We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Discounted variable - What type of a mortgage is this?

Are you "fixed" for a certain period to get the discount? Does it normally have ERCs? Do you apply in the same way and are affordability checks similar to a conventional (fixed) mortgage? Do most lenders offer such a product?0 -

Nationwide slow? My experience with them this month is App submitted 22/9 Offer 26/9…K_S said:

@pinewood12 Nationwide is extremely slow at the moment so don't be too worried by how long it's taking. And you've used a broker so you've done all you can. I hope the offer comes through in the next few weeks, good luck!pinewood12 said:

Just bumping this - I wonder if anyone has any thoughts/insight to try and reduce my anxiety as it's been 3 weeks since application now.pinewood12 said:Hi all, I am purely asking these questions to try as best I can to manage to increasing anxiety on gaining a mortgage offer. Hopefully the below summaries my circumstances clearly:- AIP confirmed with Nationwide

- Purchasing a shared ownership property on a 5 year fix 75% LTV mortgage - application submitted 8th September @ 3.99%

- Income fits affordability, however is split 3 ways - 60% permanent contract / 20% ZHC with the same employer + 20% with another employer somewhere between ZHC/Self Employed as fall under IR35 and on PAYE.

- Near perfect credit score, no loans/credit cards etc.

Obviously I am just very worried the lender will eventually come back and reject my application despite sizable costs already paid for arrangement fees, solicitor fees, property reservations etc.

Looking forward to hearing peoples thoughts. Thanks

Thanks a lot0 -

Are bates rates predicted to be worse in Q1 or Q2 2023?0

-

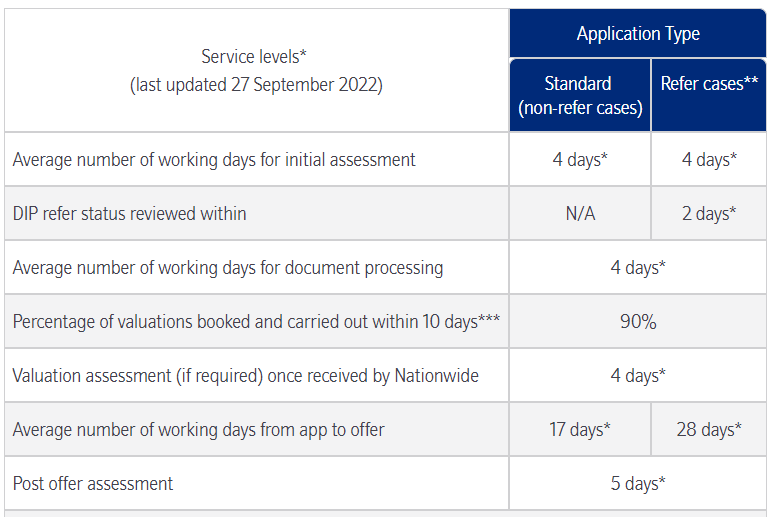

@gambitv5 Yes they are extremely slow and on average taking between 17 to 28 working days (so around 4-6 calendar weeks) from app to offer and 1 week to turnaround queries (of which the OP has already had 2). Please see current average service levels here https://www.nationwide-intermediary.co.uk/placing-business/service-updatesGAMBITv5 said:

Nationwide slow? My experience with them this month is App submitted 22/9 Offer 26/9…K_S said:

@pinewood12 Nationwide is extremely slow at the moment so don't be too worried by how long it's taking. And you've used a broker so you've done all you can. I hope the offer comes through in the next few weeks, good luck!pinewood12 said:

Just bumping this - I wonder if anyone has any thoughts/insight to try and reduce my anxiety as it's been 3 weeks since application now.pinewood12 said:Hi all, I am purely asking these questions to try as best I can to manage to increasing anxiety on gaining a mortgage offer. Hopefully the below summaries my circumstances clearly:- AIP confirmed with Nationwide

- Purchasing a shared ownership property on a 5 year fix 75% LTV mortgage - application submitted 8th September @ 3.99%

- Income fits affordability, however is split 3 ways - 60% permanent contract / 20% ZHC with the same employer + 20% with another employer somewhere between ZHC/Self Employed as fall under IR35 and on PAYE.

- Near perfect credit score, no loans/credit cards etc.

Obviously I am just very worried the lender will eventually come back and reject my application despite sizable costs already paid for arrangement fees, solicitor fees, property reservations etc.

Looking forward to hearing peoples thoughts. Thanks

Thanks a lot

The timelines above will include both cases like your's which go to offer in a few days and cases which drag on for months.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@tony3619 The financial markets have an ever-changing opinion (currently it is that BoE rates will hit 6% by next summer), but that has and can change with events and isn't something that I am brave enough to factor in when advising clients.tony3619 said:Are bates rates predicted to be worse in Q1 or Q2 2023?I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

@aoleks It's a product that offers you an x% discount off of the specific lender's SVR (which can be varied at will and does not track the BOE rate) for a fixed period of time - mostly 2 years but there are also term-products available.aoleks said:Discounted variable - What type of a mortgage is this?

Are you "fixed" for a certain period to get the discount? Does it normally have ERCs? Do you apply in the same way and are affordability checks similar to a conventional (fixed) mortgage? Do most lenders offer such a product?

The product is variable from day 1. The vast majority of discount products I've come across have an ERC, though it's usually kinder than a fixed product.

It's usually offered by smaller lenders (I can't think of any mainstream lenders that offer discount products) as they can adjust their SVR to account for any significant changes in their funding to maintain margins and don't have the capacity to absorb large volatility. The building societies have a mandate to have x% of their lending on variable products so this helps with meeting that requirement as well.

Affordability differs based on the specific lender. Very very generally speaking, it is usually tighter with the smaller lenders that offer these products.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

2 -

Thanks for explaining averages0

-

@gambitv5 Apologies if that came across as patronising, that wasn't my intentionGAMBITv5 said:Thanks for explaining averages I've edited my post.

I've edited my post. I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Does Lloyds do a final credit check in the days leading up to completion before release of funds for a remortgage? I’m aware that some lenders do but wasn’t sure if Lloyds are one of them.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards