We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

I dont think so, they would amend a purchase case or they would amend a remortgage case but we have to state very early in the process if its a purchase or a remortgage and the application system is slightly different for them.Nuri123 said:Hi just wanted to ask, I've got a mortgage offer from natwest couple of months ago, but I want to buy my brother out of my home I own with him, its high in value than the house I was going to buy so could bring the ltv down slightly,the mortgage amount would stay the same aswell, would natwest change the property on the current offer as its probably going to be a remortgage now instead of a purchase of another property, but my brother would be coming off the mortgage.

You might be better off starting again anyway as the rates have dropped quite a lot across the industry and be worth just looking at the whole market againI am a Mortgage Adviser

You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

Is a purchase application more thorough than a remortgage?JMA74 said:

I dont think so, they would amend a purchase case or they would amend a remortgage case but we have to state very early in the process if its a purchase or a remortgage and the application system is slightly different for them.Nuri123 said:Hi just wanted to ask, I've got a mortgage offer from natwest couple of months ago, but I want to buy my brother out of my home I own with him, its high in value than the house I was going to buy so could bring the ltv down slightly,the mortgage amount would stay the same aswell, would natwest change the property on the current offer as its probably going to be a remortgage now instead of a purchase of another property, but my brother would be coming off the mortgage.

You might be better off starting again anyway as the rates have dropped quite a lot across the industry and be worth just looking at the whole market again0 -

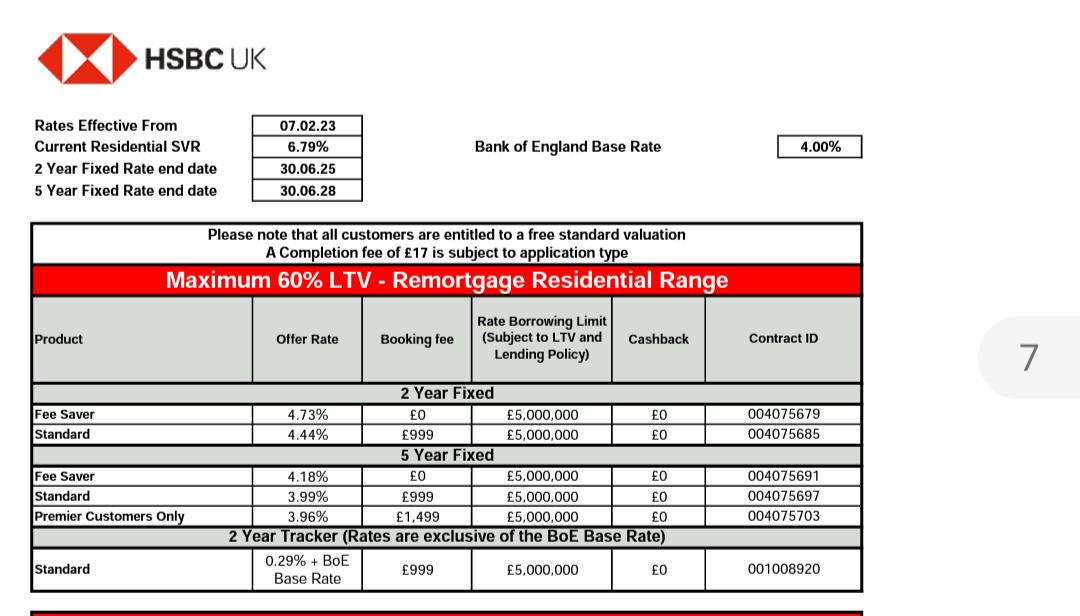

I did a search on MSE's mortgage comparison this morning at around 9 am, and found a 3.99% 5-year fix from HSBC. This is the first sub-4% 5-year rate I've seen since Liz Truss, so I was quite excited. I double checked the rate was also on the HSBC website.

I checked again at 10am and the rate had disappeared from both MSE and HSBC.Is it common for products to appear and then disappear an hour later? What could have happened here?

I'm certain I didn't imagine the 3.99 rate as I took screenshots!0 -

@nailer99 It is available as far as I can tell, perhaps their systems are still being updatedNailer99 said:I did a search on MSE's mortgage comparison this morning at around 9 am, and found a 3.99% 5-year fix from HSBC. This is the first sub-4% 5-year rate I've seen since Liz Truss, so I was quite excited. I double checked the rate was also on the HSBC website.

I checked again at 10am and the rate had disappeared from both MSE and HSBC.Is it common for products to appear and then disappear an hour later? What could have happened here?

I'm certain I didn't imagine the 3.99 rate as I took screenshots!

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thanks K_S! I will check their webpage again later.0

-

Apologies if this has been asked before (I did try looking before asking). I am looking to purchase a house (on my own) sometime this year. In readiness for this I want to make sure I look as appealing as possible to lenders. I have no loans, no student loan and a credit card which I pay off in full monthly.

In respect to my credit card, when inputting a credit card figure on a DIP application form, is it asking me for my current balance or the balance this is unpaid from month to month? I'm unsure what it counts as credit card debt, to me any balance on a credit card would be debt.

I've been looking at the MSE mortgage best buys page. I can see that Newcastle Building Society have a 90% LTV 2 year fix at 4.19% this seems too good to be true. Are you aware if this is a typo and the figure should be 4.91% (inline with other fix rates)? I know rates will change by the time I look to buy but I have a family member who is looking to put an offer in for a house shortly.0 -

@tj200 CC - conservatively, best to put the usual monthly balance on there, even if it's paid off in full every month. Whether or not it impacts how much you can borrow will depend on the numbers and whether or not you are looking to absolutely maximum borrowing or not.tj200 said:Apologies if this has been asked before (I did try looking before asking). I am looking to purchase a house (on my own) sometime this year. In readiness for this I want to make sure I look as appealing as possible to lenders. I have no loans, no student loan and a credit card which I pay off in full monthly.

In respect to my credit card, when inputting a credit card figure on a DIP application form, is it asking me for my current balance or the balance this is unpaid from month to month? I'm unsure what it counts as credit card debt, to me any balance on a credit card would be debt.

I've been looking at the MSE mortgage best buys page. I can see that Newcastle Building Society have a 90% LTV 2 year fix at 4.19% this seems too good to be true. Are you aware if this is a typo and the figure should be 4.91% (inline with other fix rates)? I know rates will change by the time I look to buy but I have a family member who is looking to put an offer in for a house shortly.

Newcastle - Afaik that's a govt scheme product and probably a discounted variable rate rather than a fix. Might want to check on the lenders website.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Thanks K_S appreciate the response0

-

Question over income. Do they generally look at salary or net income for multiples? I have been informed by HMRC that due to issues thier end, I have underpaid £1.8k in tax and they will be taking off £150pcm off my pay for 12 months starting in April to recover it. WIll this impact on mortgage application?

I currently have credit cards and a loan which will be paid off in August, so I want to appy for the mortgage to receive it then?0 -

@scorpio33Scorpio33 said:Question over income. Do they generally look at salary or net income for multiples? I have been informed by HMRC that due to issues thier end, I have underpaid £1.8k in tax and they will be taking off £150pcm off my pay for 12 months starting in April to recover it. WIll this impact on mortgage application?

I currently have credit cards and a loan which will be paid off in August, so I want to appy for the mortgage to receive it then?

Gross/net - With the vast majority of lenders, only the gross pay will matter for the purposes of a mortgage app

Cc and loans - differs across lenders and LTV bands, some will ignore loans ending within 3/6 months, some will ignore debt to be paid off before completion up to an LTV threshold, etc.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards