We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

@coypondboy That's a good question.

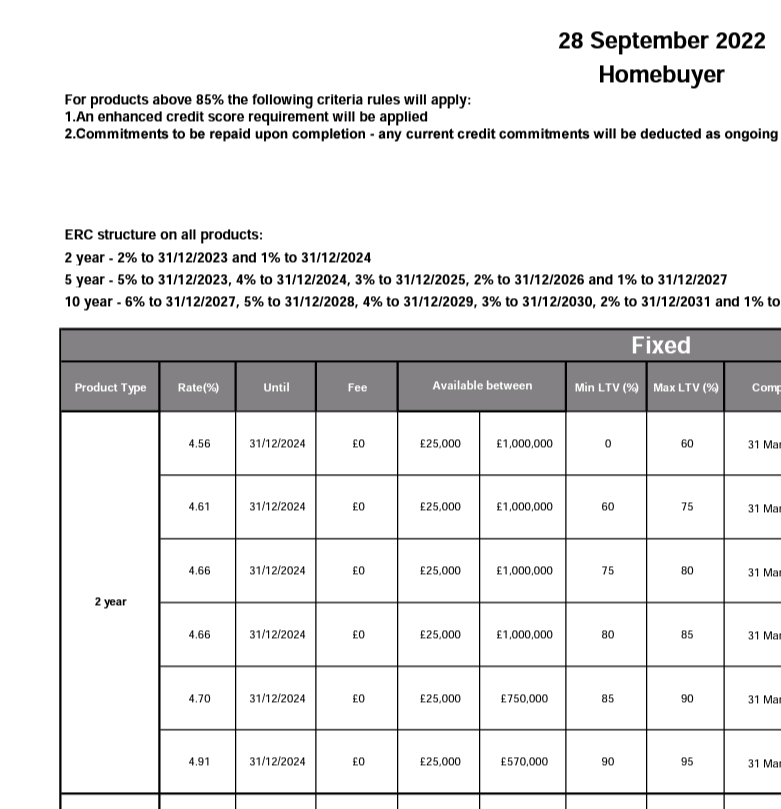

Halifax is the first of the mainstream lenders that's published new rates applicable from Wednesday. This is a snapshot so you can compare it to their homebuyer rates as of today

Larger bank lenders aren't as affected by the swap rates.

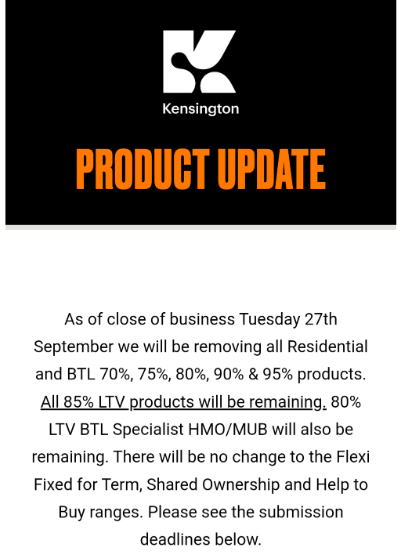

With smaller lenders that are, I've got a few lender emails this morning notifying brokers of temporary withdrawal from new business to be followed by launch of new products. That'll probably see a bigger jump, withdrawal of fixed rates, consolidation of LTV bands (eg: Kensington has already limited their range from Wednesday to just one single LTV band - 85%), etc.

All said and done, not a particularly good time to be an applicant nor a broker, as I'm having to do everything twice because of how fast rates/availability is moving and clients are stressed out as they're not getting the time they need to mull over their options properly.coypondboy said:How high will 2 yr fixed rate mortgages go now the bond market rate for 2 yr gilts nearly 5%, will it mean 2 yr fixed rates priced at 7% later in the week?

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Just saw a sky news article saying the biggest majority of fixed rates end when they expect a 6% peak in q2 2023. Can't wait for my 1.69% to end in May.... Really thinking about paying my ERC and settling on 4-5%. Saves me roughly £1400 over a 2 year fix.0

-

I have a fixed rate mortgage at a rate of 1.6% and ends on 31/10/2024. At that point will have £215k and 15 years. I am a bit concerned about current events and just wonder if i should exit (exit fee £80) and secure a 10 year fixed rate. I am inclined to stick with it and review the position in 2024 - over the next 2 years will clear all o/s loans. Just after your advice - does that sound like the right decision - i am preparing myself to pay more in 2 years time. Thanks in advance for any advice0

-

Hi, our fixed runs out 31st October 2023 (1.93%) we are thinking of remortgaging to get a 5 year fixed at 3.39% but have to pay exit fee of £6300, which we will need to add to mortgage balance (£217k).

I’m hoping to get the application sorted tomorrow, but will have 6 months to opt out before it goes live so thinking I can reassess before then.Does this sound like our best option? thanks.0 -

Hi all,

Anybody offer any advice my head hurts thinking about it

Our mortgage with Halifax ends 28 Feb 2023 and fixed rate currently is 2.13%.

I've tried to see what they would offer online but all I get is the following.

You can't continue online

One of our advisers will explain your best next steps.

Please call us or book an appointment to speak with a Mortgage Adviser.

0 -

Could it be because they have temporarily removed a lot of their products?@leew said:Hi all,

Anybody offer any advice my head hurts thinking about it

Our mortgage with Halifax ends 28 Feb 2023 and fixed rate currently is 2.13%.

I've tried to see what they would offer online but all I get is the following.

You can't continue online

One of our advisers will explain your best next steps.

Please call us or book an appointment to speak with a Mortgage Adviser.

https://www.standard.co.uk/news/uk/mortgage-halifax-skipton-market-fixedrate-b1028242.html

1 -

@leew Halifax PT (product-transfer/product-switch/rate-switch) window is 3 months before the end of the fix, so 01 Dec in your case. It may be possible to switch prior to that by paying an ERC but I guess you need an appointment for that.leew said:Hi all,

Anybody offer any advice my head hurts thinking about it

Our mortgage with Halifax ends 28 Feb 2023 and fixed rate currently is 2.13%.

I've tried to see what they would offer online but all I get is the following.

You can't continue online

One of our advisers will explain your best next steps.

Please call us or book an appointment to speak with a Mortgage Adviser.

If you are able to meet affordability for a remortgage (changing lenders), given that you are less than 6 months away from the end of your fix, it may be worth exploring your remortgage options. That way you'll be able to secure a new rate to start on 1st March and avoid paying any penalty/ERC.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@housecr Sounds like a good plan to hedge your bets. Assuming you're talking about a remortgage (changing to a new lender) rather than a product-transfer/product-switch/rate-switch (staying with current lender), I hope the 3.39% rate is already secured/reserved? I don't expect to see any sub 4% rates remaining after mid-week or so.HouseCR said:Hi, our fixed runs out 31st October 2023 (1.93%) we are thinking of remortgaging to get a 5 year fixed at 3.39% but have to pay exit fee of £6300, which we will need to add to mortgage balance (£217k).

I’m hoping to get the application sorted tomorrow, but will have 6 months to opt out before it goes live so thinking I can reassess before then.Does this sound like our best option? thanks.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Not sure what I am best doing, I had thought my fixed rate ran out next march, so with all this talk of rates rising, I was thinking about re fixing now, but after logging in it turns out that it does not run out till 31 jan 2024 at 2.19%.To move to a new 5 year fix, for 53k, would cost me £647 ERPF and be at 3.94%, so I had thought i might be better staying put, till i just read this about interest rates pos having to go up to 6%So now i am rethinking, should i mortgage with the bank i am currently with and pay the extra £60 a month (from a higher interest rate) to lock it in for 5 years? are they likely to come down before then or do i just take the hit now, to save in the long term?

0 -

It is with same lender (Barclays) but they said only way we can add exit fee to mortgage value was by a remortgage with them (otherwise they wanted the exit fee paid up front and the rate was the same 3.39%)K_S said:

@housecr Sounds like a good plan to hedge your bets. Assuming you're talking about a remortgage (changing to a new lender) rather than a product-transfer/product-switch/rate-switch (staying with current lender), I hope the 3.39% rate is already secured/reserved? I don't expect to see any sub 4% rates remaining after mid-week or so.HouseCR said:Hi, our fixed runs out 31st October 2023 (1.93%) we are thinking of remortgaging to get a 5 year fixed at 3.39% but have to pay exit fee of £6300, which we will need to add to mortgage balance (£217k).

I’m hoping to get the application sorted tomorrow, but will have 6 months to opt out before it goes live so thinking I can reassess before then.Does this sound like our best option? thanks.

I’ve looked on comparison sites and couldn’t see any cheaper 5 year rates with other providers but appreciate a broker might have access to other deals that I can’t see, but my worry now is the time we’ve got before 5 year fixes go up again. Hoping I can secure the Barclays 3.39% before they change their rates. I’ve sent all the necessary paperwork, so I guess it’s now in their hands… ☹️0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards