We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@silversix How long is a piece of string? Unfortunately there’s no general answer to that. It depends on the lender, the query, their post-offer service levels at that moment in time, how efficient the conveyancer is, etc etc.SilverSix said:In your experience, how long should it take a lender to respond to an enquiry? (Santander)Lower chain requested comment on a Deed of Variation relating to leasehold over a week ago.This is quite straight forward, an indemnity is usually (and should be in this case) be acceptable and has been offered.

This is Santander’s current published service levels, but related to the pre-offer stage.

https://www.santanderforintermediaries.co.uk/submit-and-track-business/our-service-levels/

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

I'd like help with our situation, with apologies to most of the people using this thread who could only dream of having our problem.

I'm 70 and in good health, my partner is 75 and ok day to day but the long term outlook isn't good for him.

We own our current home outright but have decided we have to leave it as it's unsuitable for various reasons, mainly but not only because of the large garden. We both find the prospect of being in a chain worrying, previous moves we've rented for a period in between and one possibility is to do that again but there isn't a big rental market in this area and we're a bit old for roughing it. Also it means moving twice with all the stress that involves.

Question is, could we get a mortgage to buy another property with the intention of repaying it after 2 years? We can use savings for a decent deposit and would be able to pay the interest out of our pensions. This would also allow us to do any work needed on the new house before we moved in.

Is it worth just approaching a lender or would we need a broker? I don't know how unusual this plan is.

Thanks in advance for any help you can offer.0 -

@kathg_74 If I understand you correctly, you're looking to downsize without a chain and so for a period will own two properties. Not uncommon at all tbh, and there are a few different ways of going about it.kathg_74 said:I'd like help with our situation, with apologies to most of the people using this thread who could only dream of having our problem.

I'm 70 and in good health, my partner is 75 and ok day to day but the long term outlook isn't good for him.

We own our current home outright but have decided we have to leave it as it's unsuitable for various reasons, mainly but not only because of the large garden. We both find the prospect of being in a chain worrying, previous moves we've rented for a period in between and one possibility is to do that again but there isn't a big rental market in this area and we're a bit old for roughing it. Also it means moving twice with all the stress that involves.

Question is, could we get a mortgage to buy another property with the intention of repaying it after 2 years? We can use savings for a decent deposit and would be able to pay the interest out of our pensions. This would also allow us to do any work needed on the new house before we moved in.

Is it worth just approaching a lender or would we need a broker? I don't know how unusual this plan is.

Thanks in advance for any help you can offer.

- assuming your pension income meets affordability requirements (as per the lender) for the loan amount that you need, you could look at getting a normal mortgage and then paying it off whenever you sell the old property. Do keep in mind that mainstream lenders are not in the business of short term lending so if you express an intention to use it merely as a short-term bridging vehicle, they will probably decline your application.

- another option is to use specialist products meant specifically to help break the chain during downsizing. For example this one https://www.furnessbs.co.uk/intermediaries/news-and-articles/anne-short-term-lending-case-study

Direct or broker - entirely up to you. Your plan isn't unusual but due to your ages you will not meet criteria for some lenders.

All the best, hope everything works out!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

That's why I said 2 years, thought that would be the minimum we'd get away with.K_S said:Do keep in mind that mainstream lenders are not in the business of short term lending so if you express an intention to use it merely as a short-term bridging vehicle, they will probably decline your application.

Specialist products look v.expensive and might mean ending up with a stressful deadline after all.

I shall investigate further, just wanted to be assured it was a reasonably common scenario.

Thank you very much.0 -

Hello,

Thank you for helping so many people on the forum! I have a question on my partner and I's current situation:

In 2021 we were discharged from our Debt Relief Orders and since then and we have taken a few payday loans in the past 12 months. We are very stable now, both have worked full time all our lives and have a combined income of around £60k and no other debts or credit commitments at all. We have a 29k deposit for 290k house but are struggling to find a lender who will accept less than a 15-20% deposit at a 7% rate mainly due to the payday loans.

Do you have any recommendations for lenders who will accept a 10% deposit and do a 90% mortgage with our situation?

Thanks in advance0 -

@greenfields123 If you’ve spoken to a good broker (or two), they’ve looked at your credit reports, and they’ve all given you a set of similar options, then that is probably the best you can do at this point in time.GreenFields123 said:Hello,

Thank you for helping so many people on the forum! I have a question on my partner and I's current situation:

In 2021 we were discharged from our Debt Relief Orders and since then and we have taken a few payday loans in the past 12 months. We are very stable now, both have worked full time all our lives and have a combined income of around £60k and no other debts or credit commitments at all. We have a 29k deposit for 290k house but are struggling to find a lender who will accept less than a 15-20% deposit at a 7% rate mainly due to the payday loans.

Do you have any recommendations for lenders who will accept a 10% deposit and do a 90% mortgage with our situation?

Thanks in advance

Hope it works out, all the best.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thanks In advance for any assistance

my wife owns a buy to let property worth 450k, outright and unencumbered. She is 79.

she wants to gift her son 100k.

can she get an equity release on this please?

0 -

Speaking to the broker this week, but do you know Santander policy on extending a mortgage offer? Mortgage offer expires at the end of the month and it looks unlikely that exchange/ completion will happen within that time.I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0

-

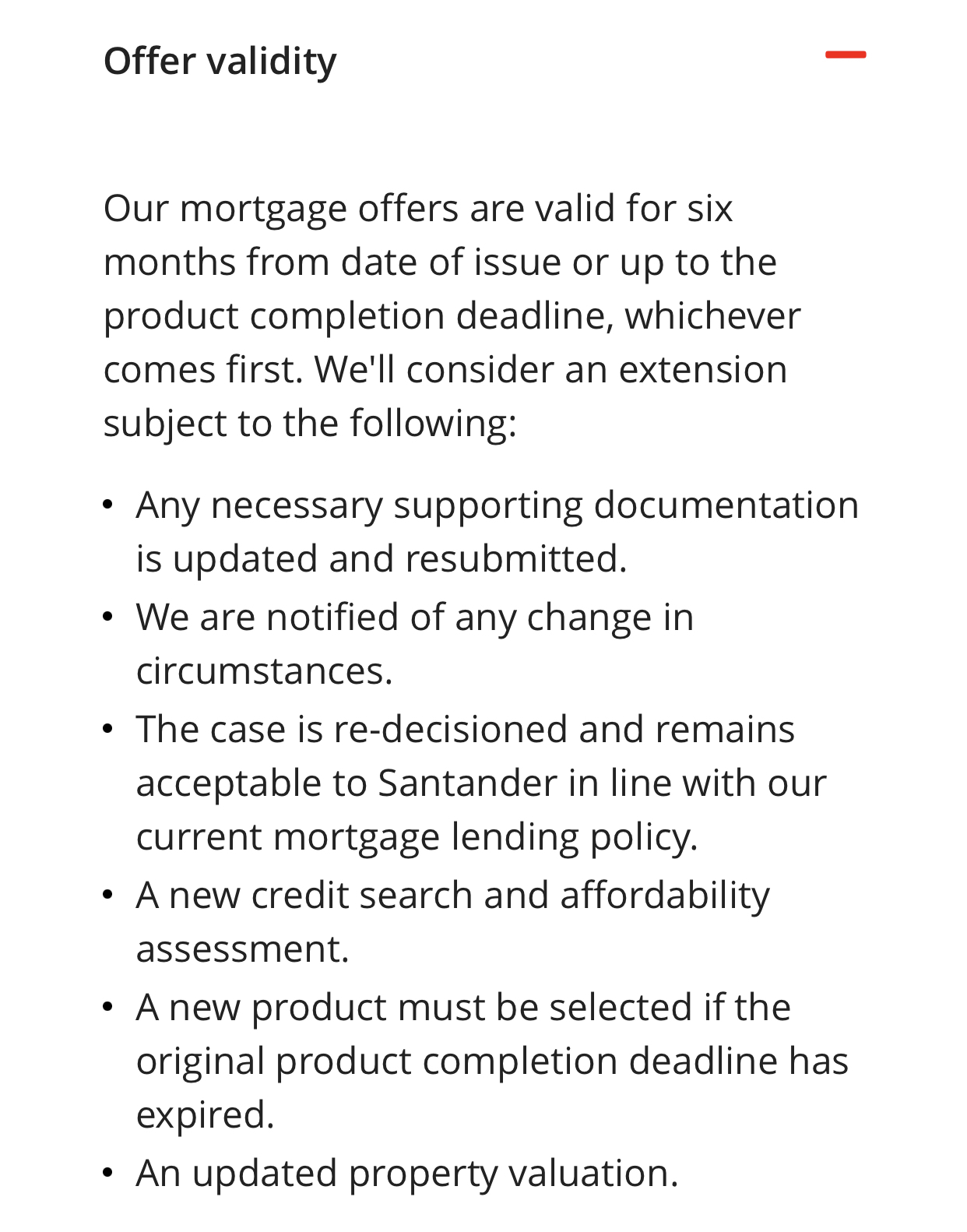

@silvercar This is their policy, you might as well re-consider re-reviewing the whole market if you have a few weeks+ to go.silvercar said:Speaking to the broker this week, but do you know Santander policy on extending a mortgage offer? Mortgage offer expires at the end of the month and it looks unlikely that exchange/ completion will happen within that time.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@motorman99 ‘Equity release’ has a specific meaning with respect to later life lending, but I’m assuming you mean a normal capital-raise remortgage?motorman99 said:Thanks In advance for any assistance

my wife owns a buy to let property worth 450k, outright and unencumbered. She is 79.

she wants to gift her son 100k.

can she get an equity release on this please?

If the property is tenanted (non family) then you could potentially get a capital raise remo even at 79 for the purpose of gifting to family. What options you may have will depend on the details - what personal income (if any) you have, any debt, other commitments, etc.

If you actually meant an ‘Equity release’ mortgage then yes she should definitely be able to get one though that’s a much more complex product and has a lot of implications, DYOR before going down that route.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards