We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

Hi, I have a question please.

I am looking at moving from permanence to agency work (there is a heck of a difference in salary) and I am worried that I will not be able to get a mortgage if I do this. Can people employed by agency, access mortgages? Would it need to be a long term temporary post? Or would I need to go back to being oermanent before applying?Thanks0 -

HI,

What happens if you get final offer from bank for mortgage and if you wanna pull out?

Are we allow to not to go ahead even though all checks and processes been completed.0 -

@sweetpotatopie People employed on contracts through agencies can indeed get mortgages. It might be difficult right away but once you have a track record, with the right lender it's not a problem by itself.

SweetPotatoPie said:Hi, I have a question please.

I am looking at moving from permanence to agency work (there is a heck of a difference in salary) and I am worried that I will not be able to get a mortgage if I do this. Can people employed by agency, access mortgages? Would it need to be a long term temporary post? Or would I need to go back to being oermanent before applying?Thanks

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

@harry1986 Generally speaking, you can decide to not go ahead with that lender anytime until they release funds for completion.Harry1986 said:HI,

What happens if you get final offer from bank for mortgage and if you wanna pull out?

Are we allow to not to go ahead even though all checks and processes been completed.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hi there,

My wife and I are currently looking to apply for a mortgage. We have a healthy 45% LTV however we do have some defaults (currently still paying) from 4 years ago.

We currently have no credit or store cards, no overdrafts, no loans, no car finance and no missed payments for 2 years and 2 months. I was wondering if you could recommend a company that would be happy to potentially accept us with this history.

Thanks.

0 -

How many defaults? What sort of values and how long have you got left to pay? Are they on a DMP? Is it both yourself and your wife that have individual or joint defaults? There are plenty of brokers on here who will know more than me but maybe adding some more detail about your situation would be beneficial.TheFarouk said:Hi there,

My wife and I are currently looking to apply for a mortgage. We have a healthy 45% LTV however we do have some defaults (currently still paying) from 4 years ago.

We currently have no credit or store cards, no overdrafts, no loans, no car finance and no missed payments for 2 years and 2 months. I was wondering if you could recommend a company that would be happy to potentially accept us with this history.

Thanks.

0 -

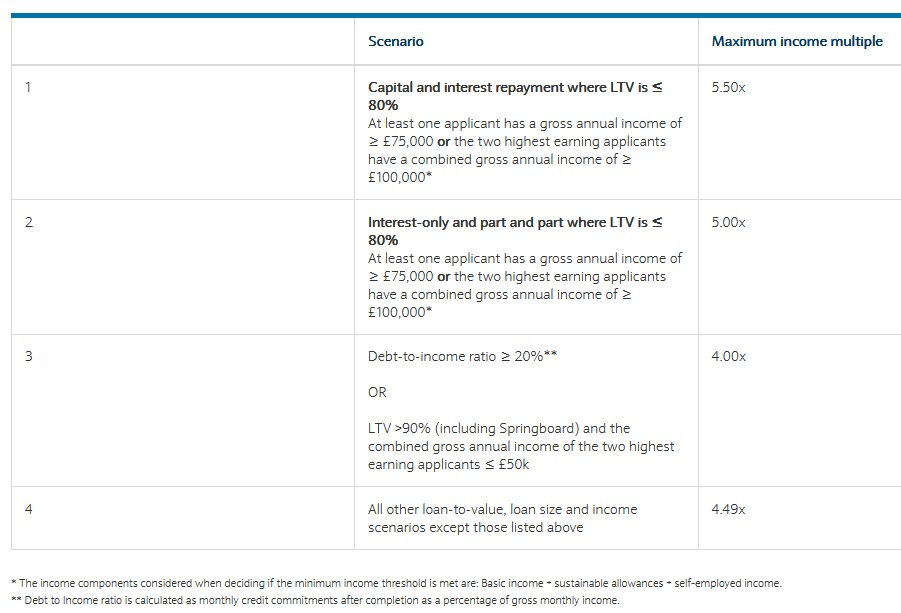

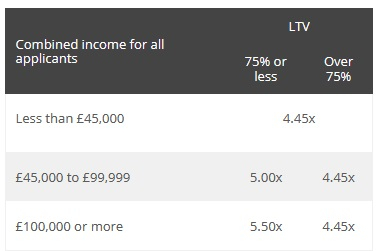

www.telegraph.co.uk/money/consumer-affairs/return-bumper-sized-mortgages-banks-loosen-rules

"Aspiring homeowners can now borrow much more after banks raised the cap on mortgage sizes. Lenders have begun to relax affordability rules for borrowers after tightening them last year amid worries over the economy's health.

High street banks including NatWest, Lloyds and HSBC will once again offer mortgages worth five times a borrower's yearly salary, while Santander and Barclays now lend up to 5.5 times an applicant's income."

Has anyone got any more info on this? I'm particularly interested in 5.5 times income mortgages. The article implies they will be available to couples with £60k joint income. No further info available (including exact LTV details).

Many thanks.

0 -

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

Hi.

We had our offer in the post today from Platform very happy. Our daughter who is 16 at present and turns 17 in April. On the application we had to agree for her to sign a deeds of consent form because it said she was 17 on the application which is wrong.

we are now stressed right out worrying that the offer will be withdrawn because of the wrong date so our adviser is going to talk to our solicitor to see if this is going to throw a spanner in the works.

so has anybody got some advice or even knows what happens now please it’s getting unbearable and very close to exchange!

having just spoken to my broker back in November I said my stepdaughter was 17 in February so got that wrong but was never asked for a date of birth by anybody.

what a nightmare 😔

thank you.

0 -

Thank you.K_S said:

If that's the case, the article is misleading or these mortgages are not yet available. Not too sure where the author is getting his info from.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards