We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@polmop Prior to submitting, a good broker would scan your bank statements to see if there is anything on there that might be queried by the underwriter or is relevant to the application.Polmop said:Hi. We are using a broker and we are at the underwriting stage. Does the broker check statements etc before submitting so if anything doesn't look right would they flag it

ThanksI am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@doraspenlow Sorry to hear that, looks like it's a no go with them then. Hopefully you're able to finance the improvements elsewhere. Personal loans aren't too much more expensive than mortgages at the moment and you can always look at consolidating it on to a remortgage with a new lender if you wish to when it comes to the end of the Nationwide fix.doraspenlow said:

@K_SK_S said:

@doraspenlow With the limited info and numbers in your post I would be surprised if you couldn't borrow what you needed and suspect it's just a matter of making it fit, most likely by stretching the term if at all possible (Nationwide will potentially go up to 75 for the older borrower) and/or or trimming the cc balance.doraspenlow said:

Sorry. When I put the details into Nationwide's 'How much can I borrow?' calculator.K_S said:

@doraspenlow Sorry it's not clear to me - who's saying that you can't borrow the extra 15k?doraspenlow said:Hello. Thanks for this thread. I am looking for some help on affordability. We'd like to take out Green Additional Borrowing with Nationwide to put solar panels on the roof, but currently the calculator is coming back with a big fat zero on what they will lend. Here's our situation:

House value: £465k

Mortgage outstanding: £230k

Would like to borrow about: £15k

Two borrowers, but only one earns. Full time permanent, on £70k pa

24.5 years left on mortgage term.

Three children, but discounting one as a dependant as he is 21 and works full time. Others are 19 (away at uni) and 11.

Currently £4300 on a 0% credit card (about 2 years left on the 0% so I haven't seen the point in hurrying to pay it).

£215 per month on a car lease (2 years to go).

What's best to do here? Even fully paying back the credit card leaves it tight on what they say they'll lend. To the point where if I then concede to spending £100 a month on petrol they won't do it. Are they really saying that we can't afford £90 a month extra on the mortgage to make energy bills lower?

Any advice, or maybe idiosyncracies about the Nationwide form it might help to know about. I would hate for them to be double counting anything. Maybe it's just a busted flush.

With a further advance for existing borrowers, even the broker affordability calculator does not give an accurate output and I always need to tinker with a DIP to get an accurate figure.

I would recommend speaking to a Nationwide adviser who can suggest a way to get what you need if it is possible. Good luck!

Just off the phone to Nationwide. Even with extending the term to 30 it's coming back as unaffordable, apparently. Nothing they can do. Won't let us speak to one of their proper advisors because the DIP was refused. Seems like a dead end.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

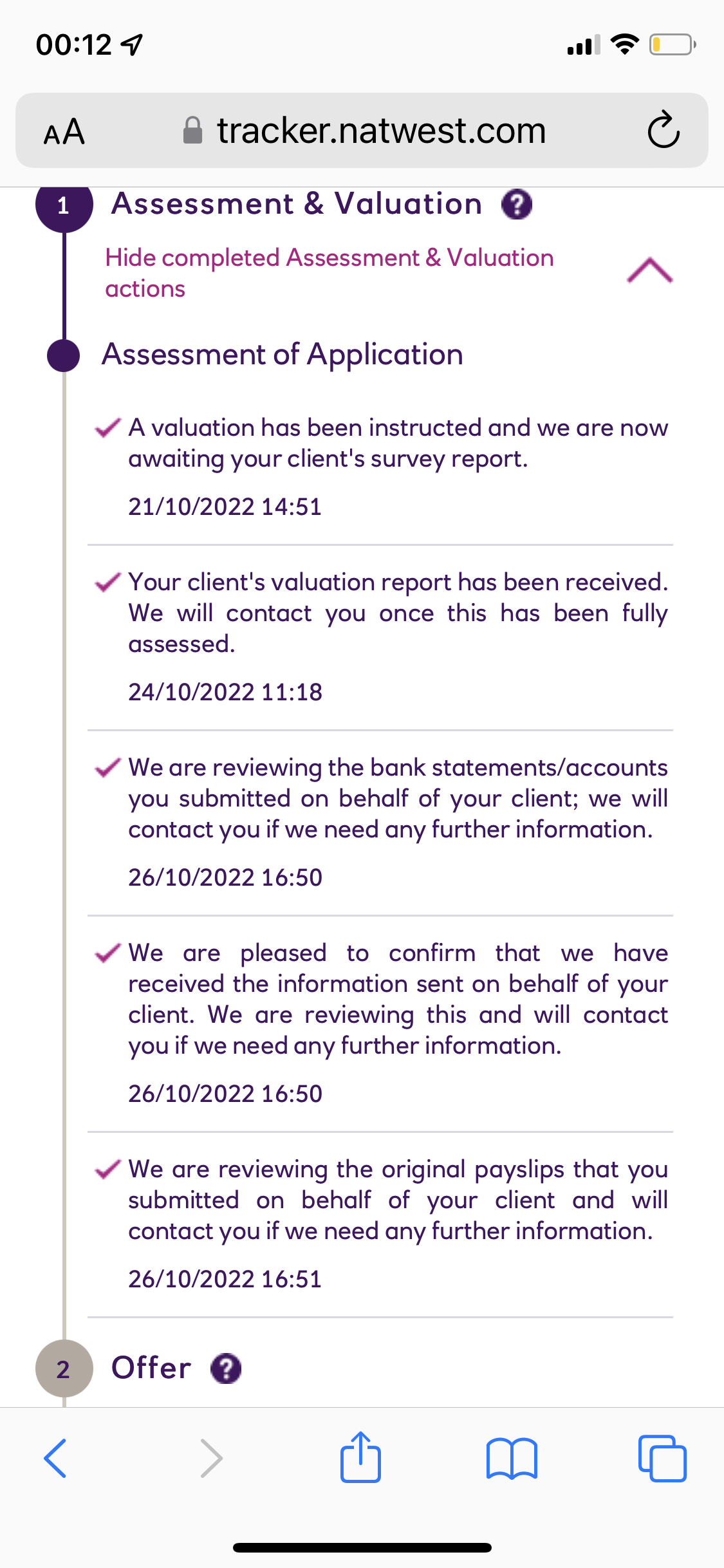

Hello, just looking for some reassurance about where I am in the process of being offered a mortgage by NatWest.

applied 06/10, valuation instructed and done, all documents ticked on the tracker (see below) and NatWest online chat told me they’re currently doing “KYC Checks” which would take up to two working days - this was on Thursday.Any thoughts about whether I’m nearing the end? 0

0 -

Just an update on this.K.s said:

@boma99 The product is still available for existing borrower rate switch, all the way up to 85% LTV.BOMA99 said:Also 4.84% is still available with Nationwide on their website however it's not on MSE best buys or other comp sites for some reason.

Once you cancel your current product switch, on 1 Nov you *should* be able to select a new product online without having to speak to an adviser. You only had to speak to an adviser because there was an ERC involved.

The above is an educated guess as I know very little about how Nationwide does direct PTs.

If you aren't able to cancel the PT and the product is still available on 1 Nov, then there's no harm in putting in a complaint asking for the ERC to be refunded.

So I can cancel the new rate until the 31st Oct however Nationwide advise I won't be able to apply for a new mortgage till the 1st Dec as it takes time for the system to adjust.

Person on the phone agrees its unfortunate that I agreed to pay the erc 3 days before the changed their terms from 5 to 6 months.

I've logged a complaint but assume they won't respond before the 1st Nov.

Unsure what to do now tbh.

If I cancel it tomorrow I expect the 4.84 rate won't be there when I can apply.

If I don't cancel they'll respond to the complaint without refunding the erc.0 -

@boma99 Ok, I vaguely recall something similar with another lender where they mandated a one month period on SVR before you could cancel and pick a new switch product, looks like Nationwide also have a one month 'cooling period'.Boma99 said:

Just an update on this.K.s said:

@boma99 The product is still available for existing borrower rate switch, all the way up to 85% LTV.BOMA99 said:Also 4.84% is still available with Nationwide on their website however it's not on MSE best buys or other comp sites for some reason.

Once you cancel your current product switch, on 1 Nov you *should* be able to select a new product online without having to speak to an adviser. You only had to speak to an adviser because there was an ERC involved.

The above is an educated guess as I know very little about how Nationwide does direct PTs.

If you aren't able to cancel the PT and the product is still available on 1 Nov, then there's no harm in putting in a complaint asking for the ERC to be refunded.

So I can cancel the new rate until the 31st Oct however Nationwide advise I won't be able to apply for a new mortgage till the 1st Dec as it takes time for the system to adjust.

Person on the phone agrees its unfortunate that I agreed to pay the erc 3 days before the changed their terms from 5 to 6 months.

I've logged a complaint but assume they won't respond before the 1st Nov.

Unsure what to do now tbh.

If I cancel it tomorrow I expect the 4.84 rate won't be there when I can apply.

If I don't cancel they'll respond to the complaint without refunding the erc.

I don't really have any advice to give as what works best for you in the end will depend on your personal preferences and future rates. I personally would be leaning towards cancelling the switch and picking a new one on 1st Dec, but that's only because I don't like paying ERCs and don't mind taking a chance on whatever the rate is on 1st Dec.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

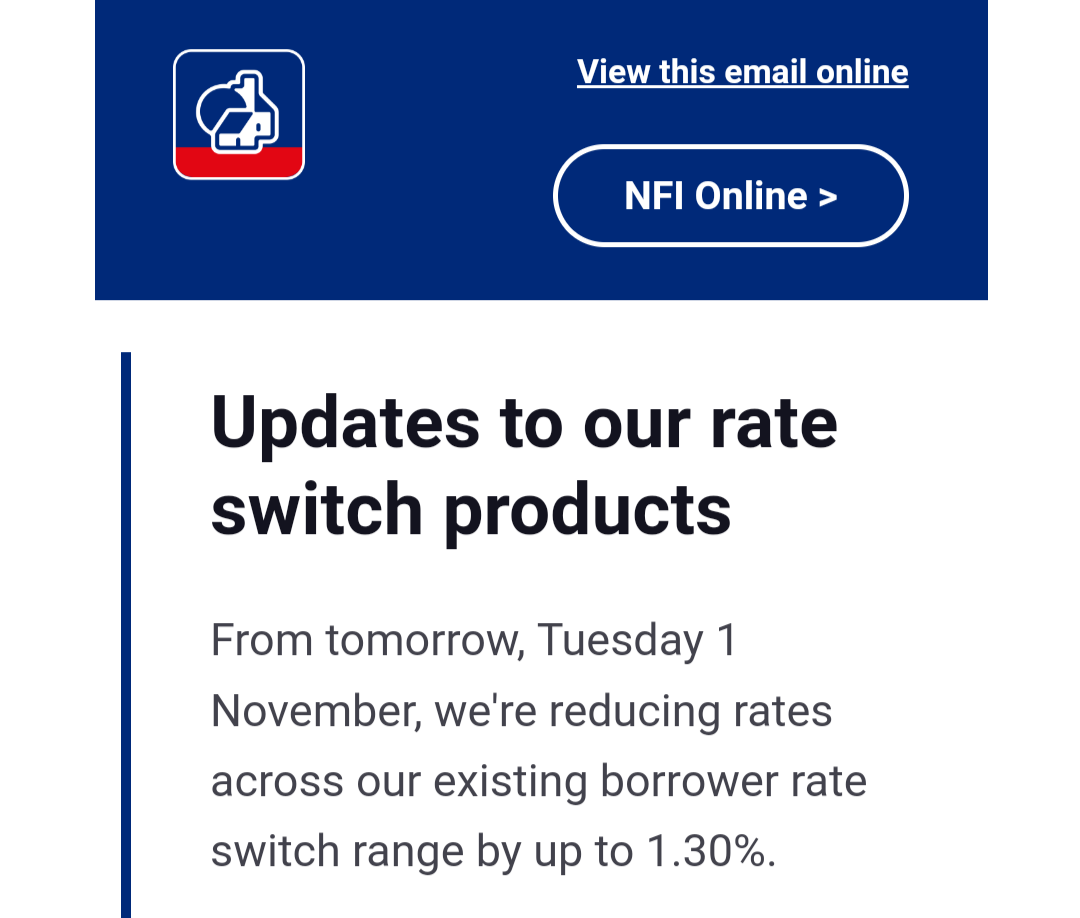

@boma99 Just got a broker notification of Nationwide PT rate reductions, and tweaks to PT windows, your post came to mind.

See here for further details

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

So am I reading it correctly that the new rate for 55% ltv with no additional borrowing on a ten year fix would be 4.84% with a £999 fee?K_S said:@boma99 Just got a broker notification of Nationwide PT rate reductions, and tweaks to PT windows, your post came to mind.

See for further details

Also they've changed it so I would need to wait till 1st Dec anyway as that's 5 months.

0 -

Or would it actually be 1st Jan as that's 4 months.0

-

@boma99 Sorry I should've made it clear that what I posted is based on Nationwide's email to brokers.

So the 6-5-4 months change in the PT window may or may not apply to direct PTs. Perhaps the direct PT window remains at 6 months, I don't really know. Best call Nationwide and check.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Thanks.K_S said:@boma99 Sorry I should've made it clear that what I posted is based on Nationwide's email to brokers.

So the 6-5-4 months change in the PT window may or may not apply to direct PTs. Perhaps the direct PT window remains at 6 months, I don't really know. Best call Nationwide and check.

I've left it as is and hopefully the complaint comes back in my favour.

When I called today they couldn't say for definate if the cancellation would go through or not and if it did I would go onto the SVR for a month which is currently 5.74%.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards