We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Hi! We went through the whole process of submitting an application with Santander at the end of March. It was declined due to them needing an extra document that I was only able to obtain now. Broker said that was apparently all that they needed, and that they were happy with everything else. We are due to apply again in the next couple of days. Our credit history, employment, salaries etc hasn't changed at all.

Have you had any situation like this on the past, where the applicant reapplied with that missing document and got accepted or declined? And would they need to conduct the valuation again or would it still be valid? I'm just worried they change their minds and that, because it is a new application probably with a different underwriter, another issue may arise that the previous one didn't catch on. What's your experience on this?

Also, when they receive the new application, do they know we are reapplying again and the reason why it was declined the first time? Basically can they see that the first time we applied they were happy with everything except that missing document, and would this help speed up the process and them making a decision faster?

Thanks!0 -

@vp0007 It depends on the specifics of the case and the actual reason for the decline.Vp0007 said:Hi! We went through the whole process of submitting an application with Santander at the end of March. It was declined due to them needing an extra document that I was only able to obtain now. Broker said that was apparently all that they needed, and that they were happy with everything else. We are due to apply again in the next couple of days. Our credit history, employment, salaries etc hasn't changed at all.

Have you had any situation like this on the past, where the applicant reapplied with that missing document and got accepted or declined? And would they need to conduct the valuation again or would it still be valid? I'm just worried they change their minds and that, because it is a new application probably with a different underwriter, another issue may arise that the previous one didn't catch on. What's your experience on this?

Also, when they receive the new application, do they know we are reapplying again and the reason why it was declined the first time? Basically can they see that the first time we applied they were happy with everything except that missing document, and would this help speed up the process and them making a decision faster?

Thanks!

Two crude examples -

Scenario 1 - Applicant is a standard perm PAYE employee working at Big Co, applied on his new salary applicable from 15th of the next month. Lender criteria is 'one full payslip' on the new salary to consider it. Applicant can't provide this until two months later as that's when he'll have a full payslip, app is declined.

Scenario 2 - Shareholder of a close ltd. co on a 15% share + 80k PAYE salary from the co applies on a PAYE basis. Until recently was a 50% shareholder Director. Lender threshold for employed/self-employed is 20% share so meets published criteria. However, lender keeps asking for more ad-hoc docs and clarifications from the applicant/accountant related to the business/sustainability/transfer of shares etc. which the applicant/accountant isn't able to provide, the application is declined.

In scenario 1, once the full payslip is provided, that should go through fine as the reason for decline is a black and white policy issue. Based on what your broker has said (just this one document pending), it looks like your situation falls in this category so it should hopefully be fine.

In scenario 2, providing whatever was missing earlier may or may not be enough as there is subjectivity involved. Where underwriters identify a higher than normal probability of something untoward, they can often go down the route of repeated queries and new document requests until the applicant goes away or gives up. As a broker I sometimes do the same when I get cases that might cause me trouble or don't look legit - ask a lot of questions and docs. It's easier than saying that you're not comfortable with the case.

To answer your questions -

- Tbh, I can't think of the last time I had a decline due to a missing doc. If I've done my bit properly prior to recommending a specific lender, that rarely happens. And where a doc isn't available now but will be available in a few weeks/a month, it is usually possible to pause/delay the process to wait

- if the case has been declined then it looks like a fresh app from scratch. I don't know about the val tbh, hopefully they'll be able to do a desktop val that just refreshes the recent one.

- yes, they will be able to see everything from the prev app. Whether that helps or hinders depends on the specifics.

- whether another underwriter looks at it differently will depend on the case, how much subjectivity is involved, what the internal notes say, etc.

All the best, I hope you get to offer soon!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Good evening,

Looking for some advice as I am driving myself mad in the wait for a mortgage approval.

I am a first time buyer, I have gone for a mortgage through the Halifax and can see from my online tracker that everything is green up to the Valuation part, does that mean that everything in my application is fine so far and is likely to be approved subject to valuation?The person who carried out my mortgage application emailed yesterday to say she was just waiting on her valuation team getting back to her then she would be in touch to arrange payment of product fee.Can anyone put a first time buyer & over thinkers mind to rest.0 -

Hi

Hoping to get some guidance if possible please.

We currently have a resi mortgage of around 336k outstanding (79% ltv according to accords online portal calculation), with the 5 year term ending in Aug 2026.

We’re looking to relocate and rent initially, and look to buy if we can all settle in fine. I understand we’ll have to change our mortgage to consent to let initially once we rent.

I wanted to know what the ramifications on mortgage affordability for a residential mortgage would be if we wanted to buy whilst having a consent to let on our first property. Are there lenders who would ignore the background property mortgage repayment by classing it as self sufficient if the rent > mortgage payment, or would it still affect how much they’d be willing to lend us on a second property.

Additionally, I’d like CTL for around three years but my renewal is up in 2. Would accord be open to transferring to another resi product through product transfer in two years with CTL or do they have some policy where you have to change to BTL when current term is up?Thanks0 -

@fkhan95 Generally speaking - at the time of application, assuming that you are renting, and your old house is on a CTL and occupied by paying tenants, you should have lenders that will factor in the rent and mortgage while assessing your affordability.Fkhan95 said:Hi

Hoping to get some guidance if possible please.

We currently have a resi mortgage of around 336k outstanding (79% ltv according to accords online portal calculation), with the 5 year term ending in Aug 2026.

We’re looking to relocate and rent initially, and look to buy if we can all settle in fine. I understand we’ll have to change our mortgage to consent to let initially once we rent. I wanted to know what the ramifications on mortgage affordability for a residential mortgage would be if we wanted to buy whilst having a consent to let on our first property. Are there lenders who would ignore the background property mortgage repayment by classing it as self sufficient if the rent > mortgage payment, or would it still affect how much they’d be willing to lend us on a second property.Thanks

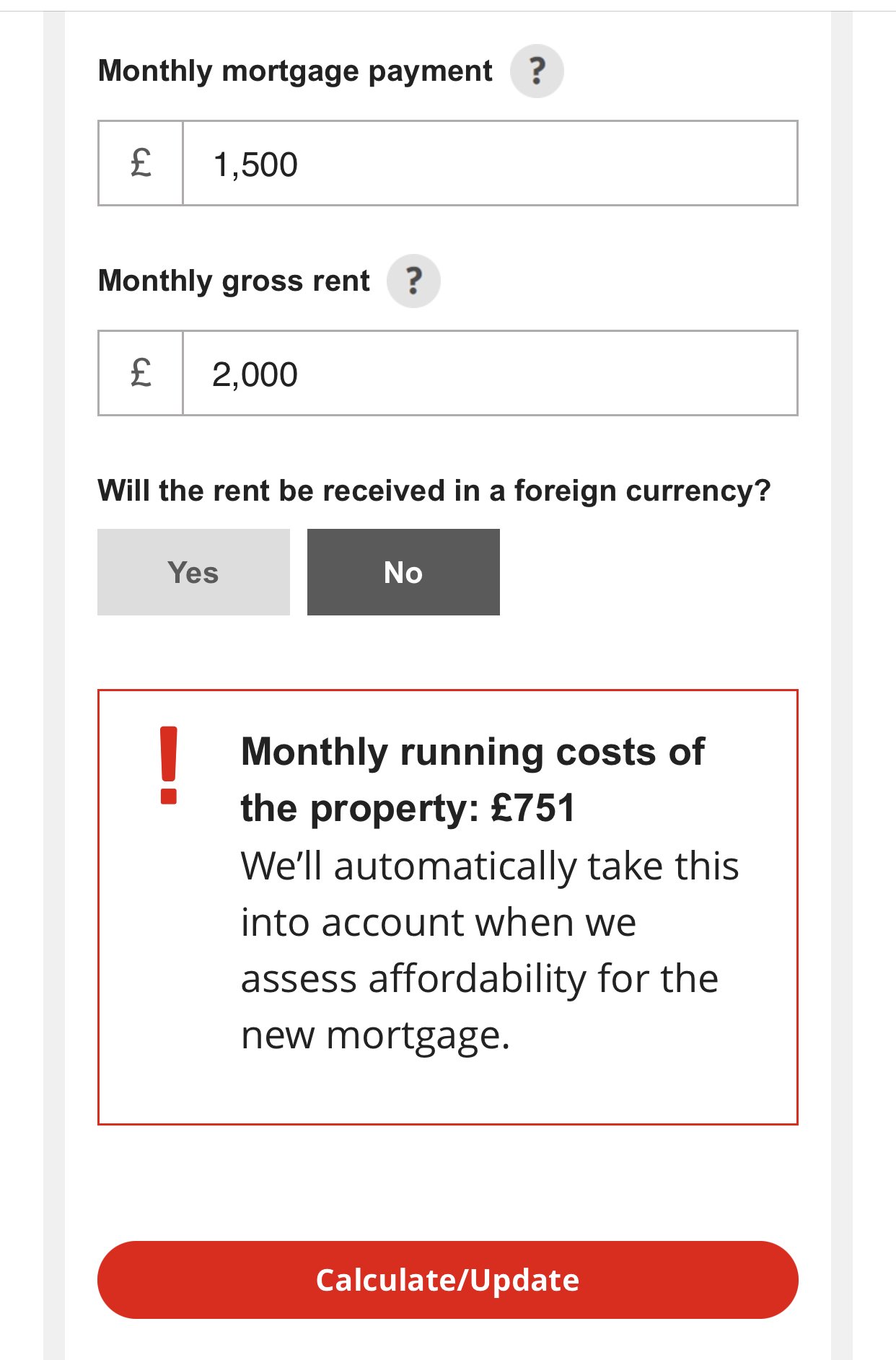

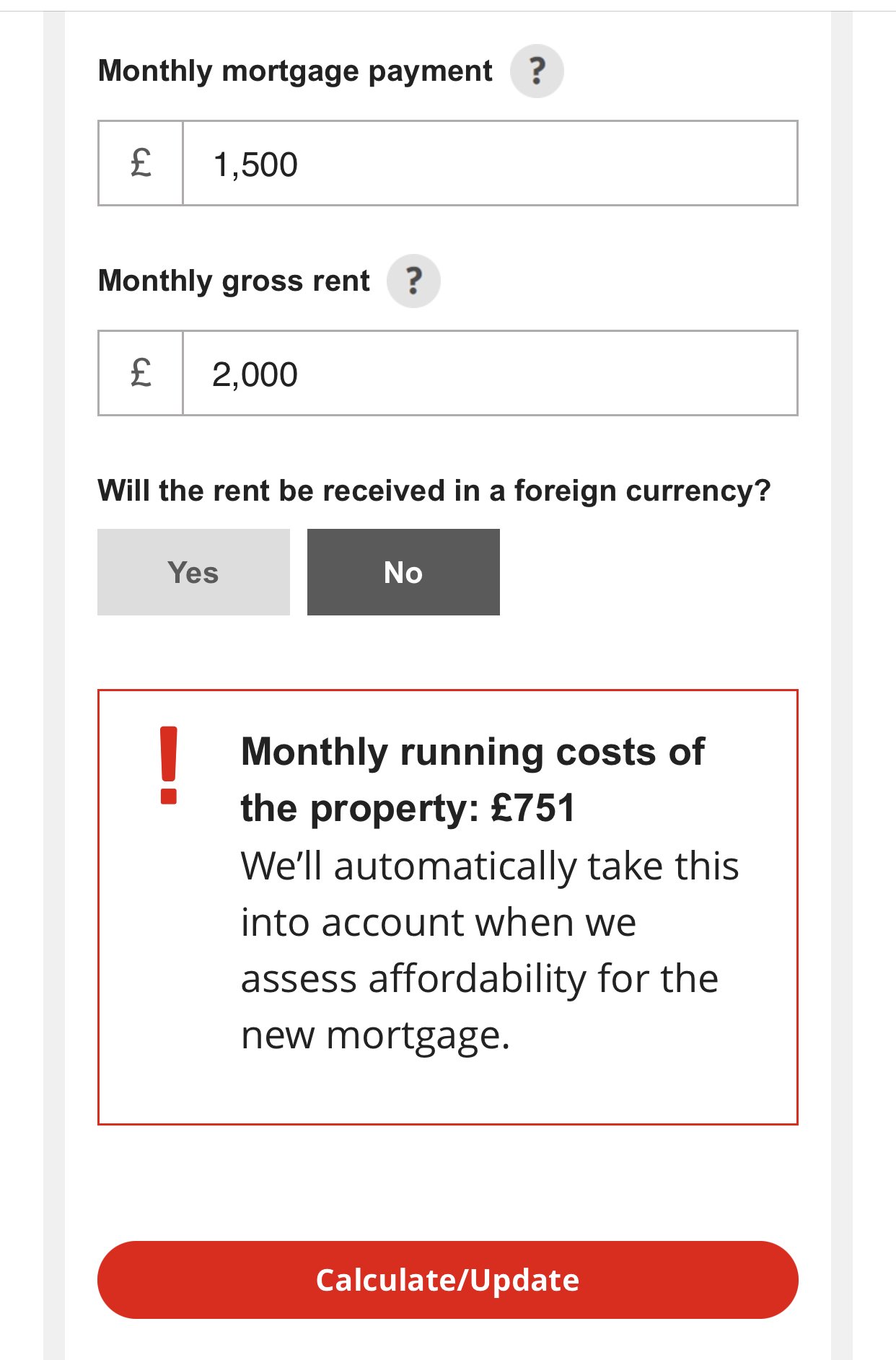

What impact (if any) it has on your onward borrowing will depend on the specific numbers, your income picture and the lender. It’s unlikely to be as straightforward as ‘if rent > mortgage payment then ignore’ as the lender will apply other assumptions and stress tests to the background borrowing as well.For example, here is how Santander might look at a background rental when calculating affordability. Just to be clear, this is just one example, every lender will have a different way of looking at it.

In the below scenario, if the applicants’ income is sufficient (as per the lender affordability calcs) to absorb the additional £751/month outgoing, then it won’t have any impact.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thanks - much appreciated!K_S said:

@fkhan95 Generally speaking - at the time of application, assuming that you are renting, and your old house is on a CTL and occupied by paying tenants, you should have lenders that will factor in the rent and mortgage while assessing your affordability.Fkhan95 said:Hi

Hoping to get some guidance if possible please.

We currently have a resi mortgage of around 336k outstanding (79% ltv according to accords online portal calculation), with the 5 year term ending in Aug 2026.

We’re looking to relocate and rent initially, and look to buy if we can all settle in fine. I understand we’ll have to change our mortgage to consent to let initially once we rent. I wanted to know what the ramifications on mortgage affordability for a residential mortgage would be if we wanted to buy whilst having a consent to let on our first property. Are there lenders who would ignore the background property mortgage repayment by classing it as self sufficient if the rent > mortgage payment, or would it still affect how much they’d be willing to lend us on a second property.Thanks

What impact (if any) it has on your onward borrowing will depend on the specific numbers, your income picture and the lender. It’s unlikely to be as straightforward as ‘if rent > mortgage payment then ignore’ as the lender will apply other assumptions and stress tests to the background borrowing as well.For example, here is how Santander might look at a background rental when calculating affordability. Just to be clear, this is just one example, every lender will have a different way of looking at it.

In the below scenario, if the applicants’ income is sufficient (as per the lender affordability calcs) to absorb the additional £751/month outgoing, then it won’t have any impact. 0

0 -

Thanks! Point 1 is defo for us as I don't want to be left with very little savings.silvercar said:

We’ve been 100% offsetting for years, occasionally dipping into the savings when we need to and then building it back up. 2 big pluses:jen_fpb said:

Thank you!silvercar said:

Say your interest rate is 5% and your mortgage is £200k.jen_fpb said:

@silvercar sorry. I'm still not understanding are you able to explain a bit more with a worked example?silvercar said:

If you are interest only, you have no monthly repayments to make if fully offset. So how low you want the balance to be is effectively the maximum amount you want available to you, if you suddenly needed access to the money.jen_fpb said:Thanks both.

Have been looking at fee free as because we are 100% off setting the interest rate isn't mich of a concern.

Unsure on your last point about how low we want to take the balance and interest only, are you able to explain?

If you have a repayment mortgage then you are repaying the capital each month, so the balance would naturally fall over time.

Assume fully offset.

Interest only. The interest charged would be £833 a month if you were not offsetting at all, but you are offsetting fully so you pay nothing. End of 2 years the mortgage balance is still £200k and you've paid nothing for 2 years. Effectively the money is there waiting for you if you want to take it out and start paying interest on it.

Repayment mortgage. (a) monthly repayments would be £1,169 a month. You are fully offset, so all that money would go to repaying the capital borrowed. At the end of 2 years, you would have repaid 24 x 1,169 = approx 28k. so your outstanding balance would be £172k. (b) (Some lenders may instead allow you to make reduced monthly repayments, based on not paying the interest on the offset balance and so would charge you less per month and the remaining balance owed would then be higher eg reduced repayments of £336 as no interest charged, so the balance reduces to £192k at the end of 2 years). Either way the balance owed on the mortgage drops and your savings in the offset mortgage stay intact.

This makes sense.

If we do interest only do we just choose how much we want to pay each month? Is there any point in 100% offsetting on an interest only mortgage?

1. The value of 100% offsetting is that the money is there to be taken if you need it, so it can be your rainy day money. Whereas you may not want to not have a mortgage and to have no savings.

2. The value in offsetting vs taking a mortgage and having a savings account elsewhere is the interest rate difference eg if you can borrow at near the rate you are getting on savings, especially for a higher rate tax payer, it makes sense, particularly taking together with the above point. There is no interest paid to you on an offset, so you won’t be hit with a tax bill as you would on a savings account. Eg £200k in an offset with a 5% interest rate costs you nothing in interest. Take a plain mortgage at 5% and you would pay interest of £10k a year (simple calculation, I know repayments make this a slightly different number). Savings of £200k in a fixed rate of 5% would pay you £10k, but you would pay tax on 9k of that at your marginal tax rate so would lose £3,600 (higher rate 40% tax) of it leaving you with £6,400.

Not a High Rate Tax Payer.

Just need to see if repayment or interest mortgage is best.0 -

Have you heard anything? They've had my valuation on Friday so I think today is Day 1 of 2 in the underwriting. I just want to know if Ive passed the credit scoring or if they are going to decline me for anything on my credit file.stampystamp said:We’ve applied with NatWest too. Application went in on Tuesday and our broker said we should hear something by end of today or early next week.0 -

Thinkandgrow1 said:

No I haven’t 😢 I emailed my broker yesterday and she said we should have an update on Wednesday. I am nervous about our valuation.

Have you heard anything? They've had my valuation on Friday so I think today is Day 1 of 2 in the underwriting. I just want to know if Ive passed the credit scoring or if they are going to decline me for anything on my credit file.stampystamp said:We’ve applied with NatWest too. Application went in on Tuesday and our broker said we should hear something by end of today or early next week.0 -

Haven't heard anything either. Think my valuation is ok but Im worried I'll fail on credit scoring. Just have to see. Such a nervous process.stampystamp said:Thinkandgrow1 said:

No I haven’t 😢 I emailed my broker yesterday and she said we should have an update on Wednesday. I am nervous about our valuation.

Have you heard anything? They've had my valuation on Friday so I think today is Day 1 of 2 in the underwriting. I just want to know if Ive passed the credit scoring or if they are going to decline me for anything on my credit file.stampystamp said:We’ve applied with NatWest too. Application went in on Tuesday and our broker said we should hear something by end of today or early next week.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards