We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@deejaybee Based on the limited info in your post, it should be fairly straightforward - either as an I/O mortgage with the pension lump-sump as the repayment vehicle, or a normal capital repayment mortgage (with term either to 70 or beyond depending on the details).deejaybee said:Hi K_SGeneral question - Im 63 in November, long term self-employed - would i be able to source a mortgage in the 50 to 70 K range, running to age 70 , obviously assuming my incomings are sufficient. Will have around 130K deposit , but that wouldnt get me the type of property i'm considering, hence the mortgage query. Profit before tax around 33K p.a, plus 2.5K pension p.a.I would look to clear it a fair way before age 70, pension lump sums due at 65.Thank you.

Whatever option or term you take, you can always pay it off in full when the initial fix/product comes to an end.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thanks K_S, thats sounds promising.We will be moving 250 ish miles north from current location - i have left a message for broker who worked for us when we bought existing property. I dont know whether it would be practical/possible for him to help with next move given the distance, for example documents that need signing etc, presumably could post them back ? Will discuss all that when he gets back to us...Have relatives who live in prospective new location, asked them whether they could recommend local broker, but they hadnt needed to themselves, so decided to try contact our broker who was very good before.1

-

@deejaybee As long as the client doesn't need in-person contact, the physical location of the broker is pretty much immaterial. The likelihood of having to send across any physical documentation to/from the broker is close to 0.deejaybee said:Thanks K_S, thats sounds promising.We will be moving 250 ish miles north from current location - i have left a message for broker who worked for us when we bought existing property. I dont know whether it would be practical/possible for him to help with next move given the distance, for example documents that need signing etc, presumably could post them back ? Will discuss all that when he gets back to us...Have relatives who live in prospective new location, asked them whether they could recommend local broker, but they hadnt needed to themselves, so decided to try contact our broker who was very good before.

All the best!I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Perfect ! Thanks again !

0 -

Peco141 said:My x2 year fix mortgage year fixed ends 31st March 2023. To keep the monthly payment as low as possible and based on the rumours of the Base rate or is it the Standard variable rate... decreasing over the next few months, should I sit tight rather than applying for another fix now?

I'd be willing to pay a little more initially if it meant the monthly fees over a 2 or 3 year fix were lower.

Also are products fees added to then overall mortgage. I've always gone for a deal with no product fee. Does it work out cheaper to get a remortgage with or without a product fee?

Just spoke to a mortgage broker who said they would charge £395 (a discount of £100) to deal with my remortgage.

He said I wouldn't get anywhere near the 3.5% rate I currently have with Britiannia. Looking closer at 5%. Even though I have an LTV of 60%. House Value £191k, left to pay 57k over 15 yr terms.

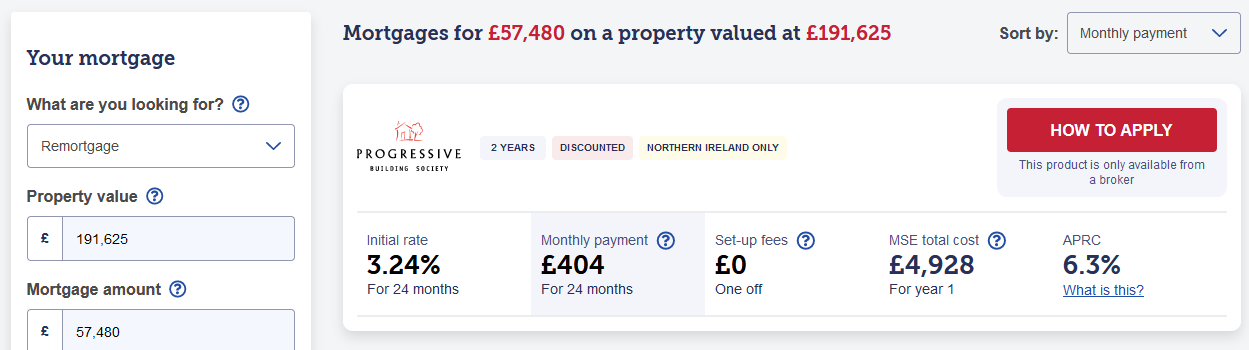

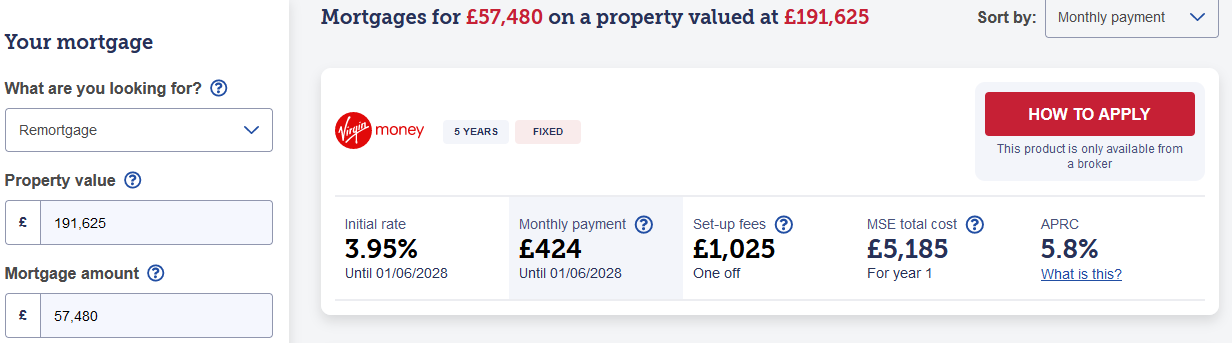

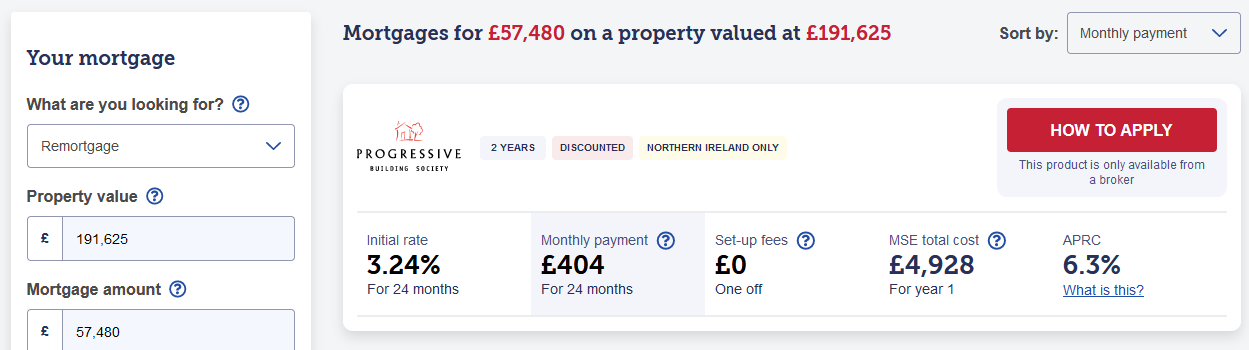

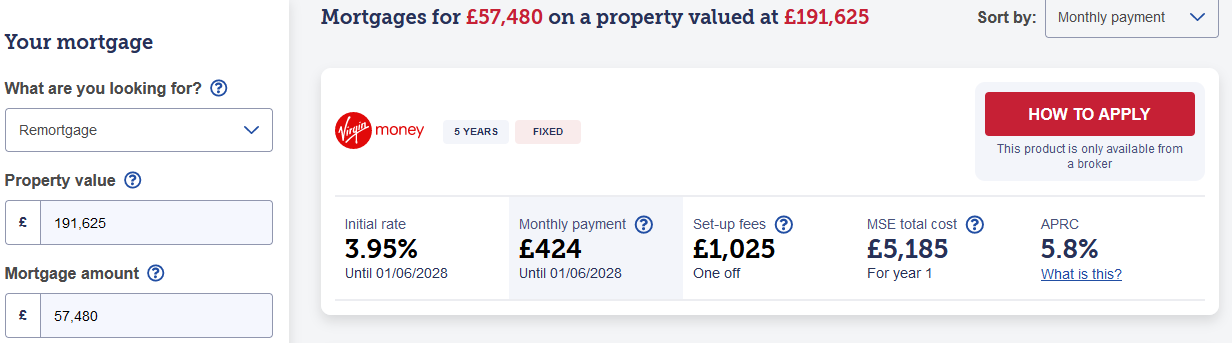

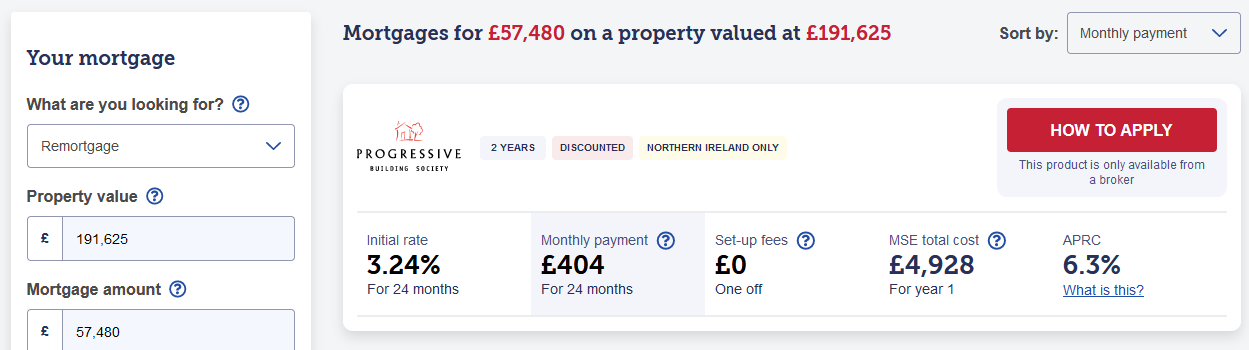

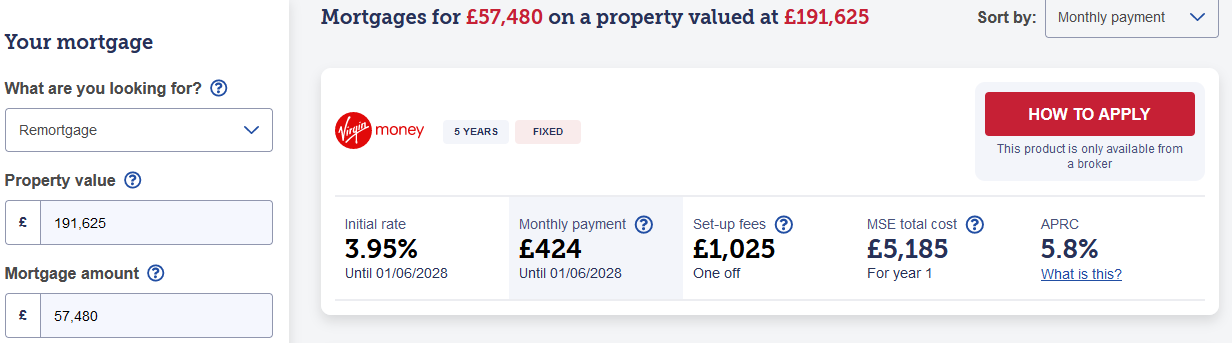

Quite confused though because the best buy comparison tool on this site shows a 2 yr discounted variable with a percentage of 3.24 and a 2 yr fixed with Virgin at 3.95%.Is ther money saving Expert site not up to date or is my mortgage broker misinformed or am I missing something?

0 -

@peco141 Quick comments -

- unless you have a complex case, there's really no need to use a fee charging broker for a 50k like for like remo. The MSE guide has plenty of fee-free brokers that you could speak to.

- at that loan size, you definitely need to look at the mortgage product on a total cost basis (rate and lender product fees) and not just rate. For instance a 4.5% no-fee product might actually be cheaper over the fixed period than a 4% product with a £999 fee.

- you also need to make sure you're eligible for the product. For example, the Progressive BS rate that you've quoted is only for Northern Ireland properties.

- plus you need to think about variable (discount/tracker) Vs fix. You can potentially get cheaper variable products but with the trade-off that they might go higher during the product period.Peco141 said:Peco141 said:My x2 year fix mortgage year fixed ends 31st March 2023. To keep the monthly payment as low as possible and based on the rumours of the Base rate or is it the Standard variable rate... decreasing over the next few months, should I sit tight rather than applying for another fix now?

I'd be willing to pay a little more initially if it meant the monthly fees over a 2 or 3 year fix were lower.

Also are products fees added to then overall mortgage. I've always gone for a deal with no product fee. Does it work out cheaper to get a remortgage with or without a product fee?

Just spoke to a mortgage broker who said they would charge £395 (a discount of £100) to deal with my remortgage.

He said I wouldn't get anywhere near the 3.5% rate I currently have with Britiannia. Looking closer at 5%. Even though I have an LTV of 60%. House Value £191k, left to pay 57k over 15 yr terms.

Quite confused though because the best buy comparison tool on this site shows a 2 yr discounted variable with a percentage of 3.24 and a 2 yr fixed with Virgin at 3.95%.Is ther money saving Expert site not up to date or is my mortgage broker misinformed or am I missing something?

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

K_S said:@peco141 Quick comments -

- unless you have a complex case, there's really no need to use a fee charging broker for a 50k like for like remo. The MSE guide has plenty of fee-free brokers that you could speak to.

- at that loan size, you definitely need to look at the mortgage product on a total cost basis (rate and lender product fees) and not just rate. For instance a 4.5% no-fee product might actually be cheaper over the fixed period than a 4% product with a £999 fee.

- you also need to make sure you're eligible for the product. For example, the Progressive BS rate that you've quoted is only for Northern Ireland properties.

- plus you need to think about variable (discount/tracker) Vs fix. You can potentially get cheaper variable products but with the trade-off that they might go higher during the product period.Peco141 said:Peco141 said:My x2 year fix mortgage year fixed ends 31st March 2023. To keep the monthly payment as low as possible and based on the rumours of the Base rate or is it the Standard variable rate... decreasing over the next few months, should I sit tight rather than applying for another fix now?

I'd be willing to pay a little more initially if it meant the monthly fees over a 2 or 3 year fix were lower.

Also are products fees added to then overall mortgage. I've always gone for a deal with no product fee. Does it work out cheaper to get a remortgage with or without a product fee?

Just spoke to a mortgage broker who said they would charge £395 (a discount of £100) to deal with my remortgage.

He said I wouldn't get anywhere near the 3.5% rate I currently have with Britiannia. Looking closer at 5%. Even though I have an LTV of 60%. House Value £191k, left to pay 57k over 15 yr terms.

Quite confused though because the best buy comparison tool on this site shows a 2 yr discounted variable with a percentage of 3.24 and a 2 yr fixed with Virgin at 3.95%.Is ther money saving Expert site not up to date or is my mortgage broker misinformed or am I missing something?

@K_S Many thanks for responding. I had not considered any of these options. I will cancel my appt with the Mrotgage Advice Bureau scheduled for next week.

I've really no clue if now is the time to move to a tracker or remain on a fix so I have arranged an appointment with moneybox through the link on this site.

Can I ask, will full credit checks be expected for any change in mortgage provider and if so will seperate debts of the joint mortgage policy holder have an impact on any application that we may decide to switch to?

Same question but from a different angle, if I remain with Britannia and go through with an execution only, will debts (I've literally just found out about) impact the remortgage?

0 -

Hi @K_S,

I'm a first time buyer and a qualified accountant who has a perfect credit rating (according to Experian anyway). What are the chances of getting a professional mortgage with a lender that would allow me to borrow 6 times my salary? Do any exist or is this just wishful thinking in the current environment?

Thanks in advance.0 -

@kuchkuch There are a few mainstream lenders (like Platform, Clydesdale, etc.) that will consider up to 5.5x for professionals and a few specialist lenders (like Kensington, Foundation, Hodge, etc.) that will consider up to 6x for professionals subject to criteria, affordability and specifics. Each will have differing criteria - age, time since qualification, minimum income, LTV caps, loan size caps, etc.KuchKuch said:Hi @K_S,

I'm a first time buyer and a qualified accountant who has a perfect credit rating (according to Experian anyway). What are the chances of getting a professional mortgage with a lender that would allow me to borrow 6 times my salary? Do any exist or is this just wishful thinking in the current environment?

Thanks in advance.

So to answer your question, they do exist but whether or not you will be able to borrow 6x will depend on the specifics and the numbers.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Hi. I am self employed builder. I don't have one fixed work place. I am ready to buy house but wondering how far away from my current place I can go? TIA

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards