insight on this?

Kids are under 5. Maintenance agreement is informal, kids dad transfers me £500 per month, but no court order or CSA. Evidenced by bank statements.

Nationwide, for example, states in their Mortgage Proofs under maintenance, "Please provide your most recent 3 months of bank statements showing a maintenance payment for each month" - which seems to indicate they would include it.

Estate Agent Mortgage Broker seems to think no issues, his system says yes. But at the risk of being ageist(!) he looks fairly young / inexperienced.

Experienced, recommended independent mortgage broker, who I’d normally trust, says absolutely no chance this maintenance would be accounted for in my mortgage application, with any lender, because it’s an informal arrangement.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi there!

I wondered if you know what credit agency Santander use?

I recently had my second mortgage offer from them after the first expired. Due to breaking the chain and paying off a few debts, quite a bit has been in flux in my credit profile and not all agency profiles have updated.

If my purchase takes longer than the next few months (8 months and counting, so possible...) I might apply for a lower rate as before it was 5.34%, now I'm on 5.14%, but they also have a new 5.09% -- if it goes down again, I will apply but just want to make sure the credit profile they are using has up-to-date info (I will ask the credit agency to update it if needed).

Thank you so much for all of your help, you've been lifesavers in here these past 8 months!!Current debt-free wannabe stats:Credit card: £8,524.31 | Loan: £3,224.80 | Student Loan (Plan 1): £5,768.55 | Total: £17,517.66Debt-free target: 21-Mar-2027

Debt-free diary0 -

@annetheman Off of the top of my head - Experian (main) and TransUnion (backup).annetheman said:Hi there!

I wondered if you know what credit agency Santander use?

I recently had my second mortgage offer from them after the first expired. Due to breaking the chain and paying off a few debts, quite a bit has been in flux in my credit profile and not all agency profiles have updated.

If my purchase takes longer than the next few months (8 months and counting, so possible...) I might apply for a lower rate as before it was 5.34%, now I'm on 5.14%, but they also have a new 5.09% -- if it goes down again, I will apply but just want to make sure the credit profile they are using has up-to-date info (I will ask the credit agency to update it if needed).

Thank you so much for all of your help, you've been lifesavers in here these past 8 months!!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

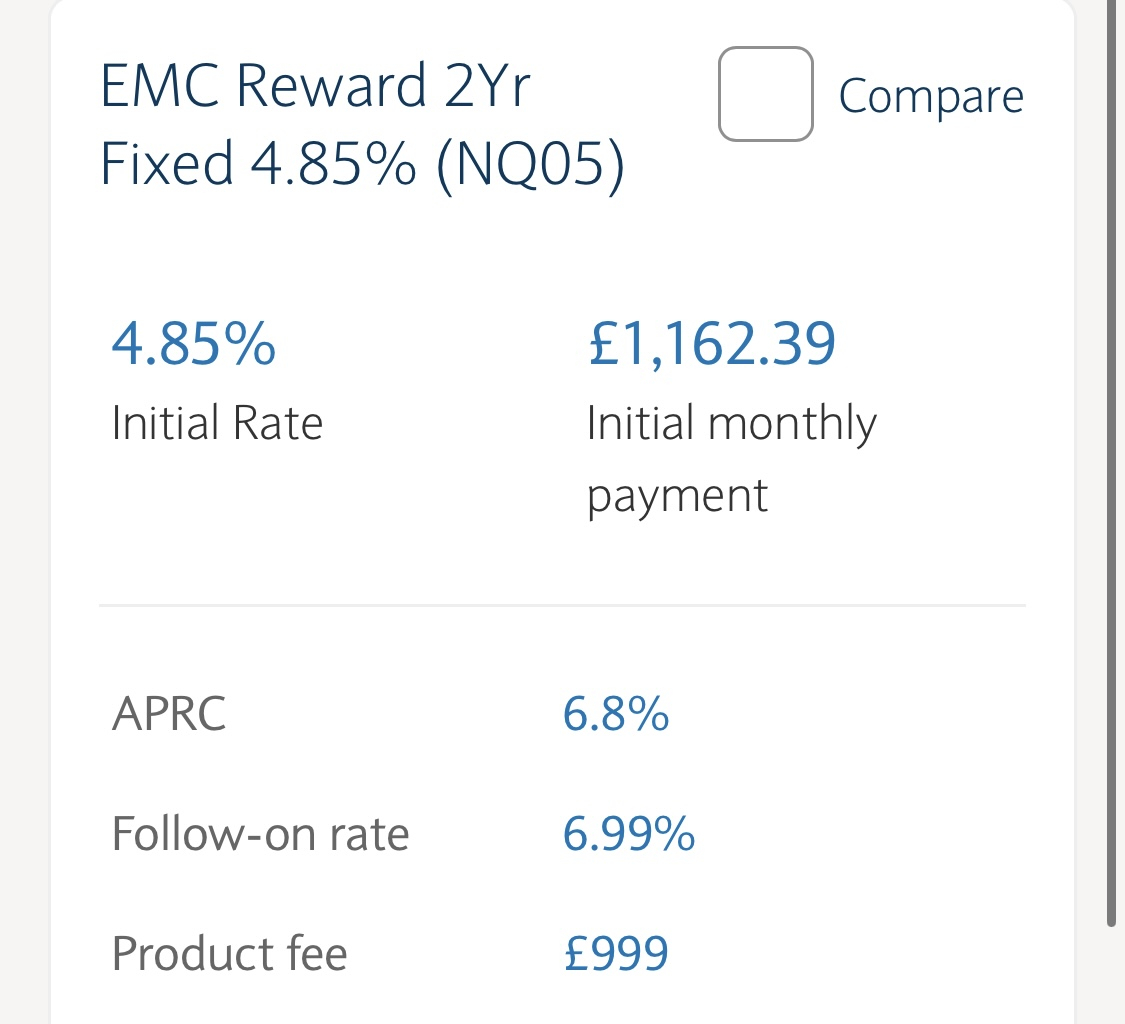

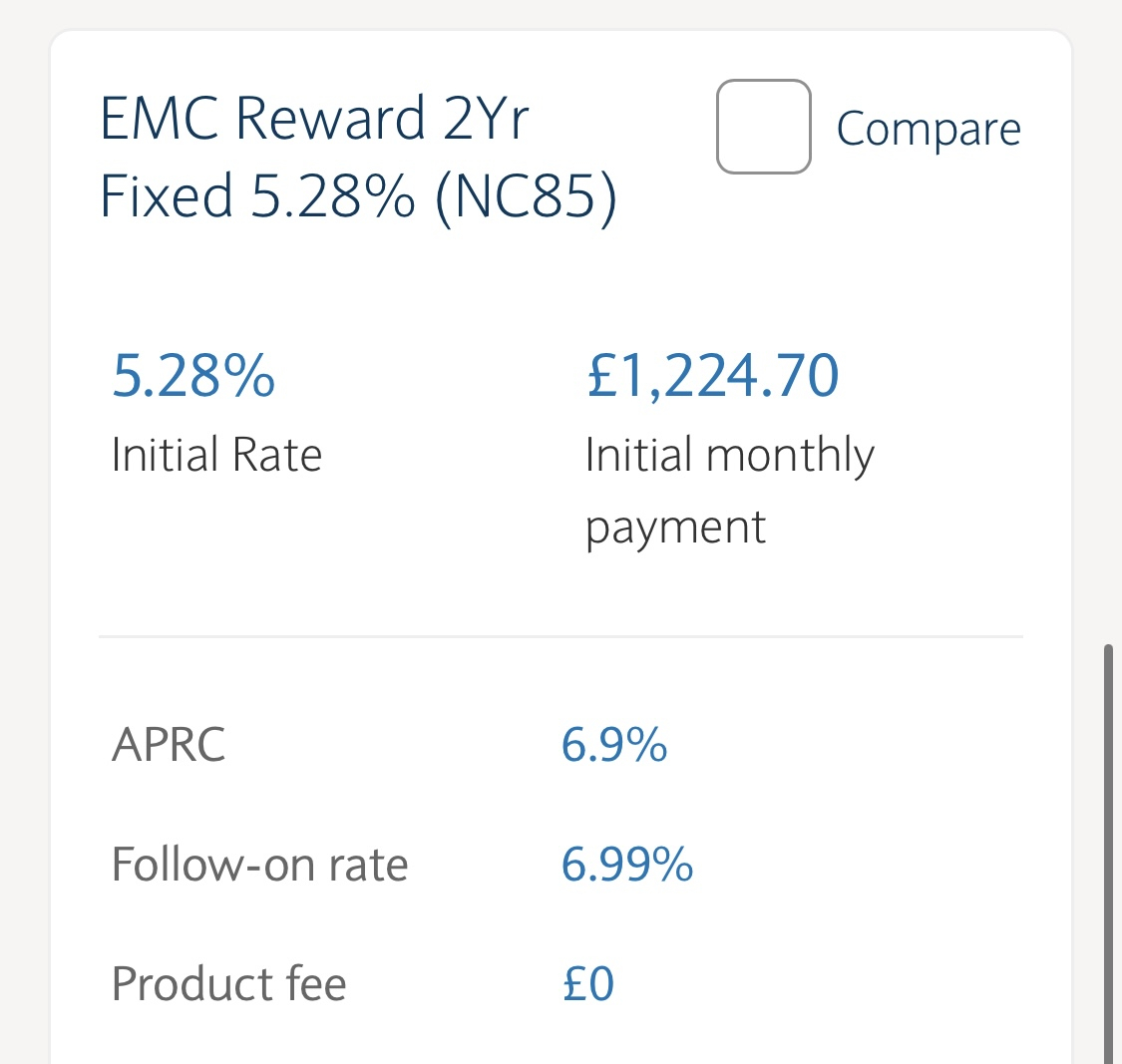

Hello!I wondered if you could help me please. My mortgage is up for renewal and I'm trying to work out if I would be better off paying £999 for the lower rate? I think ( although I'm probably wrong) the no fee rate will cost me £1500 more over the 2 years.I also plan to overpay buy around £200-300 a month.Thank you so much for your help0

Hello!I wondered if you could help me please. My mortgage is up for renewal and I'm trying to work out if I would be better off paying £999 for the lower rate? I think ( although I'm probably wrong) the no fee rate will cost me £1500 more over the 2 years.I also plan to overpay buy around £200-300 a month.Thank you so much for your help0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards