We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Hi, I submitted to HSBC without a broker on 30 May as I knew the rate was being withdrawn the next day and my broker at the time (Habito) was taking too long and wouldn't get the application in on time.

The mortgage has now been flagged as 'manual review' - looking online this means my case is too complicated, but as far as i'm aware my case is pretty straight forward. Is this a bad sign?

I have an excellent (999) credit rating on Experian, no current loans or owed credit (paid off a loan I had with HSBC in October 2022), my LTV is 90% but i have additional savings that I just didn't want to use fully on the deposit. I'm borrowing less than HSBCs max borrow amount for my LTV / wages.

Just concerned that something is going wrong?0 -

@machiavellie I don't know anything about direct apps but generally speaking I wouldn't read too much into an app being subjected to a manual review.machiavellie said:Hi, I submitted to HSBC without a broker on 30 May as I knew the rate was being withdrawn the next day and my broker at the time (Habito) was taking too long and wouldn't get the application in on time.

The mortgage has now been flagged as 'manual review' - looking online this means my case is too complicated, but as far as i'm aware my case is pretty straight forward. Is this a bad sign?

I have an excellent (999) credit rating on Experian, no current loans or owed credit (paid off a loan I had with HSBC in October 2022), my LTV is 90% but i have additional savings that I just didn't want to use fully on the deposit. I'm borrowing less than HSBCs max borrow amount for my LTV / wages.

Just concerned that something is going wrong?

It could be due to any number of benign reasons - their systems weren't able to automatically corroborate some detail on the app to the data that they have access to (not uncommon at all), or a random % of apps are picked up for manual review, or your application profile is a certain type, etc. From a criteria pov, their high LTV threshold is 85% so it could simply be that all apps over 85% LTV are picked up for manual review.

I can't really guess which of the above it might be but I wouldn't worry too much. Good luck, hope you get an offer soon!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@K_S thanks! Hopefully it's just that then!

They told me I should hear something today but havent yet, so hopefully it'll be good news...0 -

Me again! So i've had a RBSG Subsequent credit search hit my equifax today. Should I read to much into this?K_S said:@ch156 Not a silly question at all. With respect to mainstream applications, processing/underwriting/assessment are all interchangeably used so you could say that they all refer to pretty much the same thing.

If there is full manual underwriting (not all applications will go to full underwriting, some will simply involve matching payslips to income on app for example), then that may involve a human being doing a sense check on the case, digging into details (eg: asking about reasons for historic arrears showing on the Equifax credit report, making a subjective assessment as to whether or not there is carry over to the current app), digging into internal databases older than 6 years (for example these may show RBS group related arrears which are long gone from credit reports), assessing the application details to see if they need to dig into anything, etc. I hope that makes sense.

The application and credit check (contrary to what a lot of people assume, both the soft and hard check give them the same level of detail) give them the information required for a Yes/No decision at a tick-box level and if it gets picked up for full underwriting then what is additional is a sense-check and manual review of the same information in conjunction with any packaging (documentation, notes) uploaded.CH156 said:

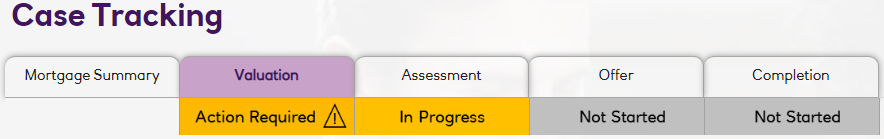

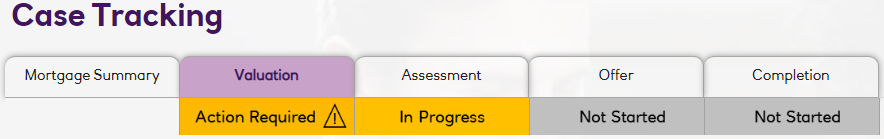

Hi K_S, apologies in advance for the silly question but is the assessment the underwriting? What actually does underwriting include that hasn’t been picked up from the hard check? Also does the hard check check the last 6 years?K_S said:@ch156 It is positive in that it's moving forward. But with most apps NatWest (like most other mainstream lenders) does the val and assessment in parallel, as you can see below for one of my in-progress cases, so in that sense it may not be positive or negative. I hope that makes sense.

Your broker should be able to get a rough idea of whether or not assessment is complete by looking at the case tracker so perhaps just drop them an email.CH156 said:Good morning all, so i had messaged a few days ago my broker put in a new AIP with Natwest followed by full application (our halifax one declined sadly before valuation stage), this was on 1st of June. I've now had a message from the developer to say the valuation has been booked for this Thursday, is this a positive step or just how NW do things differently to Halifax? Many thanks0 -

@ch156 I wouldn't read anything into that.

Even if it meant anything, I wouldn't really know tbh. As a broker I don't have sight of any credit file related alerts or changes for clients.CH156 said:

Me again! So i've had a RBSG Subsequent credit search hit my equifax today. Should I read to much into this?K_S said:@ch156 Not a silly question at all. With respect to mainstream applications, processing/underwriting/assessment are all interchangeably used so you could say that they all refer to pretty much the same thing.

If there is full manual underwriting (not all applications will go to full underwriting, some will simply involve matching payslips to income on app for example), then that may involve a human being doing a sense check on the case, digging into details (eg: asking about reasons for historic arrears showing on the Equifax credit report, making a subjective assessment as to whether or not there is carry over to the current app), digging into internal databases older than 6 years (for example these may show RBS group related arrears which are long gone from credit reports), assessing the application details to see if they need to dig into anything, etc. I hope that makes sense.

The application and credit check (contrary to what a lot of people assume, both the soft and hard check give them the same level of detail) give them the information required for a Yes/No decision at a tick-box level and if it gets picked up for full underwriting then what is additional is a sense-check and manual review of the same information in conjunction with any packaging (documentation, notes) uploaded.CH156 said:

Hi K_S, apologies in advance for the silly question but is the assessment the underwriting? What actually does underwriting include that hasn’t been picked up from the hard check? Also does the hard check check the last 6 years?K_S said:@ch156 It is positive in that it's moving forward. But with most apps NatWest (like most other mainstream lenders) does the val and assessment in parallel, as you can see below for one of my in-progress cases, so in that sense it may not be positive or negative. I hope that makes sense.

Your broker should be able to get a rough idea of whether or not assessment is complete by looking at the case tracker so perhaps just drop them an email.CH156 said:Good morning all, so i had messaged a few days ago my broker put in a new AIP with Natwest followed by full application (our halifax one declined sadly before valuation stage), this was on 1st of June. I've now had a message from the developer to say the valuation has been booked for this Thursday, is this a positive step or just how NW do things differently to Halifax? Many thanks

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Following on from the session with our broker to progress our mortgage port - unfortunately, our existing lender has this evening informed the broker that they will not consider my additional income as part of our mortgage port application. This is extremely disappointing, especially considering our broker had initially assured us that our current lender had no issue with my income structure - which was checked and confirmed as fine with the BDM at the time of inquiry.

However, they are now stating that their policy states due to my additional income coming from a day rate fixed contract position (in addition to my permanent employment), I must have had no longer than a 6-week gap between this type of income/contract, despite being employed full-time since 2020 with zero gaps and having previous contract experience as a company director.Is this normal for Clydesdale? We have an ERC thus, need to port with them sadly.

0 -

@maka344 I'm sorry to hear that.Maka344 said:Following on from the session with our broker to progress our mortgage port - unfortunately, our existing lender has this evening informed the broker that they will not consider my additional income as part of our mortgage port application. This is extremely disappointing, especially considering our broker had initially assured us that our current lender had no issue with my income structure - which was checked and confirmed as fine with the BDM at the time of inquiry.

However, they are now stating that their policy states due to my additional income coming from a day rate fixed contract position (in addition to my permanent employment), I must have had no longer than a 6-week gap between this type of income/contract, despite being employed full-time since 2020 with zero gaps and having previous contract experience as a company director.Is this normal for Clydesdale? We have an ERC thus, need to port with them sadly.

I'm not saying every single mainstream lender would give you the same outcome, but based on the limited info in your post (main income - perm PAYE and secondary income from day-rate contracting) it's to be expected that the secondary income would be scrutinised closely, based on published criteria and a subjective assessment of the overall scenario+numbers by the underwriter.

In this case, the published criteria is "We will accept applications from contractors where there has been a maximum gap of 6 weeks between contracts. If there is more than a 6 week gap, please refer to us prior to application - we may still be able to help." Clydesdale underwriters are actually quite good with exceptions for solid non-PAYE cases, but the threshold for making that exception would be even higher if the contracting income was a secondary stream. I hope that makes sense.

I hope you're able to find a solution to buy the property you need, good luck!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thank you, I have a Vanquis card that I use to fuel the car but pay off in full every month via Direct Debit.kingstreet said:

Imagine a spectrum.Penguin_ said:Would me having no credit card debt, loans, overdrafts or car finance negate 5 old defaults which are being repaid each month? As in would it be possible to look at mainstream lenders or would I still be looking at using a bad credit history mortgage company?

I earn £37k, my other half £34k & we would have about £45,000 deposit.

Bad credit data at one end, good credit data at the other. Half way along is no credit data. A well-managed credit card with Cap One or Vanquis would help to balance the negative far more than your current "no data" position. Make sure it is repaid in full each month by direct debit.

As K_S says, time elapsed and loan to value are the biggest determinants.0 -

Have you ever known HSBC to grant an offer extension or grace period of more than 5 working days?

We are exchanging tomorrow (touch wood), and have had to set our completion date to 2 days prior to our offer expiry date, due to buyers funds being tied-up until then. We'd like another 10 working days to cover us for the full 'notice to complete' period should it be needed, but have been told point blank "HSBC don't extend" by our advisor. Thanks0 -

Thank you kindly for your response.K_S said:

@maka344 I'm sorry to hear that.Maka344 said:Following on from the session with our broker to progress our mortgage port - unfortunately, our existing lender has this evening informed the broker that they will not consider my additional income as part of our mortgage port application. This is extremely disappointing, especially considering our broker had initially assured us that our current lender had no issue with my income structure - which was checked and confirmed as fine with the BDM at the time of inquiry.

However, they are now stating that their policy states due to my additional income coming from a day rate fixed contract position (in addition to my permanent employment), I must have had no longer than a 6-week gap between this type of income/contract, despite being employed full-time since 2020 with zero gaps and having previous contract experience as a company director.Is this normal for Clydesdale? We have an ERC thus, need to port with them sadly.

I'm not saying every single mainstream lender would give you the same outcome, but based on the limited info in your post (main income - perm PAYE and secondary income from day-rate contracting) it's to be expected that the secondary income would be scrutinised closely, based on published criteria and a subjective assessment of the overall scenario+numbers by the underwriter.

In this case, the published criteria is "We will accept applications from contractors where there has been a maximum gap of 6 weeks between contracts. If there is more than a 6 week gap, please refer to us prior to application - we may still be able to help." Clydesdale underwriters are actually quite good with exceptions for solid non-PAYE cases, but the threshold for making that exception would be even higher if the contracting income was a secondary stream. I hope that makes sense.

I hope you're able to find a solution to buy the property you need, good luck!

We have reverted back to a long standing broker we have used previously. He has access to a specialist leading team within CB and he is working with them to see if they can help.

Outline of my working situation is as follows:

- I have been working in the my field for over 12 years.

- There have been no gaps in my employment history in recent times.

- I have prior experience working as a Director of my own LTD company under contract in the same field.

- I started my permanent role in May 2020 and I am currently employed there.

- I began the contract with in March 2023, and it is set to conclude in February 2024 - this is a 12-month day rate contract.

My contract income is around 4 times higher than my perm income and both go via PAYE (with wage slips) as the contract is through an umbrella company inside of IR35.

The lending fits with HSBC/Halifax on my perm income alone however, the sticking point is the ERC of £11k and the higher mortgage payments from completion rather than expiry of our current fixed tariff.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards