We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@needmoreinfo101 ‘Who knows?’ is the right answerNeedmoreinfo101 said:Hi,

Looking for some advise.

I am currently on a fixed 1.69% rate until feb 2025 to which im porting to the new property with an additional top up mortgage.

I need advise on whether to fix the top up mortgage for 2 years or 5 years.

The 2 years is an extra £25 a month which isnt the issue i need advice with whether if labour do win the election are rates likely to go alot lower as a simple google search says rates will go up in the long run if labour get in. So am i best fixing for 5 years on top up mortgage to protect the 4.59% rate ive got for 5 years??

Any advise is greatly appreciated.

Thanks I definitely don’t have a useful opinion.

I definitely don’t have a useful opinion.

Looking back, I never expected rates to stay as low as they did for as long as they did. Neither did I expect rates to go up as rapidly as they did in 2022.

I suspect the future factors that will drive rates down/up/nowhere are not known to us today and if you bet one way or the other, it’s pure luck as to whether it turns out positive/negative for you.

Personally, and very generally speaking, if I was choosing between a 2 / 5 year fix, and there wasn’t any chance of moving or coming into a large lump sum within the next 5 years, I’d just fix for 5 years and concentrate on overpaying.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

I’ve just had a mortgage application declined by Leeds Building Society because the property I’m looking to purchase is in a medium risk flood area.Is this a major red flag for most lenders? Am I likely to get the same decision from most lenders?0

-

@foshiznik It's a hard one to answer as it depends on the specific details and valuer comments. I'm assuming this is at valuation as you've mentioned the application being declined. I can only remember having had one such decline previously (if I remember correctly that was medium risk for river flooding and high risk for surface water) but I was able to identify an agreeable lender by looking up recently sold title-registers on the same road and which lenders they went with.Foshiznik said:I’ve just had a mortgage application declined by Leeds Building Society because the property I’m looking to purchase is in a medium risk flood area.Is this a major red flag for most lenders? Am I likely to get the same decision from most lenders?

I can't remember off of the top of my head whether Leeds share the valuation summary or not but if they do, then do make sure that your broker (or you if direct) run it past any new lender before putting in any further applications. That might not necessarily help because in these kind of cases lenders will usually only say "subject to valuer comments" so it's unlikely that they'll give a black and white answer.

Ideally, you want a pre-valuation enquiry like the kind Nationwide offers but most other lenders will only do it informally.

From your side, do speak to the agent/vendor to understand if they've had an difficulties mortgaging/selling the property, how much insurance costs, etc. as that should give you an idea of how serious the issue is.

All the best, hope it works out if you wish to proceed with this property.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Do lenders consider certain benefits when doing affordability checks? I.e. universal credit, child benefit? Specifically Nationwide, on their Helping Hand product?0

-

@theonenonly Nationwide's criteria on benefits income -theonenonly said:Do lenders consider certain benefits when doing affordability checks? I.e. universal credit, child benefit? Specifically Nationwide, on their Helping Hand product?

https://www.nationwide-intermediary.co.uk/lending-criteria/income#benefitIncome

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hi there,

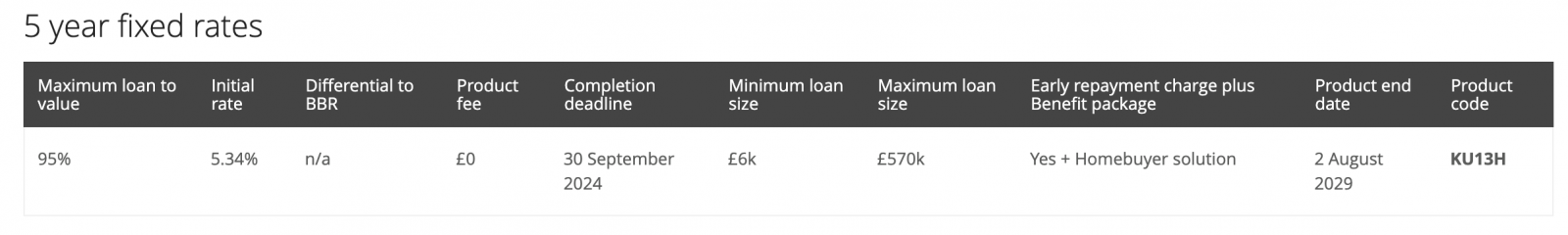

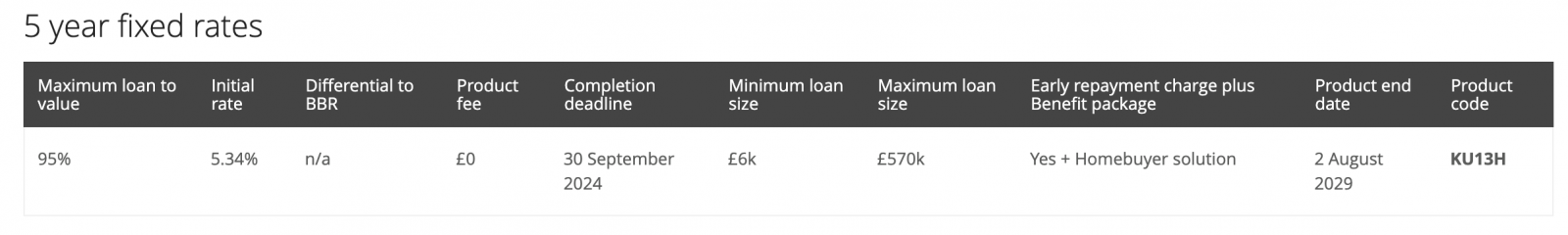

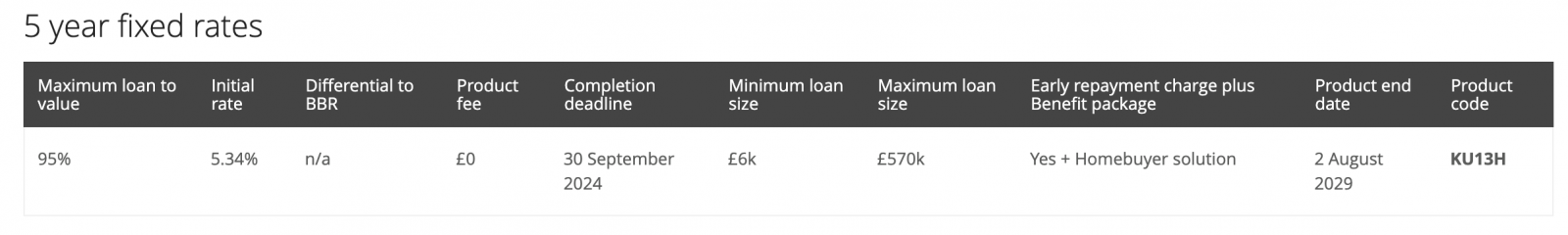

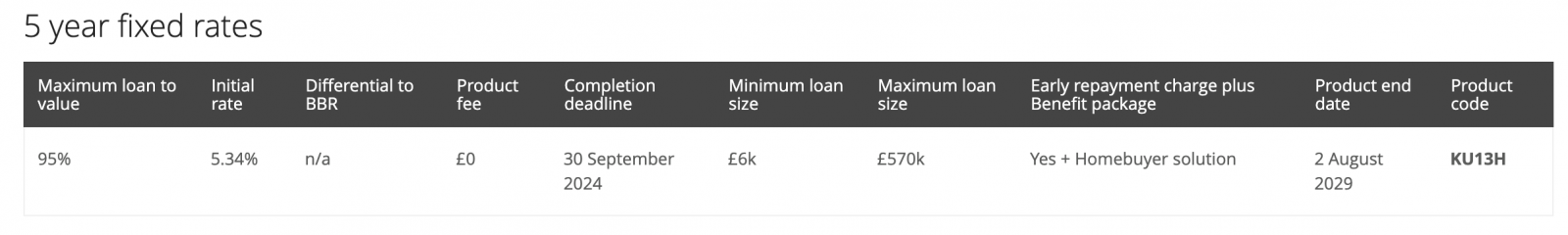

Can any broker explain what 'completion deadline' above means? Does this mean if I haven't completed, I would lose the offer? I am not sure I will complete by that time... I have just had to start the "finding a buyer" process all over again, and I'm selling SharedOwnership leasehold, so it's like to take longer (my neighbour sold from finding her buyer in 5 months so assume end September completion).

Thanks for advice!Current debt-free wannabe stats:Credit card: £8,524.31 | Loan: £3,224.80 | Student Loan (Plan 1): £5,768.55 | Total: £17,517.66Debt-free target: 21-Mar-2027

Debt-free diary0 -

@annetheman Unless things have changed recently, with Santander the mortgage-offer validity is usually six months or up to the product completion deadline, whichever comes first. The 6 month date expiry date should be given in the first box on page 1 of the Santander mortgage offer. Once the earlier of the above dates passes, you'll have to select a new product.annetheman said:Hi there,

Can any broker explain what 'completion deadline' above means? Does this mean if I haven't completed, I would lose the offer? I am not sure I will complete by that time... I have just had to start the "finding a buyer" process all over again, and I'm selling SharedOwnership leasehold, so it's like to take longer (my neighbour sold from finding her buyer in 5 months so assume end September completion).

Thanks for advice!

If you want to protect against rates rising and are worried that there might be unforeseen delays, you might want to consider getting an offer from a lender that allows extensions, like Nationwide, Platform, HSBC, NatWest, etc.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thank you! My options are extremely limited because of the type of house, this is my second lender after the first refused due to valuation report (single skin brick kitchen with high LTV) - they are last-chance saloon for me!K_S said:

@annetheman Unless things have changed recently, with Santander the mortgage-offer validity is usually six months or up to the product completion deadline, whichever comes first. The 6 month date expiry date should be given in the first box on page 1 of the Santander mortgage offer. Once the earlier of the above dates passes, you'll have to select a new product.annetheman said:Hi there,

Can any broker explain what 'completion deadline' above means? Does this mean if I haven't completed, I would lose the offer? I am not sure I will complete by that time... I have just had to start the "finding a buyer" process all over again, and I'm selling SharedOwnership leasehold, so it's like to take longer (my neighbour sold from finding her buyer in 5 months so assume end September completion).

Thanks for advice!

If you want to protect against rates rising and are worried that there might be unforeseen delays, you might want to consider getting an offer from a lender that allows extensions, like Nationwide, Platform, HSBC, NatWest, etc.

I think the 6 months from application is 12th September, could I potentially ask them to give me 2 more weeks from then if needed to use the latter 30th September completion deadline instead (if it comes to that)?

... I will be pushing my buyer to exchange, then - stressful. Thank you!

Current debt-free wannabe stats:Credit card: £8,524.31 | Loan: £3,224.80 | Student Loan (Plan 1): £5,768.55 | Total: £17,517.66Debt-free target: 21-Mar-2027

Debt-free diary0 -

@annetheman I can't comment on your chances of pulling that off, but it isn't something that I would bet on for a client as afaik there's no formal process to request an offer-extension from Santander while keeping the same product. Hopefully you won't need it, all the best!annetheman said:

Thank you! My options are extremely limited because of the type of house, this is my second lender after the first refused due to valuation report (single skin brick kitchen with high LTV) - they are last-chance saloon for me!K_S said:

@annetheman Unless things have changed recently, with Santander the mortgage-offer validity is usually six months or up to the product completion deadline, whichever comes first. The 6 month date expiry date should be given in the first box on page 1 of the Santander mortgage offer. Once the earlier of the above dates passes, you'll have to select a new product.annetheman said:Hi there,

Can any broker explain what 'completion deadline' above means? Does this mean if I haven't completed, I would lose the offer? I am not sure I will complete by that time... I have just had to start the "finding a buyer" process all over again, and I'm selling SharedOwnership leasehold, so it's like to take longer (my neighbour sold from finding her buyer in 5 months so assume end September completion).

Thanks for advice!

If you want to protect against rates rising and are worried that there might be unforeseen delays, you might want to consider getting an offer from a lender that allows extensions, like Nationwide, Platform, HSBC, NatWest, etc.

I think the 6 months from application is 12th September, could I potentially ask them to give me 2 more weeks from then if needed to use the latter 30th September completion deadline instead (if it comes to that)?

... I will be pushing my buyer to exchange, then - stressful. Thank you!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hey! What documents do lenders usually ask for if I am employed by a family business? (no shareholding, just PAYE employee but the business is owned by direct family). Application is with Santander. Thanks0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards