We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Buying house decent deposit but low income

cooners

Posts: 38 Forumite

I'm fed up of renting and want to buy my own place for me and my girlfriend. The trouble is despite soon having a decent deposit (£60-80k, not sure exactly how much yet) I only earn £20k a year over two jobs (ones retail and the others a cleaning job).

Looking briefly at online calculators I would only get a mortgage of around £70k despite the monthly payments being 25% lower than my rent is now, I'd be lucky to buy a shed in Cornwall with that!

My girlfriend is disabled so unable to work and we are currently living in two HA places as her place is tiny and mine is in a high rise that she doesn't want to live in, the HA won't give us a two bedroom place and I'm never going down the private rent route ever again so I'm desperate to buy us a place of our own.

What other options are there out there that we can look at, would shared ownership work? Is there anything else out there that would let me buy a place?

Looking briefly at online calculators I would only get a mortgage of around £70k despite the monthly payments being 25% lower than my rent is now, I'd be lucky to buy a shed in Cornwall with that!

My girlfriend is disabled so unable to work and we are currently living in two HA places as her place is tiny and mine is in a high rise that she doesn't want to live in, the HA won't give us a two bedroom place and I'm never going down the private rent route ever again so I'm desperate to buy us a place of our own.

What other options are there out there that we can look at, would shared ownership work? Is there anything else out there that would let me buy a place?

0

Comments

-

Talk to a mortgage broker - they should know more about what is possible than an online calculator. They may know the local housing market too and what you could get, where.

But a banker, engaged at enormous expense,Had the whole of their cash in his care.

Lewis Carroll0 -

I say buy the shed, overpay the mortgage and then upgrade0

-

Move somewhere that you can buy a house for £140k?

1 -

Ok thanks. Will wait until I know more then look talk to a broker.

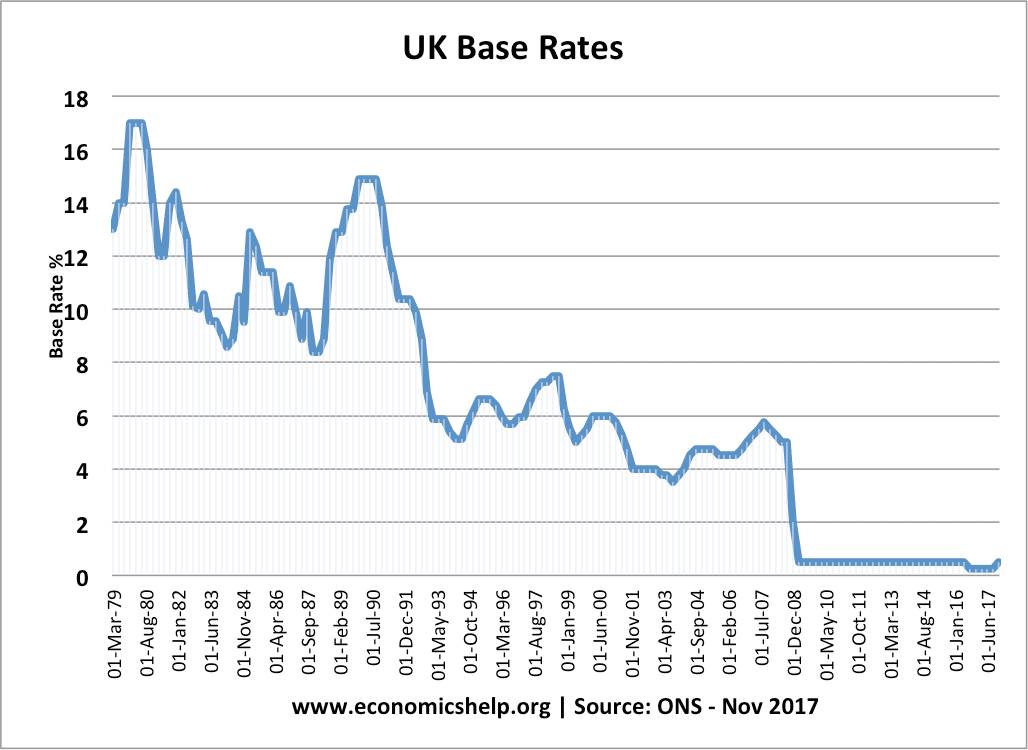

Fair point about the interest rates, they seem to have stayed at a low point since the crash in 08 though so 🤞they stay that way.

As for going somewhere more affordable both of us are Cornish and all our family is here, neither of us have any desire to move away.0 -

As well as shared ownership have you looked at the help to buy equity loan - would bring max price up from ~140-150k to ~170-180k?

Have you and girlfriend got lifetime ISAs?

By this time next year (has to be open for 1 year) could have another 4000 towards deposit.

https://www.moneysavingexpert.com/savings/lifetime-isas/

0 -

I know it's not the sort of advice you want, cooners, but I think , especially in the current climate and your own circumstances, you may wish to consider living together in one (nicer) flat, saving at least part of your dual total housing bill, then save more ; and then see where you are in about 18 months.

Any chance of better job prospects ? I told you that you wouldn't welcome my contribution. But very sincere good luck in your quest ; and I'm sure you and your girlfriend will be proud owners given time.2 -

The MSE mortgage calculator suggests you can get a mortgage of £90k on a £20k salary.

With a £60k deposit, that's a £150k house.

Make sure you are making the most of options such as the Lifetime ISA to get an extra boost when buying your first property.2 -

If your girlfriend is disabled - is she receiving benefits ? There are many mortgage companies that do take these into account - ie PIP, industrial injury, ESA and that make make all the difference

Id pick a 5 year fixed rate to give you stability for a long time2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards