We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Thanks for your reply and the link to Martin's article, it's much appreciated. Glad I wasn't overlooking anything important.0

-

Hi

My son has £12k saved in a help to buy ISA and is finally thinking about getting a mortgage.

Unfortunately his credit score is 610 on Experian and 649 on Equifax because of an unpaid credit card debt of £2,500 that was transferred to Intrum in 2018. He has buried his head in the sand with this debt thinking it would just go away and has finally asked my hubby and me for help and advice about getting it sorted.

We have said we will give him the funds to pay off the debt immediately but that he has to pay us back.

When the debt is clear what are the chances of getting a mortgage?0 -

@jdk23 You can safely ignore the actual score number as that isn't something that lenders will look at.JDK23 said:Hi

My son has £12k saved in a help to buy ISA and is finally thinking about getting a mortgage.

Unfortunately his credit score is 610 on Experian and 649 on Equifax because of an unpaid credit card debt of £2,500 that was transferred to Intrum in 2018. He has buried his head in the sand with this debt thinking it would just go away and has finally asked my hubby and me for help and advice about getting it sorted.

We have said we will give him the funds to pay off the debt immediately but that he has to pay us back.

When the debt is clear what are the chances of getting a mortgage?

If the only issue in your credit report is one satisfied (once you pay it off) default for 2500 registered 5 years ago, that on its own shouldn't stop you from getting a mortgage. Based on the limited info in your post, you may need a 10% deposit and should have access to mainstream-ish rates.

Do keep in mind that the default will fall off the report 6 years after it was registered, so do factor that in as well.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

I know form my accountant that she can change the payslip’s details 1 year back so maybe it will be worth asking your account team to change the paysplis to match with the money which was paid into to your account.zainyk said:Hello

i am trying to get a mortgage currently and my broker is very down on the prospect because of the following.My income comes from employment via one family company and income from another family company by dividend. I own 1/6 of the first company and 3/4 or the second.He is fine with my dividend income however there is a discrepancy with my payslips for the other company from which I draw a salary as PAYE. The discrepancy is because the accountants changed my pay due to some additional employees. I never read the payslips and didn’t realise do I have been receiving less in pay than the payslips say. Because it’s a family company I didn’t check and didn’t change the standing order to reflect the change .The accounts etc are in order and prepared my a large accountancy firm.Is there no way that this error could be corrected in a way that a lender would accept.The company can pay a balancing payment etc. I have paid tax on the amount on the payslip. I understand this triggers fraud protocols? But it’s an error.I understand this is my fault but I could use any advice. My brokers suggestion is to not apply wait until I have a track of matching payslips etc. this would be fairly devastating for our plans so I’m trying to see if there is any way out.Thank you

Fingers crossed0 -

Hi I have applied for a mortgage with Nationwide the valuation has come back successful.

Nationwide has just requested an audit trail for my funds. I have a child saver account with Lloyd’s bank and transferred £25k from the saver account to my current account on the 25th Jan. ( it has been back on the savings account since then)I have now uploaded it. Could there be an issue? Or is this normal steps?

appreciate the help0 -

@bellarel

It is normal to check source of deposit, usually by asking to see 3-6 months statements.

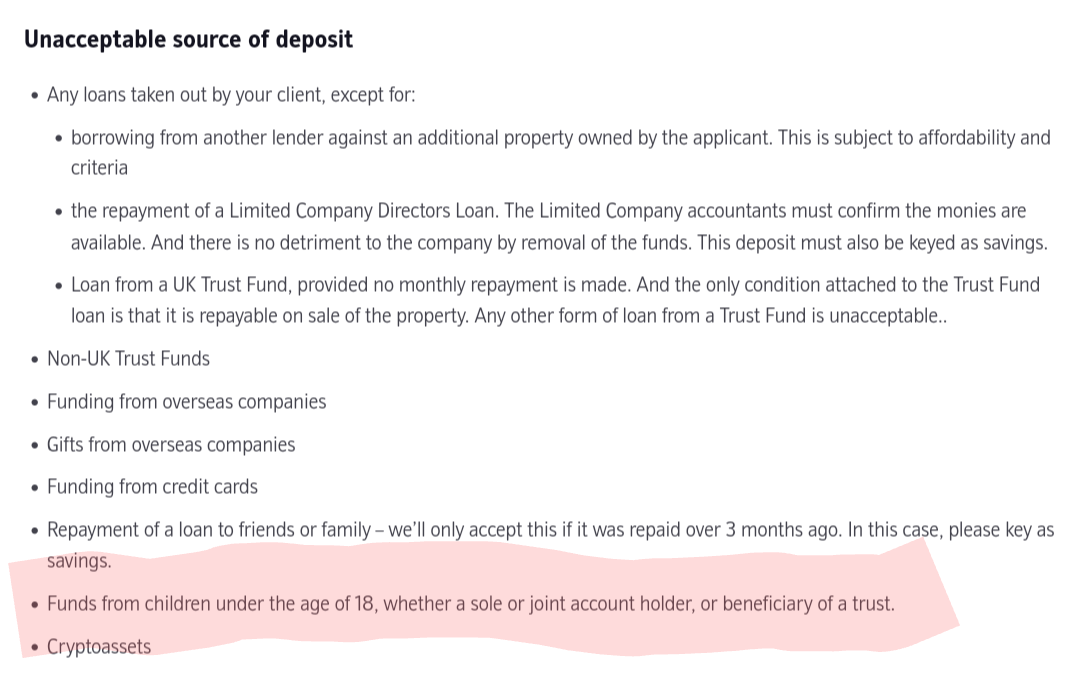

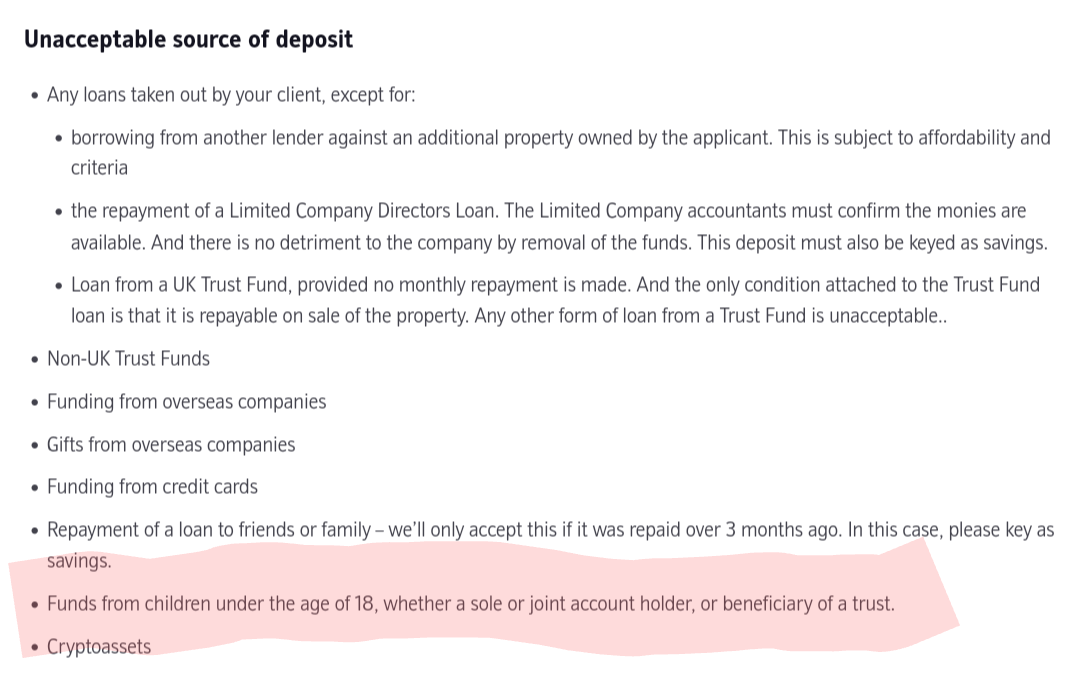

Some lenders don't like deposits coming from accounts in children's names. Not sure about Nationwide's stance. This is what they've published, but unsure as to how they define the highlighted part.

Hopefully it won't be an issue, good luck!

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

K_S said:

Thank you 🙏🏽@bellarel

It is normal to check source of deposit, usually by asking to see 3-6 months statements.

Some lenders don't like deposits coming from accounts in children's names. Not sure about Nationwide's stance. This is what they've published, but unsure as to how they define the highlighted part.

Hopefully it won't be an issue, good luck! 0

0 -

I see a lot of wrecked houses on the market in need of complete renovation. Say £50k or more. Is there any way to mortgage that?

Or how about self builds?

Would need to borrow about 300-350k on a 63k income.0 -

@[Deleted User][Deleted User] said:I see a lot of wrecked houses on the market in need of complete renovation. Say £50k or more. Is there any way to mortgage that?

Or how about self builds?

Would need to borrow about 300-350k on a 63k income.

Wrecked houses requiring complete renovation - you'd have to get something like a bridging loan, make it habitable and then re-mortgage to a BTL or residential mortgage depending on what you intend to do with it.

Self-build - you'll need a self-build mortgage which will usually allow you to buy land and fund the build cost

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thanks. How would you buy it if you have to fix it up first to get a mortgage?K_S said:

@[Deleted User][Deleted User] said:I see a lot of wrecked houses on the market in need of complete renovation. Say £50k or more. Is there any way to mortgage that?

Or how about self builds?

Would need to borrow about 300-350k on a 63k income.

Wrecked houses requiring complete renovation - you'd have to get something like a bridging loan, make it habitable and then re-mortgage to a BTL or residential mortgage depending on what you intend to do with it.

Self-build - you'll need a self-build mortgage which will usually allow you to buy land and fund the build cost

I guess it depends what they consider habitable. I wouldn't live there, but you could.

Seems impossible anyway. A huge loan and a huge mortgage.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards